From January to July 2025, China's passenger vehicle exports reflected a global landscape defined by diversification, electrification, and deeper regional integration. BYD stood out as a front-runner across Europe, Southeast Asia, North America, and Oceania—dominating the European market with over 150,000 units exported and a 237.1% YoY surge, reinforcing China's growing edge in electrification technologies.

Emerging markets continued to gain traction. Leapmotor and eGT recorded over 600% growth in Europe, Jiangling Motors doubled its sales in Latin America, and Chery Auto saw exports to Oceania soar nearly fourfold. These results highlight how Chinese automakers are capturing new ground through region-specific strategies and competitive product portfolios.

At the same time, performance divergence is becoming more pronounced. Tesla and Geely Auto saw exports to Europe weaken, while SAIC Motor's shipments to North America plunged by 66.2% YoY. The competition is shifting from simple scale expansion to a test of product strength, brand recognition, and local adaptability. In this new phase, success increasingly depends on two pillars: electrification leadership and supply chain resilience.

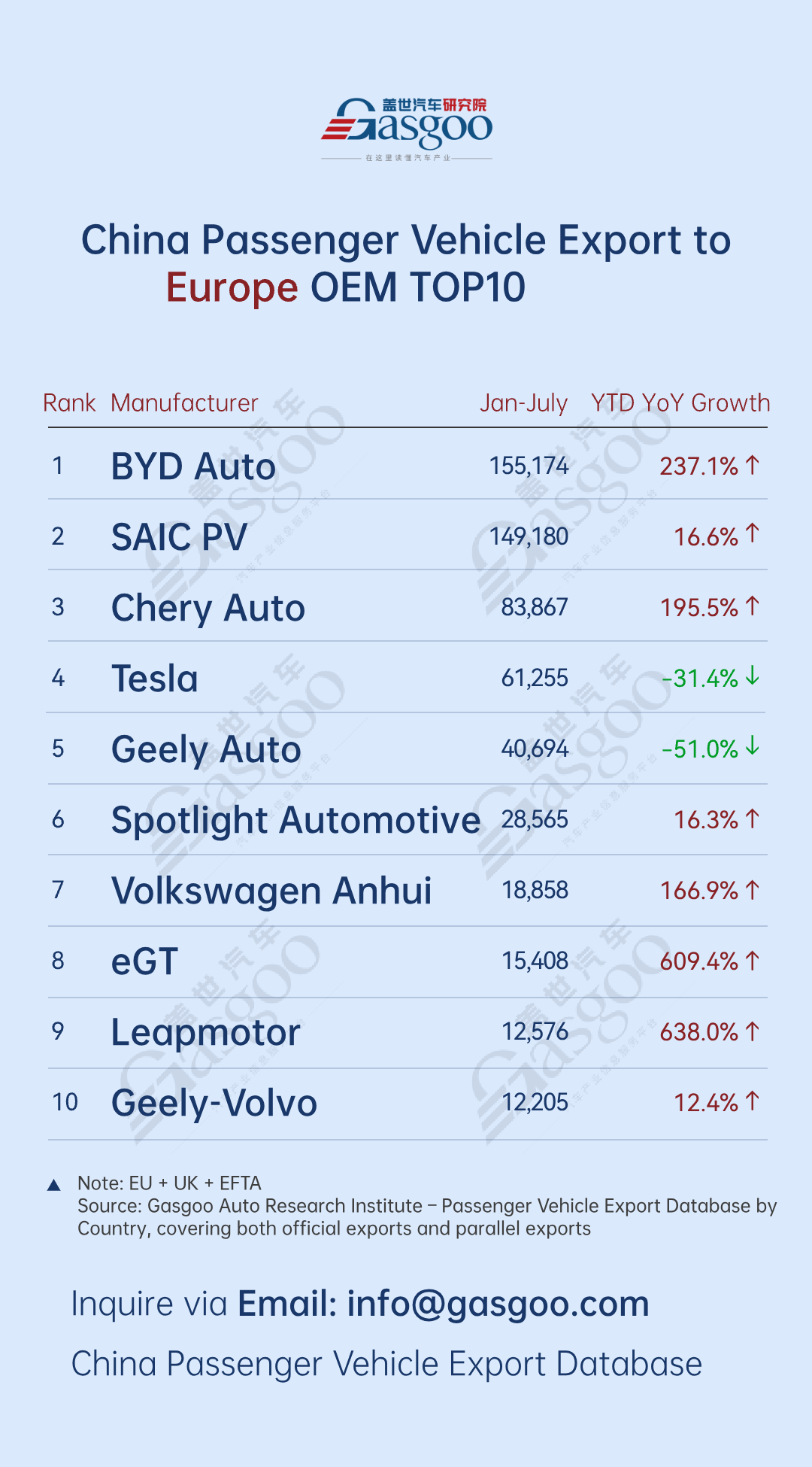

Top 10 Chinese automakers by passenger vehicle exports to Europe

BYD Auto: 155,174 units, up 237.1% year-on-year

SAIC Passenger Vehicle: 149,180 units, up 16.6% year-on-year

Chery Auto: 83,867 units, up 195.5% year-on-year

Tesla: 61,255 units, down 31.4% year-on-year

Geely Auto: 40,694 units, down 51.0% year-on-year

Spotlight Automotive: 28,565 units, up 16.3% year-on-year

Volkswagen Anhui: 18,858 units, up 166.9% year-on-year

eGT: 15,408 units, up 609.4% year-on-year

Leapmotor: 12,576 units, up 638.0% year-on-year

Geely-Volvo: 12,205 units, up 12.4% year-on-year

The European market showed a clear pattern of leading incumbents, emerging players' rapid growth, and significant differentiation among manufacturers.

Among the top players, BYD Auto led the pack with a remarkable 237.1% YoY increase, demonstrating its strong breakthrough in Europe under an electrification and globalization strategy. SAIC Passenger Vehicle maintained steady growth at 16.6%, consolidating its leading position, while Chery Auto achieved a robust 195.5% increase, reflecting the effectiveness of its product competitiveness and targeted regional market development.

Emerging players showed particularly strong performance: Leapmotor and Easyget achieved YoY growth exceeding 600%, rapidly entered the European market with differentiated products, and became new drivers of export growth. Notably, Leapmotor announced that starting July 18, it would launch an EV subsidy program funded by the company, offering up to £3,750 in purchase incentives. This reduced the on-road price of Leapmotor's five-door micro EV T03 to £14,495, and the family-oriented electric SUV C10 to £32,750. Both models were available with zero-interest installment plans.

Meanwhile, market differentiation has intensified: Tesla and Geely Auto experienced YoY declines, likely influenced by product cycle adjustments and heightened local competition, including the influx of Chinese brands and the accelerated electrification of European incumbents.

Overall, Chinese brands continue to expand their penetration in the European market. The combination of established leaders maintaining strong positions and emerging players breaking through drives export growth. However, the wide disparity in growth rates among companies indicates that competition in Europe will become increasingly fierce, with product competitiveness, supply chain resilience, and regional operational capabilities emerging as decisive factors.

Top 10 Chinese automakers by passenger vehicle exports to Southeast Asia

BYD Auto: 80,060 units, up 162.3% year-on-year

Geely Auto: 49,427 units, up 56.7% year-on-year

Chery Auto: 46,425 units, up 143.8% year-on-year

Changan Auto: 20,982 units, up 35.9% year-on-year

Jiangsu Yueda Kia: 10,862 units, up 35.7% year-on-year

Great Wall Motor: 10,563 units, up 7.8% year-on-year

SAIC Passenger Vehicle: 9,398 units, down 38.8% year-on-year

XPENG: 9,277 units (new entry)

Tesla: 8,827 units, down 1.0% year-on-year

Jiangling Motor: 8,806 units, up 9.3% year-on-year

From January to July, China's passenger vehicle exports to Southeast Asia showed overall growth. BYD Auto led the pack with 80,060 units, up 162.3% YoY, driven by the technological competitiveness of its new energy vehicles (NEVs) and deep regional market penetration. Chery Auto and Geely Auto followed closely, with YoY increases of 143.8% and 56.7%, respectively, as traditional strong players continued to consolidate their advantages through diverse product portfolios and brand recognition. Changan Automobile and Jiangsu Yueda Kia also maintained double-digit growth.

Overall, Chinese brands have continued to increase their share in the Southeast Asian export market, with NEVs playing an increasingly prominent role. Meanwhile, differentiation in product offerings and varying competitive strategies among companies have begun to emerge. Leading enterprises are further widening the gap through advantages in product portfolios and distribution channels, making Southeast Asia a key market for Chinese passenger vehicle exports.

Top 10 Chinese automakers by passenger vehicle exports to North America

BYD Auto: 74,180 units, up 131.6% year-on-year

SAIC-GM-Wuling: 59,178 units, up 6.7% year-on-year

Chery Auto: 20,382 units, up 12.8% year-on-year

SAIC-GM: 18,077 units, down 32.0% year-on-year

Jiangsu Yueda Kia: 18,060 units, up 5.0% year-on-year

Changan-Ford: 17,670 units, down 28.8% year-on-year

Geely Auto: 14,765 units, down 15.9% year-on-year

SAIC Passenger Vehicle: 14,388 units, down 66.2% year-on-year

GAC Trumpchi: 10,427 units, up 94.4% year-on-year

Great Wall Motor: 9,469 units, up 77.9% year-on-year

The North American market is showing a clear split. New energy and newly positioned Chinese automakers are growing rapidly: BYD Auto surged 131.6% YoY, while GAC Trumpchi and Great Wall Motor each rose over 70%, highlighting how advantages in NEV technology and differentiated product strategies are translating into market competitiveness. NEVs are increasingly becoming the key to gaining ground. Meanwhile, traditional joint ventures and some legacy Chinese brands are facing headwinds: SAIC-GM, Changan-Ford, and SAIC Passenger Vehicle all saw double-digit declines, with SAIC Passenger Vehicles plunging 66.2%.

Mid-tier players remain steady but need to accelerate: Chery Auto and SAIC-GM Wuling achieved modest single-digit growth, yet the rapid rise of leading NEV brands like BYD Auto underscores the urgency of upgrading products and expanding NEV offerings to capture more market share. Overall, Chinese automakers in North America are at a turning point, where NEV adoption and global product strategies will largely determine the future market hierarchy.

Top 10 Chinese automakers by passenger vehicle exports to Central and South America

BYD Auto: 97,194 units, down 13.4% year-on-year

Chery Auto: 71,614 units, up 15.6% year-on-year

Great Wall Motor: 37,701 units, up 47.7% year-on-year

Jiangsu Yueda Kia: 27,114 units, down 2.3% year-on-year

Jiangling Motor: 20,183 units, up 127.0% year-on-year

Geely Auto: 15,089 units, down 9.1% year-on-year

SAIC-GM-Wuling: 14,454 units, down 21.0% year-on-year

DFSK: 12,496 units, up 70.9% year-on-year

Changan Auto: 10,491 units, down 18.5% year-on-year

SAIC Passenger Vehicle: 10,003 units, up 3.9% year-on-year

From January to July, South America saw concentrated competition with divergent growth. BYD led the pack with 97,194 units units but fell 13.4% YoY, while Chery grew 15.6%. Great Wall Motor (+47.7%), Jiangling Motor (+127%) and DFSK (+70.9%) drove regional growth, with Jiangling doubling sales through precise product-market fit. SAIC-GM-Wuling and Changan Auto dropped over 18%, facing market pressure.

Going forward, success will depend on product differentiation, local presence, and rapid tech iteration, with alignment to regional demand key for sustainable growth.

Top 10 Chinese automakers by passenger vehicle exports to Middle East

Chery Auto: 76,429 units, down 8.2% year-on-year

BYD Auto: 61,330 units, up 163.5% year-on-year

Geely Auto: 56,073 units

SAIC Passenger Vehicle: 53,297 units, down 7.8% year-on-year

Jiangsu Yueda Kia: 50,001 units, up 34.1% year-on-year

FAW-Toyota: 47,141 units, up 164.5% year-on-year

Great Wall Motor: 28,704 units, up 107.8% year-on-year

Southeast Auto: 28,549 units, up 398.8% year-on-year

Beijing Hyundai: 28,130 units, up 120.4% year-on-year

Changan Auto: 19,235 units, down 9.1% year-on-year

From January to July, among traditional leading exporters to the Middle East, Chery Auto took the lead with 76,400 units but saw a slight YoY decline of 8.2%; SAIC Passenger Vehicle and Changan Auto also fell 7.8% and 9.1% respectively, reflecting mounting competitive pressure on some established players.

BYD Auto (+163.5% YoY) and FAW Toyota (+164.5% YoY) achieved more than double growth, with BYD Auto leveraging its NEV product lineup to rapidly penetrate the Middle East market. Southeast Auto surged 398.8% YoY, demonstrating precise alignment between product positioning and regional market expansion. Great Wall Motor and Beijing Hyundai also maintained triple-digit growth, underscoring the rising acceptance of Chinese brands—including joint ventures—in the region, particularly for NEVs and smart vehicles.

Overall, the Middle East has become a strategic export market for Chinese automakers, where NEV adoption and differentiated product strategies are driving growth, while traditional leaders must accelerate adjustments to navigate the evolving competitive landscape.

Top 10 Chinese automakers by passenger vehicle exports to Oceania

BYD Auto: 26,424 units, up 120.8% year-on-year

Chery Auto: 25,536 units, up 373.6% year-on-year

Great Wall Motor: 25,474 units, up 17.1% year-on-year

SAIC Passenger Vehicle: 24,916 units, down 0.9% year-on-year

Tesla: 22,221 units, down 25.7% year-on-year

Geely Auto: 5,837 units, up 33.8% year-on-year

Jiangsu Yueda Kia: 3,980 units, up 838.7% year-on-year

SAIC-GM-Wuling: 2,796 units, up 5,077.8% year-on-year

SAIC-Maxus: 1,595 units, up 104.0% year-on-year

Geely-Volvo: 1,220 units, up 2.4% year-on-year

From January to July, leading exporters to the Oceania market saw strong growth. BYD Auto (+120.8% YoY) and Chery Auto (+373.6% YoY) achieved explosive gains, while Great Wall Motor recorded a steady 17.1% increase. Notably, Jiangsu Yueda Kia and SAIC-GM-Wuling posted YoY growth of over 8x and 50x, respectively, achieving rapid gains through precise market positioning and new product iterations. Overall, Chinese automakers' NEV transformation and globalization strategies have delivered tangible results in Oceania, with most players recording growth, reflecting both market concentration and diversified development, and injecting momentum for continued export expansion.