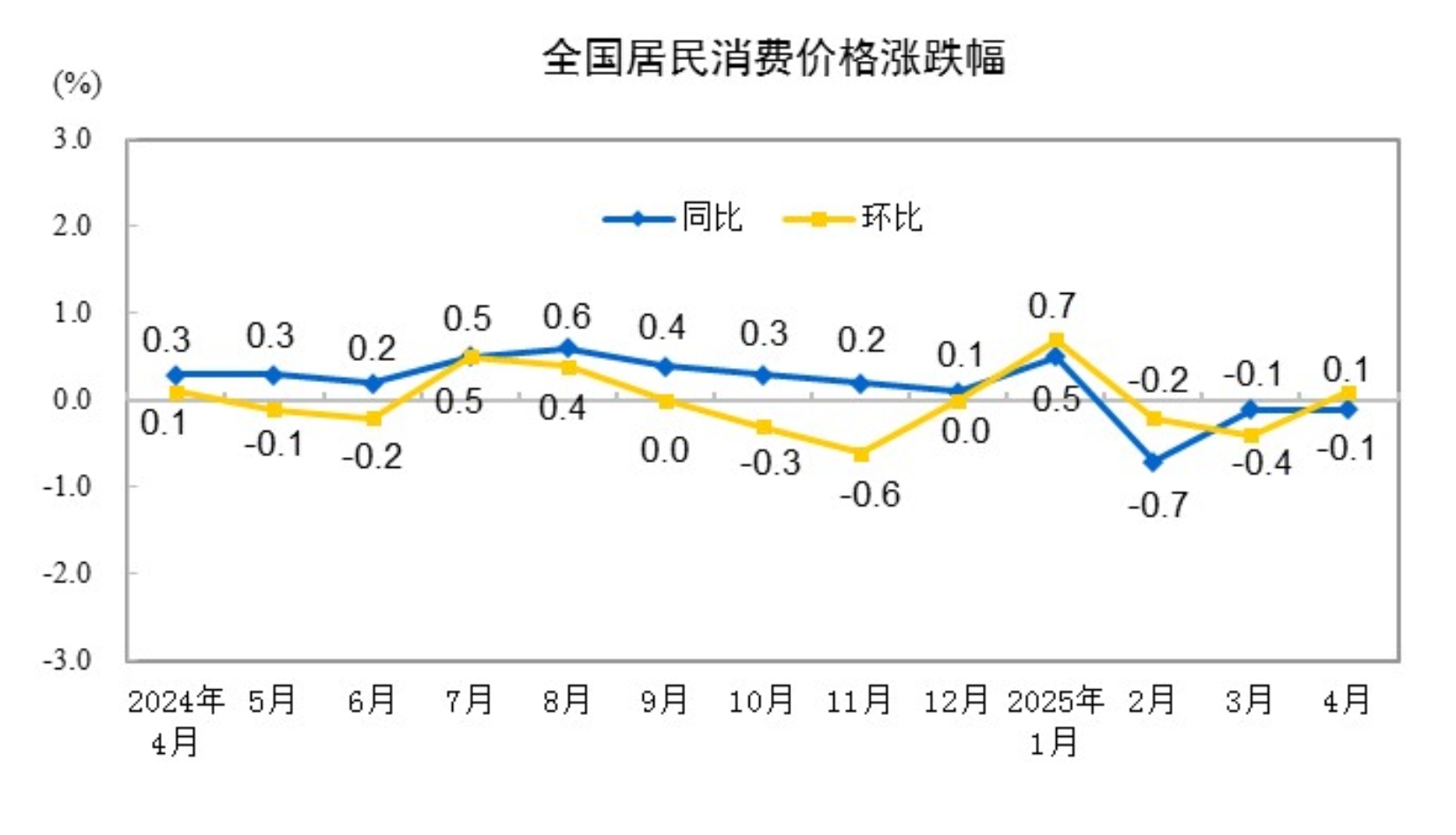

According to data from the National Bureau of Statistics (NBS), in April 2025, China's national consumer price index (CPI) decreased by 0.1% YoY. Specifically, prices in urban areas remained flat, while those in rural areas decreased by 0.3%. Food prices decreased by 0.2%, while non-food prices remained flat. Prices for consumer goods decreased by 0.3%, while service prices increased by 0.3%. On average from January to April, the national CPI decreased by 0.1% compared to the same period last year. NBS data also showed that in April 2025, China's national producer ex-factory prices decreased by 2.7% YoY and 0.4% MoM, while producer purchase prices decreased by 2.7% YoY and 0.6% MoM. On average from January to April, both producer ex-factory prices and purchase prices decreased by 2.4% compared to the same period last year. Dong Lijuan, the chief statistician of the NBS's Urban Department, interpreted the CPI and PPI data for April 2025: In April, the CPI MoM turned from a 0.4% decrease in the previous month to a 0.1% increase, with a 0.1% YoY decrease, the same as the previous month. Core CPI MoM turned from flat to an increase of 0.2%, with a 0.5% YoY increase, maintaining a stable growth rate. The producer price index (PPI) MoM decreased by 0.4%, the same as the previous month, with a 2.7% YoY decrease, 0.2 percentage points wider than the previous month. Although international imported factors have had a certain downward impact on prices in some industries, China's economic foundation remains stable and resilient, with various macro policies working in synergy to advance high-quality development, and prices in some areas showing positive changes.

In April 2025, China's national CPI decreased by 0.1% YoY. Specifically, prices in urban areas remained flat, while those in rural areas decreased by 0.3%. Food prices decreased by 0.2%, while non-food prices remained flat. Prices for consumer goods decreased by 0.3%, while service prices increased by 0.3%. On average from January to April, the national CPI decreased by 0.1% compared to the same period last year.

In April 2025, China's national CPI decreased by 0.1% YoY.

In April, China's national CPI increased by 0.1% MoM. Specifically, prices in urban areas increased by 0.2%, while those in rural areas remained flat. Food prices increased by 0.2%, while non-food prices increased by 0.1%. Prices for consumer goods remained flat, while service prices increased by 0.3%.

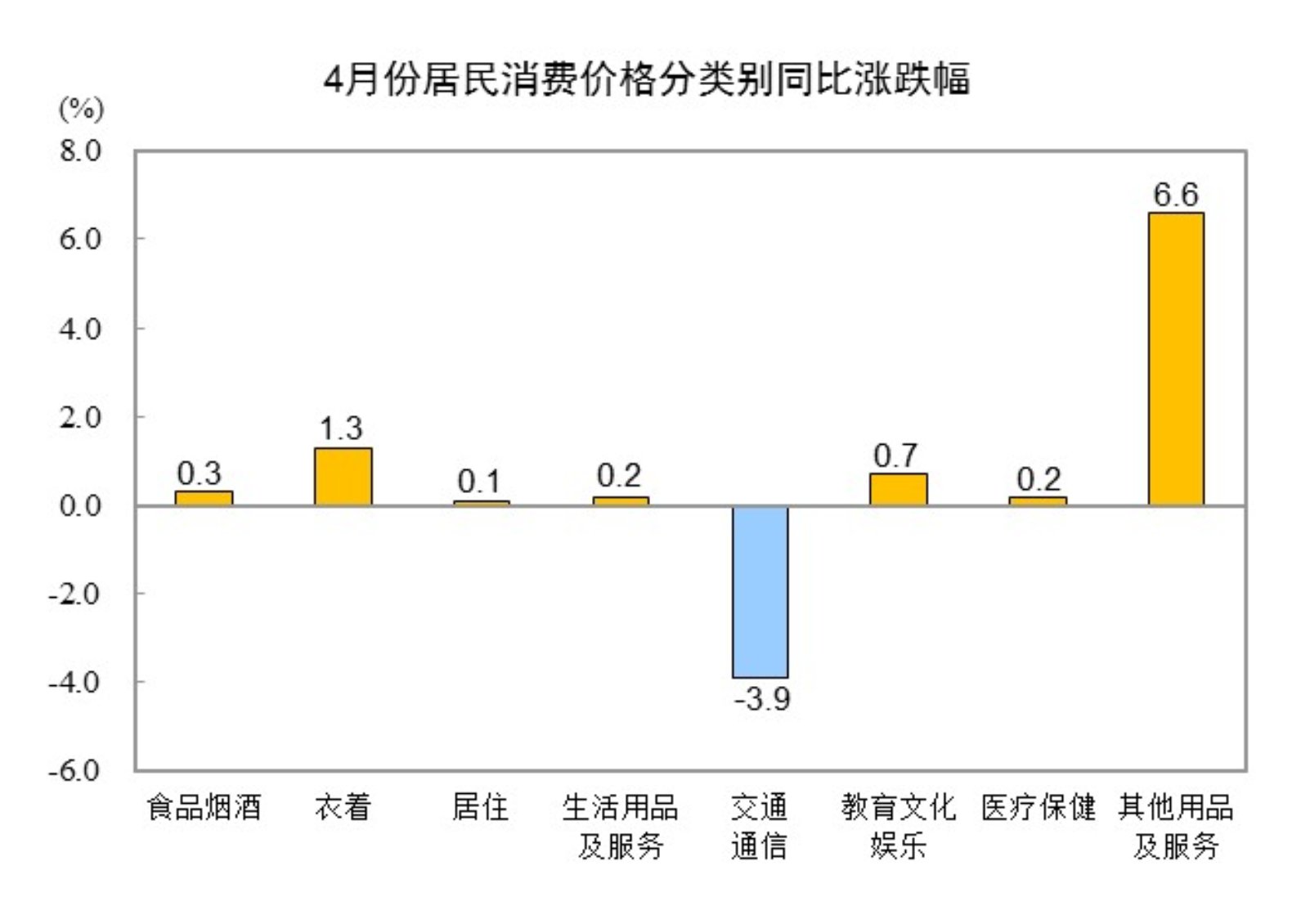

I. Year-on-Year Changes in Prices of Various Goods and Services

In April, prices for food, tobacco, and liquor increased by 0.3% YoY, contributing approximately 0.07 percentage points to the CPI increase. Among food items, fresh fruit prices increased by 5.2%, contributing approximately 0.11 percentage points to the CPI increase; aquatic product prices increased by 1.5%, contributing approximately 0.03 percentage points to the CPI increase; meat prices increased by 0.6%, contributing approximately 0.02 percentage points to the CPI increase, with pork prices increasing by 5.0%, contributing approximately 0.06 percentage points to the CPI increase; fresh vegetable prices decreased by 5.0%, contributing approximately 0.10 percentage points to the CPI decrease; and grain prices decreased by 1.4%, contributing approximately 0.02 percentage points to the CPI decrease.

Among the other seven major categories, prices increased for six and decreased for one on a YoY basis. Specifically, prices for other goods and services, clothing, and education, culture, and recreation rose by 6.6%, 1.3%, and 0.7%, respectively, while prices for household goods and services, healthcare, and housing increased by 0.2%, 0.2%, and 0.1%, respectively. In contrast, prices for transportation and communication fell by 3.9%.

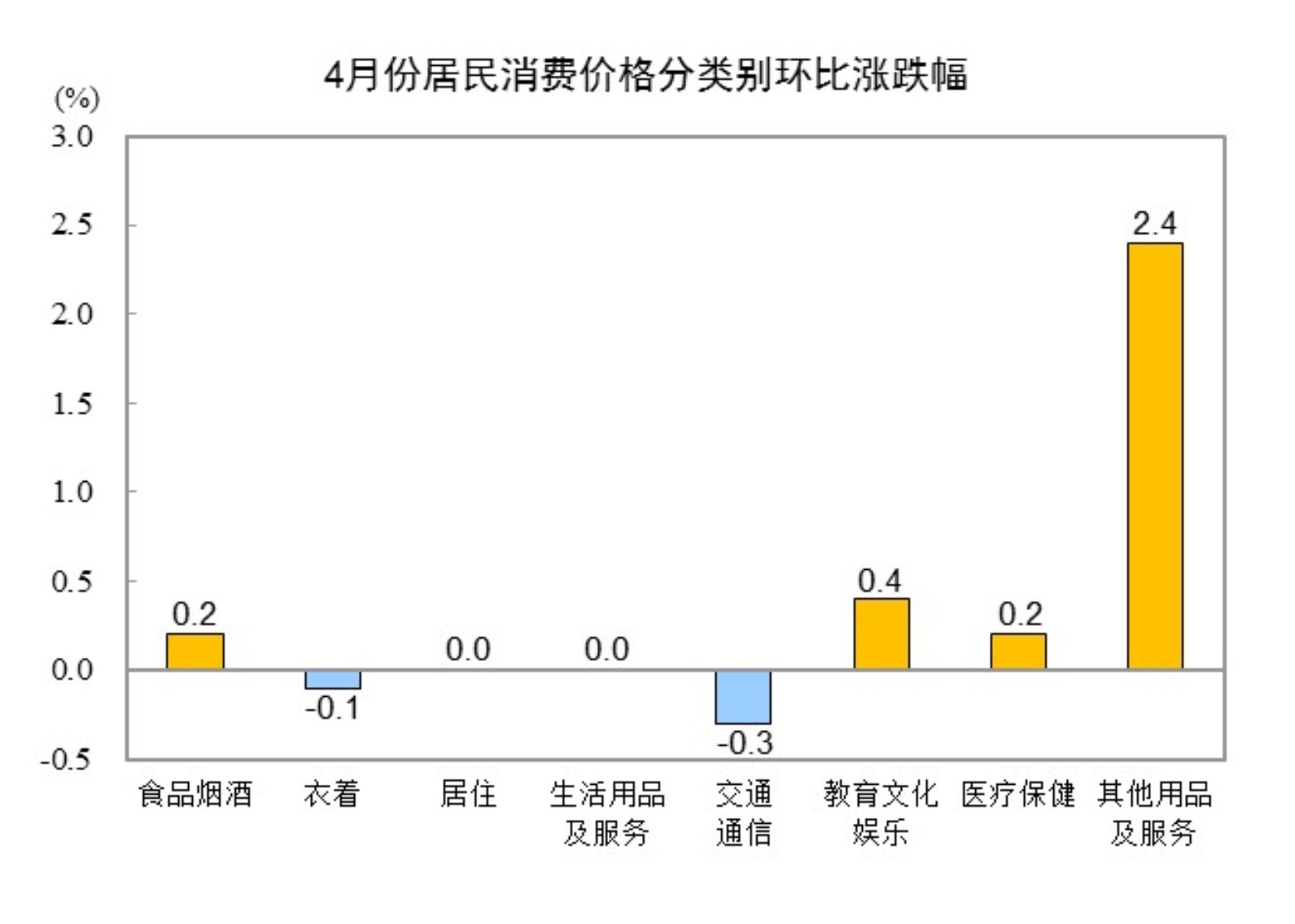

II. Month-on-Month (MoM) Changes in Prices of Various Goods and Services

In April, prices for food, tobacco, and liquor increased by 0.2% MoM, contributing approximately 0.05 percentage points to the rise in the Consumer Price Index (CPI). Among food items, fresh fruit prices rose by 2.2%, contributing approximately 0.05 percentage points to the CPI increase; aquatic product prices increased by 1.2%, contributing approximately 0.02 percentage points; fresh vegetable prices fell by 1.8%, contributing approximately 0.04 percentage points to the CPI decrease; pork prices dropped by 1.6%, contributing approximately 0.02 percentage points; and egg prices decreased by 1.0%, contributing approximately 0.01 percentage points to the CPI decrease.

Among the other seven major categories, prices increased for three, remained flat for two, and decreased for two on a MoM basis. Specifically, prices for other goods and services, education, culture, and recreation, and healthcare rose by 2.4%, 0.4%, and 0.2%, respectively. Prices for housing and household goods and services remained unchanged, while prices for transportation and communication and clothing fell by 0.3% and 0.1%, respectively.

Key Data on Resident Consumption Prices in April 2025

CPI Rebounds MoM in April 2025, While Core CPI Growth Remains Stable

—Interpretation of CPI and PPI Data for April 2025 by Dong Lijuan, Chief Statistician of the Urban Department, National Bureau of Statistics (NBS)

In April, the Consumer Price Index (CPI) rebounded MoM, rising by 0.1% after a 0.4% decrease in the previous month, and fell by 0.1% YoY, the same rate of decline as the previous month. Core CPI rebounded MoM, rising by 0.2% after remaining flat in the previous month, and increased by 0.5% YoY, maintaining stable growth. The Producer Price Index (PPI) for industrial products fell by 0.4% MoM, the same rate of decline as the previous month, and decreased by 2.7% YoY, with the rate of decline expanding by 0.2 percentage points from the previous month. Despite the downward pressure on prices in some industries due to international input factors, China's economic fundamentals remain stable and resilient. With the coordinated implementation of various macro policies and steady progress in high-quality development, prices in some areas have shown positive changes.

I. CPI Rebounds MoM, Falls Slightly YoY, While Core CPI Growth Remains Stable

On a MoM basis, the CPI rebounded, with the rate of increase exceeding the seasonal level by 0.2 percentage points, mainly driven by the rebound in food and travel service prices. Food prices increased by 0.2% MoM, exceeding the seasonal level by 1.4 percentage points.Specifically, beef prices rose by 3.9% due to factors such as a decrease in imports. As some regions entered the marine fishing moratorium period, the prices of marine fish increased by 2.6%. During the initial period of new fruit availability, the seasonal supply of potatoes and fresh fruits decreased, leading to price increases of 4.7% and 2.2%, respectively. The prices of fresh vegetables and pork fell by 1.8% and 1.6%, respectively, with the declines being smaller than seasonal trends. Influenced by the combined effects of recovering demand and holiday factors, the prices of travel services rebounded significantly. Airline tickets, vehicle rental fees, hotel accommodation, and tourism prices rose by 13.5%, 7.3%, 4.5%, and 3.1%, respectively, with all increases exceeding seasonal levels, jointly contributing to an approximate 0.10 percentage point increase in the CPI MoM. Due to changes in international gold prices, the prices of domestic gold jewelry increased by 10.1%, contributing to an approximate 0.06 percentage point increase in the CPI MoM.

On a YoY basis, the CPI declined slightly, primarily influenced by the downward trend in international oil prices. Energy prices fell by 4.8% YoY, with the decline widening by 2.2 percentage points from the previous month. Among them, gasoline prices dropped by 10.4%, contributing to an approximate 0.38 percentage point decrease in the CPI YoY, which was the main factor driving the YoY decline in the CPI. Food prices decreased by 0.2%, with the decline narrowing by 1.2 percentage points from the previous month, contributing to an approximate 0.03 percentage point decrease in the CPI. The core CPI, excluding food and energy prices, rose by 0.5%, with the increase remaining stable. Among them, service prices increased by 0.3%, with the increase remaining the same as the previous month. Within services, the prices of domestic services, elderly care services, and education services rose by 2.5%, 1.4%, and 1.2%, respectively, with the increases generally stable. The prices of industrial consumer goods excluding energy rose by 0.4%, contributing to an approximate 0.10 percentage point increase in the CPI YoY. Among them, the prices of gold jewelry increased by 35.8%, with the increase slightly widening from the previous month; the prices of clothing and communication tools increased by 1.5% and 1.0%, respectively, with the increases remaining basically stable; the prices of gasoline-powered passenger cars and new energy passenger cars decreased by 4.6% and 3.4%, respectively, with the declines narrowing.

II. The MoM decline in PPI remained the same as the previous month, with prices in some industrial sectors continuing to show a stable and improving trend.

PPI fell by 0.4% MoM, with the decline remaining the same as the previous month. The main reasons for the decline in PPI this month are as follows: Firstly, international imported factors influenced the downward trend in prices of related domestic industries. Changes in the international trade environment led to a rapid decline in the prices of some international commodities, affecting the price declines in related domestic industries. Among them, the decline in international crude oil prices influenced the MoM decline in prices of domestic petroleum-related industries, with the prices of the oil and natural gas extraction industry falling by 3.1%, the prices of refined petroleum product manufacturing falling by 2.5%, and the prices of the chemical raw materials and chemical products manufacturing industry falling by 0.6%; the decline in international prices of non-ferrous metals such as aluminum, zinc, and copper influenced the respective declines of 2.4%, 1.6%, and 0.8% in the prices of domestic aluminum smelting, zinc smelting, and copper smelting.Prices in some export-oriented industries declined on a MoM basis. The automobile manufacturing industry saw a 0.5% decrease, while the computer, communication, and other electronic equipment manufacturing industry, furniture manufacturing industry, and fabricated metal product industry each experienced a 0.2% decline. Collectively, these 10 industries contributed to an approximate 0.24 percentage point MoM decrease in the Producer Price Index (PPI). Second, domestic energy prices declined seasonally. With the complete conclusion of the northern heating season, coal demand entered the traditional off-season, leading to a 3.3% MoM decrease in both coal mining and washing industry and coal processing prices. The low cost and strong substitution effect of new energy power generation, coupled with increased wind power output, resulted in a 0.3% MoM decrease in prices in the electricity, heat production, and supply industry. Collectively, these three industries contributed to an approximate 0.10 percentage point MoM decrease in PPI.

China has intensified and expanded its macro policies, such as promoting consumption, to accelerate the growth of high-tech industries. As a result, demand in some industries has increased, and prices in certain areas have shown positive changes. First, the supply-demand relationship in some industries has improved, with narrowing price declines. Steady progress in infrastructure construction projects across the country and good implementation of staggered production schedules by cement enterprises have led to a narrowing of the YoY decline in prices in the ferrous metal smelting and rolling processing industry and non-metallic mineral products industry by 1.4 and 1.0 percentage points, respectively, compared to the previous month. Policies promoting consumption and equipment renewal continue to take effect, with the release of demand for some consumer goods and equipment manufacturing products driving price rebounds in related industries. The YoY decline in household washing machine prices narrowed by 0.3 percentage points compared to the previous month, while the YoY decline in food manufacturing and passenger NEV prices both narrowed by 0.2 percentage points. The YoY decline in prices for special equipment manufacturing for electrical machinery narrowed by 0.7 percentage points, and the YoY decline in prices for special equipment manufacturing for agriculture, forestry, animal husbandry, and fisheries, as well as metal processing machinery manufacturing, both narrowed by 0.2 percentage points. Second, the development of high-tech industries has driven price increases in related industries. The continuous cultivation and growth of new quality productive forces, along with the deep integration of technological innovation and industrial innovation, have led to YoY price increases in related industries driven by the development of industries such as intelligent manufacturing and high-end equipment manufacturing. The price of wearable smart device manufacturing increased by 3.0%, aircraft manufacturing by 1.3%, micro and special motor and component manufacturing by 1.2%, server manufacturing by 1.0%, and ship and related equipment manufacturing by 0.8%. In addition, China has continued to promote trade diversification, and market expansion has driven YoY price increases or narrowing price declines in some export-oriented industries. The prices of integrated circuit packaging and testing series increased by 2.7%, and the prices of special equipment manufacturing for semiconductor devices increased by 1.0%. The price declines in the tractor manufacturing, electronic device manufacturing, and textile, clothing, and apparel industries narrowed by 1.2, 0.7, and 0.3 percentage points, respectively, compared to the previous month.