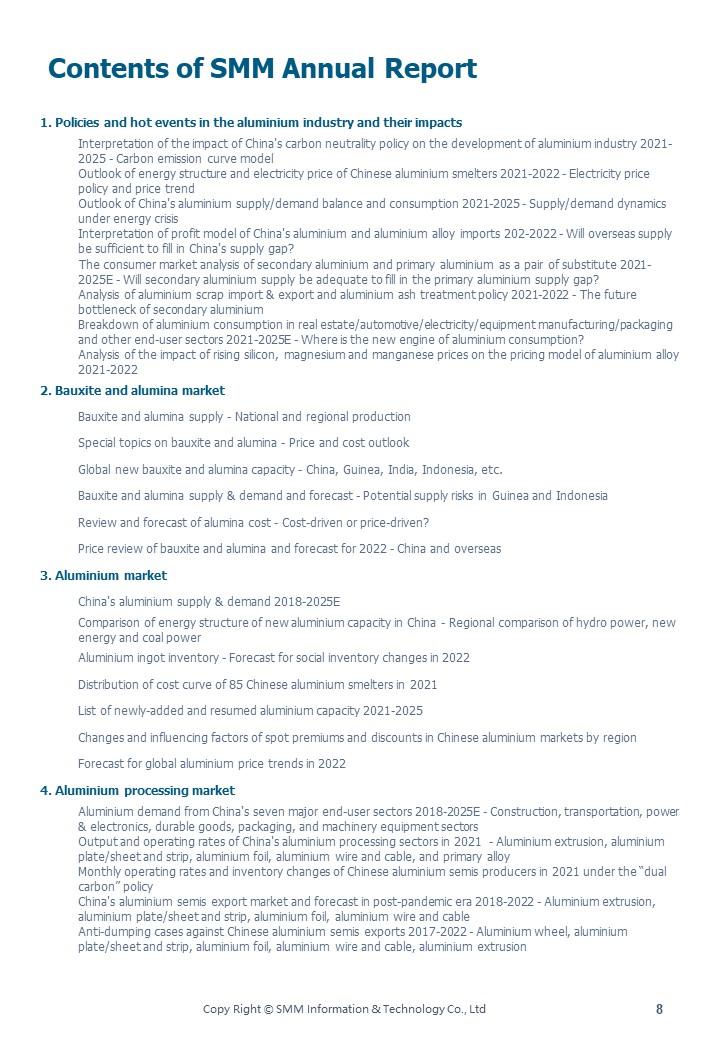

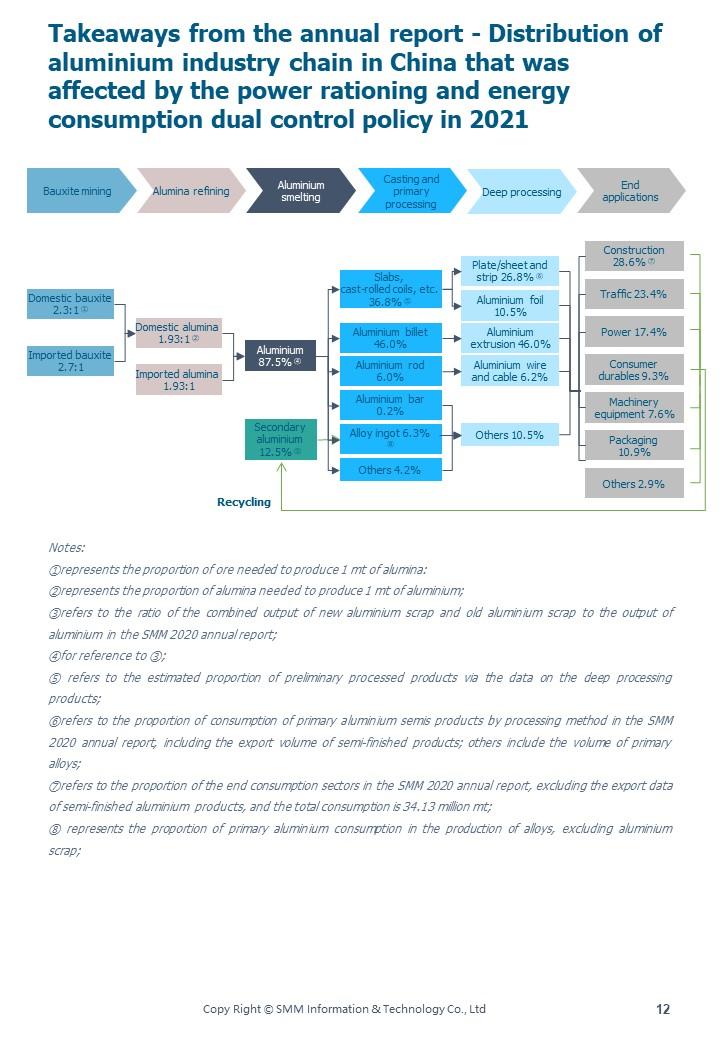

SHANGHAI, Nov 10 (SMM) - The carbon peak and carbon neutrality (“dual carbon”) policy has affected the Chinese and even the global aluminium supply and demand throughout 2021, a year which not only marks the beginning of the "14th Five-Year Plan” period (2021-2025), but also unveils the “dual carbon” policy. The domestic and international aluminium markets have experienced earth-shaking changes in the past year. The domestic aluminium smelters have suffered frequent production restrictions and power rationing. The continuously rising prices of aluminium-related commodities, such as coal and natural gas, have increased the manufacturing costs of the aluminium industry chain. The production restrictions and power rationing extended from domestic aluminium smelters to downstream aluminium processing enterprises near the end of 2021, leading to an increase in social inventory in the peak season and weighing on aluminium prices. The "dual-carbon" policy, which is seen as a basic national policy, has been integrated into all aspects of industry policy and can provide guidance for the future trend of the aluminium industry.

The aluminium smelters struggled in a global "energy crisis" at the end of 2021. SMM will try to tell whether the energy crisis can be alleviated in 2022 by analysing the upstream, middle and downstream sectors of the aluminium industry chain. The energy crisis is one of the unprecedented challenges encountered by the global aluminium industry. The aluminium industry will continue to be affected by this crisis due to its high power consumption. How to survive under the "energy crisis" and “dual carbon” policy has become a common challenge for each enterprise in the Chinese aluminium industry.

In the upstream sectors, the political turmoil in Guinea and the flooding in Shanxi and Henan, which are the two main alumina producing provinces, disrupted the supply of bauxite and alumina in 2021, boosting their prices, even as the power rationing toward aluminium smelters has softened the demand for alumina. SMM will predict the future price trend of bauxite and alumina from multiple perspectives including the costs, supply and demand, and policy. The much-anticipated alumina futures will be launched in 2022. Whether this can create new trading models and what data should be closely watched for guidance on future price trends are worth of market attention. SMM will make a detailed interpretation of the opportunities and challenges in the bauxite and alumina markets.

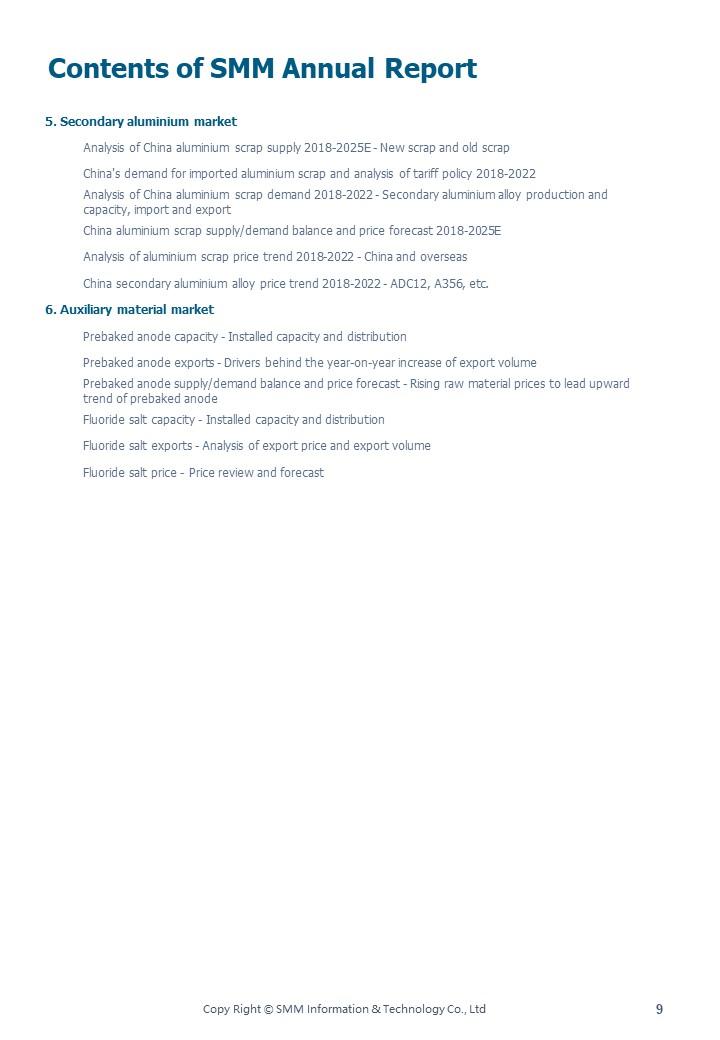

In the aluminium downstream sectors, 2021 is a difficult year for the aluminium processing enterprises. The aluminium smelters reaped lucrative profits in the first three quarters of 2021, but the aluminium processing enterprises suffered higher costs and unexpected power rationing. The surge in the prices of raw material (aluminium), auxiliary materials (silicon, magnesium, and manganese), as well as energy (natural gas and electricity) significantly pushed up the costs of the aluminium processing enterprises. Besides, the unexpected power rationing and production restrictions in late 2021 severely affected the operating rates of aluminium processing enterprises in Jiangsu, Guangdong and some other provinces. This situation was complicated by the anti-dumping, carbon tariffs, and high freight. SMM has sorted out the related industry events and core data, and analysed how these events will affect the future aluminium processing industry.

For the end consumption of aluminium, SMM has taken a review of the structural change of the aluminium consumption trend caused by the "dual carbon" policy. The consumption of low-carbon aluminium has gradually become a fashion. The secondary aluminium has become the first choice for green raw materials due to its extremely low carbon emissions. In the process of carbon peak in the aluminium industry, these two trends will deepen further. In 2022-2025, we will see more Chinese low-carbon aluminium brands, as well as more low-carbon aluminium products available in the market. The proportion of secondary aluminium in the total aluminium consumption will expand across the construction, transportation, packaging, machinery equipment, and power sectors. The aluminium consumption structure in China will emulate Europe and the United States by increasing the proportion of secondary aluminium while at the same time incorporating the essence of the "dual-carbon" policy by reducing the carbon emissions, thereby forming a low-carbon aluminium market with Chinese characteristics.

The development of China's aluminium market has entered a new stage. Having your finger on the pulse of the market, policy formulation, and investment decision-making require authoritative and reliable data, as well as in-depth and prudent consulting and research. SMM has updated the medium and long-term aluminium industry chain report, which could help you make more informed decisions and bring you ahead of your peers and one step closer to success.