SHANGHAI, Jul 2 (SMM) – This is a roundup of China's metals weekly inventory as of July 2.

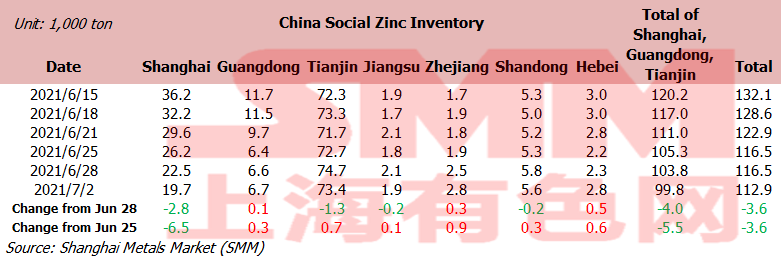

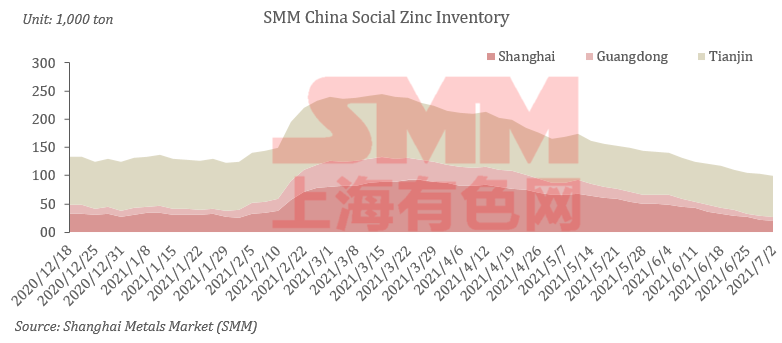

Zinc social inventories shrank 3,600 mt on week

SMM data showed that social inventories of refined zinc ingots across Shanghai, Tianjin, Guangdong, Jiangsu, Zhejiang, Shandong and Hebei decreased 3,600 mt in the week ended July 2 to 112,900 mt. The stocks fell 3,600 mt from Monday June 28.

Stocks in Shanghai continued to decrease as the arrivals of imported zinc were limited and the market mainly digested domestic zinc. In south China's Guangdong, market arrivals improved slightly, downstream demand weakened, and inventories stopped falling and rebounded. In Tianjin, downstream demand declined obviously due to production cut and shutdown for the environmental protection, and traders sent some Tianjin stocks to East China, resulting in an increase in outbound goods on week.

Stocks across the three major trading hubs (Shanghai, Tianjin and Guangdong) fell 5,500 mt this week, after an 11,700 mt decrease last week.

Copper social inventories shrank 5,900 mt on week

Social inventories of copper in China's major trading markets decreased 5,900 mt from June 28 to 232,700 mt as of Friday July 2, according to SMM data.

Among them, stocks in Shanghai decreased 3,800 mt from Monday to 112,500 mt. Stocks in Guangdong fell 400 mt to 89,900 mt from Monday. Stocks in Jiangsu went up 700 mt to 19,300 mt from Monday. Stocks in Zhejiang decreased 400 mt to 3,900 mt from Monday. Stocks in Chongqing decreased 600 mt to 1,400 mt from Monday. Stocks in Jiangxi, Chengdu and Tianjin remained unchanged from Monday.

Copper social inventories continued to decline on week, while the decline was lower than the previous two weeks. From the arrivals and shipments, the main reason for inventory reduction was the decrease of arrivals and the outbound quantity was relatively stable this week. However, after terms of trade decreased last week, the inflow of goods shrank, resulting in a decline in copper social inventories.

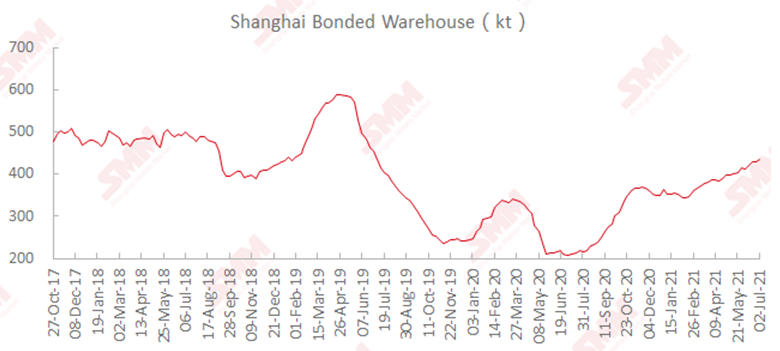

Shanghai bonded copper stocks rose 5,800 mt on week

Stocks of copper in Shanghai bonded areas increased on larger arrivals for the fourth consecutive week.

SMM data showed that the stocks rose 5,800 mt from the prior week to 435,600 mt as of Friday July 2.

Terms of trade fell again since the end of last week, and the US dollar copper market returned to a tepid state. The drop in customs import demand led to a month-on-month decline in the outbound volume of copper. However, there were still bills of lading arriving in ports constantly flowing into the bonded warehouse, which led to a continuous increase in copper stocks.

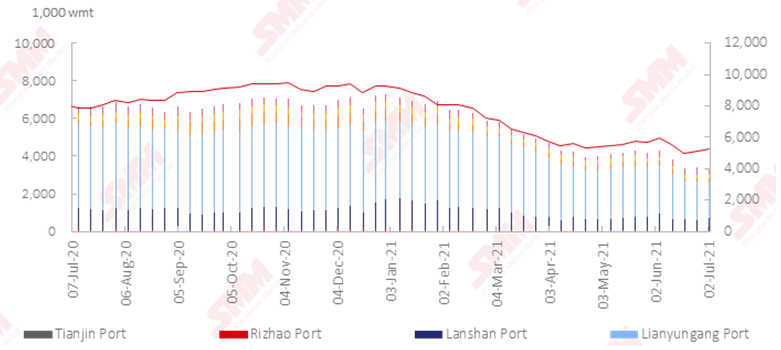

Nickel ore inventories at Chinese ports rose 129,000 wmt to 5.23 million wmt

Nickel ore inventories across all Chinese ports increased 129,000 wmt from June 25 to 5.23 million wmt as of July 2, showed SMM data.

In Ni content, the stocks stood at 41,200 mt.

SMM data also showed that nickel ore stocks across seven major Chinese ports increased 19,000 wmt during the same period to 3.42 million wmt.

Nickel ore stocks increased slightly this week, and the shipping schedule delay caused by weather problems in the Philippines gradually recovered. At present, most of the shipping schedules in mid-July are still delayed orders in late June. As the weather gets better in July, the shipment volume will gradually increase and the stocks will continue to pile up.

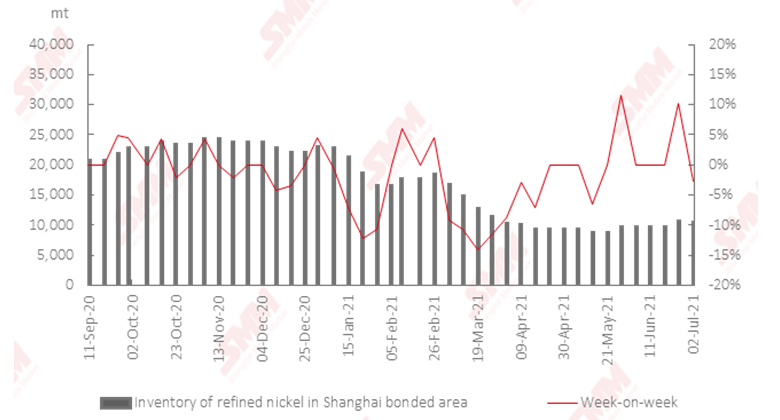

Shanghai bonded refined nickel stocks fell 400 mt on week

Inventories of refined nickel in the Shanghai bonded areas decreased 400 mt from a week ago and stood at 10,300 mt as of July 2, showed SMM data.

As inventories of nickel plates in China were at a low level and the import window was open, hundreds of mt of Russian nickel stocks were imported into China after customs clearance on week. Trading of nickel briquettes in US dollars gradually picked up recently, and the warehouse receipt prices of bonded area rose to around $210-230/mt. The cargoes are expected to be released one after another in the later period. The quantity of LME nickel briquettes out of the warehouse continued to be stable, while most of them were locked by downstream buyers on the way back to China by sea. It is unlikely that they will flow into bonded warehouses later. It is expected that Shanghai bonded refined nickel stocks will continue to decrease in the later period.

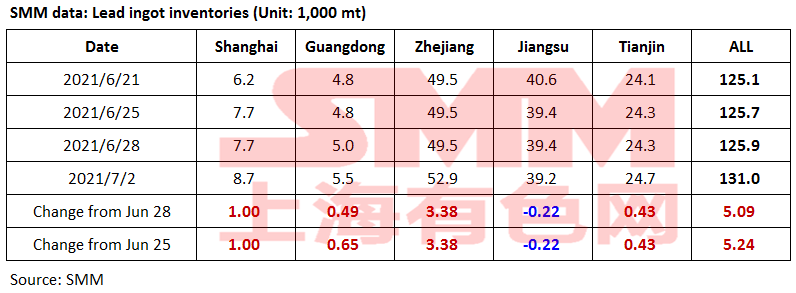

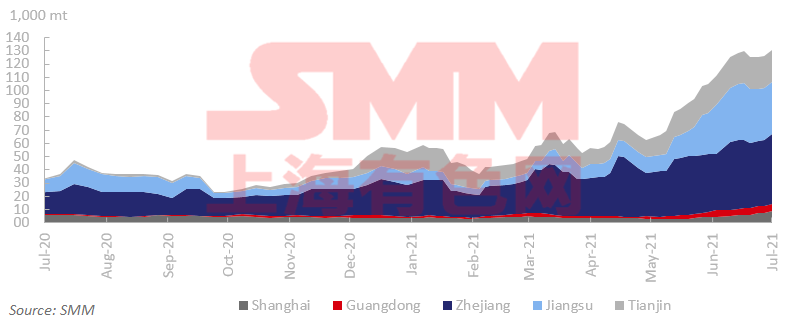

Lead ingot social inventories up 5,200 mt on week

Social inventories of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin increased 5,200 mt from the prior week and rose 5,100 mt from June 28 to 131,000 mt as of Friday July 2, hitting a record high since March 2015, an SMM survey showed.

The production of primary and secondary lead was largely unchanged this week, and downstream purchase remained low. Lead prices bottomed out, and rose to near 16,000 yuan/mt later this week. Downstream users only purchased on rigid demand early this week, and then mostly turned wait-and-see, so the market trade was quiet. At the same time, lead futures went up, spot discounts expanded, and the price difference between futures and spots was over 400 yuan/mt, prompting holders to deliver goods. The inventories were transferred from plants to social warehouses. The supply and demand of lead ingots are expected to stay unchanged next week. Export expectations appeared amid the opened export window, but the actual exports were impeded by the adverse transportation conditions. In addition, the goods were flowing into social warehouses before the contract settlement. Lead ingot social inventories are expected keep rising next week.

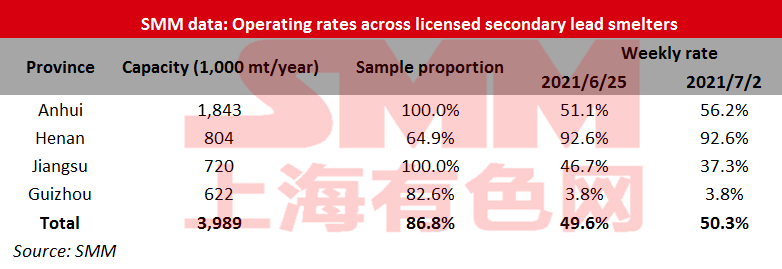

Secondary lead smelter operating rates rose to 50.34%

Operating rates across licensed smelters of secondary lead in Jiangsu, Anhui, Henan and Guizhou averaged 50.34% in the week ended July 2, up 0.71 percentage point from the previous week, showed an SMM survey. (Last week’s operating rate was revised up to 49.63% as Anhui Huaxin Xinda resumed work from maintenance.)

In Anhui, Camel resumed production from maintenance this week, while Huaxin Xinhua suspended production for overhual due to the environmental protection inspections in the mid-week. Jiangsu New Chunxing reduced production. Beside the sample companies, Jiangxi Xinya resumed work after overhaul, and some plants in Hebei cut production due to the 100th anniversary of the founding of CPC, but the reduction was limited. The plants in maintenance in Anhui will further recover production next week, and the impact of the off-peak season will weaken. Operating rates of secondary lead is expected to keep rising next week.

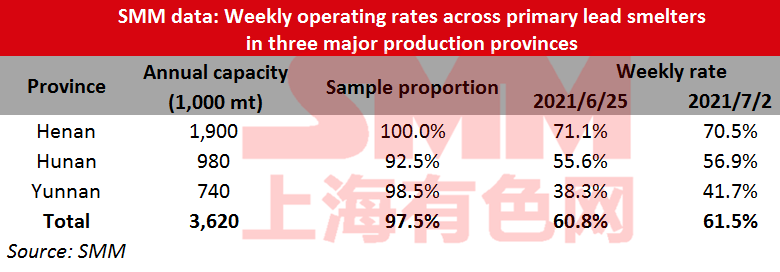

Primary lead smelter operating rates rose to 61.5%

Operating rates across primary lead smelters in Henan, Hunan and Yunnan provinces gained 0.64 percentage point from the previous week to 61.5% in the week ended July 2, showed an SMM survey.

Henan Shibin slightly adjusted production plan due to limited raw materials. Yongning Jinqian stopped the crude lead production before the 100th anniversary of the founding of CPC, but the output of refined lead was unaffected. Hunan Shuikoushan Jinxin resumed normal output after finishing the restocking of raw materials. Hunan Yuteng slightly reduced production for lack of raw materials this week, and had no plan to resume production in early July. Hunan Jingui slightly increased production by around 50 mt/day. Yunnan Mengzi resumed the smelting of crude lead, and the production of refined lead was partly recovered.

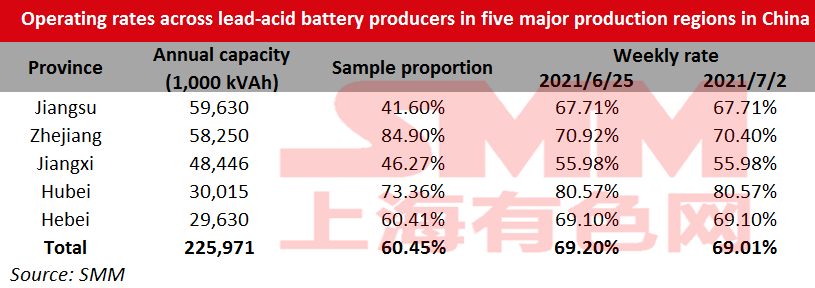

Operating rates of lead-acid battery fell to 69.01%

Operating rates across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces lost 0.19 percentage point from June 25 to 69.01% as of Friday July 2.

Lead-acid battery market remained in the off-peak season, and the companies scheduled the production based on the sales. The output of some companies in Zhejiang declined slightly due to the high inventories, so the operating rates fell this week. The consumption usually shifts from the off-peak season to the peak season in July, but the lead-acid battery companies have not yet seen the sign of consumption rebound. This, coupled with the rising raw material prices, made companies cautious in production.

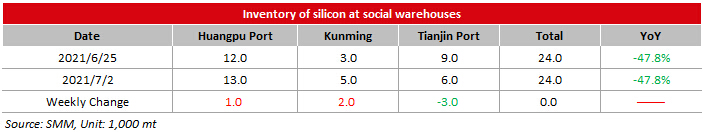

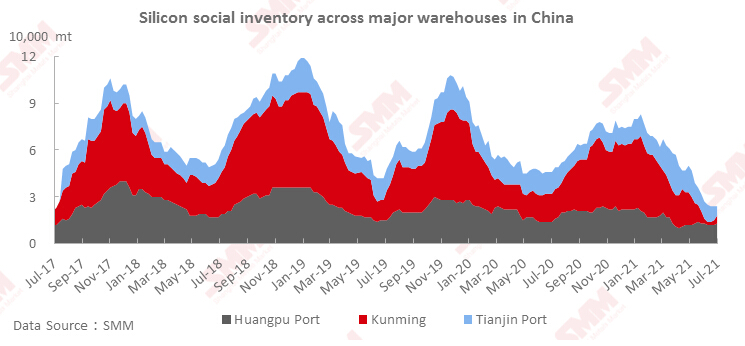

Silicon metal social inventories stood flat on week

Social inventories of silicon metal across Huangpu port, Kunming city and Tianjin port stood flat on the week at 24,000 mt as of July 2, an SMM survey showed. The inventories kept rising in south China and falling in north China. The outbound volume at Tianjin port increased significantly, while the inflow volume was low. The inventories gradually increased in Kunming after Yunnan resumed production, but the increment was limited as some plants directly traded with other plants. The inventories at Huangpu port rose slightly amid low inflow volume in early July. Social inventories of silicon metal are expected to increase slightly in the short term.

China steel rebar inventory up 2.7% on week

Inventories of rebar across Chinese steelmakers and social warehouses stood at 11.31 million mt as of July 1, up 2.7% from a week ago. Stocks are up 6.7% from a year earlier.

Inventories at Chinese steelmakers rose 40,200 mt on the week and stood at 3.60 million mt. Stocks are up 1.1% from a week ago and 5.5% from a year earlier.

Inventories at social warehouses rose 260,700 mt on the week and stood at 7.71 million mt, up 3.5% from a week ago and 7.2% higher from a year ago.

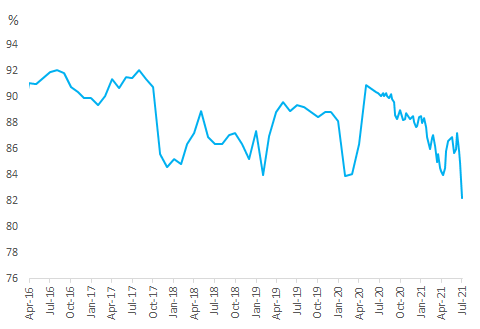

Operating rates of blast furnaces across Chinese steelmakers fell 2.7 percentage points on week

Operating rates of blast furnaces at steel mills fell 2.7 percentage points from a week ago and decreased 3.8 percentage points from a month ago to 82.2% as of July 1, SMM survey showed.

In order to greet the 100th anniversary of the founding of the party, Tangshan, Hebei and other places strictly implemented production cuts and shutdowns, resulting in a sharp drop in operating rates of blast furnaces. Production will gradually resume next week, and operating rates are expected to rebound.

Operating rates of blast furnaces at Chinese steelmakers

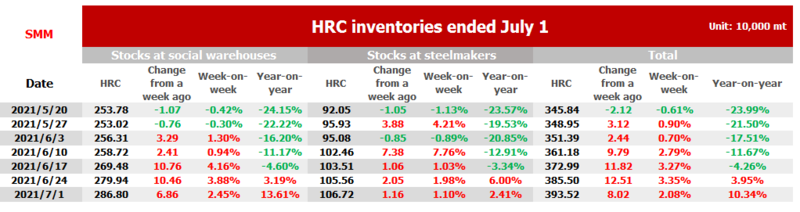

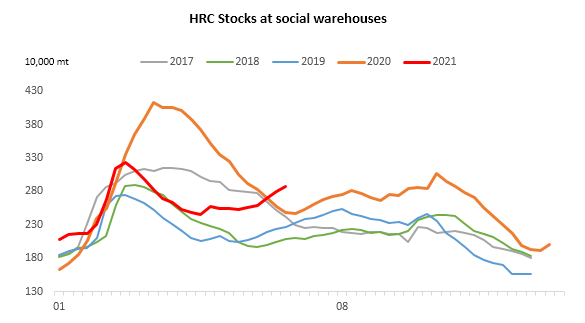

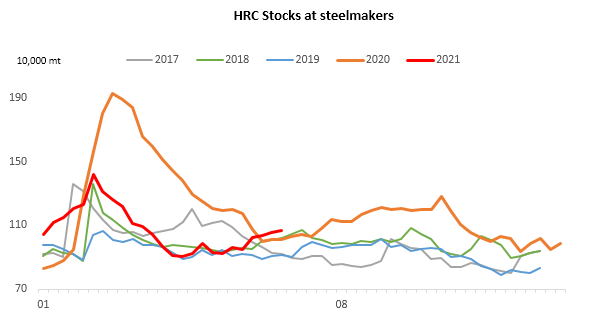

China HRC inventory rose 2.08% on week

SMM data showed that HRC stocks across social warehouses and steel makers rose 80,200 mt or 2.08% on the week, an increase of 10.34% than a year ago, to 3.94 million mt in the week ended July 1.

Inventories across social warehouses increased 68,600 mt or 2.45% week on week to 2.87 million mt. This was 13.61% higher than the same period last year.

Stocks at Chinese steel makers came in at 1.07 million mt, up 11,600 mt or 2.08% week on week and 10.34% year on year.

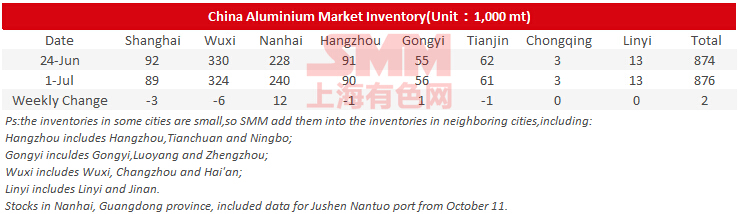

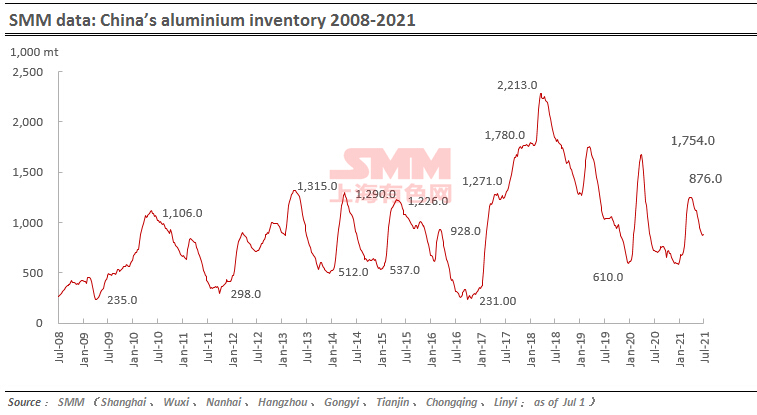

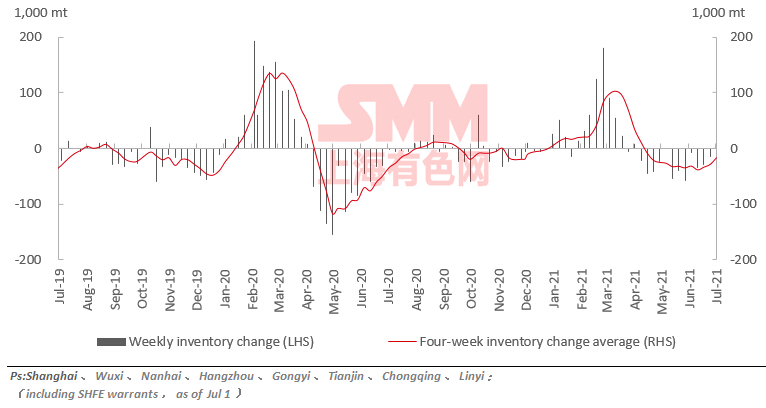

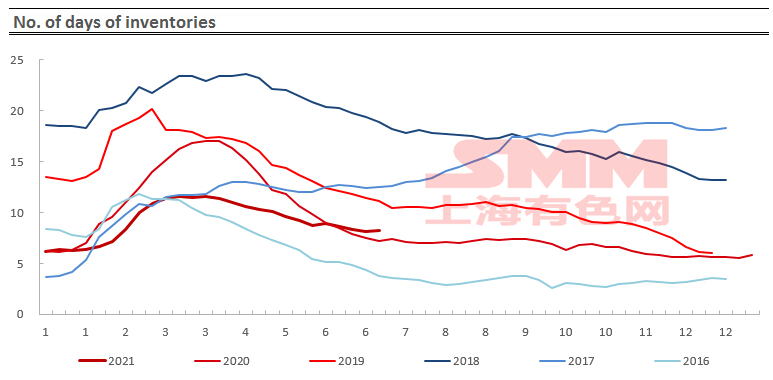

Primary aluminium inventories increased 2,000 mt on week

SMM data showed that China’s social inventories of aluminium across eight consumption areas increased 2,000 mt on the week to 876,000 mt as of July 1. The stocks kept falling in Wuxi and Hainan, while the inventories in the regions of South China Sea rose from the previous week due to the higher arrivals and lower outbound volume.

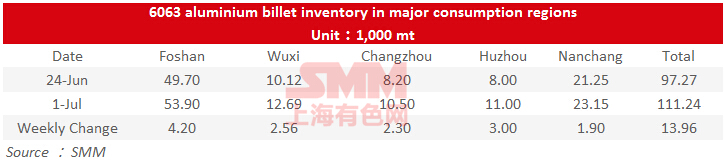

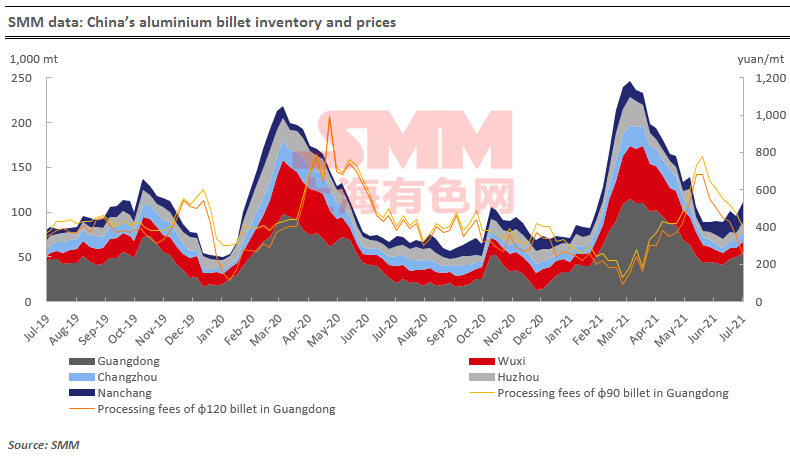

Aluminium billet inventories up 14,000 mt on week

The outbound volume of the aluminium billet rose by 12,800 mt to 51,100 mt last week, an increase of 33.5%. The transportation was severely restricted in some regions with the approaching of the 100th anniversary of the founding of CPC last week, and the downstream willingness to restock slightly recovered.

The stocks of aluminium billet in five major consumption increased by 1,400 mt to 111,200 mt from the previous week, an increase of 14.35%. Foshan saw the largest increase volume by 4,200 mt, and Huzhou registered the highest growth rate by 37.5%. Aluminium prices fluctuated widely under the impact of policies, macroeconomics, and fundamentals. The overall market trade was flat amid the strong downstream wait-and-see sentiment.

According to SMM survey, aluminium downstream orders will decline in July. The first batch of national reserve will be released next Monday and Tuesday, which will lead to the looser liquidity in the spot market, and the holders may had difficulties in sales. The outbound volume of aluminium billet is expected to drop next week, and the inventories may increase.