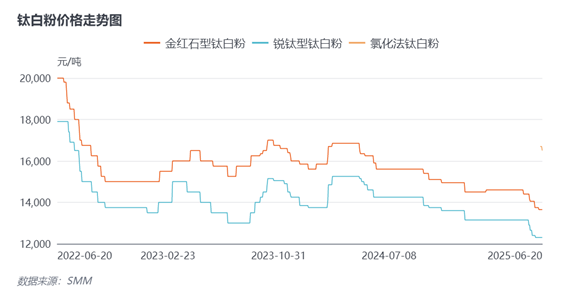

Titanium dioxide (TiO₂) prices continue to decline, and exports face severe challenges. According to the latest data from SMM, in June, the price range for anatase TiO₂ remained at 12,000-12,600 yuan/mt, while rutile TiO₂ was priced at 13,000-14,300 yuan/mt, and chloride-process TiO₂ was quoted at 16,000-17,000 yuan/mt, with prices hitting a three-year low.

The current market exhibits two notable characteristics. Firstly, there has been a significant widening of price differentials, primarily due to two factors: natural price spreads exist among different product models, and leading enterprises can maintain higher quotes by leveraging product quality and stable customer relationships, while small and medium-sized producers have to compete at lower prices to survive, yet their actual transaction volumes are often less than one-tenth of those of large producers. Secondly, prices have continued to decline since March without signs of bottoming out. Through communication with producers, it is understood that this is mainly due to insufficient domestic demand coupled with export obstacles, leading to production cuts at small factories and inventory backlogs at large ones, with an uncertain outlook for overseas markets.

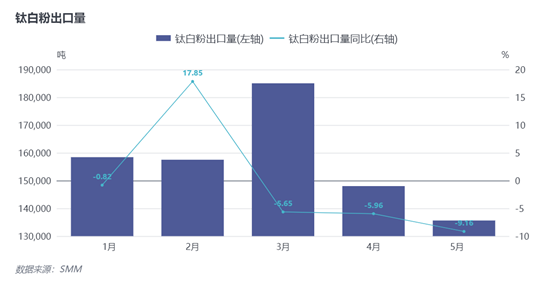

From the perspective of export data, TiO₂ exports plummeted in April and reached a trough in May. In terms of different markets, the Indian market has imposed anti-dumping duties on Chinese TiO₂ since February, coupled with fluctuating and rising ocean freight rates, putting the Indian export market, which originally accounted for a 20% share, in crisis. The European market has imposed temporary anti-dumping surcharges on Chinese TiO₂ since September 2024, with demand remaining sluggish. Additionally, the dominance of local chloride-process producers has further compressed the export space for Chinese products. Recently, the Middle Eastern market has been affected by the escalation of the Iran-Israel conflict, leading to disrupted ocean shipping and stagnant orders from major customers such as Turkey and Iran. The uncertainty in the global trade environment has left producers in a dilemma, with weak domestic demand and overseas markets almost closed.

From the perspective of product types, anatase TiO₂, due to its lower price and unique production process in China, is mainly used in the coatings sector. Although its market size is relatively small, it remains competitive in the international market. Rutile TiO₂, as the main domestic product, faces fierce market competition, with exports dominated by leading enterprises. Currently, the US dollar quote is slightly lower than the domestic price, reflecting expectations of a depreciating exchange rate and also a concession by traders to overseas customers in response to anti-dumping policies. Some small and medium-sized producers have chosen to cut or halt production to avoid inventory pressure. The situation for chloride-process products is even more passive. Despite their wide application in industrial coatings and higher prices, Chinese products mainly rely on maintaining customer relationships with long-established customers to sustain exports, while actively seeking new downstream partners.

Looking ahead, the international market still poses severe challenges. The current period is an adjustment and adaptation phase for domestic producers and downstream customers, requiring the establishment of new cooperation models through negotiation to explore overseas markets. Although production cuts are gradually easing the oversupply situation, it still takes time to digest inventories. In the domestic market, all parties are waiting for large orders to enter the market and buy the dip at the current low prices. Prices are expected to maintain a weak and stable trend.