The National Bureau of Statistics Service Industry Survey Center and the China Federation of Logistics & Purchasing released China's manufacturing PMI for October today (31st). Affected by seasonal factors, the manufacturing PMI experienced some fluctuations, but new momentum and consumer goods manufacturing maintained steady growth, with positive changes still seen in market prices.China's manufacturing PMI for October was 49%, down 0.8 percentage points MoM.

Huo Lihui, Chief Statistician of the National Bureau of Statistics Service Industry Survey Center, interpreted China's PMI for October 2025.

China's Purchasing Managers' Index Operation in October 2025

I. Operation of China's Manufacturing Purchasing Managers' Index

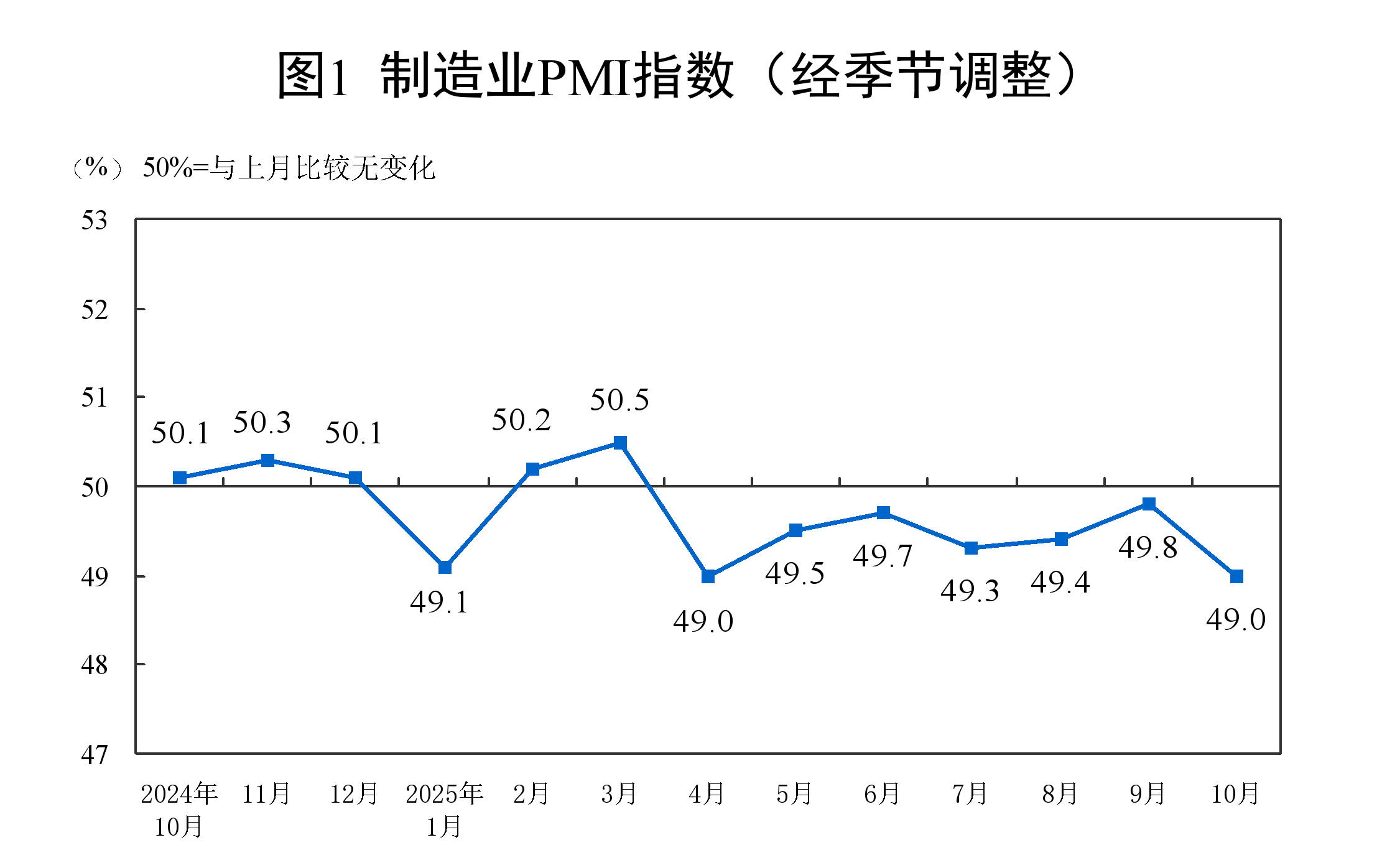

In October, the manufacturing PMI was 49.0%, down 0.8 percentage points from the previous month, indicating a pullback in manufacturing prosperity.

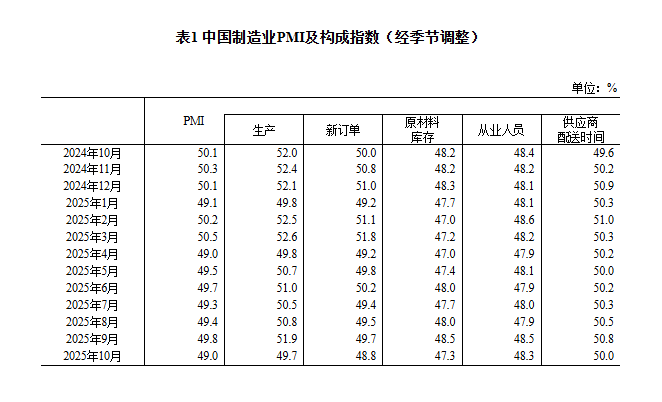

By enterprise size, the PMI for large, medium, and small enterprises was 49.9%, 48.7%, and 47.1%, respectively, down 1.1, 0.1, and 1.1 percentage points from the previous month, all below the critical point.

Among the five sub-indices that constitute the manufacturing PMI, the supplier delivery time index was at the critical point, while the production index, new orders index, raw material inventory index, and employment index were all below the critical point.

The production index was 49.7%, down 2.2 percentage points from the previous month, indicating a slowdown in manufacturing production.

The new orders index was 48.8%, down 0.9 percentage points from the previous month, indicating a pullback in manufacturing market demand.

The raw material inventory index was 47.3%, down 1.2 percentage points from the previous month, indicating a continued reduction in the inventory of major raw materials in manufacturing.

The employment index was 48.3%, down 0.2 percentage points from the previous month, indicating a slight drop in employment prosperity among manufacturing enterprises.

The supplier delivery time index was 50.0%, down 0.8 percentage points from the previous month, at the critical point, indicating that the delivery time of raw material suppliers in manufacturing was basically flat compared to the previous month.

II. Operation of China's Non-Manufacturing Purchasing Managers' Index

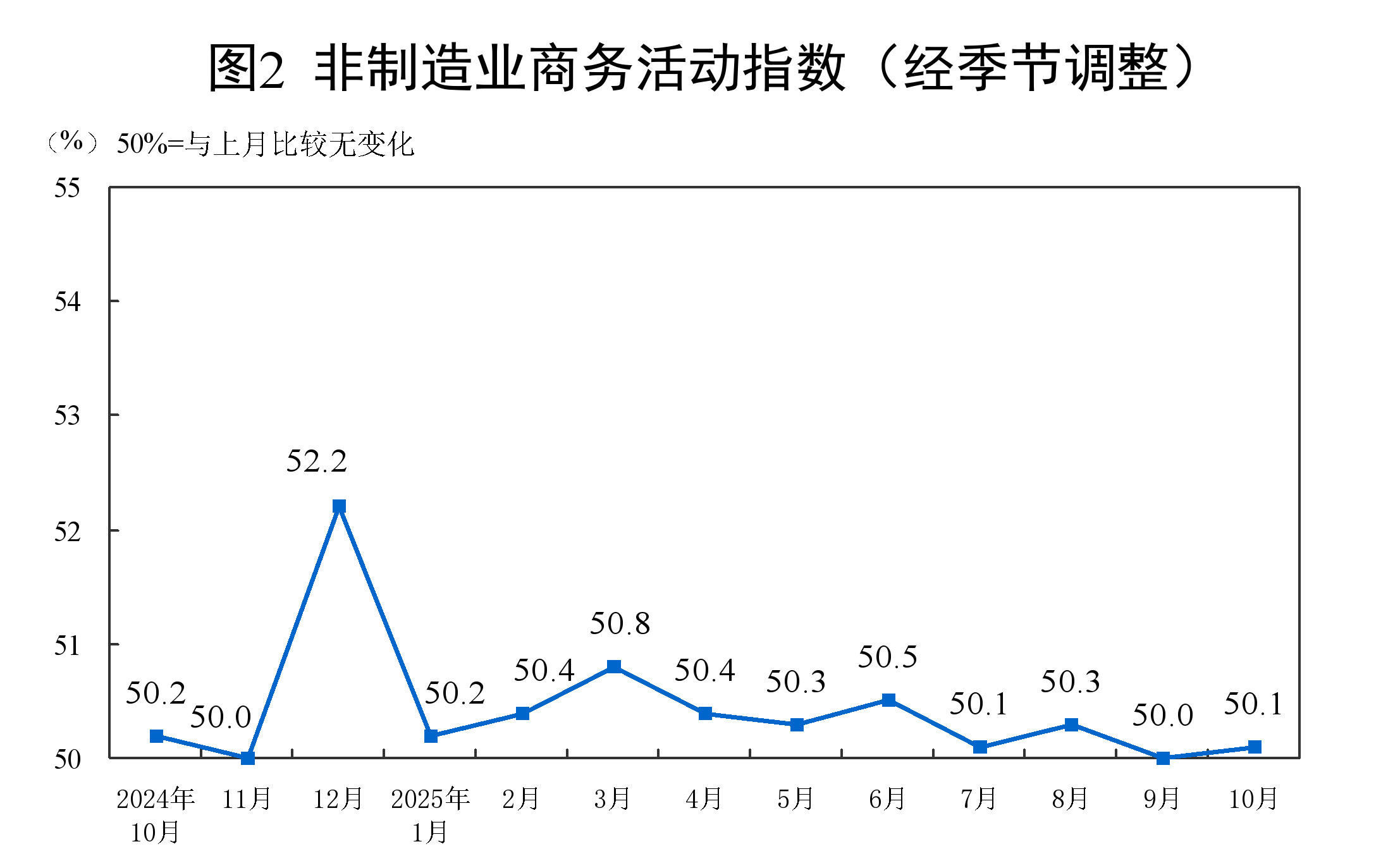

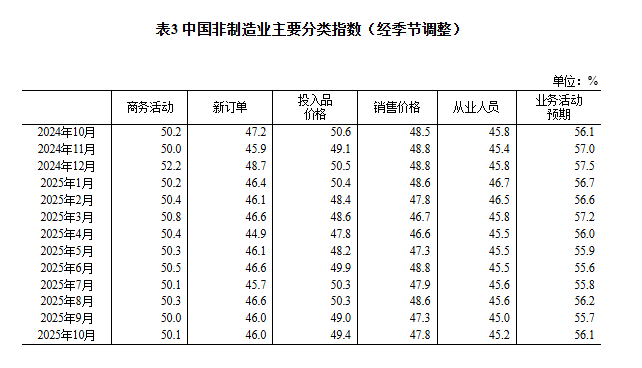

In October, the non-manufacturing business activity index was 50.1%, up 0.1 percentage points from the previous month, rising into expansion territory.

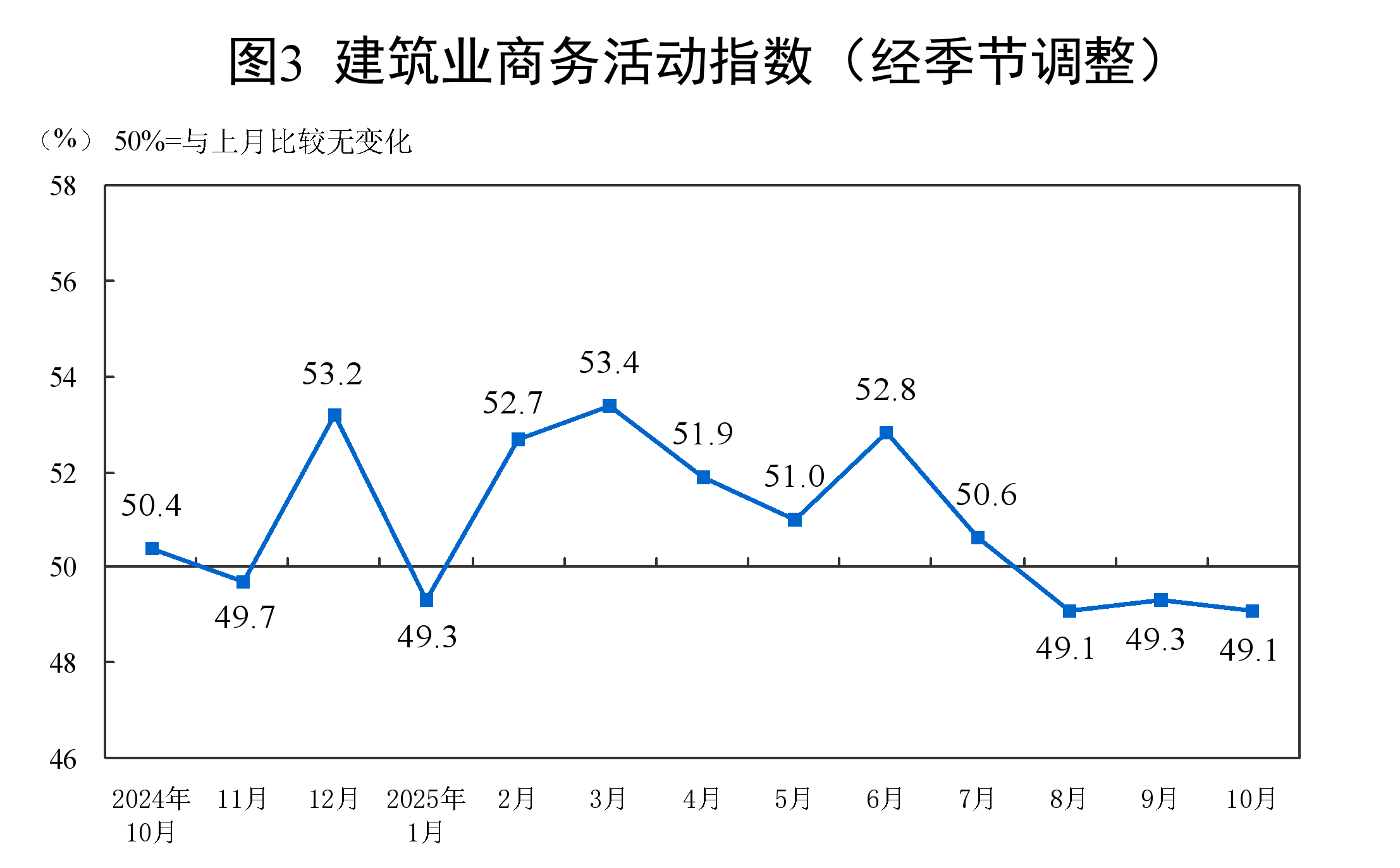

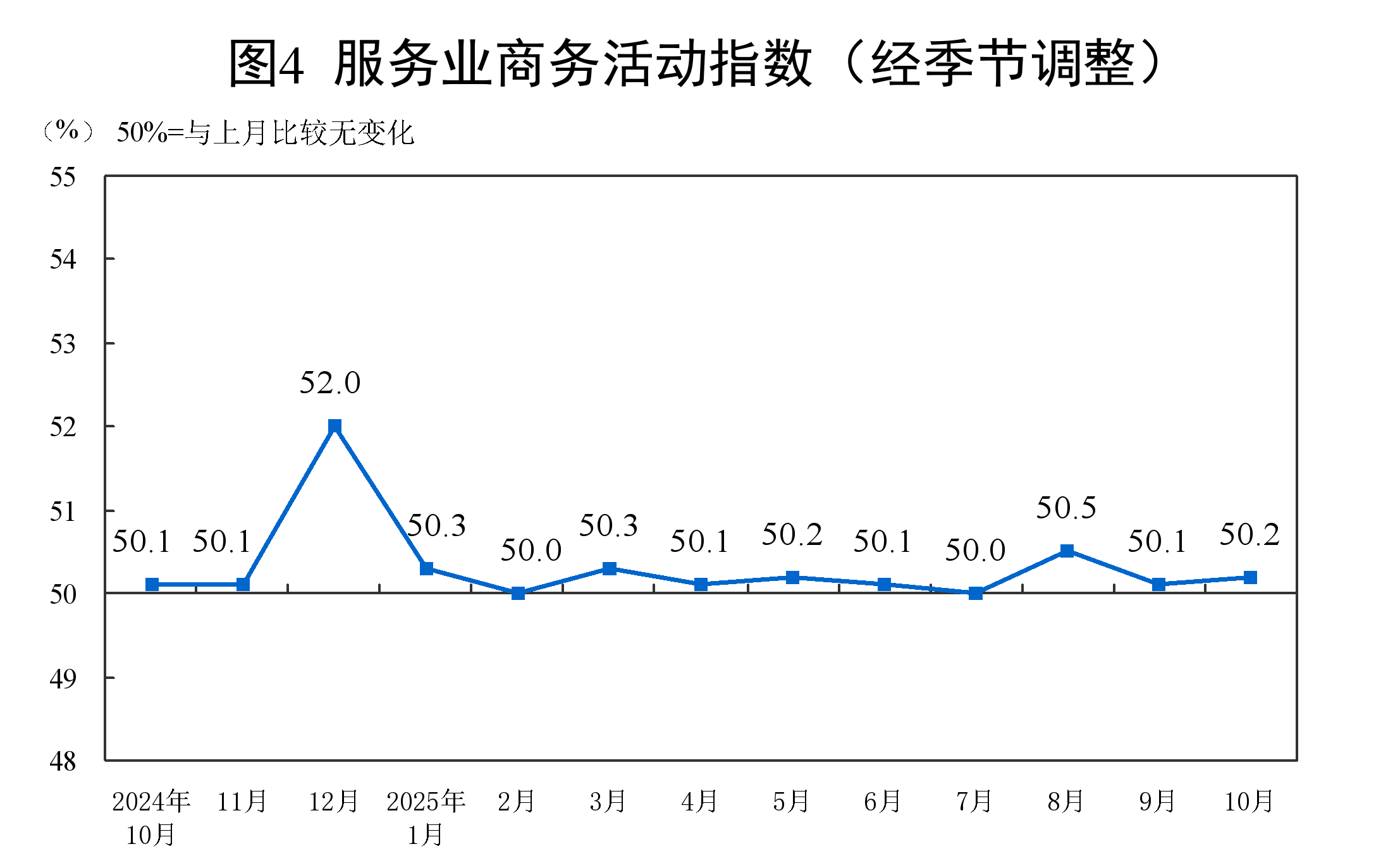

By sector, the business activity index for the construction sector was 49.1%, down 0.2 percentage points from the previous month; the business activity index for the service sector was 50.2%, up 0.1 percentage points from the previous month. In the service sector, the business activity indices for industries such as railway transportation, air transportation, postal services, accommodation, culture, sports, and entertainment were all in the high prosperity range of 60.0% and above; the business activity indices for industries such as insurance and real estate were all below the critical point.

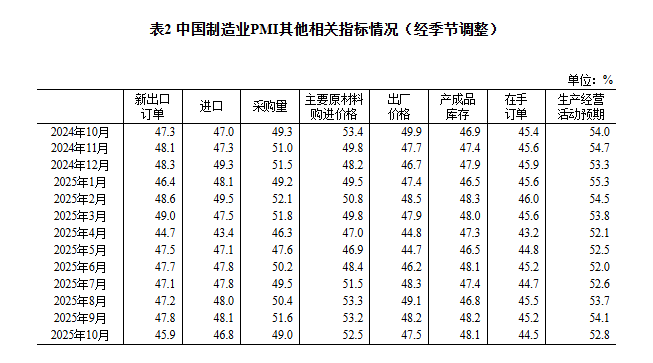

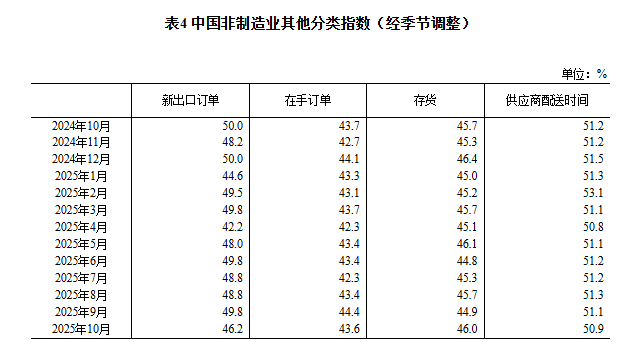

The new orders index stood at 46.0%, flat from the previous month and remaining below the threshold, indicating weak market demand in the non-manufacturing sector. By sector, the new orders index for construction was 45.9%, up 3.7 percentage points from the previous month, while that for services was 46.0%, down 0.7 percentage points.

The input price index was 49.4%, up 0.4 percentage points from the previous month but still below the threshold, indicating a narrowing decline in the overall price level of inputs used by non-manufacturing enterprises for business activities. By sector, the input price index for construction was 49.6%, up 2.4 percentage points from the previous month, while that for services was 49.4%, up 0.1 percentage points.

The selling price index was 47.8%, up 0.5 percentage points from the previous month but remaining below the threshold, indicating that the overall selling price level in the non-manufacturing sector was lower than the previous month. By sector, the selling price index for construction was 48.4%, up 0.3 percentage points from the previous month, while that for services was 47.7%, up 0.5 percentage points.

The employment index was 45.2%, up 0.2 percentage points from the previous month, indicating an improvement in the employment sentiment of non-manufacturing enterprises. By sector, the employment index for construction was 39.9%, up 0.2 percentage points from the previous month, while that for services was 46.1%, up 0.2 percentage points.

The business activity expectation index was 56.1%, up 0.4 percentage points from the previous month, indicating that most non-manufacturing enterprises are relatively optimistic about market development prospects. By sector, the business activity expectation index for construction was 56.0%, up 3.6 percentage points from the previous month, while that for services was 56.1%, down 0.2 percentage points.

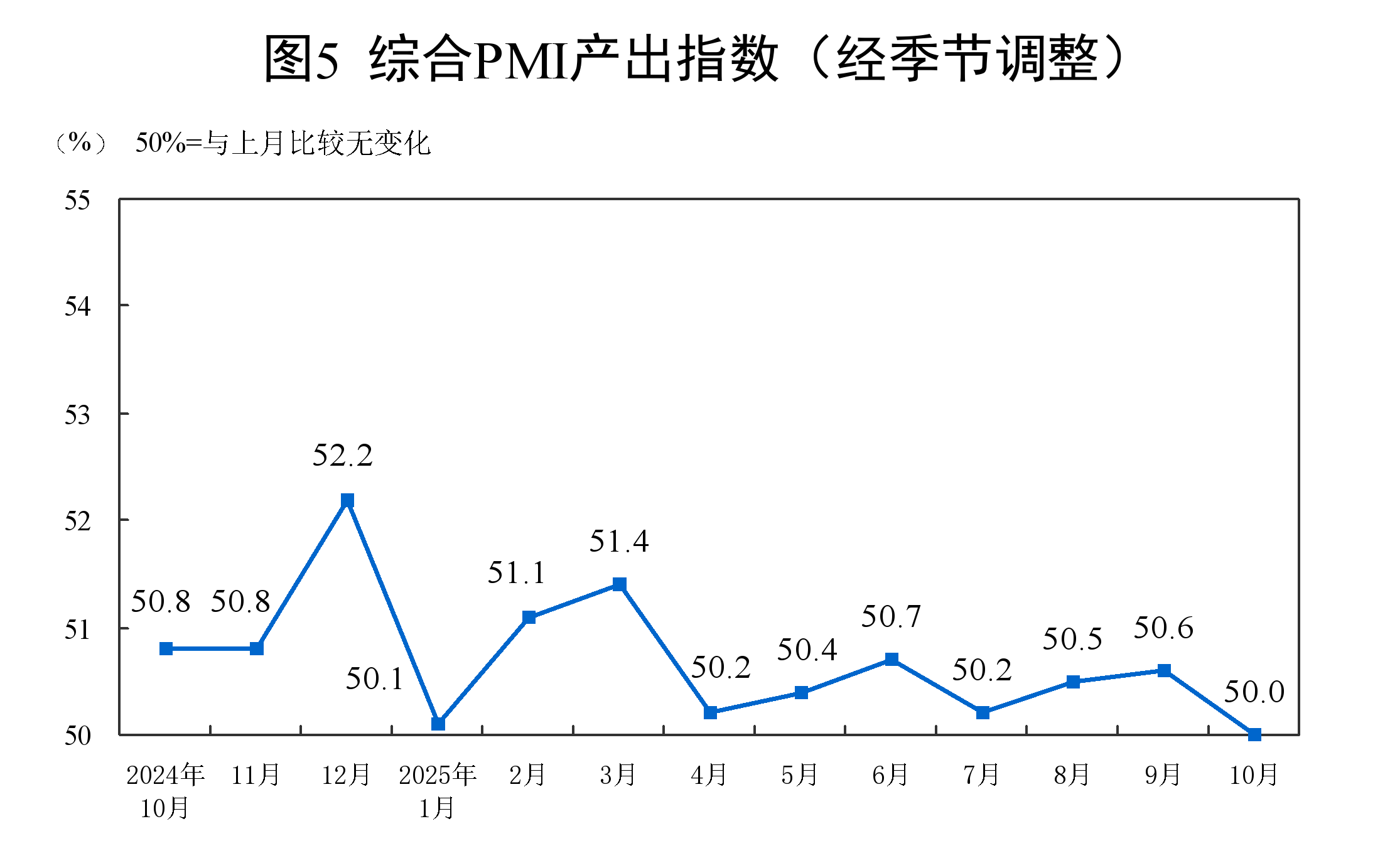

III. Operation of China's Composite PMI Output Index

In October, the composite PMI output index was 50.0%, down 0.6 percentage points from the previous month, standing at the threshold, indicating overall stability in the production and business activities of Chinese enterprises.

Manufacturing PMI Pulled Back in October

Non-Manufacturing Business Activity Index Slightly Rebounded

—Huo Lihui, Chief Statistician of the NBS Service Industry Survey Center, Interprets China's Purchasing Managers' Index for October 2025

On October 31, 2025, the Purchasing Managers' Index for China was released by the NBS Service Industry Survey Center and the China Federation of Logistics & Purchasing. In this regard, Huo Lihui, Chief Statistician of the NBS Service Industry Survey Center, offered an interpretation.

In October, the manufacturing PMI stood at 49.0%, down 0.8 percentage points MoM; the non-manufacturing business activity index was 50.1%, up 0.1 percentage points MoM; the composite PMI output index registered 50.0%, down 0.6 percentage points MoM, indicating overall stable economic output in China.

I. Manufacturing PMI Experienced a Pullback

In October, influenced by factors such as pre-holiday demand release and a more complex international environment, manufacturing production activities slowed down compared to the previous month, with the PMI dropping to 49.0%.

(1) Both Supply and Demand Sides Slowed Down. The production index and new orders index were 49.7% and 48.8%, respectively, down 2.2 and 0.9 percentage points from the previous month, indicating a pullback in both production and market demand for manufacturing enterprises. By sector, the production and new orders indices for agricultural and non-staple food processing, automobiles, and railway, ship, aerospace equipment industries all remained above 52.0%, showing active production and demand; meanwhile, both indices for textile, apparel, and accessories, chemical fibers, rubber and plastic products, and non-metallic mineral products industries were below the threshold, reflecting weak supply-demand conditions in these sectors.

(2) Large Enterprises' Production and Demand Indices Continued Above the Threshold. The PMI for large, medium, and small enterprises were 49.9%, 48.7%, and 47.1%, respectively, down 1.1, 0.1, and 1.1 percentage points from the previous month, indicating varying degrees of decline in business sentiment. Among them, the production and new orders indices for large enterprises were 50.9% and 50.1%, respectively, both staying in expansion territory for six consecutive months, demonstrating sustained release of production and demand in large manufacturing enterprises.

(3) Three Key Industries Maintained Expansion. The PMI for high-tech manufacturing, equipment manufacturing, and consumer goods industries were 50.5%, 50.2%, and 50.1%, respectively, continuing to reside in expansion territory and significantly higher than the overall manufacturing level, with ongoing supportive roles from these sectors. The PMI for high-energy-consumption industries was 47.3%, down 0.2 percentage points from the previous month, indicating a pullback in business sentiment.

(4) Overall Optimistic Market Expectations. The production and business activity expectation index was 52.8%, remaining in expansion territory, suggesting that most manufacturing enterprises maintain optimistic expectations for market development. By sector, the expectation indices for non-ferrous metal smelting and rolling processing, and railway, ship, aerospace equipment industries rose to above 60.0%, entering a high prosperity range, indicating enhanced confidence among related enterprises in industry development.

II. Non-Manufacturing Business Activity Index Slightly Rebounded

In October, the non-manufacturing business activity index was 50.1%, up 0.1 percentage points from the previous month, rising into expansion territory.

(I) The Service Sector Business Activity Index Continued to Expand. The service sector business activity index stood at 50.2%, up 0.1 percentage points from the previous month, indicating a rebound in the service sector's level of prosperity. By industry, driven by the holiday effects of National Day and Mid-Autumn Festival, industries closely related to residents' travel and consumption—such as railway transport, air transport, accommodation, culture, sports, and entertainment—all recorded business activity indices in the high prosperity range of 60.0% and above, reflecting strong market activity. Boosted by factors such as the "Double 11" shopping festival's promotional activities, the business activity index for the postal industry rose to over 70.0%, with total business volume accelerating. Meanwhile, industries such as insurance and real estate had business activity indices below the threshold, indicating weaker prosperity. In terms of market expectations, the business activity expectation index was 56.1%, remaining in a relatively high prosperity range, suggesting that service sector enterprises maintain strong confidence in industry development.

(II) The Construction Sector Business Activity Index Dropped Back Slightly. The construction sector business activity index was 49.1%, down 0.2 percentage points from the previous month, indicating a pullback in the construction sector's level of prosperity. In terms of market expectations, the business activity expectation index was 56.0%, up 3.6 percentage points from the previous month, suggesting that construction sector enterprises continue to improve their expectations for market development.

III. The Composite PMI Output Index Remained at the Threshold

In October, the composite PMI output index was 50.0%, at the threshold, indicating overall stability in the production and operating activities of China's enterprises. The manufacturing production index and the non-manufacturing business activity index, which constitute the composite PMI output index, were 49.7% and 50.1%, respectively.