In the final stage of April, the 2024 financial reports of some automakers were released late, coinciding with the release of their Q1 2025 financial reports.

Gasgoo compiled the financial data of 19 mainstream domestic automakers from the previous year. Against the backdrop of a continuous increase in new energy penetration and intensified market competition, the performance of automakers generally exhibited three major trends: the competitiveness of leading independent brands continued to strengthen; traditional state-owned automakers accelerated their transformation but had not yet stabilized; and new energy vehicle (NEV) startups faced a critical transition from "scaling for growth" to "efficiency for profit."

Revenue divergence, profit landscape continues to be reshaped

A comparison of the 2024 financial reports of various automakers reveals a further amplification of performance differentiation. Except for BYD, which maintained its position as the most profitable automaker in China, the profitability of other automakers fluctuated significantly, and their rankings also underwent notable changes.

BYD continued to lead with a revenue of 777.1 billion yuan, up 29% YoY. Its net profit attributable to shareholders during the reporting period was 40.25 billion yuan, a 34% increase, adding over 10 billion yuan compared to the previous year. In terms of sales, it reached 4.272 million units in 2024, up over 41.3% YoY. The simultaneous increase in both volume and price drove double-digit growth in revenue and profit, further solidifying its position as the industry leader.

Meanwhile, SAIC's performance continued to decline. Although its revenue still ranked second in the industry at 627.6 billion yuan, it fell 15.73% YoY. Sales dropped to 4.013 million units, a 20.1% decrease from 5.02 million units in 2023, shrinking by over 40% from its peak.

This led to a significant contraction in its profitability, with net profit attributable to shareholders plunging from 14.11 billion yuan in 2023 to 1.666 billion yuan in 2024, a staggering 88.2% drop. In terms of net profit excluding non-recurring gains and losses, SAIC swung from a profit of 10.04 billion yuan in 2023 to a loss of 5.41 billion yuan in 2024, a 1.5-fold YoY decline. It is evident that SAIC, particularly its joint venture business segment, is undergoing a severe adjustment period.

Institutional analysts believe that SAIC-GM is the primary reason for the widening losses. Due to declining sales, SAIC-GM and its holding subsidiaries made asset impairment provisions of 23.212 billion yuan in Q4 2024, resulting in a reduction of approximately 7.874 billion yuan in net profit attributable to shareholders of publicly listed firms in SAIC's consolidated financial statements for Q4.

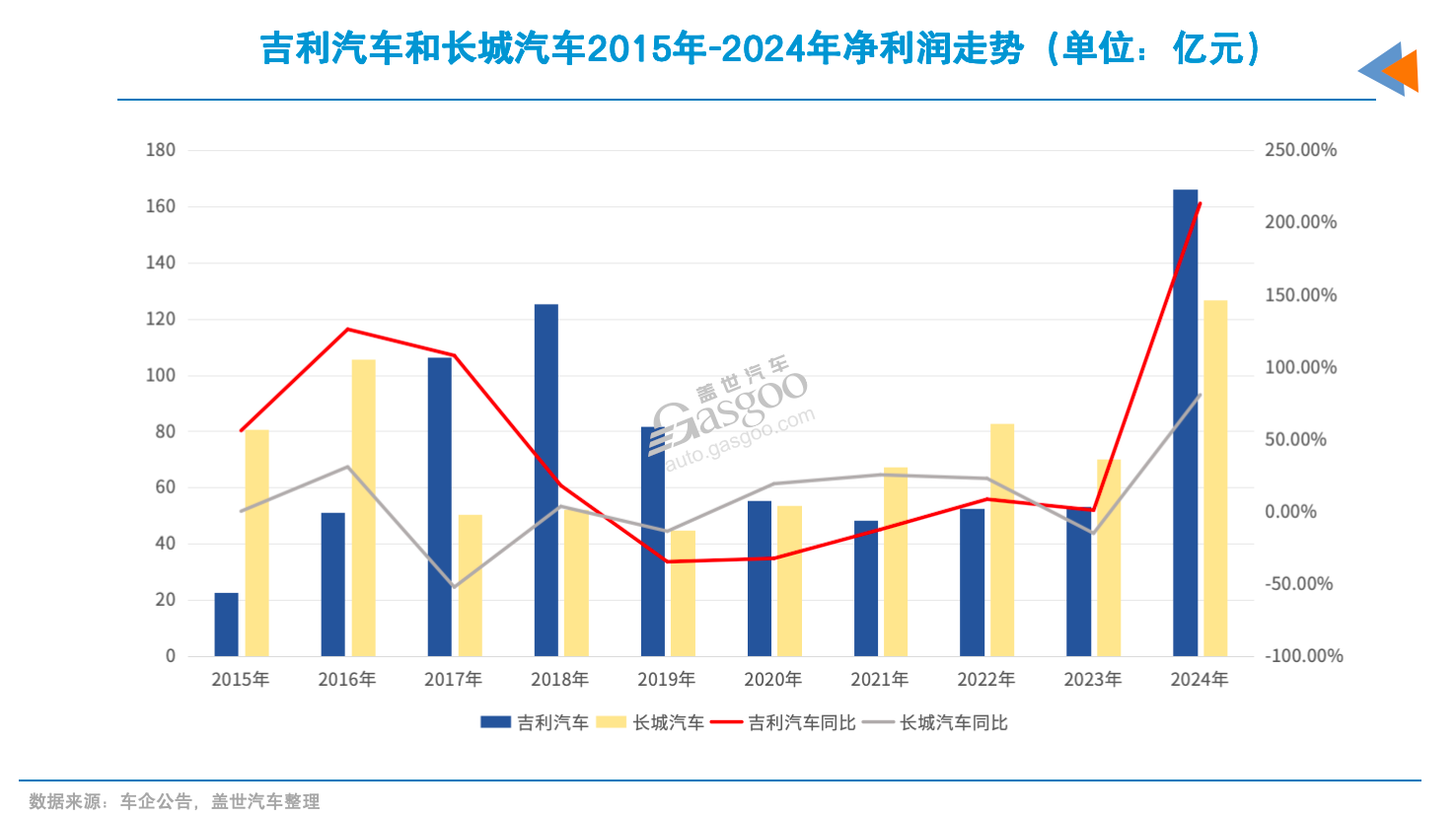

In stark contrast, Geely and Great Wall Motor delivered impressive performances in 2024, with revenues exceeding 200 billion yuan and significantly improved profitability.

Geely's revenue in 2024 increased 34% YoY to 240.2 billion yuan, and its net profit attributable to shareholders surged from 5.31 billion yuan in 2023 to 16.63 billion yuan, up 213.3% YoY, propelling it to second place in the industry.

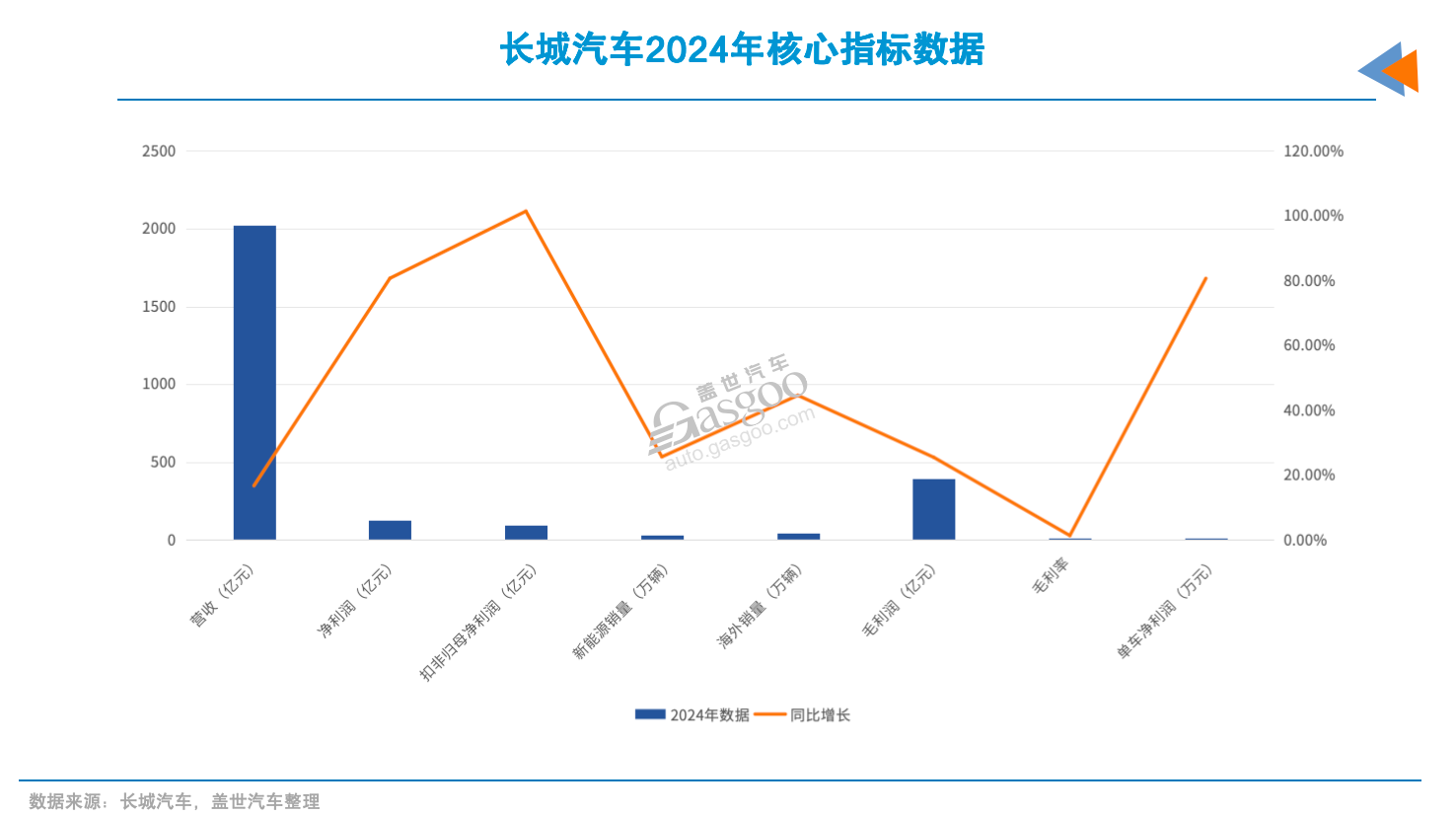

Although Great Wall Motor's sales volume remained relatively stable in 2024, with a slight YoY increase of 0.21% to 1.233 million units, its revenue grew 16.7% YoY to 202.2 billion yuan. Net profit attributable to shareholders of the listed company reached 12.69 billion yuan, surging 80.8% YoY, propelling its profitability ranking to third place in the industry.

Notably, Great Wall Motor's net profit excluding non-recurring gains and losses saw a remarkable increase, reaching 9.74 billion yuan, doubling YoY, demonstrating the robust profitability of its core business.

Li Auto, a dark horse in the industry in 2023, once ranked among the top three most profitable automakers in China. However, in 2024, it experienced a situation where revenue increased but profit did not. Last year, its revenue reached 144.5 billion yuan, up 16.6% YoY, while sales volume exceeded 500,000 units, a 33.1% YoY increase. However, net profit attributable to shareholders of the listed company shrank to 8.03 billion yuan, down 31.4% YoY.

This was primarily due to a decline in product prices (with the Li L6, priced below 300,000 yuan, accounting for over half of sales) and an increase in expenses.

Changan Automobile also faced the dilemma of rising revenue but stagnant profit. In 2024, its revenue reached 159.7 billion yuan, up 5.6% YoY, while net profit attributable to shareholders of the listed company fell 35.4% YoY to 7.32 billion yuan. This was closely related to the growing pains during its new energy transition, with declining profitability in its traditional internal combustion engine vehicle business and the new energy business not yet fully achieving profitability breakthroughs. Last year, the combined losses of its two major new energy brands, Shenlan and Avatr, amounted to 5.6 billion yuan.

Seres was one of the biggest beneficiaries of the growth in the new energy market size. In 2024, Seres' revenue hit a record high, reaching 145.2 billion yuan, a 305% increase. Net profit swung from a net loss of 2.45 billion yuan in 2023 to a profit of 5.95 billion yuan, up 342.7% YoY. Its sales volume also increased 96.98% YoY to 497,000 units.

Automakers such as SAIC, GAC Group, and Dongfeng Motor Group, which ranked after Seres in terms of net profit, are currently constrained by their joint venture businesses and face challenges in the transition to electrification and intelligence, leading to a significant decline in their profitability over the past two years.

In 2024, despite GAC Group's sales volume of 2 million units, its net profit attributable to shareholders of the listed company was only 800 million yuan. Net profit excluding non-recurring gains and losses even hit a recent low, with a loss of 4.35 billion yuan, plummeting 221.8% YoY.

Although Dongfeng Motor Group's net profit improved compared to the previous year, turning from a loss to a profit, its profit level of less than 100 million yuan remained relatively low in the industry, indicating significant room for improvement in its profitability.

The halving of net profits at Brilliance China and BAIC Motor also reveals that foreign luxury brands are under immense profit pressure amidst the cut-throat competition in the Chinese market.

Under the impact of domestic mid-to-high-end brands such as AITO and Li Auto, BBA has also embarked on the path of "volume discount" in recent years, leading to a decline in profitability. In 2024, the net profits of Brilliance China and BAIC Motor, two automakers heavily reliant on joint-venture luxury brands, were more than halved. The former reported a net profit of 3.1 billion yuan, while the latter's dropped to as low as 900 million yuan.

Among the automakers, JMC performed relatively steadily. In 2024, its revenue reached 38.37 billion yuan, up 15.7% YoY, and its net profit attributable to shareholders was 1.54 billion yuan, up 4.2% YoY.

However, another automaker pursuing both commercial and passenger vehicle businesses, JAC, incurred a net loss close to 1.8 billion yuan last year, a more than 22-fold plunge YoY, representing a sharp deterioration from its profitability of 120 million yuan in 2023. The widening loss was mainly due to the drag from Volkswagen Anhui, a joint-venture brand that incurred a loss of 5.35 billion yuan in 2024, leading JAC to recognize a loss provision of approximately 1.34 billion yuan.

Qianli Technology (formerly Lifan Technology), despite its relatively small scale, achieved profit growth. In 2024, its revenue reached 7.04 billion yuan, up 3.9% YoY, and its net profit was 40 million yuan, up 65.3% YoY, corresponding to sales of 59,000 units.

BAIC BluePark's situation remained largely unchanged. In 2024, its revenue reached 14.51 billion yuan, up slightly by 1.35% YoY, but its net loss widened to 6.95 billion yuan, nearly a 30% increase from the loss in 2023. Its gross profit margin was -11.64%, making it the only automaker among the 19 to report a negative gross profit margin, indicating severe challenges in product competitiveness and cost control.

Among the new energy vehicle (NEV) startups, XPeng Motors and Leap Motor continued to improve their fundamentals. Leap Motor's revenue last year reached 32.16 billion yuan, up 92.1%, and its net loss attributable to shareholders narrowed significantly to 2.82 billion yuan. Notably, it achieved a positive net profit in Q4, reaching 80 million yuan, achieving the goal of turning a single-quarter net profit positive one year ahead of schedule.

XPeng Motors' loss narrowed to 5.79 billion yuan last year from 10.38 billion yuan in 2023, a 44.19% decrease YoY, and its gross profit margin improved to 14.3%.

Zeekr, as Geely's high-end NEV brand, demonstrated strong growth momentum in 2024, with revenue reaching 75.91 billion yuan, up 46.9% YoY, and its net loss narrowing to 6.424 billion yuan, showing significant improvement from the previous year.

However, NIO's profitability still faces severe challenges. In 2024, its revenue reached 65.73 billion yuan, up 18.2% YoY, and its sales volume reached 222,000 units, up 38.7% YoY. However, its net loss widened to 22.66 billion yuan from the previous year, remaining one of the most loss-making companies in the industry.

Given NIO's gross margin of 9.88%, its high-end positioning has failed to bring about the expected improvement in profitability, while investments in R&D and expansion continue to erode its financial performance.

Why did their profits soar?

In 2024, amidst the profit pressures faced by many traditional automakers and the divergent performances within the new energy vehicle (NEV) sector, some automakers achieved significant growth in net profits, even turning losses into profits or substantially reducing losses despite the intense market competition. Among them, automakers such as Geely, Great Wall Motor, and Seres stood out.

Geely's net profit in 2024 reached a new high in nearly 15 years, surpassing the 15 billion yuan threshold for the first time. Its profit growth was attributed to the continuous optimization of its product mix and the expansion of economies of scale in the NEV sector. Geely sold 2.177 million vehicles in 2024, up 14% YoY, with the proportion of NEV car model sales rising to 40%, driving an improvement in the overall gross margin.

Geely's high-end NEV brand, Zeekr, performed notably well, with sales increasing significantly YoY in 2024, surpassing the 200,000-unit mark and directly boosting the profit margin per vehicle. Additionally, Geely's investments in the intelligent vehicle sector have begun to pay off, with upgrades to its assisted driving and in-vehicle systems enhancing product competitiveness and further driving growth in both sales and profits.

According to Guosen Securities' estimates, the average selling price (ASP) of Geely's finished vehicles has risen to 107,400 yuan, indicating a significant optimization of the product mix. It can be said that Geely has successfully optimized its product mix through its high-end brands and NEV transformation, providing crucial support for its profit growth.

Great Wall Motor also experienced sustained profit growth in 2024, reaching a new high in nearly a decade. Despite stable sales, the company achieved substantial growth in performance, driven by the simultaneous expansion of its high-end brands and overseas markets. Data shows that the Tank brand sold 230,000 vehicles in 2024, accounting for 18% of total sales. Meanwhile, WEY's annual sales also recovered, reaching 54,000 units.

Minsheng Securities analysis suggests that the continuous increase in sales of high-end car models priced above 200,000 yuan drove up Great Wall Motor's gross margin and ASP per vehicle. According to estimates, its finished vehicle ASP reached 158,000 yuan in Q4, up 12,000 yuan YoY.

Seres, on the other hand, achieved a transformation from losses to substantial profits in 2024, with an annual net profit of nearly 6 billion yuan, making it one of the fastest-growing automakers during the reporting period.

In particular, the rapid sales growth of Seres' AITO WENJIE series car models drove an overall sales increase of nearly 97% YoY. Seres' net profit in Q3 reached 2.4 billion yuan, far exceeding the profit levels of other quarters throughout the year.

The improvement in Seres' sales structure significantly boosted its gross profit margin, which reached 26.2% last year, surpassing the industry average of 10.07%. Ping An Securities pointed out that the strong sales performance of the AITO M9 car model served as a crucial breakthrough for the AITO brand to penetrate the mid-to-high-end market and became a key driving factor for Seres to turn from losses to profits.

As for Leap Motor, although it was still incurring losses, the amount of losses narrowed significantly in 2024, and it achieved positive profitability in the fourth quarter. The emergence of economies of scale was the main reason for the reduction in losses. With the rapid growth in sales, Leap Motor's costs in manufacturing and the supply chain were gradually diluted, significantly reducing the loss per vehicle. Financial reports showed that Leap Motor's gross profit margin increased from 0.5% in 2023 to 8.4% in 2024, an improvement driven by the strong sales of its most-traded car models such as the C11 and C01.

In addition, Leap Motor's technological accumulation in the field of intelligence also helped it save some costs. Its self-developed assisted driving systems and core three-electric technologies reduced its reliance on external purchases, further optimizing its cost structure. According to Pudong International's analysis, through economies of scale and self-developed technologies, Leap Motor has gradually improved its profitability. Although it has not yet turned from losses to profits, its development path has shown a clear upward trend.

XPeng Motors has also taken a significant step on the path of reducing losses, achieving dual progress in sales and profitability.

The key to XPeng Motors' improved profitability lies in the empowerment of intelligent technologies and the adjustment of its product structure. With assisted driving as its core selling point, models such as the G6 and P7i performed strongly in the price range of 200,000-300,000 yuan, attracting a large number of consumers who value technological experiences. The growth in sales directly drove an increase in revenue.

Meanwhile, by optimizing product pricing and supply chain management, XPeng Motors achieved a revenue of 160,000 yuan per vehicle in the fourth quarter of 2024. Its gross profit margin also increased from 1.5% in 2023 to 14.3%, exceeding 14% for three consecutive quarters. Haitong International's analysis pointed out that XPeng Motors, leveraging its leading edge in assisted driving technology and the optimization of its product structure, successfully reduced its loss margin, demonstrating the profit potential of new-energy automakers driven by technology.

Overall, the growth in net profits or the improvement in losses for the aforementioned automakers in 2024 can be attributed to factors such as the optimization of product structures, the advancement of high-end strategies, and the acceleration of technology implementation. Some view this round of "profit recovery" as one of the clear signals indicating the industry's shift from price wars to structural battles.

The Growing Importance of Overseas Markets

The importance of overseas markets for Chinese automakers is becoming increasingly prominent. Whether in terms of revenue growth rate, sales increment, gross margin performance, or market share, the overseas businesses of some automakers are no longer just "supplementary items" but have become the "main engine" driving overall growth.

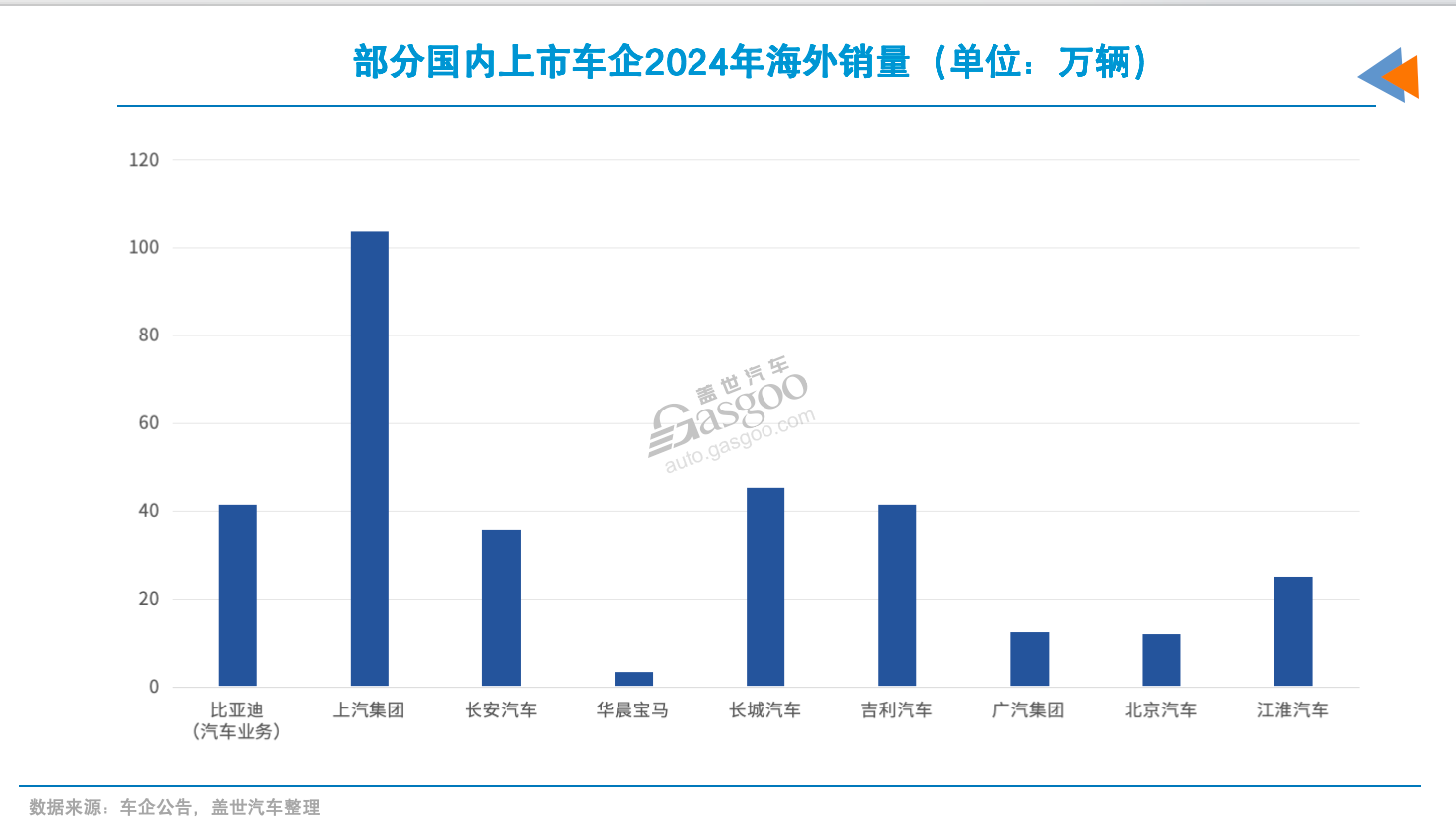

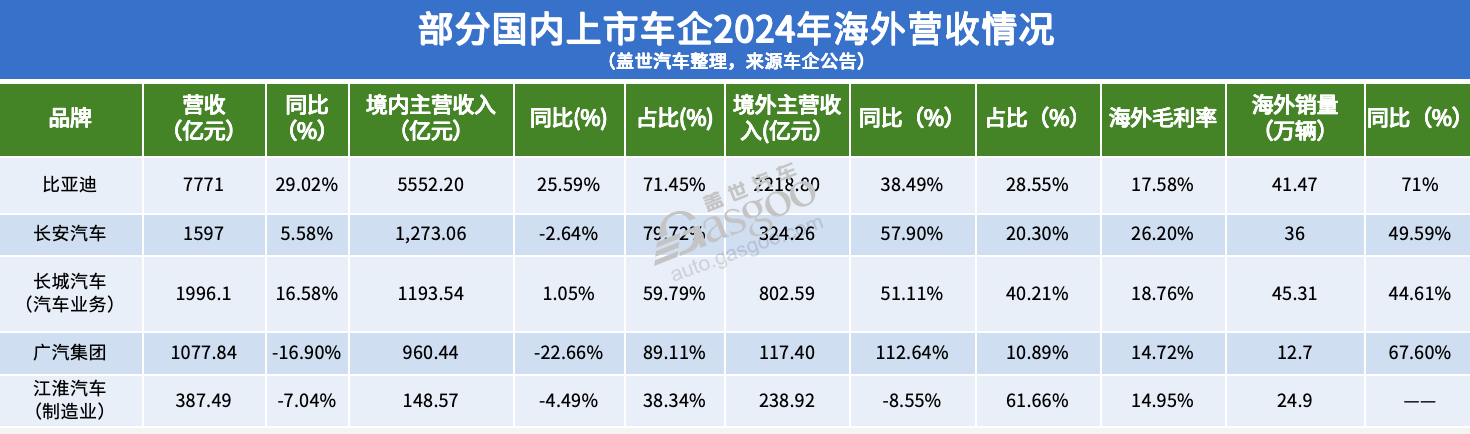

Data shows that BYD's overseas revenue reached 221.88 billion yuan in 2024, up 38.5% YoY, accounting for 28.6% of its total revenue, making it one of the key variables boosting the growth of total revenue. Overseas sales also reached 415,000 units, up 71% YoY, demonstrating a strong expansion momentum.

According to its annual report, BYD has established a presence across 6 continents and in over 100 countries and regions globally, and has also deployed two self-operated ro-ro ships for operation. SPDB International pointed out in a research report that BYD is accelerating its global expansion, coupled with the localization of factories, and predicts that its overseas auto sales this year are expected to nearly double.

Changan Automobile has also achieved breakthroughs in overseas markets. In 2024, its overseas revenue reached 32.43 billion yuan, up 56.1% YoY, accounting for approximately 20% of its total revenue. Annual overseas sales reached 360,000 units, up 47.8% YoY.

According to disclosed data, Changan Automobile's overseas business gross margin is as high as 26.2%, nearly twice the domestic gross margin. It not only exceeds the average domestic gross margin level but has also become an important source of the company's profits. Hualong Securities analysis suggests that Changan Automobile's global "Ocean-embracing" plan is accelerating, and the launch of new factories or new products in Mexico, Thailand, Brazil, and other places in 2025 will further strengthen its global market presence.

Geely Automobile also demonstrated strong performance in exports, with annual export sales reaching 415,000 units in 2024, up 57% YoY, accounting for 19% of its total sales. In particular, its market share in the Middle East exceeded 12%, and its overall gross margin increased to 15.9%.

Specifically for each brand, Zeekr continues to expand in multiple international markets such as Europe, the UAE, and Mexico. In 2024, it began exporting the Zeekr 009 and Zeekr X right-hand drive models to right-hand drive markets such as Thailand and Malaysia. Geely Galaxy launched the export version of the E5 model, enriching its overseas product lineup. The Geely brand has a comprehensive presence in markets such as Southeast Asia, the Middle East, Eastern Europe, and Africa. Lynk & Co has deepened its presence in markets such as Europe and the Asia-Pacific Middle East region...

It can be seen that Geely is building a more complete overseas ecosystem by establishing local factories, setting up after-sales networks, and channel systems, and its export share is expected to further increase in 2025.

Great Wall Motor is even more a beneficiary of overseas business expansion. In 2024, its overseas sales reached 454,100 units, up 44.61% YoY, exceeding 36% of its total sales, making it one of the automakers with the highest overseas share among independent brands. This drove its overseas revenue to 80.26 billion yuan, accounting for 40% of the total. In terms of gross margin, the overseas business stood at 18.76%.

It is evident that Great Wall Motor's "ecosystem going global" strategy is gradually being implemented, with localized projects in Thailand, Brazil, and Vietnam already entering the operational phase. The release of overseas capacity will support its future gross margin levels.

Despite a slight decline in overall revenue, GAC Group's overseas performance was commendable. In 2024, its overseas revenue reached 11.74 billion yuan, up 112.64% YoY, the fastest growth rate among all automakers that disclosed data. Overseas sales reached 127,000 units, up 67.6% YoY.

GAC Group has clearly elevated internationalization as a strategic priority (launching the One GAC globalization strategy upgrade plan), with two vehicle plants put into operation in Malaysia and Thailand throughout the year, and subsidiaries established in Europe, Brazil, and other regions, covering overseas vehicle, logistics, parts, and energy businesses across the entire value chain.

JAC's overseas business contribution has even surpassed that of the domestic market. In 2024, its overseas revenue reached 23.89 billion yuan, accounting for over 60% of total revenue. The company exported 249,000 vehicles throughout the year, representing 62% of total sales.

Although SAIC and BAIC did not disclose overseas revenue, judging from sales trends, overseas business has become an important component of stability maintenance. Especially for SAIC, last year's export sales once again exceeded 1 million units, accounting for over a quarter of the total, making a significant contribution to its profitability.

New energy vehicle companies such as XPeng, Leap Motor, and Li Auto have also made moves in overseas markets, although large-scale deliveries have yet to be achieved, their strategic direction is clear.

For example, XPeng entered markets such as Malaysia, Australia, and Spain in 2024; Seres has also begun expanding overseas channels; Leap Motor, through cooperation with overseas partners, plans to achieve product output in emerging markets such as Southeast Asia and the Middle East, and has already entered the European market, with overseas markets expected to become a new growth driver.

Multiple brokerage analyses believe that the overseas growth of Chinese automakers in 2024 not only comes from "quantity" growth but also reflects "quality" improvement. Localized production, brand promotion, and full value chain capability building are becoming key to the success of companies going global.

Meanwhile, against the backdrop of policy support in some countries and the rise in EV demand, Chinese brands are beginning to enter the mainstream consumer view in local markets, thereby establishing a more resilient market foundation.

Although there are many uncertainties in the global automotive market in 2025, it is certain that Chinese automakers still have great potential in overseas markets and will rely on them to further boost growth.