SMM News: 33 cities housing liquidity index dropped slightly month-on-month

Housing activity is higher in first-tier cities.

The activity of second-hand housing transactions continued to decline in September, with an average second-hand housing liquidity index of 81.6 in 33 key cities, down 1.0% from the previous month and an increase of 1.4% over the same period last year (see appendix at the end of the article for index description).

Affected by epidemic factors, the seasonal law of second-hand housing transactions was broken, and the transaction activity of second-hand housing market in key cities reached a high level in May, and then since August, the housing liquidity index showed a downward trend for two consecutive months.

One of the reasons is that the accumulated demand has been gradually released, and the second-hand market in most cities began to decline naturally in the third quarter, and the second is that since the introduction of regulation and control policies in many places in July, the second-hand housing market in hot cities has cooled to a certain extent.

According to the city level, the housing activity index of first-tier cities is significantly higher than that of second-and third-tier cities.

First-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen have entered the stock housing market, and under the support of demand, the activity of second-hand housing is significantly higher than that of second-and third-tier cities. According to the data of Shell Research Institute, the mobility index of second-hand housing in first-tier cities was 85.16 in September 2020. The month-on-month decline of 0.3% compared with the previous month, the average liquidity index of second-hand housing in 21 second-tier cities was 81.06, and the month-on-month decline was 1.0%. The average second-hand housing mobility index in eight third-tier cities was 81.05, down 1.6% from the previous month.

The mobility of Shanghai, Beijing and Rong is at the top.

The month-on-month decline in Shenyang is relatively large.

According to the comparison of regional markets, it is found that there is an obvious differentiation in the activity of second-hand housing market among different cities. the mobility index of second-hand housing in the cities in the Yangtze River Delta represented by Shanghai, Ningbo and Jiaxing and the western cities represented by Chengdu and Xi'an is higher as a whole. however, the activity of second-hand housing in the cities around the Bohai Sea represented by Langfang and Jinan, as well as Shenyang, Changchun and other northeastern regions is lower as a whole.

Specifically, the cities with high second-hand housing mobility index in September 2020 include Shanghai (88.85), Beijing (87.78), Chengdu (87.24), Ningbo (85.44) and Jiaxing (85.27).

Shanghai and Beijing are typical stock housing markets, with strong demand for second-hand housing, and strong provincial capitals such as Chengdu and Xi'an, as well as Jiaxing and Ningbo, which are affected by the good profits around Shanghai, and the demand for second-hand housing is also more active.

The cities with low second-hand housing mobility index are Langfang (71.24), Nanchang (72.75), Shenyang (77.23), Zhengzhou (77.92) and so on. Cities such as Nanchang and Zhengzhou are mainly dominated by new housing transactions, and the activity of the second-hand housing market is relatively low.

And Shenyang, Changchun and other northeast regional city index ranked at the bottom, which is related to the population outflow and the shrinking overall demand for housing in Northeast China in recent years.

According to the month-on-month trend of second-hand housing mobility index, the cities with large increases in September were Xiamen (0.70%), Qingdao (0.68%), Xi'an (0.56%), Jiaxing (0.51%), Jinan (0.18%) and so on. Shenyang (- 3.91%), Shijiazhuang (- 3.27%), Langfang (- 2.82%), Huizhou (- 2.71%) and other cities showed big month-on-month declines.

Regulation and control effect appears, Shenyang, Hangzhou and other popular cities second-hand housing transaction activity has declined.

Since July, the central and local levels have stepped up regulation and control. More than a dozen cities, including Shenzhen, Ningbo and Nanjing, have issued policies to curb the overheating of the real estate market, and the transaction activity of the second-hand housing market in these cities has also declined. for example, Shenzhen's housing liquidity index fell 5.09% month-on-month in August and Shenyang second-hand housing liquidity index dropped 3.91% in September, the biggest drop in the month.

When high liquidity meets "house price friendliness"

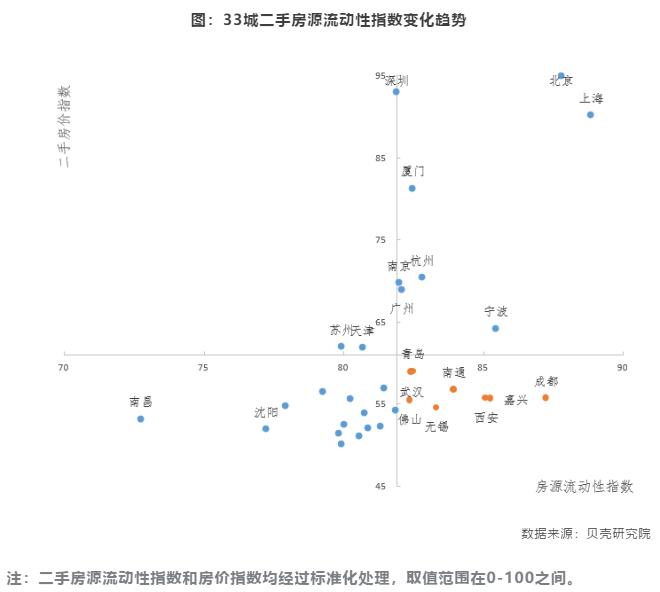

Combined with the urban housing price index and housing mobility index for two-dimensional quadrant analysis, the results show that Beijing, Shanghai, Shenzhen and other cities, although the housing mobility index is high, but the housing price level is not low, it is a typical high mobility-high housing price city.

For young people, high mobility-price-friendly cities are good choices, including Chengdu, Xi'an, Wuhan, Jiaxing, Wuxi, Foshan, Nantong and Qingdao.