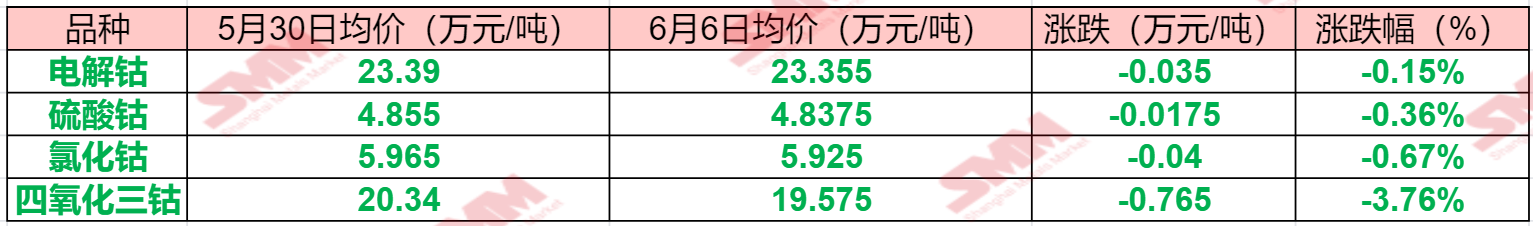

SMM News on June 6: This week, various cobalt products in the market continued to "fall endlessly". The spot quotes for Co3O4 fell sharply, with most smelters lowering their quotes to facilitate sales. Some low-price transactions led to a drop of 7,650 yuan/mt in Co3O4 prices within a single week... SMM has compiled the price changes of cobalt-related products in the market this week, as detailed below:

Refined Cobalt:

According to SMM spot quotes, refined cobalt spot prices showed a downward trend this week. As of June 6, refined cobalt spot prices temporarily stabilized at 220,600-246,500 yuan/mt, with an average price of 233,550 yuan/mt, down 350 yuan/mt or 0.15% from May 30.

》Check SMM cobalt and lithium spot quotes

According to SMM survey, from the supply side, the refined cobalt market is still digesting social inventory at a relatively slow pace. The economic efficiency of refined cobalt production remains relatively low, leading to a slight decline in smelters' capacity utilisation rates and a slight drop in quotes. From the demand side, there has been no significant change in the purchasing pace of downstream producers, who continue to make just-in-time procurement, with relatively mediocre inquiries and buying interest.It is expected that refined cobalt spot prices will continue to fluctuate next week.

Cobalt Salts (Cobalt Sulphate and Cobalt Chloride):

Cobalt Sulphate:

According to SMM spot quotes, cobalt sulphate spot prices also continued to decline this week. As of June 6, cobalt sulphate spot prices fell to 46,950-49,800 yuan/mt, with an average price of 48,375 yuan/mt, down 175 yuan/mt or 0.36% from May 30.

》Check SMM cobalt and lithium spot quotes

According to SMM survey, from the supply side, quotes from mainstream cobalt sulphate smelters remained relatively stable, with some recyclers' cobalt sulphate spot quotes slightly declining. From the demand side, given the uncertainties surrounding future policies in the DRC, downstream producers generally adopted a wait-and-see attitude. Additionally, with no significant improvement in material producers' order situations, downstream purchase willingness remained low, and there were no large-scale procurement activities.It is expected that cobalt sulphate spot prices will continue to fluctuate weakly next week.

Cobalt Chloride:

According to SMM spot quotes, cobalt chloride spot prices fluctuated slightly downward. As of June 6, cobalt chloride spot prices fell to 58,500-60,000 yuan/mt, with an average price of 59,250 yuan/mt, down 400 yuan/mt or 0.67% from May 30.

According to SMM, from the supply side, quotes from major cobalt chloride smelters remained firm, indicating a certain reluctance to sell. However, some smelters showed a strong willingness to sell, leading to a small number of low-price transactions in the market, which in turn pulled down the overall spot prices. Demand side, downstream enterprises primarily engaged in just-in-time procurement and generally maintained a certain level of cobalt salt inventory. There were fewer inquiries, and a strong wait-and-see sentiment prevailed. Despite this, due to the ongoing shortage of raw materials, market bullish sentiment remained high and consistent. It is expected that next week, the spot price of cobalt chloride will continue to fluctuate at a high level and will be difficult to decline.

Co3O4:

According to SMM spot quotes, the spot quotes for Co3O4 fell sharply this week. As of June 6, the spot quotes for Co3O4 dropped to 192,000-199,500 yuan/mt, with an average price of 195,750 yuan/mt, down 7,650 yuan/mt from May 30, representing a decline of 3.76%.

According to SMM, supply side, the Co3O4 market was relatively sluggish after the holiday. Most smelters lowered their quotes and showed increased willingness to sell, with some low-price transactions further pulling down the spot price. Demand side, LCO producers only maintained necessary procurement without the intention of stockpiling inventory, adopting an overall wait-and-see attitude. Their acceptance of Co3O4 prices decreased, and market inquiries remained scarce. It is expected that next week, the peak of market procurement has not yet arrived, demand will remain weak, and there will be a lack of obvious upward momentum. The short-term spot price of Co3O4 is expected to continue to decline.

In terms of corporate developments, as one of the well-known cobalt industry giants in China, GEM mentioned in its 2024 annual report that the company's shipments of Co3O4 products for 3C batteries ranked second in the world, accounting for over 20% of the global market. The company's ultra-fine cobalt powder ranked first in the global industry market, occupying over 50% of the global cemented carbide market. The company stated that in 2024, the production and sales of Co3O4 strongly recovered, achieving annual sales of 20,664 mt, up 88% YoY. The company sold 12,557 mt of cobalt products (including ultra-fine cobalt powder and cobalt sheets), up 76% YoY. The company's ultra-fine cobalt powder occupied over 50% of the global market, ranking first globally for 12 consecutive years. In 2024, the company's Co3O4 production line with an annual capacity of 5,000 mt was completed.

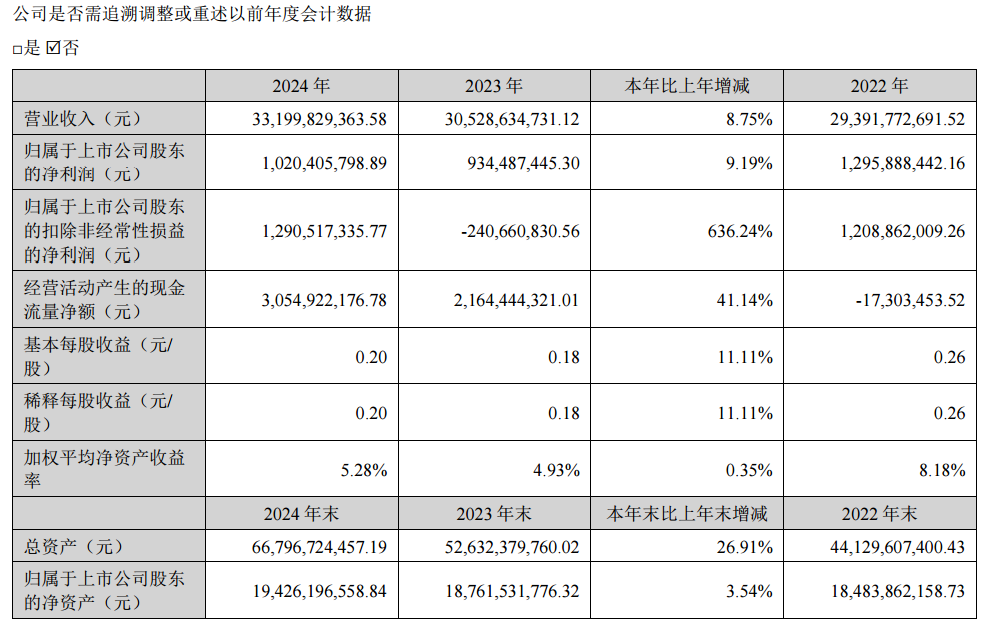

In 2024, the company achieved a total revenue of 33.2 billion yuan, up 8.75% YoY, hitting a record high. The net profit attributable to shareholders of the publicly listed firm was 1.02 billion yuan, up 9.19% YoY.

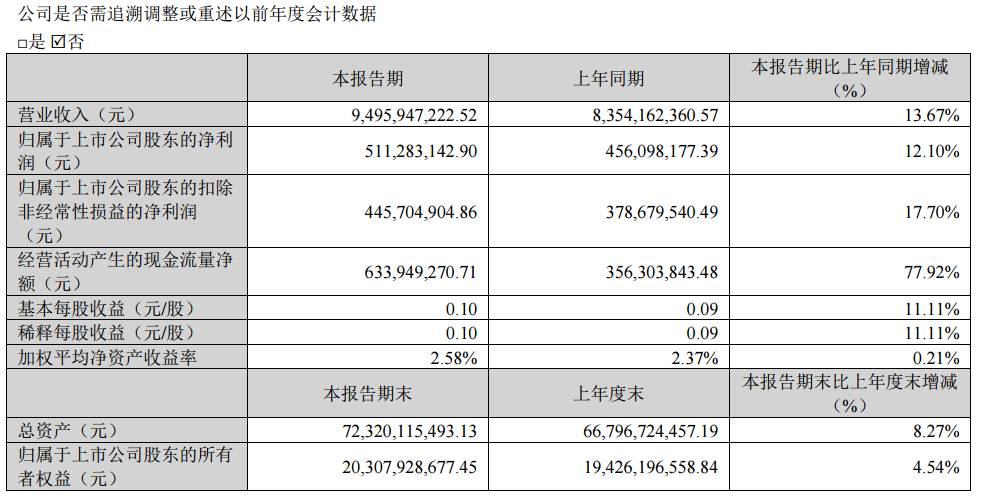

In Q1 2025, the company's dual-track business capacity was significantly released, with robust production and sales. The average capacity utilisation rate of core products exceeded 97%, and the global market remained stable, unaffected by global tariff trade challenges. The company's operating performance grew significantly, with key financial indicators such as sales revenue, net profit, and operating cash flow all hitting record highs for the same period. The company achieved operating revenue of 9.496 billion yuan, up 13.67% YoY, and net profit attributable to shareholders of the publicly listed firm of 511 million yuan, up 12.10% YoY.

Looking ahead to 2025, the company expects shipments of its cobalt products (including ultra-fine cobalt powder, cobalt sheet, and Co3O4) to be around 40,000-55,000 mt, and shipments of ternary cathode precursor are expected to be around 200,000-300,000 mt.