SHANGHAI, Apr 14 (SMM) – China's environmental authorities on April 10 issued the fifth batch of aluminium scrap import quotas for 2020, allowing 191,100 mt of high-grade aluminium scrap to enter China.

The latest quotas went to more than 60 companies, with the volumes significantly higher than the previous batch. This brought aluminium scrap import allowances granted so far this year to 475,600 mt.

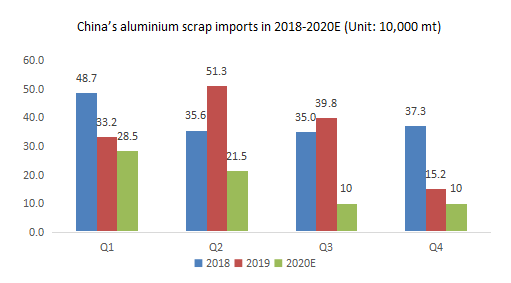

China imported only 122,000 mt of aluminium scrap in the first two months of the year, down 40.7% from a year earlier, according to customs data. This suggested that there remained large amounts of import quotas unused.

Customs data also indicated that China took 490,000 mt of seaborne aluminium scrap in January-April 2019.

Note: The data for 2018-2019 refer to actual imports of aluminium scrap; data for Q1 2020 are the actual volumes of import quotas and data for Q2-Q4 2020 refer to estimated volumes of quotas.

While the import quotas so far are sufficient in volumes, aluminium scrap supply in the Chinese market may unlikely to increase soon due to the headwinds of subdued consumption and supply disruptions amid the worldwide spread of the COVID-19.

On the backdrop of the current weak consumption of secondary aluminium both at home and abroad, Chinese companies adjusted their import pace based on demand.

Chinese authorities have announced restrictions on the import of the materials known as Category 7 scrap, ordering that only aluminium processing companies, rather than traders, are eligible for importing such materials since July 2017. This also created some obstacles to the shipment of aluminium scrap to China.

As the spread of the COVID-19 has not shown signs of slowdown globally, the continued virus crisis in April may further impact the production of aluminium scrap overseas and the deliveries to China, and threaten to disrupt the supply chain.

While tight supply underpinned aluminium scrap prices in China, the prices overseas declined as demand has been badly hit by the pandemic. The downward trend may continue before effective containment of the virus. SMM assessed that prices of imported shredded auto aluminium have slipped to $850-950/mt as of April 13.

In the near term, SMM expects the gradual increase in the inflow of imported cargoes to China to weigh on domestic prices of aluminium scrap and ADC12 aluminium alloy.