Operating Revenue and Operating Costs of Publicly Listed Lithium Chemicals Firms in Q1 2025 (100 million yuan)

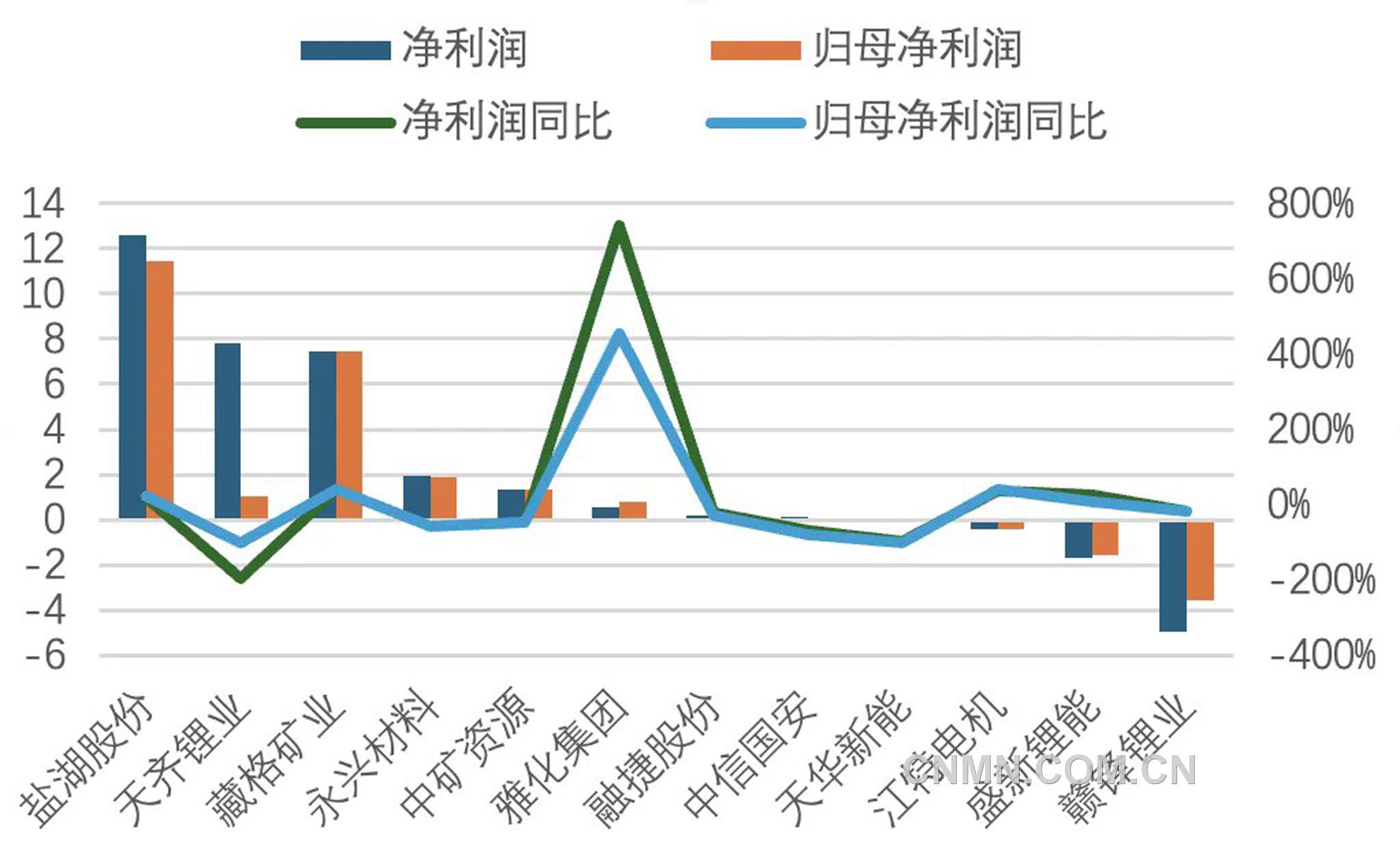

Profitability of Publicly Listed Lithium Chemicals Firms in Q1 2025 (100 million yuan)

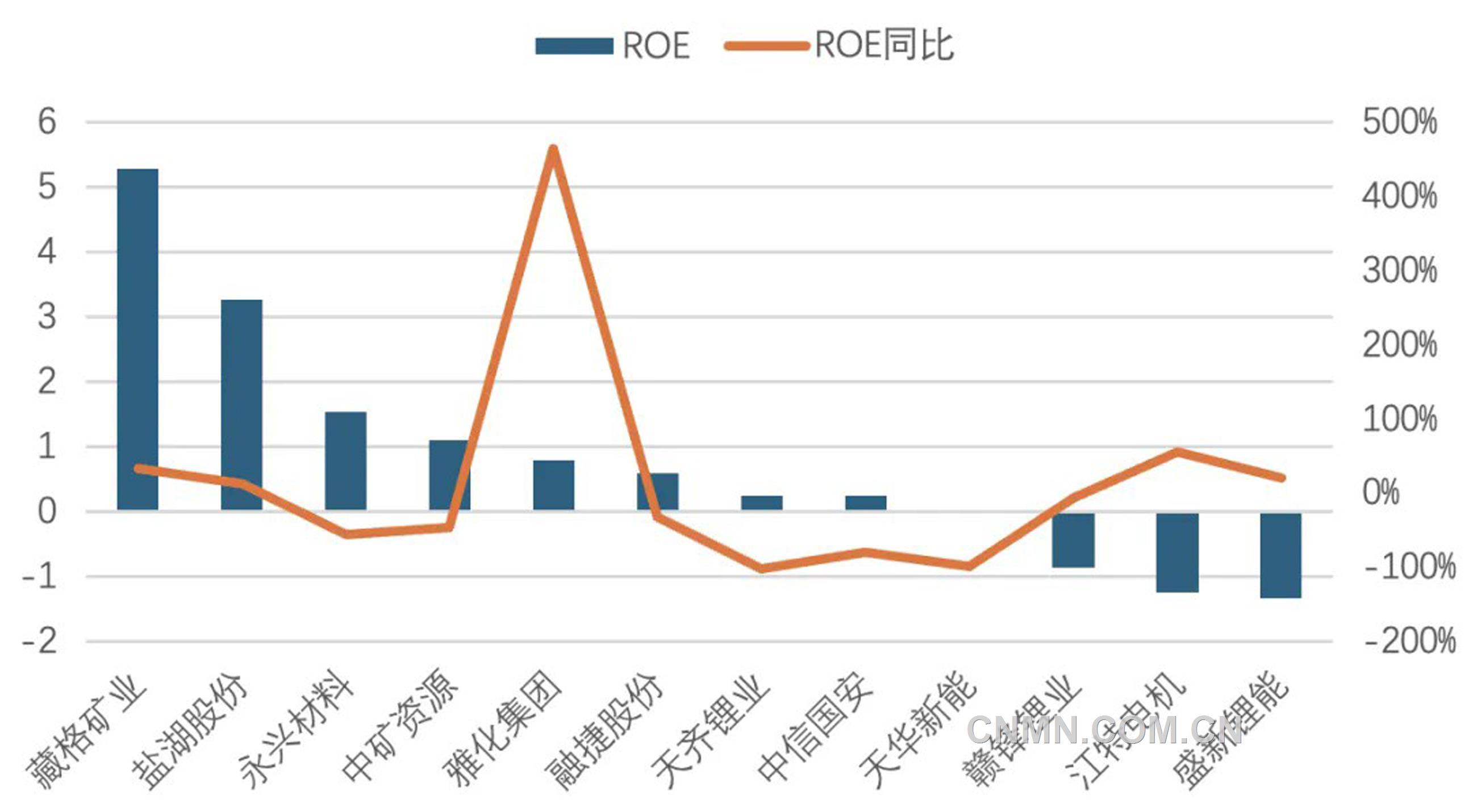

ROE of Publicly Listed Lithium Chemicals Firms in Q1 2025

This newspaper reports: Recently, the Q1 2025 reports of publicly listed lithium chemicals firms have all been disclosed. The 12 publicly listed firms in the lithium chemicals industry included in this statistical analysis are Tianqi Lithium, Ganfeng Lithium, Chengxin Lithium, Yahua Group, Jiangxi Special Electric Motor, Canmax, Sinomine Resource Group, YOUNGY, Yongxing Materials, Salt Lake Potash, CITIC Guoan, and Zangge Mining (in no particular order). Based on a comprehensive review of various financial indicators, amid the market environment of persistently low lithium chemicals prices, the Q1 performance of publicly listed lithium chemicals firms showed a divergence, with some companies achieving growth against the trend.

Overall stable operating revenue, with positive growth in some firms. In terms of operating revenue, the average operating revenue of the 12 publicly listed lithium chemicals firms in Q1 was 1.558 billion yuan, with the highest value reaching 3.772 billion yuan. The YoY growth rates of operating revenue varied among firms, ranging from -43.44% to 67.74%, indicating significant differences in overall growth rates. However, four firms still achieved positive growth in operating revenue, demonstrating strong market competitiveness.

From the perspective of operating costs, in Q1, the average operating cost of the 12 firms was 1.375 billion yuan, with the highest value reaching 4.177 billion yuan. The YoY growth rates of operating costs fluctuated between -32.51% and 59.77%. Overall, the growth rates of operating costs were largely in sync with those of revenue.

Profit divergence is evident, with some firms remaining profitable. In terms of profit performance, in Q1, the average net profit of the 12 firms was 209 million yuan, with the highest net profit reaching 1.26 billion yuan. The average net profit attributable to shareholders was 156 million yuan, with the highest value reaching 1.145 billion yuan. In terms of profitability, nine firms achieved profits, while three firms incurred losses, with significant differences in YoY profit growth rates. Among them, five firms saw an increase in profits compared to the same period last year, while seven firms experienced a year-on-year decline in profits.

The average return on equity (ROE) is relatively low, with some firms performing outstandingly. In terms of ROE, in Q1, the average ROE of the 12 firms was 0.80%, with the highest value reaching 5.27%. Among the 12 firms, four had an ROE exceeding 1%. From a YoY growth perspective, the performance of firms varied, with five firms achieving an increase in ROE compared to the same period last year.

Based on a comprehensive analysis of the Q1 reports disclosed by publicly listed firms, the decline in lithium chemicals selling prices was the primary reason for the decrease in firms' gross profit margins and operating revenues.However, some companies have achieved performance growth through their own business layouts and adjustments. For example, Tianqi Lithium's profit growth was mainly due to the gradual alignment of the pricing cycles for lithium concentrates and lithium chemicals sales. Qarhan Salt Lake, Sinomine Resource Group, and Yahua Group saw an increase in operating revenue, primarily driven by revenue contributions from other business segments such as potassium fertilizer, light metals, and civilian explosives.

Currently, the market price of lithium chemicals has fallen below the cost line for most companies except those extracting lithium from salt lakes, and prices continue to show a downward trend. Against this backdrop, subsequent lithium chemical companies are facing significant operational pressures. To address these challenges, companies need to actively adjust their capacity and production, improve production technologies, reduce production energy consumption, and adopt a multi-pronged approach to lower comprehensive production costs, thereby enhancing their risk-resistance capabilities and competitiveness in the market.

Author: Lithium Branch of China Nonferrous Metals Industry Association