by Raul de Frutos on FEBRUARY 22, 2017

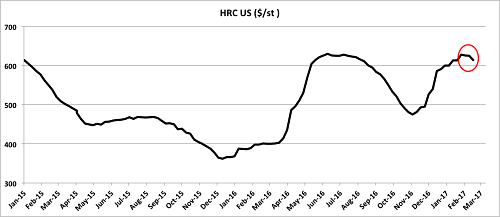

US hot-rolled coil prices retrace. Source: MetalMiner IndX.

Since November — Coinciding with Donald Trump’s victory — U.S. steel prices have been on a tear.

However, in February momentum started to cool down. It’s now buyers’ job to determine whether this is a major peak or just a pause within this bull market.

Chinese Steel Capacity Rises in 2016

In February, a report by Greenpeace East Asia and Chinese consultancy Custeel stated that despite China’s high-profile efforts to tackle overcapacity, China’s operating steel capacity increased in 2016. The report says that 73% of the announced cuts in capacity were already idle — in other words the plants were not operating. Only 23 million metric tons of cut capacity involved shutting down production plants that were operating.

Meanwhile, some 49 mmt of capacity that had previously been suspended was restarted, and 12 mmt of new operating capacity came online. That means that China added 37 million metric tons additional operating capacity in 2016.

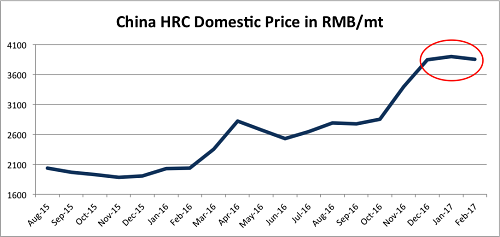

Hot-rolled coil prices in China also take a pause. Source: MetalMiner IndX.

This news is bearish for steel prices and it is likely contributing to lower steel prices in February, both in the U.S. and China.

On the other hand, in January, China unleashed its boldest reform plan so far for its bloated steel sector, saying it will eliminate all production of low-quality steel products by the end of June.

Eliminating excess steel capacity and restructuring the industry has enormous environmental significance because the steel industry is the second-largest emitter of air pollution in China. There are reasons to think Beijing will strengthen its supply-side reforms this year. However, given what happened in 2016, we will need actual facts this year before buying on promises.

“Buy American Steel Policies” to Prove Feasible

One of the things adding fuel to the rally in steel prices was Donald Trump’s commitment to boost the American steel industry. In addition to executive orders essentially reviving the Keystone XL and Dakota Access pipelines, President Donald Trump signed a memorandum requiring the federal government to come up with a plan to mandate American-made steel for all new, expanded or retrofitted pipelines in the U.S.

That news is bullish for U.S. steel prices but after the initial hype, Trump now needs to give more details about his administration’s new “Buy America” steel policy. The appeal of mandating American steel for pipelines has yet to prove feasible as few American steelmakers make the type of steel required for all pipelines.

Like with Chinese promises to cut steel output, the industry now needs real facts on the proposed Buy American steel policy, which is just an idea at present, before price momentum picks up.

Raw Material Prices Supporting Steel Rally

Steelmakers are using the argument of rising iron ore, coal and other raw material prices to press steel buyers to pay more for their steel products.

Iron ore prices traded above $90 per dry metric ton in February, the highest since mid-August 2014. After an 85% rise in 2016, the price of iron ore has improved by more than 16% so far this year and has more than doubled in value since hitting near-decade lows at the end of 2015. Chinese imports continue to increase in 2017 after hitting an all-time high last year.

In addition, coking coal and coke extended gains amid possible curbs on coal output and China’s suspension of North Korean coal imports. China said in mid-February that it will suspend all imports of coal from North Korea until next year, China’s fourth-biggest supplier of imported coal.

If the ban is implemented, it’s possible that Chinese consumers will be short by about 20 million mt of high-quality coal. Other countries may have difficulty in ramping up output, possibly giving a renewed boost to coal prices this year.

What This Means For Metal Buyers

Steel prices have increased for three-consecutive months. The right time to buy steel was in November, now prices might need some time to digest last year’s gains. Steel buyers need to keep a close eye on China’s production, President Trump’s new policies and raw material price trends in order to identify new opportunities to buy steel in 2017.