SMM News on June 20: Today, the SS futures market, along with SHFE nickel, showed a fluctuating trend in the doldrums. In the spot market, the end-use demand for stainless steel remained sluggish throughout the week, with market transactions being slow. Steel mills and traders faced difficulties in destocking, leading to a further accumulation of social inventory, which has now surpassed the 1 million mt mark. Under the pressure to sell, traders took the initiative to lower prices to boost transactions. Despite the continuous decline in stainless steel prices, it has also intensified the cautious wait-and-see sentiment among downstream buyers, with purchases mainly driven by small-scale rigid demand, pulling down the psychological price level for procurement.Although the current stainless steel prices have fallen to a nearly five-year low, confidence remains generally low amid the current oversupply market situation, with prices continuing to run in the doldrums.

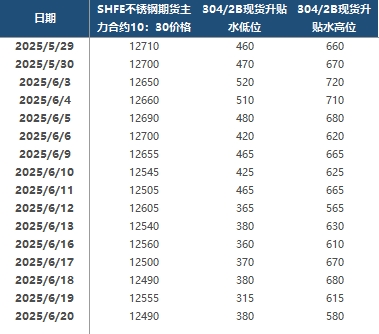

In the futures market, the most-traded 2508 contract weakened and pulled back. At 10:30 a.m., SS2508 was quoted at 12,490 yuan/mt, down 65 yuan/mt from the previous trading day. The spot premiums and discounts for 304/2B stainless steel in the Wuxi region ranged from 380 to 580 yuan/mt. In the spot market, the cold-rolled 201/2B coils in both Wuxi and Foshan were quoted at 7,675 yuan/mt; the cold-rolled mill edge 304/2B coils had an average price of 12,800 yuan/mt in Wuxi and the same in Foshan; the cold-rolled 316L/2B coils were priced at 24,000 yuan/mt in Wuxi and the same in Foshan; the hot-rolled 316L/NO.1 coils were quoted at 23,350 yuan/mt in both regions; and the cold-rolled 430/2B coils were priced at 7,500 yuan/mt in both Wuxi and Foshan.

Currently, the stainless steel market is in the traditional off-season, with downstream demand remaining persistently sluggish. Despite enterprises generally facing the dilemma of losses, some steel mills have already begun to implement production cuts. However,due to the large production base in the early stage, the current market supply remains at a historically high level for the same period, and the contradiction of oversupply has become increasingly prominent. The selling pressure on stainless steel mills, agents, and traders has risen sharply,with both in-plant inventory and social inventory remaining high. Market pessimism has spread widely, and traders are scrambling to sell, leading to a continuous decline in stainless steel quotes. The raw material side is also under tremendous pressure. Affected by expectations for production cuts at steel mills, the prices of raw materials such as high-grade NPI and high-carbon ferrochrome have also weakened simultaneously, further weakening the cost support for stainless steel.The market generally expects stainless steel mills to introduce further production cut plans to rectify the current supply-demand imbalance.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)