Fed Chairman Jerome Powell downplayed expectations on Wednesday that the US Fed might cut interest rates to cushion the economic impact of President Trump's tariff policies.

According to Nick Timiraos, a renowned journalist dubbed the "new Fed Wire," an interesting detail emerged during the post-meeting press conference: Powell used variations of the word "wait" (such as "waiting," "await") 22 times to emphasize that the US Fed would not rush into action.

This undoubtedly sparked significant attention after the meeting.As Powell put it, "We think the cost of waiting and seeing more is quite low, so that's what we're doing."

In response, Timiraos pointed out that the US Fed's cautious stance on preemptive interest rate cuts actually underscores how Trump's erratic trade policies have led to significant monetary policy divergence among developed economies like the US and Europe.

What exactly is Powell afraid of amid the global wave of interest rate cuts?

Timiraos believes the reason for this divergence is clear:

Other economies have not yet imposed large-scale tariff hikes on imported goods. Therefore, these economies are more affected by weak demand and a cooling labour market, without needing to worry as much as the US Fed about potential upward pressure on prices later this year.

Moreover, as the US economy has just gone through a difficult period of high inflation, many Fed officials also believe they should not risk preemptive interest rate cuts to boost slowing employment, lest it exacerbate upward pressure on prices in the short term.

This situation stands in stark contrast to the trade war during Trump's first term in 2019, when the US Fed cut interest rates three times to support the economy amid deteriorating sentiment following Trump's trade war with China.

Powell also said on Wednesday, "In this case, we cannot act preemptively because, before we see more data, we cannot actually determine the correct response to economic data."

This stance has placed the US Fed on a starkly different policy trajectory from central banks in Europe, Canada, and the UK.

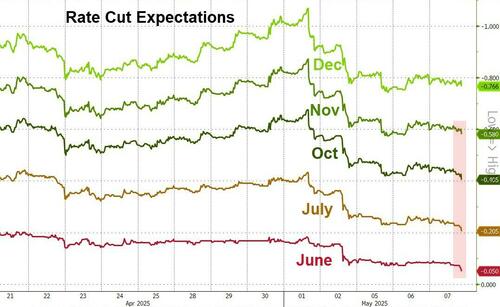

(Expectations for US Fed interest rate cuts decline across the board after Wednesday's meeting)

The US Fed is moving slower than other economies

Looking back over the past year,in the second half of 2024, the US Fed lowered the target range for the federal funds rate by a cumulative 100 basis points due to declining inflation and rising unemployment. However, since the beginning of this year, the US Fed has maintained interest rates unchanged at 4.25%-4.5%.

Meanwhile, the European Central Bank (ECB) has cut its benchmark interest rate seven times over the past year, with cumulative interest rate cuts totaling 175 basis points. Last month, it lowered the deposit facility rate to 2.25%.

The Bank of England (BoE) is also rapidly catching up with the US Fed in terms of interest rate cuts. Investors and economists expect the BoE to cut its benchmark interest rate (currently at 4.5%) by at least 25 basis points on Thursday. Since last summer, the BoE has already cut interest rates three times.

Neil Dutta, head of economic research at Renaissance Macro Research, said, "The European economy has a relatively weak foundation, so they have more room (to cut interest rates) to focus on growth issues."

Interestingly, on the eve of the ECB's interest rate cut last month, Trump publicly criticized Powell for being slow to act and suggested that the US Fed should follow the ECB's lead.

However, there is not much rationale for this. Dutta pointed out thatTrump's dissatisfaction with the divergence in monetary policies between Europe and the US indicates that no one has apparently explained to him the different impacts of tariffs on the US and Europe—the ECB does not need to worry as much as the US Fed about the inflationary consequences of tariffs. The US Fed, however, does need to be concerned.

These concerns are largely triggered by Trump's tariff policies. Some US Fed officials have recently emphasized that they are worried that cutting interest rates before the economy weakens could amplify price pressures in the short term.

In the future, the policy divergence between the US and Europe will further widen.

Currently, economists at JPMorgan Chase have adjusted their forecast for the US Fed's first interest rate cut to September.

Goldman Sachs, on the other hand, expects the US Fed to start cutting interest rates only in July, with three cuts throughout the year.

This is likely to further widen the interest rate differential between the US and Europe at least in the coming months.In Europe, Goldman Sachs expects the ECB to continue cutting interest rates by 25 basis points until September, when its benchmark interest rate will fall to 1.5%.

In fact, the current difference in inflation between the US and Europe is not significant—the inflation rate in the eurozone was 2.2% in April, while in the US it was 2.3% in March. Both the ECB and the US Fed have an inflation target of 2%.

However, their future inflation trajectories are likely to diverge sharply.

Jan Hatzius, chief economist at Goldman Sachs, said that the ECB may cut interest rates more than the bank expects, as US tariffs on China could lead to a further increase in China's exports to Europe, potentially reducing Europe's core inflation rate by 0.5 percentage point.

"This is a pretty big number, as it represents the gap between slightly above 2% and slightly below 2%," he said. If inflation in Europe ultimately falls below 2%, then "you can convince many of the hawks at the European Central Bank... to {{cut interest rate}} further."