In May this year, driven by multiple factors such as policy incentives, sales promotions by producers, and the release of consumer demand, China's passenger vehicle market continued to maintain a steady growth trajectory.

According to the latest forecast data from the China Passenger Car Association (CPCA), the retail sales of narrowly-defined passenger vehicles in May are expected to reach approximately 1.85 million units, up 8.5% YoY and 5.4% MoM. Among them, the retail sales of passenger NEVs are expected to reach approximately 980,000 units, with a penetration rate maintained at around 52.9%.

The auto market in May showed a "high in the first half, low in the second half" trend.

Looking back at April this year, the boost from the "program of large-scale equipment upgrades and consumer goods trade-ins" policy, coupled with increased subsidies from producers, led to narrowly-defined passenger vehicle retail sales in China reaching 1.755 million units, up 14.5% YoY and down 9.4% MoM. Among them, the retail sales of passenger NEVs reached 905,000 units, up 33.9% YoY, with a penetration rate of 51.5%, basically flat compared to March. This data indicates that although the market pulled back somewhat in April, it still maintained a relatively high level overall.

Entering May, the boosting effect of the "program of large-scale equipment upgrades and consumer goods trade-ins" policy continued to manifest. According to data from the Ministry of Commerce, as of May 11, the number of trade-in subsidy applications nationwide reached 3.225 million, including 1.035 million for vehicle scrappage and renewal and 2.19 million for trade-in renewal. Since the implementation of the policy in 2024, the cumulative number of subsidy applications has exceeded 10 million, providing strong support for the auto market.

The CPCA pointed out that, in the face of wait-and-see sentiment brought about by the rapidly changing and complex international situation, China's auto market has maintained a steady and upward trend driven by the "program of large-scale equipment upgrades and consumer goods trade-ins" policy.

At the same time, the intensification of local auto shows and sales promotions by producers has also injected new vitality into the market.

It is reported that local auto shows were held across the country in May, and enterprises also actively implemented a series of terminal sales promotion policies, such as "fixed-price" and "0-interest" car purchase financing schemes, during the Golden Week. The CPCA's terminal survey results showed that terminal customer traffic surged significantly during the Labour Day holiday Golden Week, with a concentrated release of consumer demand.

Of course, it is worth noting that as customer traffic naturally pulled back after the holiday, the overall heat of the auto market tended to level off, and the auto market in May is expected to show a "high in the first half, low in the second half" trend.

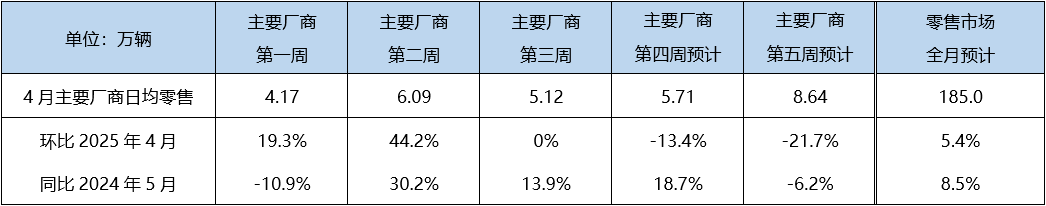

Observing the weekly market trends in May based on CPCA data, distinct differentiation characteristics before and after the holiday can be found.

In the first week of May, influenced by the Labour Day holiday, terminals focused mainly on order collection, with fewer actual vehicle deliveries. The daily average retail sales were 41,700 units, down 10.9% YoY but up 19.3% MoM.

Entering the second week, concentrated post-holiday deliveries drove a significant rebound in sales, with daily average retail sales reaching 60,900 units, up 30.2% YoY and 44.2% MoM, and the market experiencing a short-term peak.

In Week 3, the daily average retail sales of passenger vehicles are expected to reach 51,200 units, up 13.9% YoY and flat WoW, indicating a normal pullback after the holiday. In Week 4, the daily average retail sales are projected to be 57,100 units, up 18.7% YoY but down 13.4% WoW, with market enthusiasm experiencing a mild pullback. The last week of May has five working days, with daily average retail sales expected to be 86,400 units, down 6.2% YoY and 21.7% WoW.

New EnergyVehicle Market Maintains Strong Momentum

According to data from the China Passenger Car Association (CPCA), retail sales of passenger NEVs in May are expected to reach 980,000 units, with a penetration rate of 52.9%, basically flat MoM compared to April.

This data indicates that NEVs have become the mainstream in the market, with consumers' acceptance of electrified and intelligent car models continuing to rise.

The dual drivers of policy and product innovation are key contributors to this trend. The "trade-in" policy provides additional subsidies for NEV replacements, and combined with the launch of new models by producers, further stimulates market demand. Additionally, the improvement of charging infrastructure and advancements in battery technology have significantly reduced consumers' purchase concerns, creating favorable conditions for the widespread adoption of NEVs.

Looking ahead to future market development trends, policy dividends are expected to continue to be released. 2025 is a crucial year for national policies aimed at boosting consumption, and it is anticipated that the "trade-in" and local car purchase subsidy policies will continue to drive growth in the automotive market in H2.

The CPCA also pointed out that after the Chinese New Year, the penetration rate in March was relatively high due to short-term policy boosts. In April, numerous new products were launched, but there was a time lag between launch and actual delivery, leading to a slower growth rate in market penetration subsequently. However, with new products gradually starting to gain traction, the growth rate of NEV penetration is expected to gradually rebound.

Of course, intensified market competition will also bring about profound changes in the industry landscape. Against the backdrop of price wars and rapid product iteration, some weaker brands may face elimination, and industry concentration will further increase. At the same time, cutting-edge technologies such as intelligent assisted driving will become new focal points of competition among automakers, driving the entire industry to higher levels of development.

Overall, the Chinese passenger vehicle market in May continued to maintain steady growth under the dual impetus of policy incentives and producer promotions, with the NEV penetration rate remaining stable above 50%, indicating profound changes in the market structure.

In the future, with the continuous strengthening of policies, ongoing technological advancements, and the upgrading of consumer demand, the Chinese automotive market will move towards a new stage of greater electrification and intelligence. For automakers, this represents both opportunities and challenges. They need to accelerate the pace of technological innovation and product iteration to cope with increasingly fierce market competition, seize the development opportunities in NEVs and intelligence, and occupy a favorable position in the tide of industrial transformation.