SHANGHAI, Jun 11 (SMM) – Planned output of construction steel rebar across China’s major blast furnace steelmakers in June edged up 0.17% from the realised production in May to 9.21 million mt, showed an SMM survey. The upsides in output are capped as expected, as most steel mills have ramped up to full operations.

The amount of planned rebar output for export was roughly unchanged from a month ago, staying at low levels as the ongoing spread of the coronavirus overseas deters exports from China.

Scheduled production of wire rods in June, meanwhile, decreased 0.46% from the actual output in May to stand at 2.66 million mt.

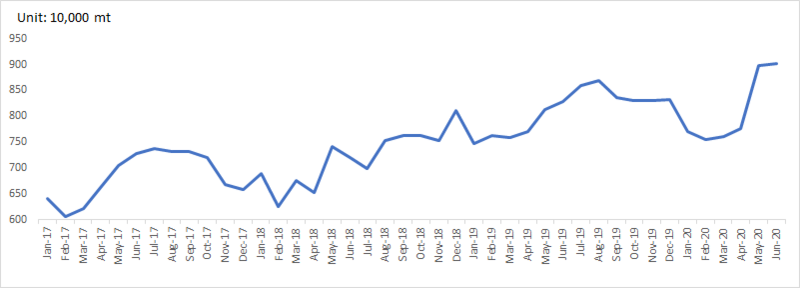

Planned rebar output across China’s major blast furnace steelmakers (Source: SMM)

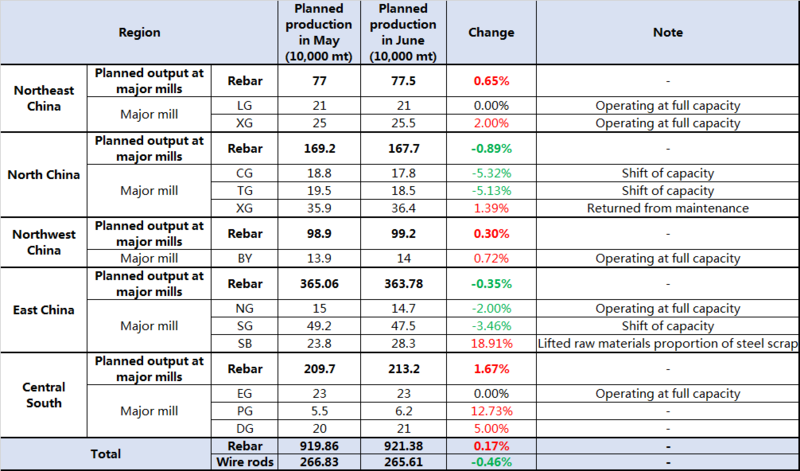

SMM survey showed that scheduled production of rebar at steel mills in north and east China edged lower on the month for June, while the planned output in central south, north-west and north-east China expanded in June.

Scheduled rebar production in north-west and central south China increased 0.3% and 1.67%, respectively, from a month ago in June.

In north-east China, the planned rebar output for June was 0.65% higher, driven by healthy demand amid accelerated work and the commissioning of new projects in the infrastructure and construction industry. Some steel mills still saw high net profits of 400 yuan/mt as brisk demand supported steel prices, while raw materials costs also grew.

In north China, planned rebar production for June is assessed to fall 0.89%, as steel plants shifted capacity from rebar back to plate, strip and wire rods as consumption recovered. The prolonged tighter anti-smog production controls in Tangshan also affected steelmakers operations.

Planned output of rebar across steel mills in east China dipped 0.35% in June, also due to the shift of capacity to industrial wire rods and high-quality special steel products.

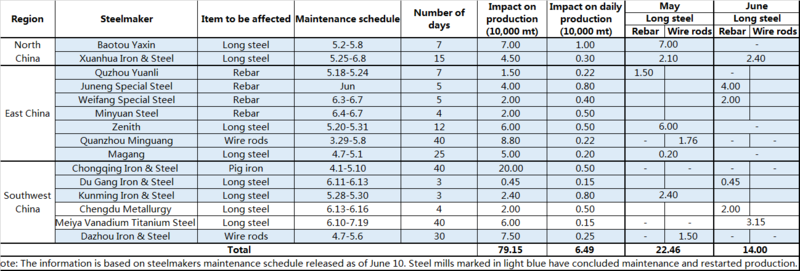

Maintenance at Chinese steel mills in May-June (Source: SMM)

Planned production of rebar and wire rods by region (Source: SMM)

SMM expects overall rebar production in China to see little upsides in June as steelmakers, not only blast furnace steel plants but also electric arc furnace (EAF) mills and steel rolling mills, are mostly running at close to full capacity.

On the demand front, the arrival of the rainy season in most southern Chinese regions have dampened end-users consumption. However, demand in north China remains strong, which coupled with expectations of the release of pent-up demand in late-June after the seasonality impact, will continue to support near-term prices of rebar.