7.15 minutes of the Bronze Morning meeting

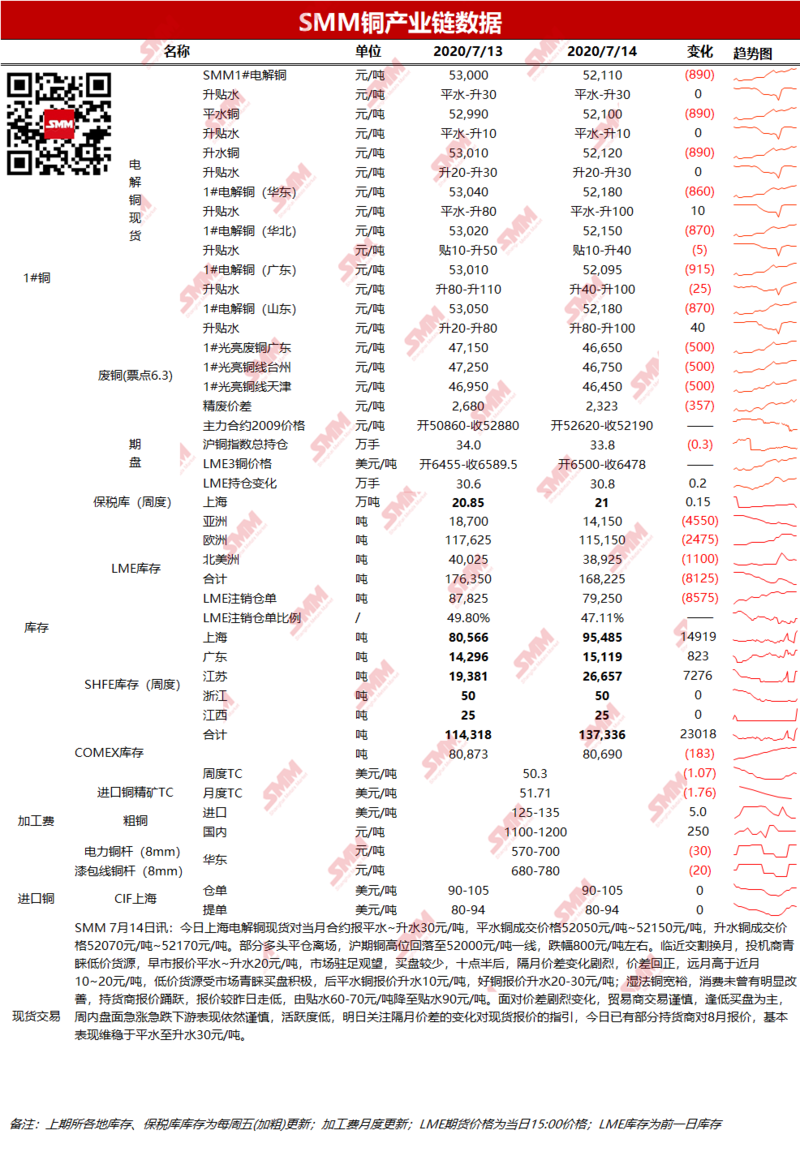

Macro aspects: 1) New Crown epidemic tracking: studies have shown that Moderna's new crown vaccine has produced antibodies in all tested patients, and the company will conduct final phase vaccine trials on 30, 000 people. Overnight US economic data: CPI posted its biggest monthly gain since 2012 in June, boosted by a rebound in gasoline prices. But overall inflation remains subdued. [neutral] fundamentals: 1) scrap copper in Guangdong was quoted at 46500 yuan / ton ~ 46800 yuan / ton on July 14, which was 500 yuan / ton lower than that of the previous trading day, and the price difference of fine waste was 2323 yuan / ton, which was narrowed by 357 yuan compared with the previous trading day. Near the delivery market speculation came to an end, copper prices fell, some scrap copper merchants saw this profit-taking delivery, and traders saw that the willingness to receive goods was not high, but due to the expansion of disk deductions for scrap copper rods yesterday, a large number of transactions at low prices, yesterday's scrap copper rod factory shipments declined, and actively replenished raw material inventory, the bid was higher. 2) the warehouse receipt for imported copper on July 14 was quoted at US $90mur105 / ton, with the average price unchanged from the previous day. LME0-3 raised water by US $9 / ton, and the import loss was around 120 yuan / ton. After a brief opening of the price comparison, the foreign trade market returned to a deserted state yesterday. The willingness of shippers to ship has increased, and the number of offers has also increased significantly. Most of the traders are flat at the price level of the day before, and some of them are lower than before. However, the price comparison directly affects the import demand, and there is still a large gap between the buyer's psychological expected price and the market quotation, so it is difficult to see the transaction. The transaction of warehouse receipts is limited and the price remains unchanged for the time being. 3) LME copper inventory decreased by 8125 tons to 168225 tons month-on-month on July 14, while copper warehouse receipt inventory increased by 5148 tons to 52574 tons in the previous period. 4) spot East China: on July 14, Shanghai electrolytic copper spot to the current month contract quoted flat water ~ litre water 30 yuan / ton, the average price remains the same as the previous day. On the spot side, the market price rose sharply and fell sharply downstream, but the quotation of traders was strong after the price difference narrowed every other month. It is expected that the spot water will rise to 10 RMB3 / ton today. South China: on July 14, the spot price of electrolytic copper in Guangdong province rose by 40 per cent to that month's contract, with the average price falling by 25 yuan / ton. Spot market: Guangdong inventory skyrocketed for two consecutive days. Affected by this, the holder continues to adjust the price to ship the goods. In terms of market trading, due to a certain correction in copper prices yesterday, and rising water fell, some downstream began to replenish, but the purchase volume is still limited; and traders affected by the approaching delivery, trading is not active. Overall, the trading atmosphere in the market yesterday was better than the day before, but it did not return to the normal level. Finally, it is reported that copper imports are still arriving in Hong Kong this week, and stocks are still rising. Copper price and forecast: last night, Lun Copper closed at 6500 US dollars / ton, down 0.70%. The trading volume was 17000 lots, and the short position increased by 1055 to 309000 lots. The Shanghai Copper 2009 contract closed at 52310 yuan / ton, up 0.23%, the trading volume was 41000 lots, and the long positions increased by 359 lots to 112000 lots. Last night, copper prices continued the momentum of consolidation, showing a wide range of shocks, fluctuating up and down around the daily moving average. On the macro front, the pathology of the new US crown continued to surge, affecting the prospects for economic restart and risk aversion caused by geopolitical tensions, but expectations of EU stimulus policies boosted market sentiment. In addition, OPEC+ cut production as scheduled, and oil prices stabilized last night, driving US stocks higher in late trading. As the fundamentals of copper prices continue to improve and other large categories of assets stabilize, copper prices are expected to continue to rise after adjustment. It is estimated that today Lun Copper 6530 RMB6590 / ton, Shanghai Copper 52450 RMB52850 / ton.