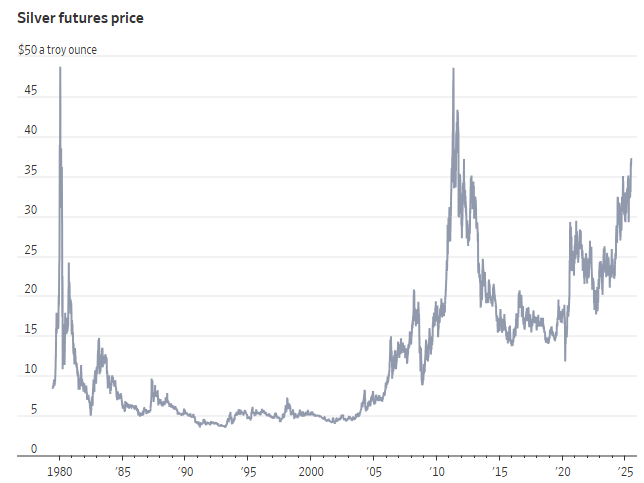

Although gold captured everyone's attention earlier this year, as H1 2025 draws to a close, silver prices have quietly matched the gains of its "big brother," gold—rising 27% year-to-date and reaching its highest level in over a decade.

Currently, silver is fluctuating around $35.7 per ounce.With the surge in silver prices, many US investors seem to be caught between two extremes:

Some investors, who remain bullish on silver's prospects, continue to hoard the precious metal, while another group is rushing to coin shops, metal dealers, and jewelers to cash in their coins, silverware, and silver bars.

According to media reports, many Americans are now rummaging through their homes, trying to find various silver items and coins to sell.

The rise in silver prices has made it worthwhile to search for those "heirloom" coin jars—to cash in old 10¢, 25¢, and 50¢ coins.It's worth noting that before 1964, the vast majority of everyday circulating 10¢, 25¢, 50¢, and $1 coins in the US were minted from an alloy containing 90% silver.

According to industry insiders, 25¢ coins minted before 1965 are now worth over $6.50 when melted down.

Russ Bega, the Chief Operating Officer of Harlan J. Berk, a coin dealer in Chicago, said that many silver sellers visiting their store bought silver coins for $10 per ounce decades ago and are now looking to sell.

Bega mentioned that one of their recent clients was a demolition worker who found a stash of old silver coins worth over $20,000 in the walls of a house.

Daniel Herzner, who deals in estate jewelry in White Plains, New York, said that his phone has been ringing off the hook lately, with clients eager to sell jewelry and silverware they previously inherited or no longer need.

"They prefer to cash it in directly," he said.

A Significant Number of Chasers Still Exist

Of course, while many sellers are looking to cash in on silver's high prices, there are also many investors who still believe silver will rise further.

Andrei Hnedchyk, the owner of Honest Coin Shop, which deals in gold and silver coins, said that foot traffic at his store has recently increased by about 20%, mainly from "silver stackers"—those who hoard the precious metal to hedge against economic uncertainty.

Bega also noted that despite the high silver prices, many customers are still making regular small purchases of silver, fearing they might miss out on the current rally. Last month, Bega sold two 1,000-ounce silver bars and recently sold another 1,500 ounces of silver to another customer. He pointed out that to keep up with demand, the company has more than doubled its monthly silver purchases.

Unlike gold, which is primarily used for wealth storage and jewelry making, the majority of silver demand (about 80%) comes from manufacturers in the industrial sector. This was supposed to be a troubling issue for silver prices this year—analysts had predicted that the trade war initiated by Trump and his cancellation of renewable energy incentives could harm silver demand.

However, it has turned out that industrial demand for silver has not yet slowed down. Michael Widmer, head of metals research at Bank of America, said that silver consumption in tableware and electronics remains stable, while demand from solar panel manufacturers continues to grow.

Many ETF investors have also been continuously betting on further increases in silver prices recently.According to fund documents, the world's largest silver ETF, iShares Silver Trust, has increased its silver holdings by nearly 11 million ounces this year to meet demand.

Historically, silver prices have approached the $50 mark twice (in 1980 and 2011), only to plummet almost as quickly as they rose. This time, how far will the silver rally go? And what will be the final outcome? Let's wait and see.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)