Since the beginning of this year, SHFE zinc prices have gradually declined. Before the Chinese New Year, downstream companies completed restocking and took an early holiday, leading to a gradual weakening of market demand. The tight supply of zinc ore was alleviated, putting downward pressure on zinc prices. After the Chinese New Year, US tariff policies disrupted the market, with fundamentals tightening initially before shifting to a more relaxed state, resulting in a fluctuating trend in zinc prices. In early April, the US tariff policies far exceeded market expectations, exacerbating the risk of stagflation in the US. Affected by this, the fundamentals of zinc weakened, and zinc prices plummeted significantly.

At the beginning of this year, driven by expectations of a slowdown in the US Fed's interest rate cuts and a decline in market demand, the price trend of LME zinc was relatively weak. Subsequently, the repeated fluctuations in US tariff policies and the increasing expectations of a US economic recession led to downward pressure on the US dollar index, and LME zinc prices entered a phase of fluctuating upward. After entering April, the US "reciprocal tariff" policy exceeded expectations, pushing up the risk of stagflation and causing LME zinc prices to fall sharply to a low point in nearly a year. During the Labour Day holiday, fluctuations in US employment data were limited, and the manufacturing index continued to remain in contraction territory, with LME zinc prices maintaining a stable trend.

From a medium and long-term perspective, the main influencing factors at the macro perspective are still related to US tariff policies and the US Fed's interest rate cut path. Regarding US tariffs, considering the attitudes of various countries and negotiation factors, there may still be some adjustments to the US tariff policy in the future. As for the US Fed's interest rate cut path, Powell has repeatedly emphasized at press conferences the impact of economic uncertainties on the dot plot projections. Therefore, there is a possibility of a slowdown in the US Fed's interest rate cut path.

From the perspective of overseas mines, driven by Endeavor mine's planned commissioning in the near future, capacity ramp-up at Tara and Kipushi mines, and increased production at Antamina mine, it is expected that overseas mines will show an increasing production trend in the medium term. Domestically, in Q1, domestic mines reduced production by 10.04% due to seasonal factors. As the weather warms up, production at northern mines has seasonally recovered, while mines such as Huoshaoyun and Yinzhushan have stabilized their production, indicating significant room for growth in domestic zinc concentrate production.

With the release of overseas mine capacities, port inventories of zinc concentrates are expected to remain at a relatively high level of over 300,000 mt within the year. As of the end of March, raw material inventories of smelters increased by 51.37% YoY, verifying the expectation of a loose raw material supply. It is expected that with the gradual release of incremental supplies from domestic and overseas mines, the loose raw material situation will continue. In this context, the increased supply of ore will further drive up the zinc concentrate TCs.

In the refined zinc sector, there is a game between mines and smelters over processing fees. Affected by the Chinese New Year holiday, the transmission of incremental ore supply to the smelting side has been relatively limited.Additionally, the import window only opened briefly at the beginning of the year. In Q1, zinc ingot imports fell by 24.65% QoQ.

Overall, in the medium term, zinc concentrate TCs are expected to continue rising, which will further boost smelting profits. Against this backdrop, smelters' willingness to increase production has strengthened, and there is still a possibility for the zinc ingot import window to reopen. It is anticipated that zinc ingot supply will experience significant growth.

From the beginning of the year to date, the infrastructure sector has performed relatively weakly. The operating rates of the cement milling industry, asphalt plant industry, and aluminum wire and cable industry have all fallen short of expectations. The real estate market continues to face pressure, with cumulative YoY declines in new construction starts and completed areas persisting. Additionally, auto sales data has exceeded market expectations.

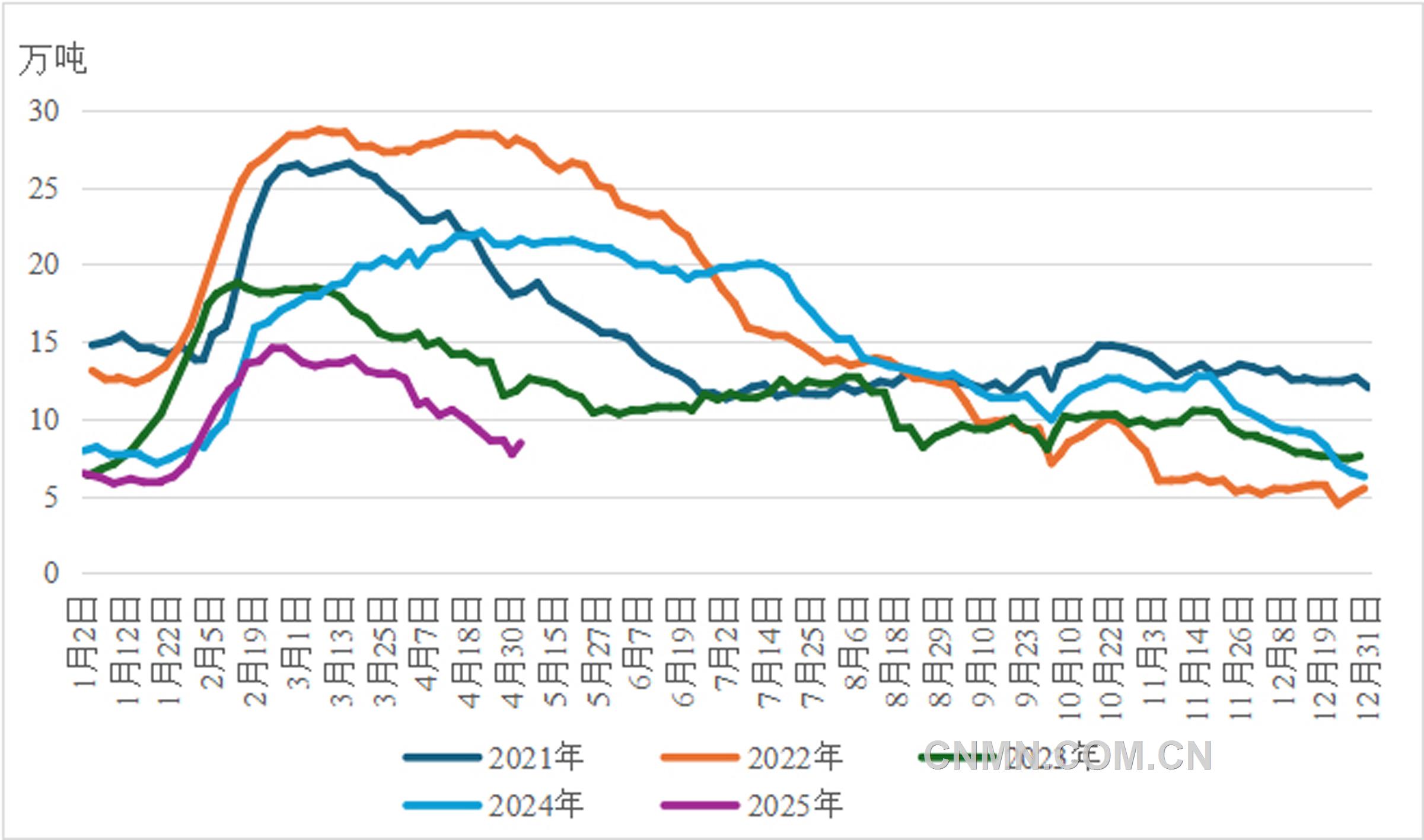

In the galvanizing and die-casting sectors, after the Chinese New Year, galvanizing and die-casting zinc alloy enterprises have focused on inventory destocking, with slow progress in production resumptions. The operating rates of these enterprises have been at relatively low levels compared to the same period in recent years. However, driven by the rush-to-export effect triggered by uncertainties in trade policies, galvanized sheet exports have increased significantly, further expanding their share in total demand.

Looking ahead, the power infrastructure and automotive industries remain the main growth points for end-use demand. However, their combined zinc consumption accounts for only about 20% of total zinc consumption, limiting their boosting effect on zinc demand. Furthermore, although the US's extension of the "reciprocal tariff" has preserved a channel for the re-export of galvanized products, Vietnam's anti-dumping review, which imposes a 37.13% temporary tariff on some Chinese galvanized sheet exports, may hinder the export of relevant domestic products. Overall, the support for zinc prices from the demand side is weak.

From a macro front, as the US continues to advance its "reciprocal tariff" policy, market concerns about a US economic recession have intensified, which will exert downward pressure on zinc prices. From a fundamental perspective, zinc concentrate TCs have rebounded to a high level, improving smelters' profit margins and significantly enhancing their enthusiasm for production resumptions. It is expected that zinc ingot supply will experience significant growth.

On the demand side, the boosting effect of the domestic market on zinc prices remains to be seen, while the export sector, constrained by trade policies, is unlikely to provide effective support. Therefore, the support for zinc prices from the demand side is relatively weak.

In summary, the fundamentals of the zinc market will gradually shift towards a looser pattern. Influenced by bearish macro factors, it is expected that the zinc price range will gradually trend downward in the medium term.

(Author's affiliation: Guoyuan Futures)