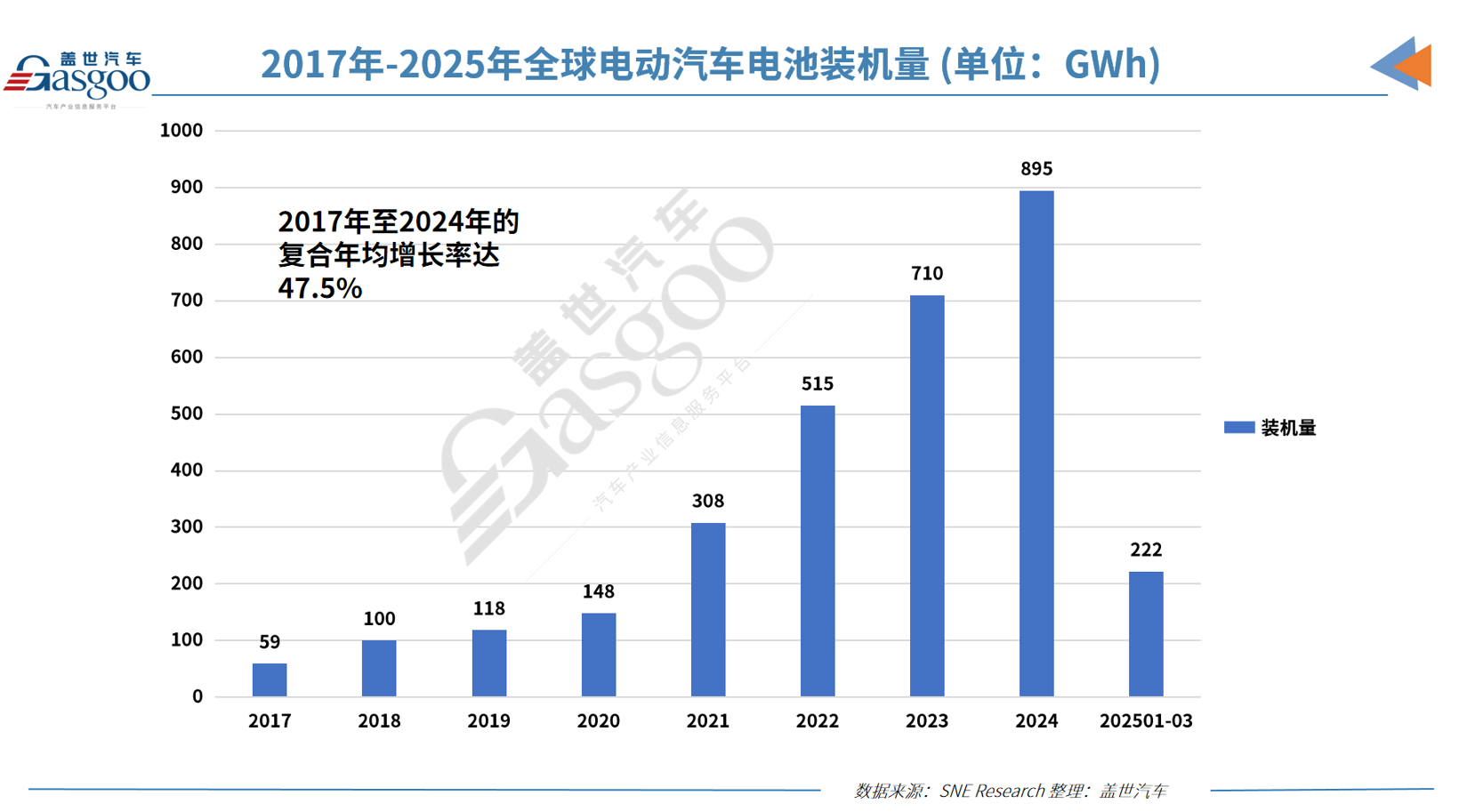

Recently, data released by South Korean market research firm SNE Research revealed that in the first quarter of 2025, global battery installations for electric vehicles (including battery electric vehicles, plug-in hybrid electric vehicles, and hybrid electric vehicles) reached 221.8 GWh, marking a 38.8% increase from 159.8 GWh in the same period last year.

Q1 Global EV Battery Installations: CATL Dominates the Rankings, SVOLT Energy Technology Posts Fastest Growth

In the first quarter of this year, six Chinese EV battery manufacturers secured spots in the top 10 global EV battery installation rankings.

Among them, CATL maintained its position as the global leader, with battery installations increasing 40.2% YoY to 84.9 GWh. In addition to Chinese automotive brands such as Zeekr, AITO, Li Auto, and Xiaomi, global mainstream automakers including Tesla, BMW, Mercedes-Benz, and the Volkswagen Group also widely adopt CATL's batteries.

BYD's battery installations grew 62.0% YoY to 37.0 GWh, securing the second spot. As a company that produces both batteries and electric vehicles (including battery electric vehicles and plug-in hybrid electric vehicles), BYD has launched multiple best-selling car models with strong price competitiveness. In 2024, BYD's EV sales reached approximately 4 million units, and it plans to achieve a sales target of around 6 million units in 2025. Additionally, BYD is actively expanding into the Asian and European markets, accelerating the expansion of its overseas market share.

The other four Chinese battery manufacturers also continued to maintain strong growth momentum. CALB's battery installations increased 31.5% YoY to 8.6 GWh, ranking fifth; Gotion High-tech's battery installations reached 7.7 GWh, surging 86.6% YoY, placing it sixth; EVE's battery installations soared 59.6% YoY to 5.7 GWh, ranking ninth; closely following was SVOLT Energy Technology, with battery installations reaching 5.6 GWh, skyrocketing 100.2% YoY, making it the battery manufacturer with the highest YoY growth in the first quarter on this list.

The combined battery installations of South Korea's top three battery manufacturers (LG Energy Solution, SK On, and Samsung SDI) accounted for 18.7% of global EV battery installations, a 4.6 percentage point decrease YoY. Among them, LG Energy Solution's battery installations still increased 15.1% YoY to 23.8 GWh, ranking third; SK On's battery installations grew 35.6% YoY to 10.5 GWh, ranking fourth; while Samsung SDI's battery installations decreased 17.2% YoY to 7.3 GWh, primarily due to a decline in battery demand from major automakers in Europe and North America.

In terms of specific corresponding car models, Samsung SDI's batteries are primarily used in models from BMW, Audi, and Rivian. In Q1 this year, although sales of BMW models equipped with Samsung SDI batteries, such as the i4, i5, and iX, remained stable, Rivian's standard-range R1S and R1T models adopted LFP batteries not produced by Samsung SDI, negatively impacting Samsung SDI's battery installations. Additionally, the decline in sales of the Audi Q8 e-Tron further dragged down Samsung SDI's battery installation performance.

SK On mainly supplies batteries to the Hyundai Motor Group, Mercedes-Benz, and the Volkswagen Group. In Q1 this year, Hyundai Motor Group's sales rebounded following the launch of the revised IONIQ 5 and EV6 models. Meanwhile, the stable sales of compact SUVs like the Mercedes-Benz EQA and EQB provided steady support for SK On's battery installations. Additionally, the robust sales of the Volkswagen ID.7 and ID.4 also drove growth in SK On's battery installations.

LG Energy Solution's batteries are mainly used in models from brands such as Tesla, Kia, Volkswagen, and Chevrolet. In Q1 this year, although weak sales of Tesla models led to a 17.3% YoY decline in LG Energy Solution's battery installations for Tesla, strong sales of the Volkswagen ID series and Kia EV3, as well as increased sales of Chevrolet models like the Equinox, Blazer, and Silverado EV produced on the Ultium platform, still drove a 15.1% YoY increase in LG Energy Solution's overall battery installations.

Additionally, among the top 10 global EV battery installation rankings in Q1, Panasonic, which primarily supplies batteries to Tesla, was the only Japanese company and the only other battery manufacturer besides Samsung SDI to experience a decline in battery installations. In Q1 this year, Panasonic's battery installations fell 6.3% YoY to 7.2 GWh, ranking eighth. Affected by reduced demand for the Tesla Model 3 and Y, Tesla's sales declined this year, and given its high reliance on Tesla, Panasonic's battery installations also decreased. However, with the upgrade of its 2170 and 4680 batteries, Panasonic's battery installations in the North American market are expected to rebound rapidly.

The market share gap between Chinese and Korean battery producers further widened

. It is worth noting that from 2017 to 2024, the compound annual growth rate (CAGR) of global EV battery installations reached 47.5%. In Q1 this year, leveraging the world's largest EV market, China's two EV battery giants, CATL and BYD, continued to increase their market shares, collectively accounting for 55% of the global EV battery market. The other four Chinese battery producers on the list, including SVOLT Energy Technology and Gotion High-tech, also significantly enhanced their competitiveness in the global market with remarkable growth rates, achieving a 12.5% market share. This means that Chinese EV battery manufacturers collectively hold a 67.5% market share in the global market. In contrast, the market share of battery installations for South Korea's top three battery producers has shrunk from 23.2% in the same period last year to 18.7%, further widening the gap between Chinese and South Korean battery producers. Meanwhile, Japanese battery producer Panasonic's market share has dwindled to just 3.3%.

However, after Trump was re-elected as the US President, the US has officially implemented stringent tariff policies on Chinese batteries and raw materials, escalating tensions in the global supply chain. As a countermeasure, South Korean battery companies are expanding joint venture partnerships with local automakers and strengthening their strategic deployment of local production in the US to ensure continued policy support in the North American market.

However, given the high dependence of South Korea's battery industry on Chinese raw materials, medium and long-term measures to restructure the supply chain and diversify the sources of raw material procurement have become urgent. Amidst a complex environment characterized by intensified US protectionism, stricter European environmental protection regulations, and rising price pressures from China, South Korea's battery industry must seek new growth strategies.