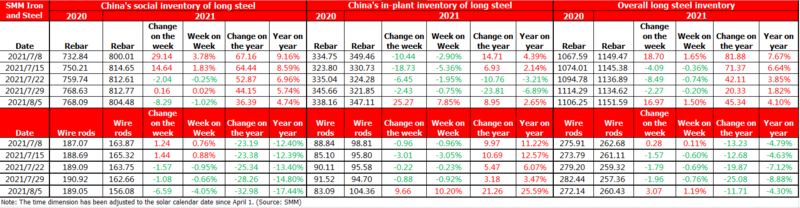

SHANGHAI, Aug 6 (SMM) - The rebar output fell 3.31% week on week, and apparent demand of rebar dropped 9.69% on the week. Inventories of rebar across Chinese steelmakers and social warehouses stood at 11.52 million mt as of August 5, up 169,700 mt or 1.50% from a week ago. Stocks are up 453,400 mt or 4.10% from a year earlier.

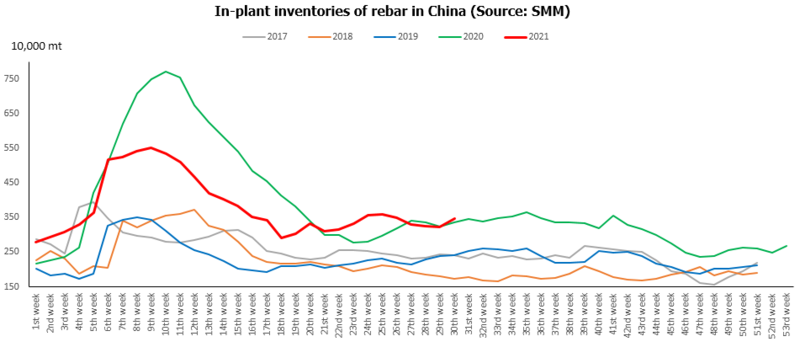

Inventories at Chinese steelmakers rose 252,700 mt or 7.85% on the week and stood at 3.47 million mt. Stocks are up 89,500 mt or 2.65% from a year earlier.

Last week’s Political Bureau meeting delivered the instruction to ensure supply, stabilise prices, and crack down on the speculations or over reaction on carbon reduction. The market worried that the policy on carbon reduction may ease in H2, which triggered the sharp drop in rebar prices. Although there was news that the instruction had nothing to do with the production restrictions of crude steel, the market still had strong sentiments of risk aversion, and dealers were reluctant to purchase. The inventory pressure increased sharply in plants.

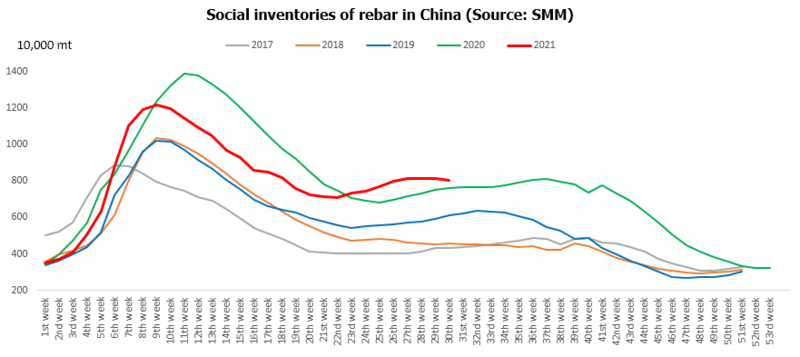

Inventories at social warehouses declined 82,900 mt or 1.02% on the week and stood at 8.04 million mt, up 369,000 mt or 4.74% from a year ago.

The market expectation of the production restrictions in H2 weakened, and some plants actively sold out stocks when steel prices stabilised and rebounded. The speculative demand grew in the market, and social inventories fell pre rapidly.

On the supply side, the policy of reducing crude steel production will be further implemented in H2. The regions with high production increase in H1 and the steel mills that released production cut plans will reduce production in the second half of the year. However, considering the long implementation period of the policy and the high profits, steel mills will be reluctant to reduce production with the approaching of the peak season. The output decline in the next 1-2 months may be less than expected. The stricter production restrictions this year may be in Q4 due to the environmental protection in winter. There is no such trend on the policy side, but most steel companies are waiting for it.

On the demand side, the off season impact sitll exists in the transitional period before the peak season. The high temperature and pandemic will continue to restrict the release of rigid demand in August. As the current supply is mainly concentrated in the middle and up stream of the industry, and the inventories of end users and dealers are low, the middle and down stream users are expected to restock earlier in late August. The demand from real estate market in H2 is expected to be low, but the overall demand is still resilient with the support of infrastructure construction.

The rebound after sharp drop was due to the expectation reversal, emotional recovery, capital promotion and other factors. The later production decline and whether demand can be released as expected are the dominant factors for the price rebound range. If the output rebounds repeatedly or the demand falls short of expectation, the prices may fall back again. Therefore, close attention must be paid to the impact of the pandemic on the market trade and the implementation of the production cuts at steel mills.