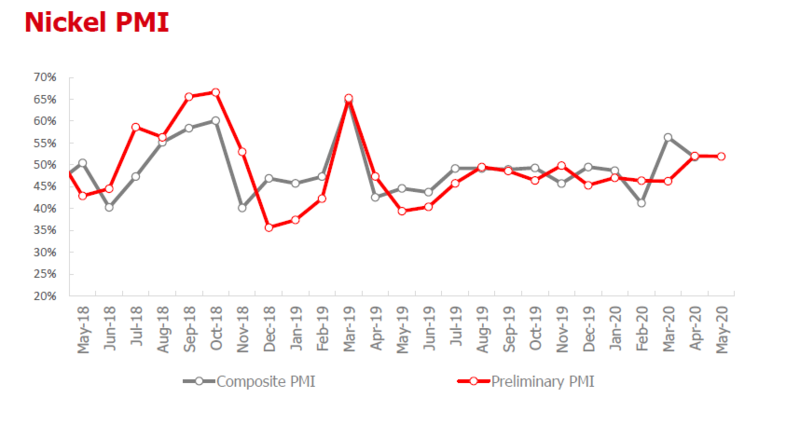

SHANGHAI, Apr 30 (SMM) – Manufacturing activities across nickel downstream sectors in China expanded for the second consecutive month in April, as factories stepped up operations with the coronavirus outbreak under control in China.

SMM data showed that the purchasing managers index (PMI) for downstream nickel industries, including stainless steel, electroplating, alloy and battery, stood at 51.76 in April, down 4.55 points from March. A reading above 50 indicates expansion.

The preliminary nickel downstream sectors PMI for May is assessed at 51.95, up 0.18 point from the final reading for April.

Production sub-index remained in expansion as companies operations stabilise

The composite sub-index for production in April eased 6.36 points from March to 56.51, staying in expansion, as domestic companies have shrugged off pressure from the COVID-19 related curbs. The sub-index for production in the stainless steel sector stood at 56.95, supported by higher operating rates. Most stainless steel mills ramped up production as scheduled and this offset the output cut at a handful of mills.

Electroplating plants kept their operating rates stable in April as they continued to fulfil orders received before the Chinese New Year holiday due to late-resumption of operations due to the pandemic. The alloy casting sector had returned to normal production as companies in Hubei has resumed operations. But some of the large-scale alloy producers were running at only 80% of their capacity. This slightly drove up the sub-index for production in the alloy sector.

New orders sub-index continued to expand

According to SMM data, the overall sub-index for new orders across downstream nickel sectors decreased 10.82 points from March, to 50.33 in April, still recording an expansion. Orders in the stainless steel sector further improved, bolstered by stockpiling by traders due to the pent-up demand caused by the coronavirus crisis, while the increase in actual downstream demand was moderate. This kept the new orders sub-index of the stainless steel sector at 50.67.

The new orders sub-index for the electroplating sector slipped to 44.3, as export orders were affected with lockdown measures outside China still in place. Most electroplating plants reported fewer-than-expected orders received in April. The new orders sub-index for the battery sector also contracted, standing at 47.74, pressured by a reduction in orders and production in the traditional battery market amid weakening demand for consumer digital batteries. In other nickel downstream sectors of printing, nickel wire and mesh, the sub-index for new export orders declined to 43.15.

Raw materials inventory sub-index swung to expansion as companies resumed restocking

The overall sub-index for raw materials inventories rebounded 7.65 points to 50.47 in April, as enterprises resumed normal stockpiling with the recovering of domestic economy and a rally in nickel prices. The raw materials inventory sub-index for the stainless steel sector came in at 50.29, supported by the continued increase in the feedstock imports by large-scale stainless steel mills. Purchases of domestic nickel raw materials were relatively steady.

Finished goods inventory sub-index expanded as inventory pressure eased

The overall sub-index for finished products stocks climbed 4.59 points to an expansion territory of 50.44, on the back of easing inventory burden in the stainless steel sector. The finished goods inventory sub-index for the stainless steel sector stood at 50. While the market inventory shrank, stainless steel mills faced continued issues of destocking. The current stock pressure was mostly due to the built-up of backlogged cargoes, and it remains encouraging that no further inventory pressure was seen even as supply was elevated.

![[SMM Nickel Midday Review] On March 3, nickel prices continued to retreat, and Iran claimed the Strait of Hormuz had been closed](https://imgqn.smm.cn/usercenter/yaAtG20251217171733.jpg)

![[SMM Nickel Intermediate Product Daily Review] On March 3, MHP and high-grade nickel matte prices declined](https://imgqn.smm.cn/usercenter/biBGl20251217171733.jpg)