SHANGHAI, Nov 20 (SMM) –

1) Price Trend Review

Source: SMM

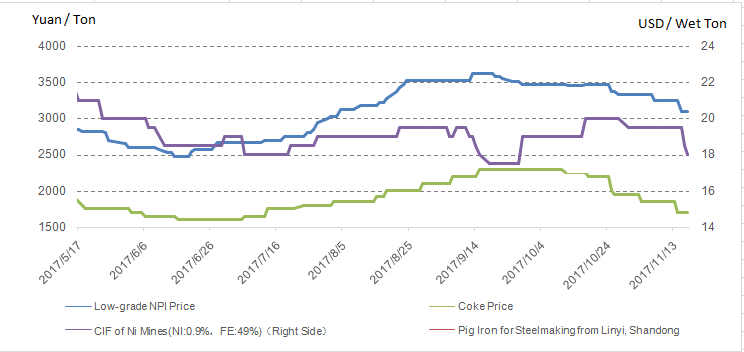

Low-grade nickel pig iron (NPI) factories usually stock up before the rainy season in Philippines (November - March) which affects the exploitation, and this brought up the price.

The CIF is affected by the ocean freight.

NPI price has decreased since mid-September, but the factors above make the price of low-grade nickel mines fluctuate, which do not match the trend of low-grade NPI.

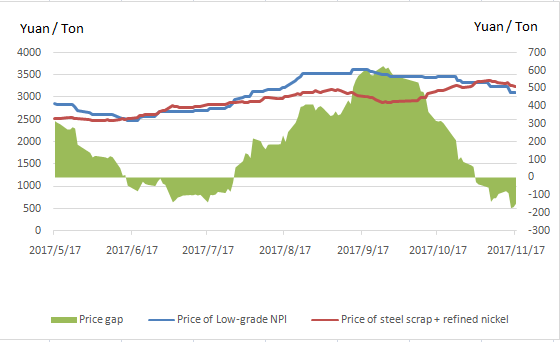

2) Profit of Low-grade NPI

Source:SMM & Industrial data

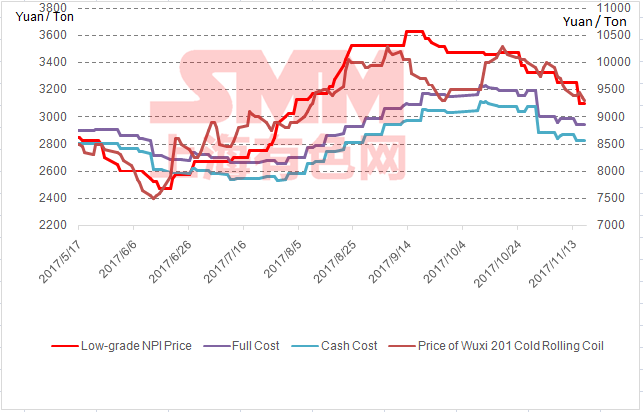

Low-grade NPI price went down from May to June, rallied until mid-September and then dipped again. The last decrease was because the weakened price of coke and stainless steels. However, NPI enterprises are still earning its profit, which is narrowed by the declining price. The profit margin of full cost came to 5% from 20%, with approximately 9% of cash cost.

3) Supply and Demand

Source: SMM

(1)Supply

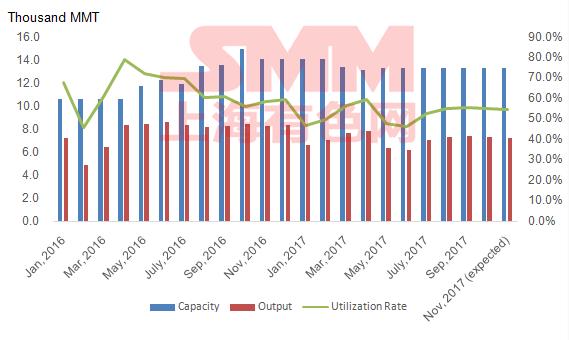

The output of low-grade NPI was 450,000 ton in October, which equals 7,300 MMT of nickel. The output of NPI was down 0.9% MoM and down 12.4% YoY. The reason is the government’s focus on environment and cutting excessive industrial capacity and the low price of #200 stainless steels and the shrinking output.

The utilization rate of low-grade NPI capacity is 55% in October 2017, compared with 56% in October 2016.

The output restriction started from Nov 15, and the rate will decline to 54% in November, with the low-grade NPI output going down to 440,000 tons (7,200 MMT of nickel).

(2) Demand

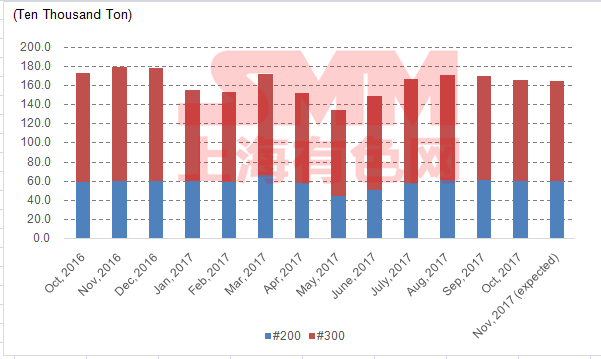

Stainless Steel Output Trend

Source: SMM

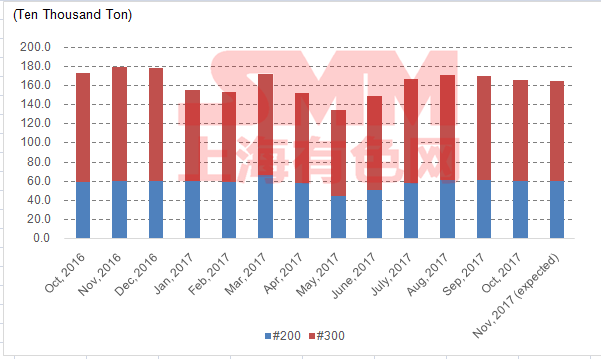

#200 stainless steel output went down to 600,000 tons, 1% down MoM but 3.2% up YoY. Its nickel consumption rate is 1.2%, so its total demand of nickel is 7,200 MMT. 10% of the consumption came from the stainless steel scraps, so the demand of low-grade NPI is 6,500 MMT, lower than October. Therefore the supply is sufficient in October.

The estimated output of low-grade NPI is 7,200 MMT of nickel, and the demand from #200 stainless steel is 6,400 MMT (apart from those coming from scraps). So the supply is still sufficient.

Inventory of #200 Stainless Steel

Source: Industrial data

October’s inventory of #200 stainless steel in Wuxi and Foshan rose to 53,500 ton in total, up 11% MoM and 18% YoY. The falling price in November led to the pessimism to the market’s future. The inventory fell to 40,000 tons in November as more purchases happened in this month. However, the output was not severely cut and the pressure was on factories, and the price may go down in the future as the off-season of stainless steels approaches.

4) Substitutions of Low-grade NPI

Source: SMM

When the price of low-grade NPI (the red line) is higher than the combination of steel scrap and refined nickel (the blue line), factories tend to turn their back to NPI to lower their cost, and vice versa.

(5) Forecast

The consumption of #200 stainless steel may weaken in November and December as the off-season approaches, and the price is likely to fall. The output restriction in North and East China will weaken coke’s price. Low-grade NPI supply surpasses the demand whereas enterprises are able to profit. Overall, bad news are more than good ones from mid-November, and the main price range of mill price may be less than RMB 3,000 / ton.

For more information, please go to Xiong Yilin (TEL: 021-20707814 QQ:2880505667 Wechat:zya0514).

The article is edited by SMM and is provided for information purpose only. It does not mean SMM agrees with its views and SMM assumes no liability for accuracy of information contained or quoted in the article.