Guangda Special Materials, a company specializing in high-end equipment special steel materials, expects its performance to increase in H1.

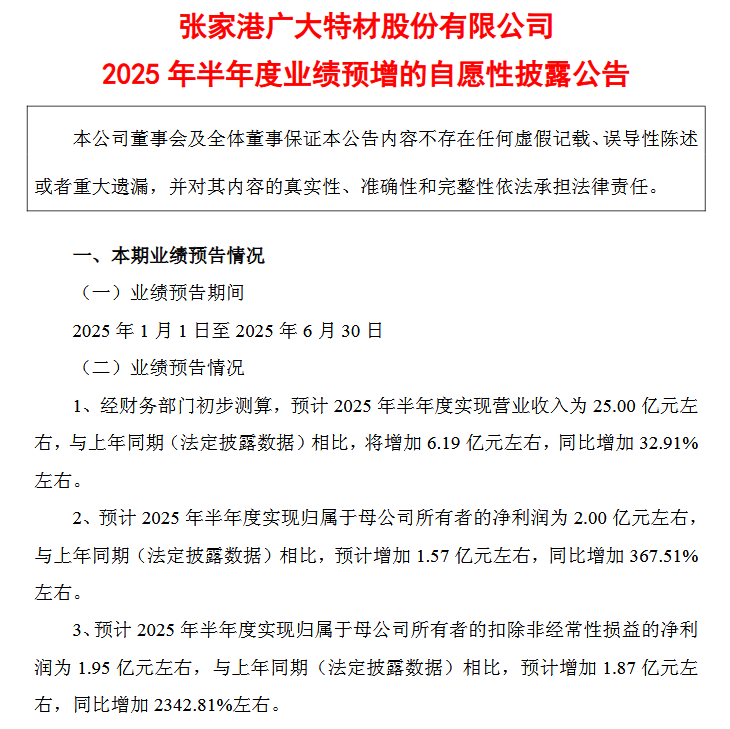

On the evening of June 24, Guangda Special Materials disclosed its performance announcement, stating that after calculations, it is expected to achieve operating revenue of approximately 2.5 billion yuan in H1 2025, up approximately 32.91% YoY; net profit is expected to reach approximately 200 million yuan, up approximately 367.51% YoY; and net profit after deducting non-recurring gains and losses is expected to reach approximately 195 million yuan, up approximately 2342.81% YoY.

A reporter from the *Science and Technology Innovation Board Daily* noted that,among several companies on the Science and Technology Innovation Board that have recently disclosed their H1 performance data, such as Jingyi Equipment, Dameng Data, and Sinobioway, Guangda Special Materials ranks among the top in terms of performance growth.**

Regarding the reasons for the performance growth, Guangda Special Materials stated that the overall demand in the downstream industries it serves is improving, with both production and sales thriving, leading to a YoY increase in operating revenue. Additionally, during the reporting period, the company optimized its internal product structure to reduce costs and increase efficiency, resulting in improved gross margins and enhanced profitability.

"The benefits of the company's fundraising and investment projects have become more evident. Among them, the capacity of the wind power gearbox parts project has been gradually released, with order volumes increasing and the average equipment utilization rate significantly improving, leading to a YoY increase in sales revenue and profitability. The offshore wind power casting project has also seen improved capacity utilization and profitability through a series of technological upgrades and production line optimizations," Guangda Special Materials stated.

However, a reporter from the *Science and Technology Innovation Board Daily* noted that Guangda Special Materials' operating cash flow has consistently lagged behind its profits.

As of Q1 2025, the net cash flow generated from Guangda Special Materials' operating activities was -249 million yuan, compared to -267 million yuan in the same period last year.

Over the past three years, Guangda Special Materials' cumulative net profit attributable to shareholders has exceeded 327 million yuan. However, the net cash flow from operating activities has remained negative, indicating that the company's profits have not been converted into actual cash.

Regarding the main reasons for the negative operating cash flow in 2024, Guangda Special Materials stated that the discounting of some undue acceptance bills was included in financing cash flow, affecting the use of bills to pay for long-term fixed asset purchases. In terms of receivables, the company has categorized historical and newly generated accounts receivable and taken proactive measures, clearly assigning responsibilities to specific individuals.

In addition, Guangda Special Materials' asset-liability ratio has increased significantly recently. From 2022 to 2024, its asset-liability ratios were 63.99%, 63.53%, and 65.14%, respectively. As of Q1 2025, the company's asset-liability ratio was 66.21%.

Guangda Special Materials focuses on high-end equipment special steel materials and high-end equipment parts, with its high-end equipment parts products mainly including new energy wind power parts, energy equipment parts, and other types of parts, which are mainly applied in equipment manufacturing industries such as new energy wind power, energy equipment, rail transit, and mechanical equipment.

As early as Q1 2024, Guangda Special Material's profit indicators were at a low point. During this period, the company achieved operating revenue of 892 million yuan, up 3.41% YoY; its net profit attributable to shareholders was 4.6735 million yuan, down 93.55% YoY.

Since the beginning of this year, the wind power industry has shown signs of recovery. Great Wall Securities stated in its research report that with the successive announcement of key offshore wind power project lists for 2025 in coastal provinces, the tender and bid market for wind power has heated up, and the industry chain's shipments have accelerated.

In addition to Guangda Special Material,among companies listed on the STAR Market, Telink Semiconductor also released a performance pre-increase announcement for the first half of 2025 tonight (June 24). Benefiting from increased customer demand, new customer expansion, and the start of mass shipments of new products, it is expected to achieve a net profit of approximately 99 million yuan in the first half of 2025, with a YoY increase of approximately 267%.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)