Amid the spectacle of Trump and Musk's public feud, many Wall Street traders have not forgotten that there is another major macroeconomic event on the horizon tonight: the US May non-farm payrolls data...

According to the schedule, the US Bureau of Labor Statistics will release the May non-farm payrolls data at 8:30 PM Beijing time tonight.Over the past few months, US economic data, particularly the "hard data," has consistently demonstrated resilience. Despite ongoing concerns about policy uncertainty, the number of layoffs has remained low, and business activity has remained stable.

However, many industry insiders are concerned that this situation may soon change. With the implementation of widespread tariff measures, multiple sets of economic data released by the US government this week have gradually shown signs of a slowdown. This has led many traders to place increasing importance on tonight's May non-farm payrolls report, attempting to identify signs of weakness in the labour market to gauge the timing of a US Fed interest rate cut.

So, what are the market expectations for tonight's non-farm payrolls? What should investors be aware of in advance? And how will the US financial markets perform tonight?

According to the median forecasts compiled by industry economists, the number of new non-farm jobs added in May is expected to slow significantly to 125,000 from the previous month, while the unemployment rate is expected to remain unchanged at 4.2%, and wage growth is also expected to slow slightly on a YoY basis.

Below are the latest median forecasts from Wall Street for the main indicators and key sub-indicators of the May non-farm payrolls compared with the previous month:

The US seasonally adjusted non-farm payrolls for May are expected to increase by 125,000, compared with the previous value of 177,000;

The US unemployment rate for May is expected to be 4.2%, unchanged from the previous value of 4.2%;

The US labour force participation rate for May is expected to be 62.6%, unchanged from the previous value of 62.6%;

The US average hourly earnings for May are expected to increase by 3.7% YoY, compared with the previous value of 3.8%;

The US average hourly earnings for May are expected to increase by 0.3% MoM, compared with the previous value of 0.2%.

In contrast to the above mainstream forecasts, CLS has also compiled some key points to note for tonight's non-farm payrolls:

① There are significant differences in investment banks' forecasts for the non-farm payrolls

The estimates for tonight's non-farm payrolls range from a high of +190,000 to a low of +75,000;

② "Whisper numbers" circulating in the market have declined as the data release date approaches

Whisper numbers are unofficial and unpublished forecasts circulating among Wall Street professionals, often disclosed to VIP clients of brokerage firms. Currently, the whisper number forecast for non-farm payrolls has dropped to 110,000 people.

③ A series of leading indicators ahead of the non-farm payrolls data have generally underperformed

Part of the reason for the decline in the aforementioned "whisper number" is clearly the poor performance of a series of leading indicators for non-farm payrolls released earlier this week, ahead of tonight's non-farm payrolls night. In particular, the ADP employment data on Wednesday and the initial jobless claims data on Thursday were extremely dismal.

According to a report released by US payroll processing company ADP on Wednesday, as signs of weakness emerged in the labour market, job growth in the US private sector nearly stalled in May, hitting the lowest level in more than two years—only 37,000 jobs were added that month, far below the market expectation of 110,000. A discrepancy of as much as 5 Sigmas between the reported figure and market expectations is extremely rare. This also marked the lowest monthly employment figure released by ADP since March 2023.

Data released by the US Department of Labor on Thursday showed that, for the week ending May 31, seasonally adjusted initial jobless claims rose by 8,000 to 247,000, higher than the market expectation of 235,000 and reaching the highest level since 2025.

In addition, the employment sub-indices in the ISM surveys presented a mixed picture overall. Although the ISM manufacturing employment index increased slightly this month, it remained below the 50 mark, while the employment situation in the services sector improved, with job growth returning to expansion territory.

④ Tonight's US Department of Labor report will correct many data points from the April non-farm payrolls report

The US Bureau of Labor Statistics (BLS) had previously issued a notice on its official website on Tuesday, indicating that it would correct "minor errors" in many data points from the April non-farm payrolls report when releasing the May non-farm employment report on Friday.

The notice stated, "Due to minor errors in weights resulting from the introduction of a redesigned Current Population Survey (CPS) sample, some estimates for April 2025 will be revised on June 6, 2025."

However, while past non-farm payrolls data will be corrected, major labour market sub-indices such as the unemployment rate, labour force participation rate, and employment-to-population ratio will remain unaffected.

⑤ Expectations for an interest rate cut ahead of the non-farm payrolls data have increased somewhat

As reported by Caixin earlier this morning, due to the poor performance of multiple sets of US economic data on Wednesday, market expectations for an interest rate cut have rapidly increased. Currently,the market has fully priced in the expectation of two interest rate cuts by the US Fed this year.

Of course, this expectation for an interest rate cut is actually at a rather sensitive juncture. The well-known financial blog website Zerohedge has analyzed that any upside surprise in non-farm payrolls data could lead to another market reversal—no longer expecting two interest rate cuts within the year, while any downside surprise could trigger concerns about an economic recession and impact risk assets.

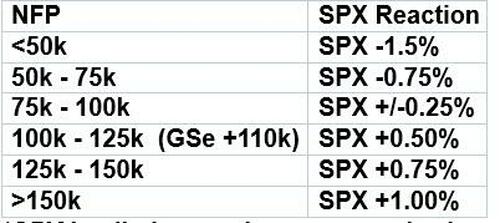

⑥ How will non-farm payrolls data affect financial markets?

In the forward-looking forecasts of Goldman Sachs and JPMorgan Chase teams, both generally expect that the better the non-farm payrolls data is tonight, the more favorable it will be for the market; on the other end, JPMorgan Chase's Andrew Tyler team believes that if the data falls below 100,000, it could potentially end the current bull market in U.S. stocks...

Below are the five scenarios forecasted by the JPMorgan Chase team:

① Non-farm payrolls exceed 170,000: This is the first tail-risk scenario. A figure of 170,000 can to some extent be considered as hiring demand driven by demand boost or seasonal contingencies. If employment further reaches 250,000 people, it may be seen as the economy reaccelerating, with the trade war at least not having a substantial impact on the labour market, thereby forcing the bond market to reprice for higher yields and eliminating the one or two interest rate cuts that the market has already priced in. The probability of this scenario occurring tonight is 5%, and the S&P 500 index will rise by 0.5%-2.5% as a result.

② Non-farm payrolls are between 140,000 and 170,000: This would be the economy's "Goldilocks scenario." The probability of this scenario occurring tonight is 25%, and the S&P 500 index will rise by 1.5%-2% as a result.

③ Non-farm payrolls are between 115,000 and 135,000: This is also the current mainstream market expectation. Even at the lower end of this range (115,000), it would be sufficient to sustain the current market rally, but attention should be paid to the unemployment rate trend. If the unemployment rate rises to 4.3%, the intraday gain of the S&P 500 index may converge to the lower end of the estimate for this scenario (0.25%), while also indicating that the unemployment rate may accelerate its climb at a rate of 0.1-0.2 percentage points per month, potentially worsening after the full impact of the trade war becomes apparent. However, it should be noted that given the almost weekly changes in trade policies, any forecast is subject to uncertainty. The probability of this scenario occurring tonight is 40%, and the S&P 500 index will rise by 0.25%-1% as a result.

④ Non-farm payrolls are between 100,000 and 115,000: When non-farm payrolls data falls below 100,000, the market will face a real test—most people will view it as an inevitable signal of a recession. The unemployment rate and wage growth also affect the outcome in this range—the worst-case scenario in this range is that the data only reaches 100,000, the unemployment rate rises to 4.3% or 4.4%, and wages decline. Overall, there is a 25% probability of this scenario occurring tonight, with the S&P 500 index expected to move between a 1.25% decline and a 0.5% increase.

⑤ Non-farm payrolls data is below 100,000. This is the second tail-risk scenario, which could potentially end the current US bull market. Economic recessions are a typical cause of bull market endings, and data below 100,000 would put the entire market on "recession alert." There is a 5% probability of this scenario occurring tonight, with the S&P 500 index expected to decline by 2%-3%.

JPMorgan Chase concluded, "Current market risks remain skewed to the upside, as we believe the market is in a 'good news is good news' macro environment. Positioning suggests investors are net short, expecting a trade war to eventually lead to an economic downturn; some believe the US is heading toward a recession or even stagflation, while the US Fed will remain on hold. Additionally, if the deficit-expanding tax/budget bill is passed, it will deplete the US fiscal reserves to combat a recession or stagflation. However, our tactical view is more measured, as we believe economic resilience will persist in the near term."

Coincidentally, Goldman Sachs currently makes a similar "good data is good news, bad data is bad news" prediction regarding the impact of tonight's non-farm payrolls data on US stocks. Goldman Sachs itself forecasts 110,000 for tonight's non-farm payrolls. Data significantly below expectations could lead to a 1.5% decline in the S&P 500 index, while data significantly exceeding expectations could drive US stocks up by over 1%.