by Lisa Reisman on MARCH 13, 2017

U.S. M3 grain-oriented electrical steel prices dropped slightly with the M3 index moving from 200 to 197.

Though U.S. prices dipped slightly, China’s Boasteel announced a price hike for GOES close to $40 per metric ton, according to a recent TEX Report. Although the Chinese have led recent GOES and other steel product price hikes, others have not necessarily followed. Nevertheless, Chinese steel prices set the floor for global steel prices.

Now that the Trump administration has begun to settle in, market observers have paid close attention to trade actions within the metals industry, particularly the cold-rolled coil circumvention case and most recently a case filed by the Aluminum Association against China involving aluminum foil. Both the domestic steel and aluminum industries have pursued trade cases to address overcapacity concerns.

GOES Prices and NAFTA

GOES markets follow some of these same patterns. Back in 2013, GOES from China accounted for about 10% of total U.S. GOES imports (by tonnage). Clearly, the trade cases filed by the domestic producers at the time limited Chinese imports, but that trade case sought to stop other countries’ imports as much as China’s.

Herein lies a big difference between the GOES case and the aluminum case as well as the prior flat-rolled product steel cases. The GOES trade case did not result in any finding of injury, so no anti-dumping and countervailing duties were assessed. Instead, domestic power equipment manufacturers shifted their global supply chains to source GOES globally and purchase transformer parts and wound cores from NAFTA countries.

Some have speculated that two years ago, the addition of two new harmonized tariff codes for both transformer parts (8504.90.9546) and wound cores (8504.90.9542) would set the stage for future trade cases brought by the lone domestic GOES producer. We think this looks like a “stretch” and, legally, we’re not even sure there is a case to be had as AK Steel currently does not manufacture transformer parts or wound cores.

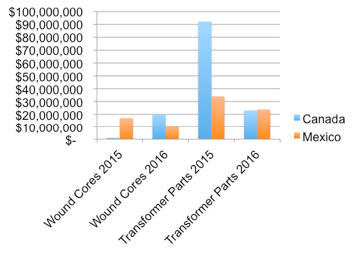

Import volumes for wound cores have modestly increased, but imports for transformer parts have actually declined:

GOES imports from 2015 to today. Source: Lisa Reisman/MetalMiner.