Driven by the significant positive developments in the new round of China-US trade negotiations, the shipping sector of the Hong Kong stock market continued its upward trend. As of press time, COSCO SHIPPING Development (02866.HK) rose by 3.67%, COSCO SHIPPING Ports (01199.HK) rose by 2.47%, and Qingdao Port (06198.HK) rose by 1.45%.

Note: Performance of shipping stocks

Meanwhile, CIMC Group (02039.HK), a global leader in containers, naturally benefited from this. Its intraday gain once exceeded 10%. It is worth noting that the group's stock price rose by 30% from April 9 to May 14.

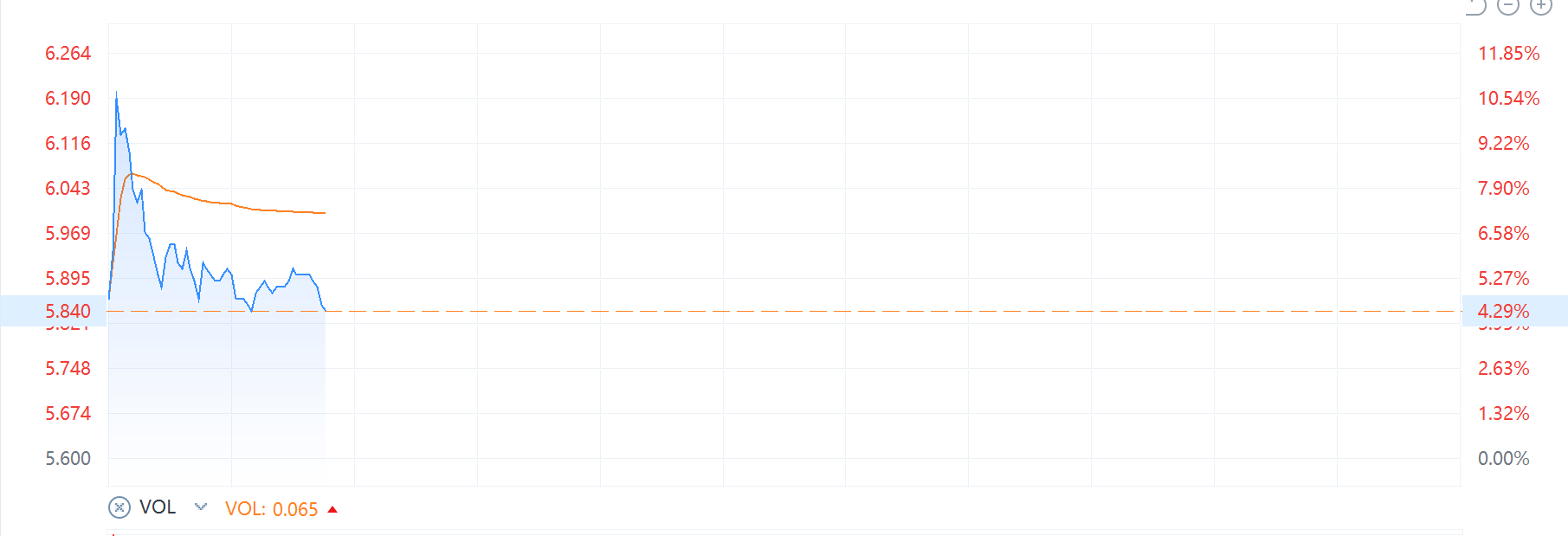

As of press time, CIMC Group rose by 4.29% to HKD 5.84.

Note: Recent performance of CIMC Group

Policy Easing Boosts Shipping

In terms of news, on May 12, China and the US reached an agreement through talks in Geneva. The US will reduce tariffs on Chinese goods from 145% to 30% within 90 days, and China will also reduce tariffs on US goods from 125% to 10%. Subsequently, both China and the US adjusted relevant tariffs in recent days.

Against this backdrop, US importers significantly increased their import orders from China this week. Data from multiple shipping companies and industry tracking showed that China's freight volume to the US has rebounded significantly.

The global shipping digital platform Vizion disclosed shocking data: Within seven days after the agreement was reached, container bookings on the China-US route surged by 277%, from 5,709 TEUs to 21,530 TEUs.

German shipping giant Hapag-Lloyd confirmed that its cabin bookings on the US-China route surged by 50% in three days. CEO Rolf Habben Jansen bluntly stated that "ship cabin space is about to sell out."

Ryan Petersen, the founder of Flexport, even issued an urgent warning on social media: On the first day, ocean freight orders surged by 35%, and the crisis of port congestion loomed.

Paul Brashier, Vice President of Global Supply Chain at ITS Logistics, a logistics company, said, "My clients have pre-loaded thousands of containers in China, ready for shipment." He expects a further surge in container shipping volume in the next four to six weeks.

Goldman Sachs analysis pointed out that US importers, in order to seize the golden window of the 30% tariff, are launching an unprecedented stockpiling wave. China's export data may hit a record in Q3.