According to data compiled by the Gasgoo Automotive Research Institute, from January to July 2025, China's electrification component market showed a clear competitive structure. FinDreams Battery led the power battery pack segment with 2,007,100 sets installed (31.9% market share). FinDreams Powertrain's installation of electric drive motors reached 2,029,953 sets (27.3% share). Across other key segments, including BMS, electric motor controller, and OBC, FinDreams-affiliated companies also maintained leading positions, underscoring their overall strength in China's new energy vehicle (NEV) component market.

Overall, most core component markets were dominated by in-house solutions from automakers, with relatively high market concentration at the top. Various suppliers leveraged their respective strengths, highlighting the leadership of top players while also reflecting a landscape of rapid technological iteration and growing market dynamism amid diverse competition.

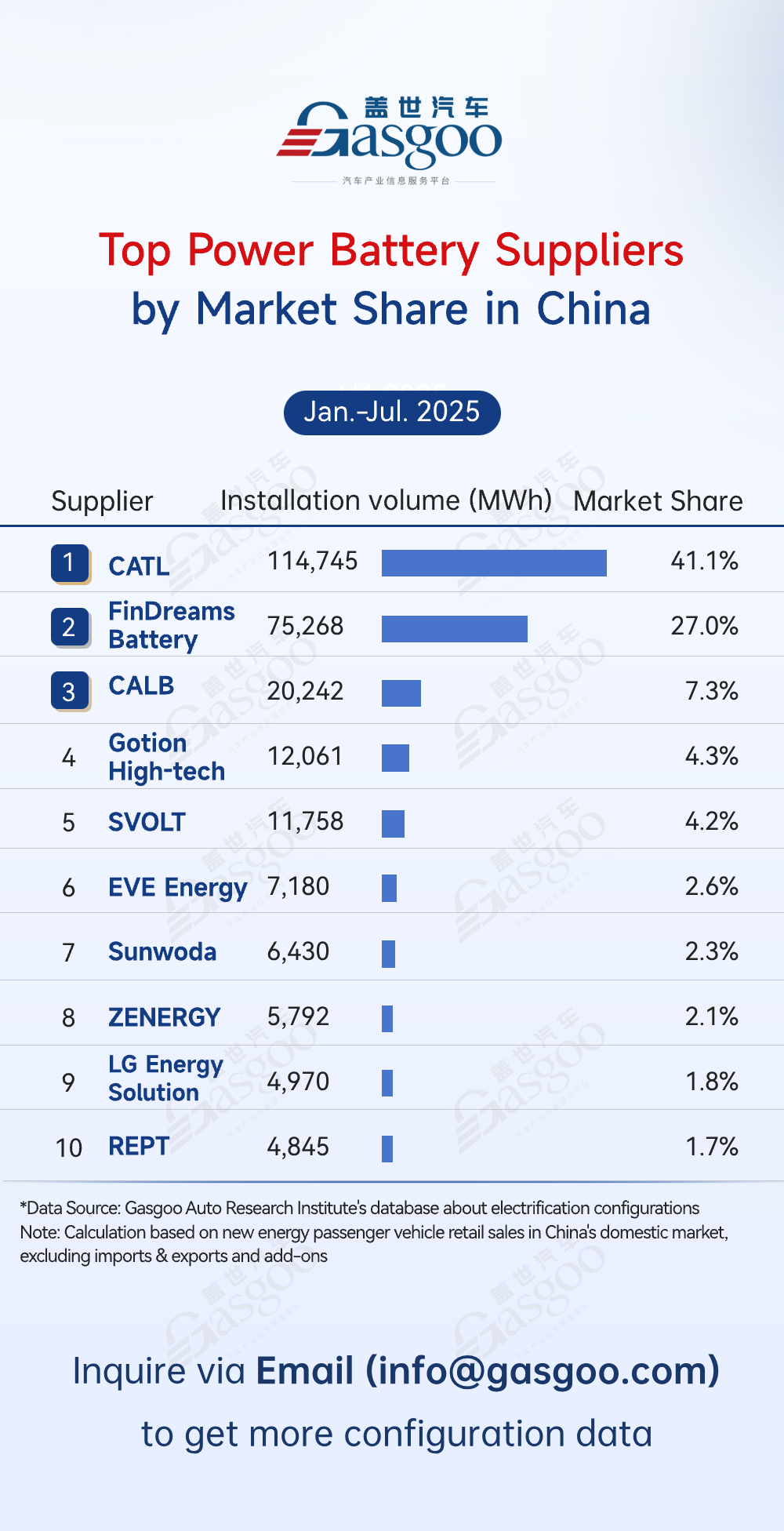

Top power battery suppliers

CATL: 114,745 MWh installed, 41.1% market share

FinDreams Battery: 75,268 MWh installed, 27.0% market share

CALB: 20,242 MWh installed, 7.3% market share

Gotion High-tech: 12,061 MWh installed, 4.3% market share

SVOLT: 11,758 MWh installed, 4.2% market share

EVE Energy: 7,180 MWh installed, 2.6% market share

Sunwoda: 6,430 MWh installed, 2.3% market share

ZENERGY: 5,792 MWh installed, 2.1% market share

LG Energy Solution: 4,970 MWh installed, 1.8% market share

REPT: 4,845 MWh installed, 1.7% market share

CATL led China's power battery market for the Jan.-Jul period with 114,745 MWh installed (41.1% share), leveraging technological expertise and supply-chain advantages to command nearly half the market. FinDreams Battery followed with 75,268 MWh (27.0% share), forming a "dual giant" landscape supported by BYD's vehicle integration. CALB (7.3%), Gotion High-tech (4.3%), and SVOLT (4.2%) formed a clear second tier, lagging behind the top players. Other suppliers, including ZENERGY, LG Energy Solution, and REPT, held less than 3% each. Notably, the top 5 accounted for over 84% of the market, indicating a high degree of concentration.

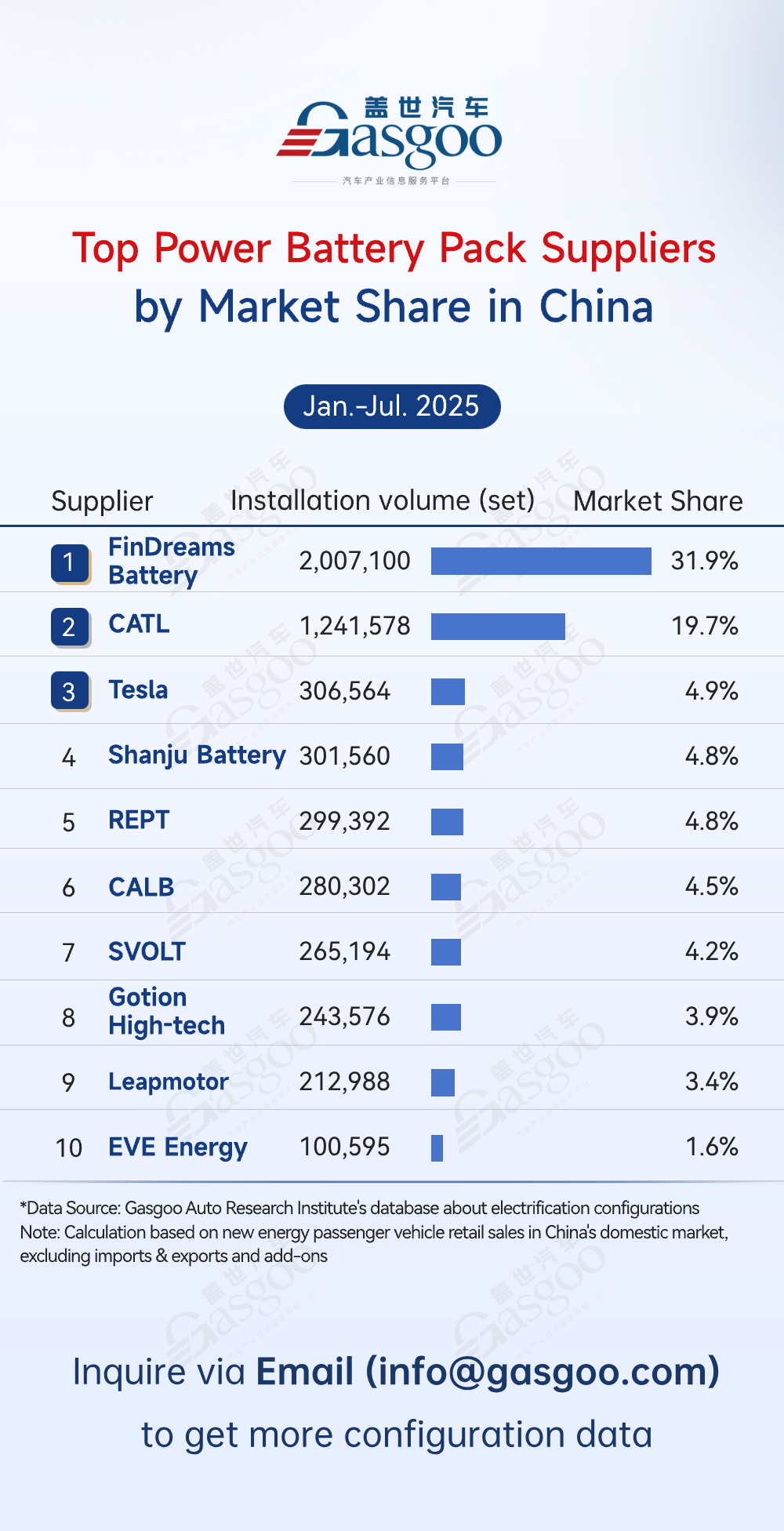

Top power battery pack suppliers

FinDreams Battery: 2,007,100 sets installed, 31.9% market share

CATL: 1,241,578 sets installed, 19.7% market share

Tesla: 306,564 sets installed, 4.9% market share

Shanju Battery: 301,560 sets installed, 4.8% market share

REPT: 299,392 sets installed, 4.8% market share

CALB: 280,302 sets installed, 4.5% market share

SVOLT: 265,194 sets installed, 4.2% market share

Gotion High-tech: 243,576 sets installed, 3.9% market share

Leapmotor: 212,988 sets installed, 3.4% market share

EVE Energy: 100,595 sets installed, 1.6% market share

In the power battery pack market, FinDreams Battery took the lead with 2,007,100 units installed and a 31.9% share, followed by CATL with 1,241,578 units (19.7% share), together accounting for over half the market and highlighting their dominant position. Tesla, Shanju Battery, and other suppliers held 4-5% each, while CALB (4.5%) and SVOLT (4.2%) also maintained notable shares. In addition, automakers' in-house pack production, such as by Leapmotor, contributed 3.4%. Overall, the market exhibited both top-heavy concentration and diversified competition, reflecting a wide supplier base and automakers' drive for greater supply-chain autonomy.

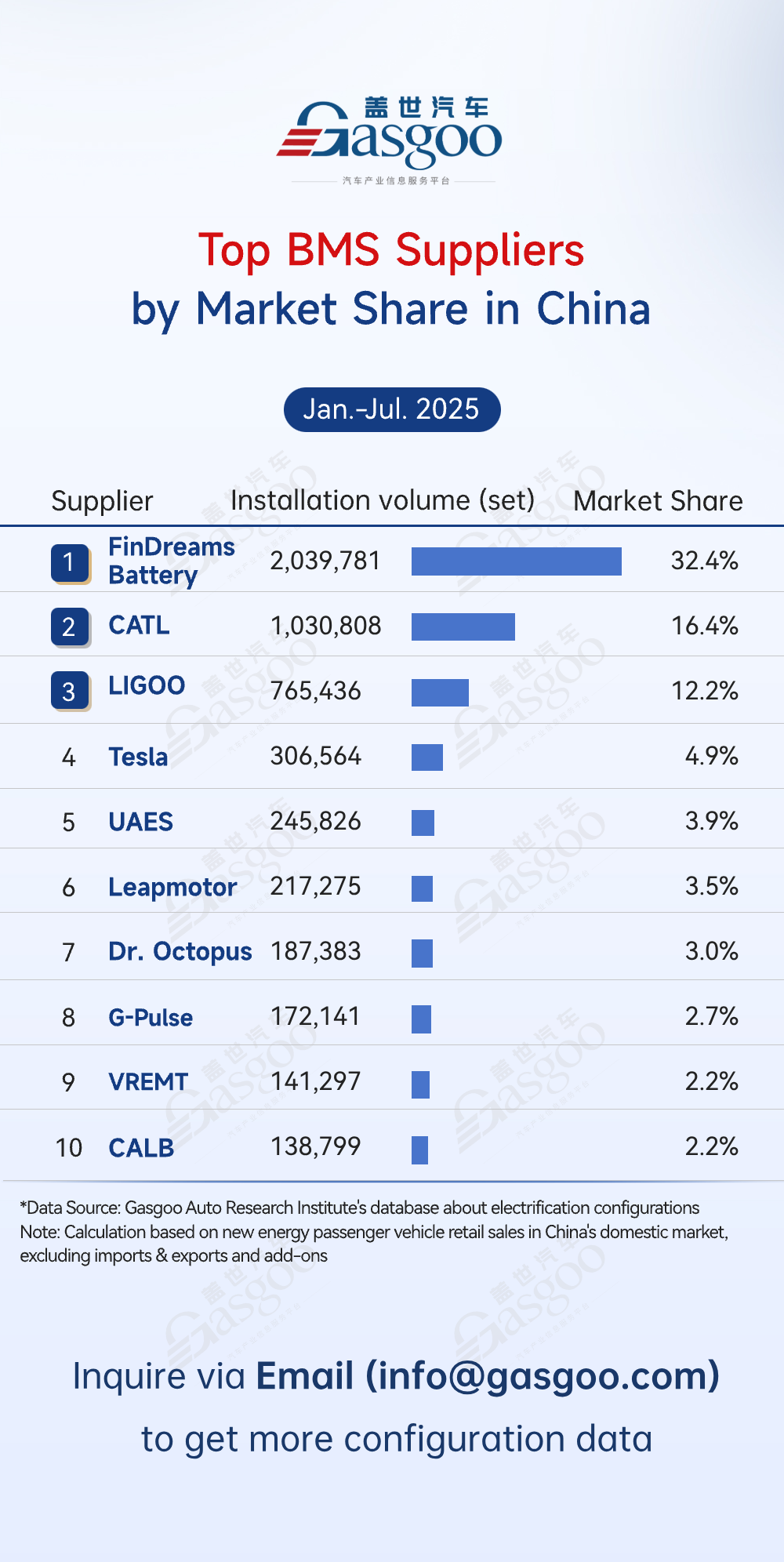

Top BMS suppliers

FinDreams Battery: 2,039,781 sets installed, 32.4% market share

CATL: 1,030,808 sets installed, 16.4% market share

LIGOO: 765,436 sets installed, 12.2% market share

Tesla: 306,564 sets installed, 4.9% market share

UAES: 245,826 sets installed, 3.9% market share

Leapmotor: 217,275 sets installed, 3.5% market share

Dr. Octopus: 187,383 sets installed, 3.0% market share

G-Pulse: 172,141 sets installed, 2.7% market share

VREMT: 141,297 sets installed, 2.2% market share

CALB: 138,799 sets installed, 2.2% market share

In the battery management system (BMS) market, FinDreams Battery led the pack for the Jan.-Jul. period with 2,039,781 sets installed (32.4% share), followed by CATL with 1,030,808 sets (16.4% share), together approaching half of the market. LIGOO held 12.2% to rank third, resulting in a relatively high market concentration. Tesla (4.9%) and UAES (3.9%) also maintained notable shares, while other suppliers each held less than 5%. At the same time, some automakers, including Tesla and Leapmotor, have achieved self-controlled BMS production, with domestic adoption continuing to advance and adding more variables to the future competitive landscape.

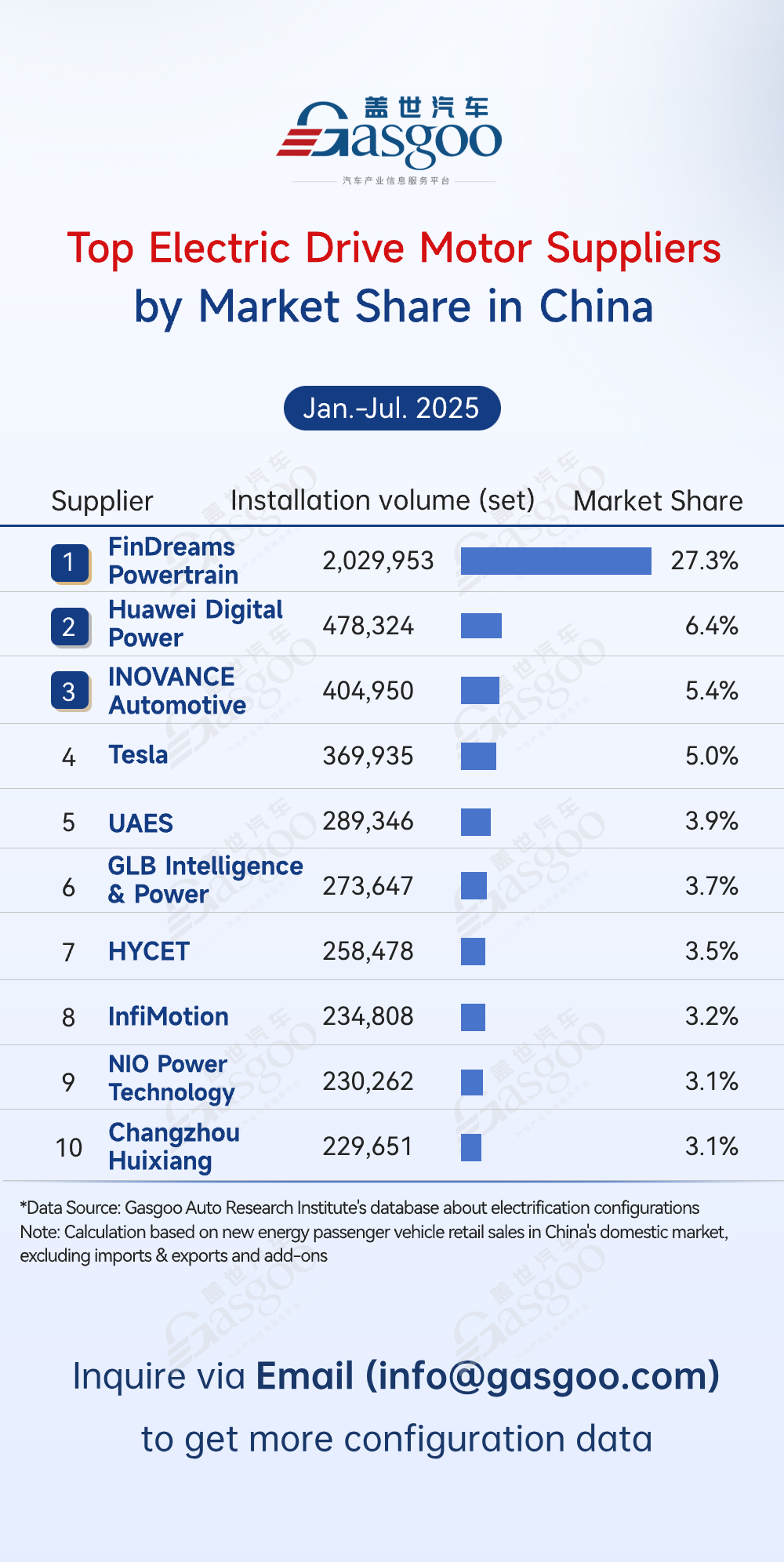

Top electric drive motor suppliers

FinDreams Powertrain: 2,029,953 sets installed, 27.3% market share

Huawei Digital Power: 478,324 sets installed, 6.4% market share

INOVANCE Automotive: 404,950 sets installed, 5.4% market share

Tesla: 369,935 sets installed, 5.0% market share

UAES: 289,346 sets installed, 3.9% market share

GLB Intelligence & Power: 273,647 sets installed, 3.7% market share

HYCET: 258,478 sets installed, 3.5% market share

InfiMotion: 234,808 sets installed, 3.2% market share

NIO Power Technology: 230,262 sets installed, 3.1% market share

Changzhou Huixiang: 229,651 sets installed, 3.1% market share

FinDreams Powertrain led the drive motor market with 2,029,953 sets installed (27.3% share), leveraging its deep integration with BYD's vehicle platform to secure a clear scale advantage. Huawei Digital Power and INOVANCE Automotive followed with 6.4% and 5.4%, respectively, demonstrating the competitiveness of tech companies and specialized powertrain suppliers. Tesla (5.0%) and UAES (3.9%) also held notable shares, while suppliers such as GLB Intelligence & Power (3.7%) and HYCET (3.5%) participated in the market as well.

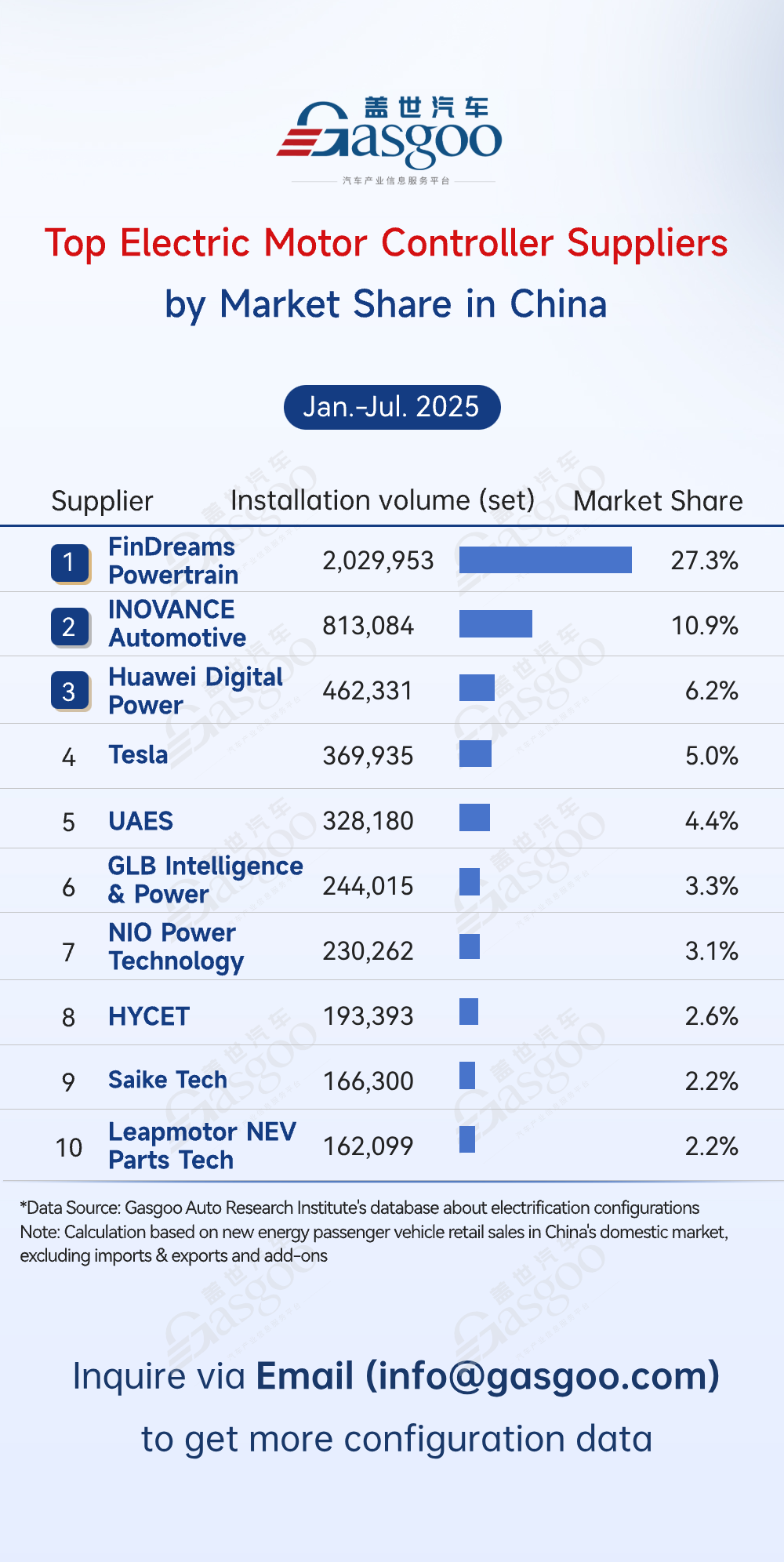

Top electric motor controller suppliers

FinDreams Powertrain: 2,029,953 sets installed, 27.3% market share

INOVANCE Automotive: 813,084 sets installed, 10.9% market share

Huawei Digital Power: 462,331 sets installed, 6.2% market share

Tesla: 369,935 sets installed, 5.0% market share

UAES: 328,180 sets installed, 4.4% market share

GLB Intelligence & Power: 244,015 sets installed, 3.3% market share

NIO Power Technology: 230,262 sets installed, 3.1% market share

HYCET: 193,393 sets installed, 2.6% market share

Saike Tech: 166,300 sets installed, 2.2% market share

Leapmotor NEV Parts Tech: 162,099 sets installed, 2.2% market share

In the electric motor controller market, FinDreams Powertrain took the lead for the Jan.-Jul. preiod with 2,029,953 sets installed and a 27.3% share. INOVANCE Automotive (10.9%) and Huawei Digital Power (6.2%) followed, while Tesla (5.0%) and UAES (4.4%) also held notable shares. NIO Power Technology (3.1%) and Leapmotor NEV Parts Tech (2.2%) ranked among the top 10, reflecting the trend of emerging automakers accelerating in-house supply chain development. Overall, OEM-produced electric motor controllers accounted for over half of the market, with shares increasingly concentrated at the top amid intensifying diversified competition.

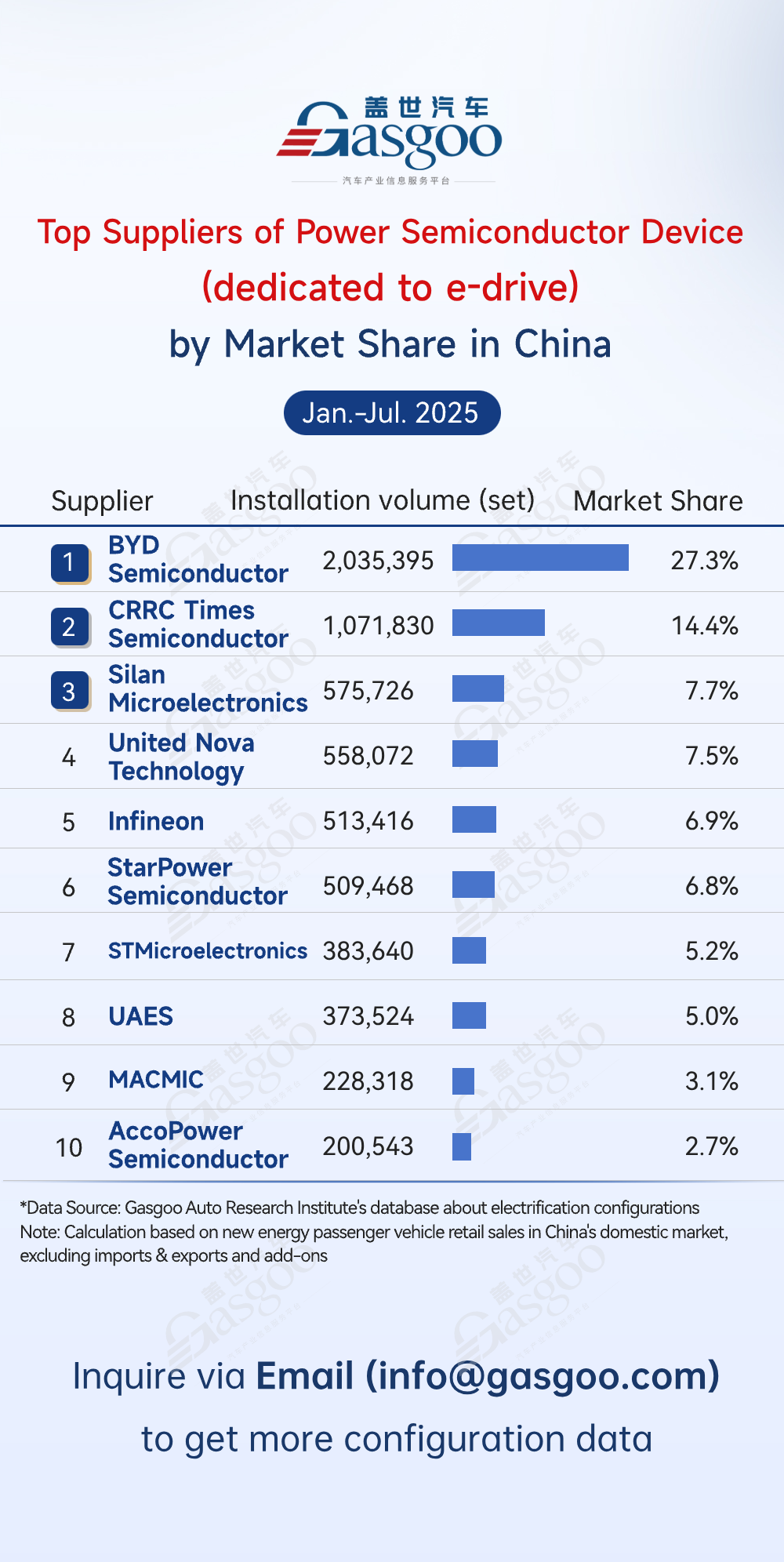

Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 2,035,395 sets installed, 27.3% market share

CRRC Times Semiconductor: 1,071,830 sets installed, 14.4% market share

Silan Microelectronics: 575,726 sets installed, 7.7% market share

United Nova Technology: 558,072 sets installed, 7.5% market share

Infineon: 513,416 sets installed, 6.9% market share

StarPower Semiconductor: 509,468 sets installed, 6.8% market share

STMicroelectronics: 383,640 sets installed, 5.2% market share

UAES: 373,524 sets installed, 5.0% market share

MACMIC: 228,318 sets installed, 3.1% market share

AccoPower Semiconductor: 200,543 sets installed, 2.7% market share

From January to July, BYD Semiconductor led the power semiconductor device (dedicated to e-drive) market with 2,035,395 sets installed (27.3% share), followed by CRRC Times Semiconductor (14.4%) and Silan Microelectronics (7.7%). The top 3 together accounted for 3,689,951 sets, nearly 50% of the market, highlighting a clear concentration at the top. The top 7 suppliers combined held over 70% of the market, with China's local players expanding rapidly through supply chain coordination and scale advantages, while international companies actively participated, making competition intense.

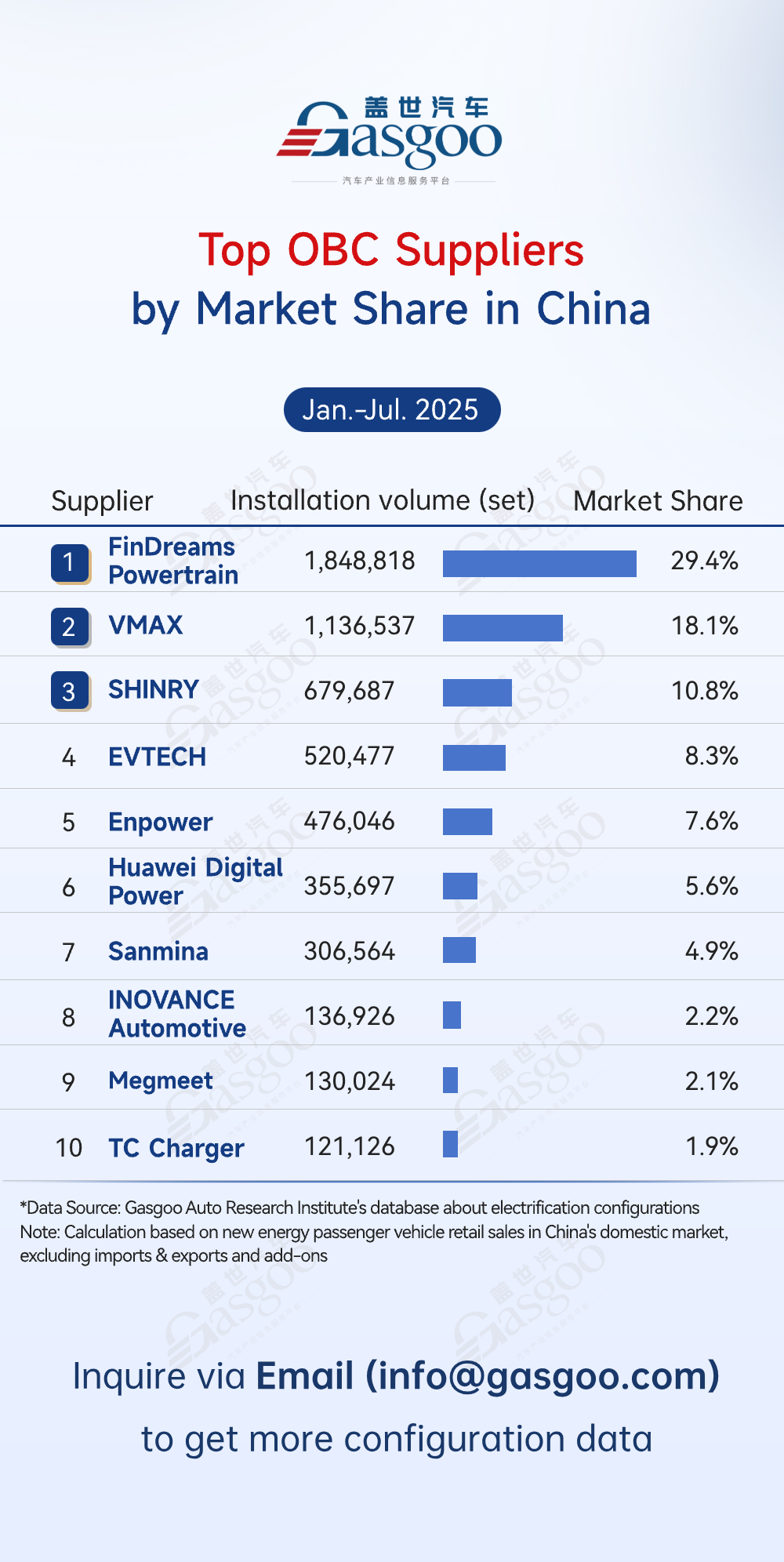

Top OBC suppliers

FinDreams Powertrain: 1,848,818 sets installed, 29.4% market share

VMAX: 1,136,537 sets installed, 18.1% market share

SHINRY: 679,687 sets installed, 10.8% market share

EVTECH: 520,477 sets installed, 8.3% market share

Enpower: 476,046 sets installed, 7.6% market share

Huawei Digital Power: 355,697 sets installed, 5.6% market share

Sanmina: 306,564 sets installed, 4.9% market share

INOVANCE Automotive: 136,926 sets installed, 2.2% market share

Megmeet: 130,024 sets installed, 2.1% market share

TC Charger: 121,126 sets installed, 1.9% market share

In the OBC market, FinDreams Powertrain led the pack with 1,848,818 sets installed (29.4% share), followed by VMAX (18.1%) and SHINRY (10.8%). The top 3 suppliers together accounted for over 3,665,000 sets, while the top 5 held a combined 74% share, demonstrating a strong concentration at the top. EVTECH (8.3%) and Enpower (7.6%) also captured notable shares, leaving room for competition. Driven by the rapid growth of NEVs, the OBC market is dominated by leading players, with emerging companies needing continuous innovation and product optimization to expand their market presence and competitiveness.

Top suppliers of multi-in-one main drive system (dedicated to BEVs)

FinDreams Powertrain: 855,380 sets installed, 25.2% market share

Tesla: 306,564 sets installed, 9.0% market share

GLB Intelligence & Power: 273,647 sets installed, 8.1% market share

UAES: 168,659 sets installed, 5.0% market share

INOVANCE Automotive: 153,911 sets installed, 4.5% market share

NIO Power Technology: 140,030 sets installed, 4.1% market share

Quzhou Jidian: 125,395 sets installed, 3.7% market share

CRRC Times Electric: 111,554 sets installed, 3.3% market share

DEEPAL: 99,982 sets installed, 2.9% market share

Lingsheng Powertech: 98,289 sets installed, 2.9% market share

The multi-in-one main drive system (dedicated to BEVs) market is dominated by in-house vehicle production. FinDreams Powertrain led the pack with 855,380 sets installed (25.2% share), while other suppliers held less than 10% each. Tesla ranked second with 306,564 sets (9.0% share), leveraging its own technology and vehicle matching needs. Overall, top players still control the majority of the market, with in-house production prevailing, and competition increasingly focusing on energy efficiency optimization and lightweight design in main drive systems.

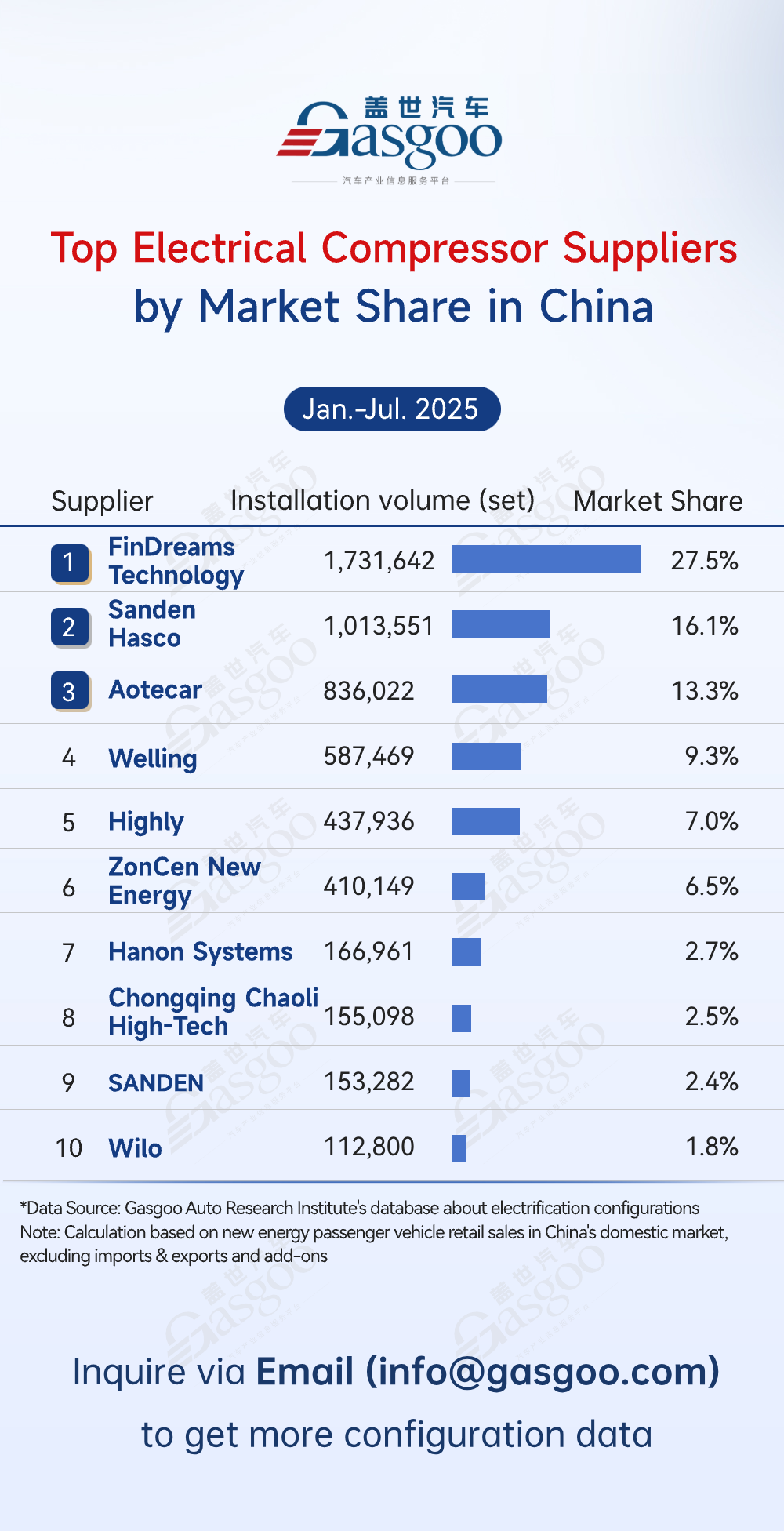

Top electrical compressor suppliers

FinDreams Technology: 1,731,642 sets installed, 27.5% market share

Sanden Hasco: 1,013,551 sets installed, 16.1% market share

Aotecar: 836,022 sets installed, 13.3% market share

Welling: 587,469 sets installed, 9.3% market share

Highly: 437,936 sets installed, 7.0% market share

ZonCen New Energy: 410,149 sets installed, 6.5% market share

Hanon Systems: 166,961 sets installed, 2.7% market share

Chongqing Chaoli High-Tech: 155,098 sets installed, 2.5% market share

SANDEN: 153,282 sets installed, 2.4% market share

Wilo: 112,800 sets installed, 1.8% market share

The electrical compressor market is highly competitive, with the top 5 suppliers accounting for 73% of the market. FinDreams Technology took the lead with 1,731,642 units installed (27.5% share), followed by Sanden Hasco and Aotecar at 16.1% and 13.3%, respectively. Welling (9.3%) and Highly (7.0%) also held notable shares, making the second tier fiercely competitive. ZonCen New Energy maintained a 6.5% share, while smaller players such as Hanon Systems (2.7%), Chongqing Chaoli High-Tech (2.6%), SANDEN (2.4%), and Wilo (1.8%) retained some market presence. Overall, the market is led by top players, yet multi-brand competition persists, driving innovation and technological advancement.