In mid-November 2025, the Passenger Car Association and CAAM successively released data on the automotive industry and passenger vehicle market for October 2025. In October, CAAM stated that automakers seized the window period for year-end policy transitions, maintaining a rapid pace of production supply. With new enterprise models continuing to launch intensively and industry-wide comprehensive management efforts steadily advancing, the auto market continued its favorable development trend, setting new highs in monthly production and sales for the same period. Among these, the passenger vehicle market showed steady growth, and the commercial vehicle market continued to improve.......SMM compiled relevant data for the automotive market and power battery market in October for readers' reference.

Automotive Sector

CAAM: October Auto Production and Sales Hit New Highs for the Same Period, January-October Auto Production and Sales Both Exceed 27 Million Units

In October, auto production and sales reached 3.359 million and 3.322 million units, respectively,up 2.5% and 3% MoM, and up 12.1% and 8.8% YoY.From January to October, auto production and sales reached 27.692 million and 27.687 million units, respectively,up 13.2% and 12.4% YoY,with the growth rates of production and sales narrowing by 0.1 and 0.5 percentage points, respectively, compared to January-September.

CAAM: NEV Sales in China Exceeded 50% of Total Sales for the First Time in October

In October, NEV production and sales reached 1.772 million and 1.715 million units, respectively,up 21.1% and 20% YoY, with NEV sales accounting for 51.6% of total new auto sales.From January to October, NEV production and sales reached 13.015 million and 12.943 million units, respectively,up 33.1% and 32.7% YoY, with NEV sales accounting for 46.7% of total new auto sales.

CAAM: NEV Exports Surpassed 2 Million Units for the First Time in January-October

In October, NEV exports reached 256,000 units, up 15.4% MoM,and up 99.9% YoY.Among these, passenger NEV exports were 250,000 units, up 15.3% MoM and doubling YoY; commercial NEV exports were 6,000 units, up 20.6% MoM and 26.7% YoY.

From January to October, NEV exports reached 2.014 million units,up 90.4% YoY.Among these, passenger NEV exports were 1.944 million units, up 89.3% YoY; commercial NEV exports were 70,000 units, up 1.3 times YoY.

The Passenger Car Association also recently released the passenger vehicle market situation for October 2025. According to data from the Passenger Car Association, retail sales in the national passenger vehicle market in October reached 2.242 million units, down 0.8% YoY and down 0.1% MoM. Cumulative retail sales since the beginning of the year totaled 9.25 million units, up 7.9% YoY. The cumulative growth rate of domestic vehicle retail sales this year started at 1.2% in January-February, rose to 15% from March to June, hovered around 6% from July to September, and fell to a flat state in October, showing a deceleration characteristic of a high base in H2, which basically aligns with the "low start, high middle, flat end" trend predicted at the beginning of the year.

On the passenger NEV front, retail sales in the passenger NEV market in October were 1.282 million units, up 7.3% YoY but down 1.3% MoM; cumulative retail sales from January to October reached 1.0151 million units, growing 21.9%. (For comparison: retail sales of conventional fuel passenger vehicles in October were 960,000 units, down 10% YoY but up 2% MoM; cumulative wholesale sales from January to October were 9.1 million units, down 4%).

On the export side, the Passenger Car Association stated that with the scale advantages and market expansion demands of Chinese new energy vehicles, China-made NEV brand products are increasingly going global, with growing recognition overseas. Plug-in hybrids accounted for 33% of NEV exports (18% in the same period last year). Although recently affected by some external disruptions, independent plug-in hybrid exports to developing countries have grown rapidly, with bright prospects. According to customs statistics, vehicle exports in October were 828,000 units, up 42% YoY; vehicle exports from January to October totaled 6.51 million units, up 23% YoY. Passenger NEV exports in October were 250,000 units, up 104% YoY and 19% MoM, accounting for 44.2% of passenger vehicle exports, an increase of 16.6 percentage points YoY; among these, pure electric vehicles accounted for 64% of NEV exports (81% in the same period last year), with A00 and A0 segment pure electric vehicles, as the core focus, making up 37% of pure electric exports (42% in the same period last year).

Regarding the passenger vehicle market in October, the "September-October peak season" feature was more pronounced before 2016, when housing prices were lower, first-time car buyers were numerous, and enthusiasm for car purchases before the Golden Week was high, with September car purchases generally exceeding those in October, hence the concept of "gold September, silver October." As housing prices surged, the vehicle market peaked in stages in 2017. With fewer young first-time buyers and trade-in buyers gradually becoming the main force, the "gold September, silver October" gradually shifted to "silver September, gold October," and vehicle sales have not broken through in the past seven years. However, this year's situation is somewhat special: as the Mid-Autumn Festival fell in October and trade-in subsidy policies tightened in some provinces and cities, regional sales growth diverged, and October sales failed to sustain an upward trend.

The CPCA identified the characteristics of the passenger car market in October 2025 as follows: First, production, exports, and wholesale figures for passenger cars by manufacturers in October all reached record highs for the month, with exports setting a new all-time high for any month in history. Second, state-owned large groups' proprietary brands demonstrated strong growth, with the combined sales of proprietary brands from five major state-owned groups—SAIC, Dongfeng, Changan, Chery, and BAIC—increasing 17% YoY in October. Among them, "second-generation" proprietary brands from major groups, such as Arcfox, VOYAH, and Deepal, experienced robust growth. Third, new vehicle launches this year occurred in successive waves, coupled with the advancement of "anti-involution" efforts curbing disorderly price cuts. Automakers shifted to a strategy of "adding features without raising prices" to enhance product appeal. Direct price wars became slightly milder, but hidden incentives proliferated, including annual model upgrades with added features, adjustments to owner benefits, the "program of large-scale equipment upgrades and consumer goods trade-ins" policy, and increased manufacturer subsidies. NEV promotions in October decreased slightly to 9.8% MoM compared to September. Fourth, domestic retail sales of internal combustion engine vehicles in October decreased 10% YoY; retail sales in the pure electric market increased 20% YoY, while extended-range electric vehicle sales decreased 7.7% YoY, and plug-in hybrid electric vehicle sales decreased 10.3% YoY. The structural share of pure electric versus extended-range vehicles among new automakers shifted from 49%:51% last year to 74%:26%. Fifth, the domestic retail penetration rate of NEVs in October was 57.2%, showing steady NEV growth underpinned by universal policies such as retirement and renewal, replacement updates, and the NEV purchase tax exemption. Sixth, exports of proprietary internal combustion engine passenger vehicles from January to October 2025 totaled 2.35 million units, down 9%, while exports of proprietary NEVs reached 1.53 million units, up 126%; NEVs accounted for 39.5% of proprietary exports.

The CAAM commented that in October, automakers seized the window period before year-end policy changes, maintaining a rapid pace of production and supply. Enterprises continued intensive launches of new products, and industry-wide comprehensive governance efforts progressed steadily, sustaining favorable development trends in the auto market, with monthly production and sales reaching record highs for the period. Specifically, the passenger car market grew steadily, the commercial vehicle market continued to improve, NEVs maintained rapid growth, and foreign trade demonstrated good resilience.

Regarding power batteries,

the cumulative sales of power and other batteries in China from January to October 2025 reached 1,233.2 GWh, up 55.1% YoY.

In October, sales of power and other batteries in China were 166.0 GWh,up 13.3% MoM and 50.8% YoY. Among these, power battery sales were 124.3 GWh, accounting for 74.9% of total sales, up 12.4% MoM and 56.6% YoY; sales of other batteries were 41.7 GWh, accounting for 25.1% of total sales, up 15.9% MoM and 35.7% YoY.

January-October, China's cumulative sales of power and other batteries reached 1,233.2 GWh, up 55.1% YoY. Among them, cumulative power battery sales were 910.3 GWh, accounting for 73.8% of total sales, up 49.9% YoY; cumulative sales of other batteries were 322.8 GWh, accounting for 26.2% of total sales, up 71.9% YoY.

From January to September 2025, domestic cumulative power battery installations were 578.0 GWh, up 42.4% YoY

In October, domestic power battery installations were 84.1 GWh, up 10.7% MoM and 42.1% YoY. Among them, ternary battery installations were 16.5 GWh, accounting for 19.7% of total installations, up 19.8% MoM and 35.8% YoY; LFP battery installations were 67.5 GWh, accounting for 80.3% of total installations, up 8.6% MoM and 43.7% YoY.

From January to October, domestic cumulative power battery installations were 578.0 GWh, up 42.4% YoY. Among them, cumulative ternary battery installations were 107.7 GWh, accounting for 18.6% of total installations, down 3.0% YoY; cumulative LFP battery installations were 470.2 GWh, accounting for 81.3% of total installations, up 59.7% YoY.

NEV Market Continues Momentum in October, Multiple Automakers Set New Monthly Delivery Records!

In October, the NEV market continued its October peak season effect, with multiple new automakers maintaining strong momentum and again refreshing their monthly delivery records. Leap Motor performed particularly outstandingly!

Among new automakers, Leap Motor's October deliveries broke the 70,000-unit barrier for the first time, reaching 70,289 units, up over 84% YoY, once again setting a new monthly delivery record for new automakers, marking another historic leap following its continuous delivery growth from March to September this year. In the first 10 months of this year, Leap Motor's cumulative deliveries have reached 465,800 units. Notably, on September 25, Leap Motor announced the official rollout of its 1 millionth vehicle, taking only 343 days to go from 500,000 to 1 million units. Zhu Jiangming, Founder, Chairman, and CEO of Leap Motor Group, stated that Leap Motor's sales are expected to reach 500,000 to 600,000 units in 2025. Based on market performance exceeding expectations, the group has recently raised its full-year 2025 sales target to 580,000 to 650,000 units and will challenge 1 million units in 2026. Based on its sales target of 580,000 to 650,000 units, Leap Motor's current target completion rate is estimated to be approximately 71.67% to 80.31%.

XPeng Motors also delivered a commendable performance in October, with monthly deliveries of new vehicles reaching 42,013 units, up 76% YoY, setting a new historical high for single-month deliveries and marking the second consecutive month that deliveries have stabilized above the 40,000-unit level. From January to October this year, XPeng's cumulative deliveries reached 355,209 units, up significantly by 190% YoY. The XPeng P7+ continued to sell well, with cumulative deliveries exceeding 80,000 units by the end of October, securing the top spot in sales of large all-electric sedans in the 150,000-200,000 yuan price range for the 11th consecutive month.

NIO ranked third among new automakers with new vehicle deliveries of 40,397 units in October, up 92.6% YoY. In the first ten months, Leap Motor's cumulative deliveries totaled 241,618 units, up 41.9% YoY;

Xiaomi Auto also continued to exceed the 40,000-unit mark for new vehicle deliveries in April.On October 16, Lei Jun, founder and CEO of Xiaomi Group, publicly stated that Xiaomi Auto products had delivered approximately 400,000 units within a year and a half since their launch. On October 24, Xiaomi Auto announced a cross-year car purchase tax subsidy plan: for orders locked before 24:00 on November 30, 2025, if, due to reasons attributable to Xiaomi Auto, the locked configuration vehicle requires invoicing and delivery in 2026, it will be eligible for the cross-year purchase tax subsidy. Applicable car models include the Xiaomi SU7 series, Xiaomi YU7 series, and Xiaomi SU7 Ultra series. Xiaomi Auto explained that it would subsidize the difference in purchase tax generated by the actual purchase price between 2026 and 2025 by deducting the amount from the final car payment, with the maximum subsidy amount not exceeding 15,000 yuan. "Reasons attributable to Xiaomi Auto" refer to circumstances within Xiaomi Auto's responsibility, such as production or transportation issues, that cause the locked configuration vehicle to require invoicing and delivery in 2026. It is estimated that Xiaomi's "purchase tax guarantee" initiative will involve an investment of over 2 billion yuan.

In October, Li Auto delivered 31,767 new vehicles. As of October 31, 2025, Li Auto's historical cumulative deliveries reached 1,462,788 units.

BYD, as the domestic "electric leader,"achieved sales of 441,706 units in October, setting a new high for the year.Its cumulative NEV sales for the year reached 3,701,852 units, up 13.88% YoY. BYD had previously set an annual sales target of 4.6 million units for 2025, of which 3.7 million units have been completed so far, achieving approximately 80.43% of the target. Additionally, the company's total installed capacity of power batteries and ESS batteries for NEVs in October 2025 was approximately 27.362 GWh, with the cumulative installed capacity reaching approximately 230.613 GWh. In October 2025, a total of 83,904 NEVs were exported.

"Two New" Subsidies Showed Significant Effects but Were Widely Suspended; CAAM Recommends Optimizing and Continuing Related Policies Next Year

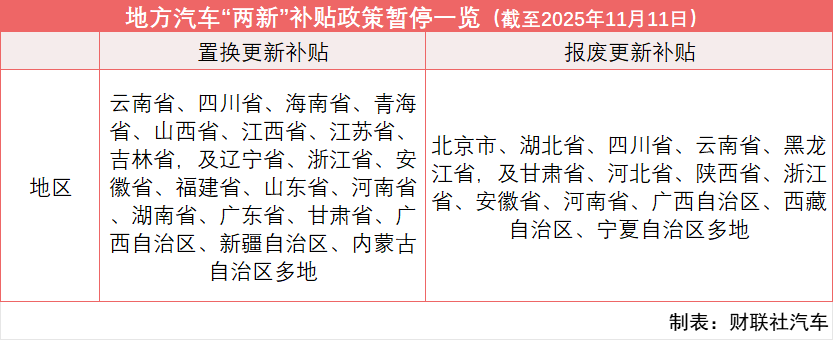

It is worth mentioning that since the beginning of 2025, many regions across the country have intensively suspended subsidies for vehicle retirement and renewal, as well as replacement subsidies. According to incomplete statistics, multiple regions, including Beijing, Hubei, Sichuan, and Yunnan, have already announced the suspension of related subsidies. The chart below shows the provinces, municipalities, and autonomous regions that have suspended vehicle replacement or retirement and renewal subsidies, as previously compiled by Cailian Press, accounting for up to 90% of the total. Meanwhile, Shanghai and other areas have conducted vehicle retirement and renewal subsidy activities through a "lottery" system.

Against the backdrop of the significant effects and widespread suspension of the "Two New" subsidies in 2025, and with policies for 2026 yet to be announced, CAAM stated that since H2 of last year, the vehicle trade-in policy has had a notable driving effect. However, it remains unclear whether the policy will be extended. "Considering that the NEV purchase tax will be halved next year, to reduce market volatility, it is recommended to continue optimizing and implementing related policies next year, and to release implementation details as early as possible to stabilize market expectations and support the stable operation of the industry."

Looking ahead to the national passenger vehicle market in November, the China Passenger Car Association indicated that there will be 20 working days in November 2025, one day less than the same period last year but one day more than the 19 working days in October. The production and sales time will be relatively shorter.

Policy-driven year-end growth. Due to the expiration of the NEV purchase tax exemption this year and the 5 percentage point increase in the purchase tax for next year, consumers have a stronger sense of urgency to purchase vehicles by year-end, leading them to prioritize delivery timelines when selecting car models. To address the rising costs for consumers caused by extended delivery cycles, automakers have introduced purchase tax subsidy schemes. However, such safety-net measures are only temporary at the end of this year and are not sustainable in the future. Car purchases are heavily influenced by the market atmosphere. As popular models face long waiting lists, many consumers are turning to less sought-after models, which helps sustain the rising momentum in the automotive market and further boosts sales.

Seasonal factors drive year-end strength. As the weather turns colder and migrant workers gradually return home for the Chinese New Year, car purchase enthusiasm in rural areas will be gradually released, and the markets for NEVs and low and mid-end internal combustion engine vehicles will gradually warm up. Inventory is essential to ensure sufficient options for car purchases. The peak sales period from December to before the Chinese New Year requires ample inventory, and November is the best time to build up inventory. Therefore, producer sales in November are expected to remain strong.