SMM News, January 22:

In 2025, China's tungsten product import and export market featured rising import volume and price, under pressure of total export volume, and intensifying structural differentiation. These characteristics not only reflect the contradiction between resource constraints and high-end demand in the domestic tungsten industry chain, but also mirror the profound impact of the global manufacturing pattern adjustment on the tungsten industry.

Import and Export Volume Comparison: Widening Import-Export Gap Highlights Structural Mismatch Between Resources and Demand

Export Side: Sustained Contraction

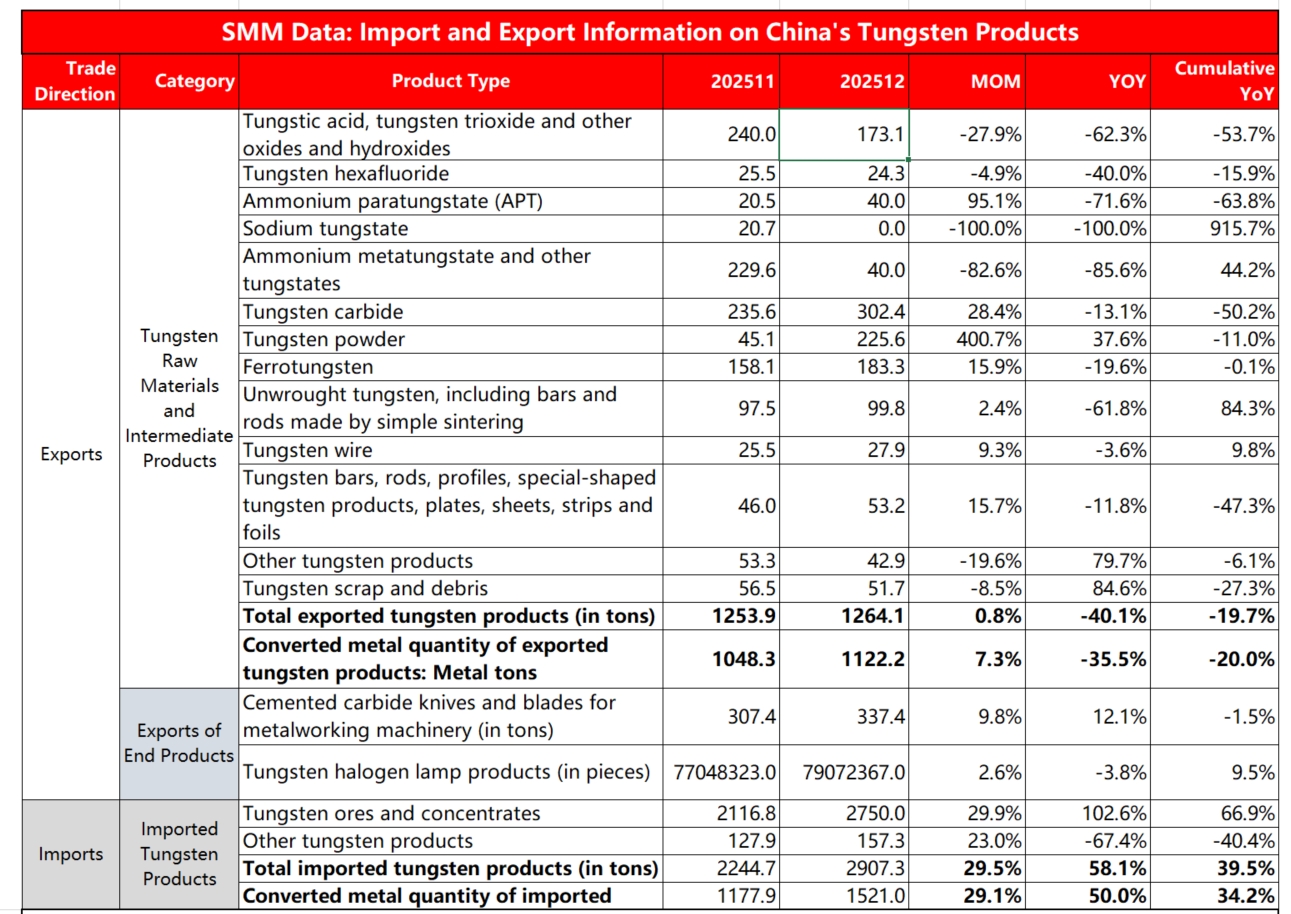

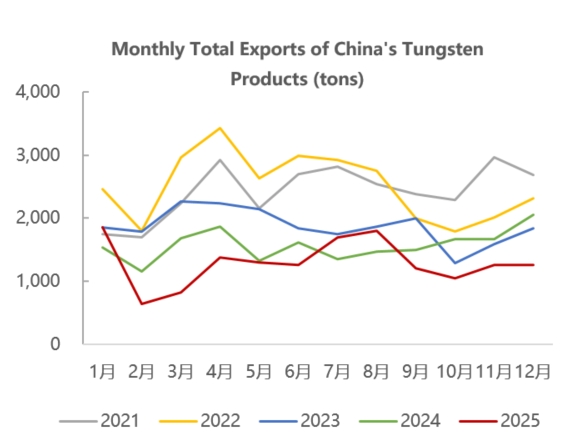

The total annual export volume of tungsten products reached 15,514.7 tons (in physical quantity) in 2025, down 19.7% year-on-year; converted to metal quantity, it stood at 13,095.7 tons, down 20.0% year-on-year. The export volume in December alone was 1,264.1 tons, a slight month-on-month increase of 0.8%, but still a sharp year-on-year decrease of 40.1%, indicating that the weak annual trend remained unchanged.

Import Side: Substantial Expansion

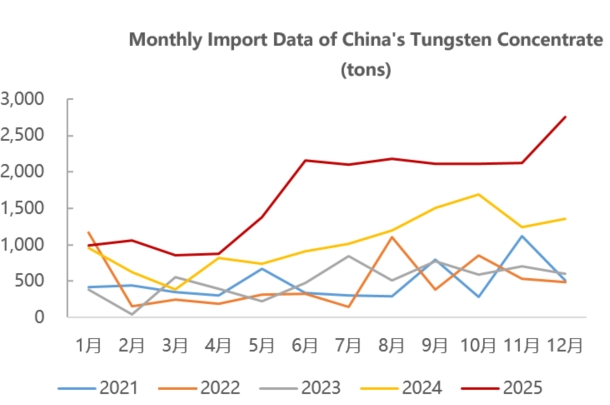

The total annual import volume of tungsten products hit 23,210.9 tons (in physical quantity) in 2025, surging 39.5% year-on-year; the import volume in December reached 2,907.3 tons, a significant month-on-month growth of 29.5% and a year-on-year increase of 58.1%, showing that the procurement intensity rose markedly at the end of the year.

Export Market of Tungsten Raw Materials and Intermediate Products: Pulsed Recovery Fails to Reverse Downtrend

Monthly export data throughout 2025 shows that after the release of China's tungsten-related product export control policies in February 2025, the export volume of controlled products such as sodium paratungstate and tungsten carbide dropped significantly. According to customs statistics, the total annual export volume of ammonium paratungstate, tungsten powder and tungsten carbide powder products in 2025 was around 3,877 tons, down about 41.7% year-on-year.

Given that some overseas enterprises are highly dependent on China for upstream tungsten raw materials, overseas premiums rose after the implementation of export controls, which also forced some overseas enterprises to switch to purchasing ammonium metatungstate and other tungstate products. The total annual export volume of these products increased by 44.2% year-on-year to around 2,837 tons, while the annual export volume of sodium tungstate products reached 306 tons, jumping 915.7% year-on-year.

In addition, the export volume of domestic tungsten materials products achieved sound growth in 2025. Among them, the total export volume of unwrought tungsten, bars and rods reached about 2,112 tons, up 84.3% year-on-year, which also reflects that some overseas terminal enterprises have switched to purchasing downstream tungsten material products as substitutes instead of intermediate products.

From the perspective of export timing, the year-on-year decline in the total export volume of domestic tungsten materials in the first three quarters of 2025 was relatively small. However, domestic tungsten prices rose rapidly in the fourth quarter, leading to a significant widening of the price gap with overseas markets. This resulted in negative export margins for some products, dampening the export enthusiasm of domestic exporters. Meanwhile, overseas terminal enterprises' willingness to purchase high-priced tungsten products declined. The total export volume of domestic tungsten products in the fourth quarter was about 3,559 tons, down 24.2% month-on-month and 34.8% year-on-year.

Export Destinations

In 2025, China's tungsten products were mainly exported to Japan, the European Union, the United States and other countries and regions. Among them, exports to Japan reached 3,879 tons (in metal quantity), down 13.3% year-on-year, accounting for about 28% of China's total tungsten product exports, ranking first.

On January 6, 2026, the Ministry of Commerce issued the Announcement on Strengthening the Export Control of Dual-Use Items to Japan, stipulating that: the export of all dual-use items to Japanese military users for military purposes, as well as for other end-user purposes that help enhance Japan's military capabilities, is prohibited. Any organization or individual in any country or region that transfers or provides relevant dual-use items originating in the People's Republic of China to organizations or individuals in Japan in violation of the above provisions shall be held legally responsible. It is expected that the subsequent export volume of tungsten-related products to Japan will show a downward trend.

Import Market: Resource-Driven, Domestic Tungsten Ore Imports Grew Significantly in 2025

Tungsten Ore Concentrates

The annual import volume reached 20,676.0 tons, surging 66.9% year-on-year; the import volume in December was 2,750.0 tons, up 29.9% month-on-month and 102.6% year-on-year.

In 2025, China's tungsten ore imports were mainly sourced from Kazakhstan, Myanmar, North Korea and other countries and regions. Among them, Kazakhstan emerged as China's largest supplier of tungsten ore concentrates, with imports from Kazakhstan totaling about 6,899 tons in 2025, accounting for 33% of China's total tungsten ore concentrate imports.

Based on import value and volume data, SMM estimates that the import unit price of tungsten ore from Kazakhstan in December was approximately 34,000 US dollars per ton (equivalent to 310,000 yuan per standard ton), while the monthly average price of domestic 65% wolframite concentrate in December was about 400,000 yuan per standard ton, indicating that Kazakh tungsten ore still enjoys a high cost advantage.

It is reported that the Bakuta tungsten mine in Kazakhstan has mineral resources of 1,104 million tons, with an average grade of 0.211% WO₃, equivalent to 233.2 thousand tons of tungsten trioxide metal content. The proven controlled resources amount to 985 million tons, with an average grade of 0.209% WO₃. The mine was put into production in July 2025, and all its output is currently shipped to Jiangxi Province, China, with a monthly output of around 850-900 tons.

- Myanmar: The second-largest supplier, with imports of 5,175 tons, accounting for 25%. The imported ore is mainly tungsten-tin associated ore with low grade (20%-30%), which requires complex pretreatment processes.

- North Korea: Imports reached 3,349 tons, accounting for 16.6% of the total imports. The imported tungsten ore concentrates are mainly sent to four provinces: Jiangxi, Yunnan, Liaoning and Fujian.

Import and Export of Cemented Carbide Cutting Tools and Inserts for Metalworking Machinery

In 2025, the annual export volume of cemented carbide cutting tools and inserts for metalworking machinery was 3,441.3 tons, down only 1.5% year-on-year. The annual import volume was 1,346.2 tons, up 6.8% year-on-year.

In the fourth quarter of 2025, the widening price gap of tungsten products between domestic and overseas markets led to a decline in export profits of domestic cemented carbide and other products, opening the import window. Some downstream enterprises chose to supplement overseas cemented carbide products, resulting in a growth in imports of cemented carbide and other products in the fourth quarter.

Nevertheless, domestic demand for some high-end cutting tools and cemented carbide products still relies on imports. From the perspective of the export market, under the impact of overseas trade tariffs, the export volume of domestic cemented carbide and cutting tools remained relatively stable in 2025. Coupled with the tight supply situation of overseas tungsten raw materials, it is expected that the export potential of cemented carbide and other products will continue to grow in the future.

Overall, against the dual backdrop of the restructuring of the global tungsten resource supply landscape and great-power geopolitical games, China's tungsten product import and export market will shift towards the characteristics of "resource-based imports and high-end-oriented export structure".

On the import side, constrained by domestic tungsten ore mining quota control and long-term tight supply, coupled with the resilient demand in high-end fields such as photovoltaics and aerospace, China's imports of resource-based products such as tungsten ore concentrates will remain at a high level in the future. Meanwhile, many countries in Europe and the United States have listed tungsten as a strategic reserve resource, ushering in a period of resource right competition in overseas tungsten ore prospecting and mining.

Recently, several tungsten mines in Central Asia have made new progress, such as the North Katpar and Upper Kailakht deposits in Kazakhstan, and the K-Tungsten project in Uzbekistan (with reserves of 106,700 tons of WO₃, scheduled to start production in 2028). At the same time, as Uzbekistan accelerates the construction of local processing capacity by revising mineral regulations and building a technology metal complex, tungsten mines in Central Asia may become an important overseas tungsten ore supply region in the future. Subsequent attention should be paid to the construction and commissioning of new mines in Central Asia.

On the export side, against the backdrop of tungsten products being included in the dual-use item export license management and the domestic APT FOB price rising by more than 200% compared with the beginning of 2025 (reaching 1,200-1,260 US dollars per ton-unit in January 2026), the export scale of traditional tungsten raw materials and mid-to-low-end products will continue to be suppressed by both policy controls and weakened price competitiveness.

However, high-value-added categories such as tungsten wires for photovoltaics and high-end cemented carbide cutting tools, relying on China's global production capacity advantage of 80%-90% and technical barriers in the deep processing link, will maintain export resilience. Moreover, enterprises will further expand markets along the Belt and Road Initiative and emerging markets to offset demand fluctuations in European and American markets caused by supply chain diversification strategies.

In general, the constraints on domestic tungsten ore resource exploitation will inevitably lead to increased overseas exploitation and utilization of tungsten ore resources. Meanwhile, China's tungsten product import and export market will focus on the core logic of "stable resource imports for security and high-end exports for building barriers", seek dynamic balance amid great-power games and industrial chain restructuring, strengthen high-end technical barriers, and gradually build an industrial system with stronger internal and external coordination and risk resistance capabilities.

![Magnesium Alloys Lead the New Quality Productive Forces, Hydrogen Storage Goes Global + Vehicle Lightweighting Reaches New Peaks [SMM Survey]](https://imgqn.smm.cn/usercenter/ZVhtl20251217171724.jpeg)

![[SMM Analysis] Stainless Steel Social Inventory Stopped Rising and Pulled Back, with Recovering Demand in the March-April Peak Season Driving Mild Destocking](https://imgqn.smm.cn/usercenter/UhBXJ20251217171724.jpeg)

![Magnesium Market Continued Consolidating at High Levels, with Cost Support and Demand Stalemate Persisting [SMM Magnesium Weekly Review]](https://imgqn.smm.cn/usercenter/xLlnY20251217171724.jpeg)