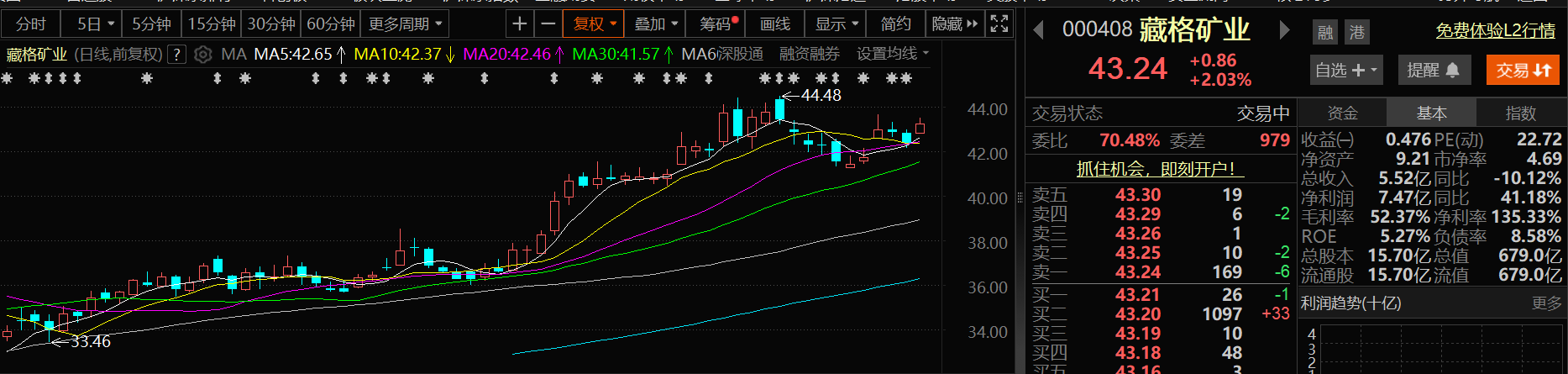

On the morning of July 17, Zangge Mining's share price rose. By 11:09 a.m. on the 17th, Zangge Mining had increased by 2.03%, trading at 43.24 yuan per share.

On the news front: An investor asked on the investor interaction platform: The performance preview indicates that the growth in H1 performance was mainly contributed by Julong Copper. What is the approximate level of Julong Copper's copper ore production for the entire year of 2025? Given the current favorable copper prices, is there a possibility of increasing copper production? Zangge Mining stated on the investor interaction platform on July 16 that,the company's significant year-on-year growth in H1 performance was mainly contributed by Julong Copper. In 2025, Julong Copper will focus on two aspects: one is to optimize technology and improve recovery rates, such as establishing a dedicated technical research team to enhance recovery rates through technological upgrades, information construction, and optimizing reagent addition points; the other is to fully release capacity and seize market opportunities, producing at full capacity on the basis of ensuring an annual copper ore production of 170,000 mt, striving to produce as much as possible, and aiming for a higher output. If everything operates normally in H2, the annual copper concentrate production is expected to reach 185,000-190,000 mt.

Regarding "How is the progress of the Phase II expansion project of Julong Copper?", Zangge Mining stated on the investor interaction platform on July 16 that,the Phase II expansion project of Julong Copper is progressing as scheduled, with several key projects having been completed ahead of schedule in H1. The project is expected to be completed and put into operation by the end of 2025. After reaching full production, the overall annual mining and beneficiation ore volume will exceed 100 million mt, and the annual copper ore production will reach 300,000-350,000 mt.

When asked "The Mami Co Project has officially obtained the mining license. With the empowerment of the controlling shareholder Zijin Mining, when is this project expected to be put into operation?", Zangge Mining stated on the investor interaction platform on July 16 that: The company will fully collaborate with the controlling shareholder Zijin Mining's experience in mineral resource development to efficiently empower the Mami Co Project. Currently, Phase I of the project has commenced construction, with a projected construction period of 9-12 months. The company will make every effort to ensure the efficient progress of the project under the collaboration of Zijin Mining.

On the evening of July 14, Zangge Mining issued an announcement stating that recently, Tibet Ali Mami Co Mining Development Co., Ltd., which is invested and controlled by Jiangsu Zangqing New Energy Industry Development Fund Partnership (Limited Partnership), in which Zangge Mining Investment (Chengdu) Co., Ltd., a wholly-owned subsidiary of the company, participated in the subscription, received the paper version of the "Mining License of the People's Republic of China" issued by the Department of Natural Resources of the Tibet Autonomous Region.The "Mining License" indicates that the mine involved in this permit is the lithium-boron mine in the Mami Co Salt Lake mining area in Gaize County, Tibet Ali. The mining area covers an area of 115.36 square kilometers, and the mining species include lithium ore, boron, and potassium, with a production scale of 364,500 mt/year. The license is valid from April 30, 2020, to April 30, 2030. Regarding the impact on the company and risk warnings, Zangge Mining stated that the acquisition of the Mining License grants Mamicuo Mining the legal right to exploit salt lake resources, enabling the company to develop lithium and boron ore resources at the Mamicuo Salt Lake in an orderly manner according to its plans. It is also conducive to obtaining credit support from local financial institutions, providing sufficient financial guarantees for project construction. Additionally, it facilitates cooperation with other enterprises to accelerate the progress of project construction. However, as the development and utilization of mineral resources may be affected by natural factors, social factors, as well as adjustments in mining-related laws, regulations, and policies, there is still uncertainty regarding whether the expected mining results can be achieved. Investors are advised to pay attention to investment risks.

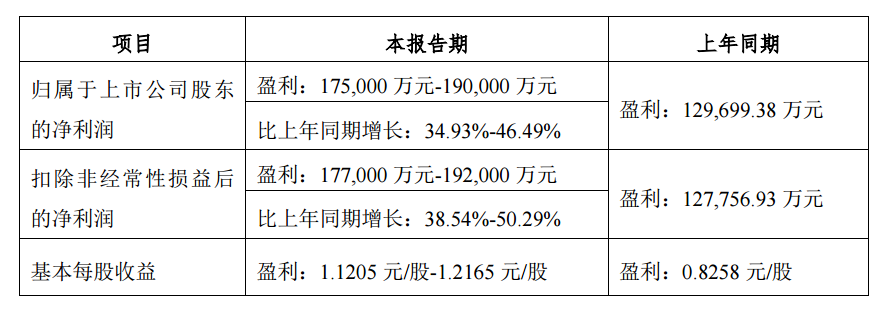

According to the 2025 H1 earnings forecast released by Zangge Mining recently, the company is expected to achieve a net profit attributable to shareholders of between 1.75 billion yuan and 1.9 billion yuan in the first half of the year, representing a YoY increase of 34.93%—46.49%. The company is also expected to achieve a net profit excluding non-recurring gains and losses of between 1.77 billion yuan and 1.92 billion yuan, up 38.54%—50.29% YoY.

Regarding the reasons for the earnings changes, Zangge Mining announced in its announcement that in the first half of this year, the company's net profit attributable to shareholders of listed companies is expected to increase YoY, mainly due to the net profit realized by its participating company, Tibet Julong Copper Industry Co., Ltd. The company expects to recognize investment income of approximately 1.265 billion yuan from it, representing a YoY increase of approximately 48.08%.

The rise in copper prices has significantly boosted the profits of many copper-related enterprises.

Click to view SMM spot copper prices

Subscribe to view historical price trends of SMM metal spot prices

Reviewing the copper price trend in the first half of the year, it can be seen that supported by multiple factors such as the decline in global copper mine output, tightening copper concentrate supply, rising expectations for production cuts by smelters, coupled with sustained growth in copper demand from sectors like NEVs and power grid investments, highlighting the resilience of the demand side, as well as market concerns triggered by the US's proposed tariff hike on imported copper, leading to stockpiling, and the intensification of geopolitical conflicts in the DRC, copper prices ultimately closed the first half of the year with gains—LME copper prices rose by 12.66% on a half-yearly basis, SHFE copper prices increased by 8.22%, and SMM #1 copper cathode prices accumulated an 8.4% gain in the first half of the year. Comparing the half-yearly daily average price trends of SMM #1 copper cathode, its daily average price in the first half of this year was 77,657.65 yuan/mt, up 3,104.79 yuan/mt from the 74,552.86 yuan/mt daily average price in the first half of 2024, representing a 4% increase.

Recently, copper prices have been in the doldrums, with fluctuations mainly influenced by a combination of multiple factors: From a macro perspective, the uncertainty surrounding tariff policies and market concerns about the independence of the US Fed's policies have intertwined, continuously disrupting market sentiment. On the fundamentals side, the overall supply side remains tight, while the demand side exhibits passive following characteristics—market transaction sentiment fluctuates with short-term copper price movements, failing to form a proactive upward driving force. Against the backdrop of a lack of substantive positive support from both macro and fundamental factors, the main pressure on copper prices in the short term will focus on August 1st — the effective date of the US imposing a 50% import tariff on copper products and broader trade tariff measures. It is expected that copper prices will continue to be under pressure and fluctuate before this date.

According to Haitong International's research report commenting on Zangge Mining's 2024 annual report, the net profit after deducting non-recurring gains and losses decreased by 28.76% YoY in 2024. The company achieved revenue of 3.251 billion yuan in 2024, down 37.79% YoY, with net profit attributable to shareholders of 2.58 billion yuan, down 24.56% YoY, and net profit after deducting non-recurring gains and losses of 2.547 billion yuan, down 28.76% YoY. The decline in the company's performance was mainly due to the fall in prices of potassium chloride and lithium carbonate. In Q4 2024, the company's operating revenue was 927 million yuan, up 64.98% MoM and down 10.55% YoY, with net profit attributable to shareholders of 712 million yuan, up 24.71% MoM and up 57.76% YoY, and net profit after deducting non-recurring gains and losses of 700 million yuan, up 23.10% MoM and up 11.84% YoY. The company has combined share repurchases with dividends to reward investors through multiple measures. By product: 1) Potassium chloride products generated revenue of 2.21 billion yuan in 2024, down 31.26% YoY, with the gross profit margin decreasing by 11.37 percentage points to 44.83%. According to the company's investor meeting minutes, the increase in the company's potassium fertilizer costs was mainly due to increased capital investment in green mine construction. This part of the cost expenditure was not sustainable, and excluding this part of the expenses, the company's average potassium fertilizer cost over the past three years remained stable at a reasonable level. In 2024, the company's potassium chloride sales volume was 1.0449 million mt, down 19.21% YoY. 2) Lithium carbonate generated revenue of 1.022 billion yuan in 2024, down 48.40% YoY, with the gross profit margin decreasing by 35.07 percentage points to 45.44% YoY, and sales volume of 13,600 mt, up 31.68% YoY. The company holds a stake in Julong Copper and owns 30.78% of its shares. Julong Copper's main product is copper ore. In 2024, the company received investment income of 1.928 billion yuan from the Julong Copper Mine, accounting for 74.72% of the company's net profit attributable to shareholders. Julong Copper (including the Julong Copper Mine and the Zhibula Copper Mine) has a proven reserve of 25.61 million mt of copper, 15,000 mt of silver, and 1.65 million mt of molybdenum, making it the copper mine with the largest proven reserves in China. Currently, the Julong Copper Mine is accelerating the Phase II expansion project with quality and quantity guaranteed, and it is expected to be completed and put into operation by the end of 2025. At that time, the copper ore production attributable to the company's equity will reach 92,000-108,000 mt/year, and after the Phase III project is put into operation, the company's equity copper capacity will rise to 180,000 mt/year. Risk warnings. Volatile prices of raw materials and products, slower-than-expected progress, weaker-than-expected downstream demand, and macroeconomic downturn.