SMM Alumina Morning Comment on May 7

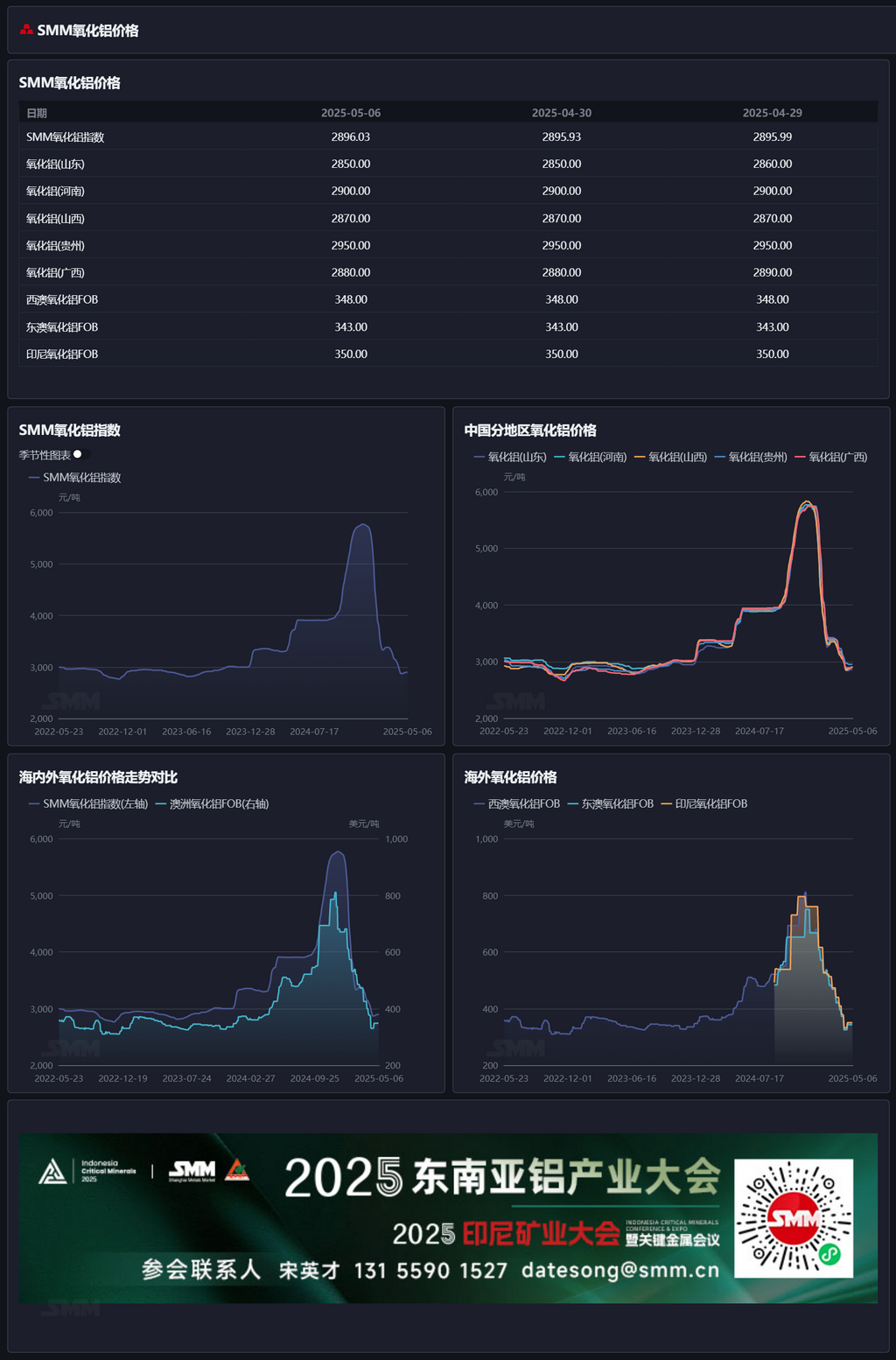

Futures Market: Overnight, the most-traded ag2509 futures contract opened at 2,686 yuan/mt, with a high of 2,723 yuan/mt, a low of 2,683 yuan/mt, and closed at 2,715 yuan/mt, up 23 yuan/mt or 0.84%, with an open interest of 290,000 lots.

Ore: As of May 6, the SMM Import Bauxite Index was reported at $78.56/mt, unchanged from the previous trading day; the SMM Guinea Bauxite CIF average price was reported at $77/mt, unchanged from the previous trading day; the SMM Australia Low-Temperature Bauxite CIF average price was reported at $80/mt, unchanged from the previous trading day; and the SMM Australia High-Temperature Bauxite CIF average price was reported at $72/mt, unchanged from the previous trading day.

Industry News:

- Overseas Alumina Transactions: On April 30, 30,000 mt of alumina was traded overseas at a transaction price of $348/mt FOB Western Australia, with a shipment schedule in late May.

- Caustic Soda Procurement Prices of Major Alumina Refineries in Henan Province in May: SMM learned that the long-term contract procurement price of 32% ionic membrane liquid caustic soda for major alumina refineries in Henan Province in May remained unchanged from April, with a delivery-to-factory price of 2,940-3,090 yuan/mt (converted to 100% concentration).

- Long-Term Contract Procurement Prices of Liquid Caustic Soda for Major Alumina Refineries in Shanxi Province in May: The procurement price of caustic soda for major alumina refineries in Shanxi Province in May remained unchanged from April, with a delivery-to-factory price of approximately 2,840-2,940 yuan/mt (converted to 100% concentration) for 50% ionic membrane liquid caustic soda, with slight price variations in some regions due to different transportation distances.

- Long-Term Contract Procurement Prices of Liquid Caustic Soda for Major Alumina Refineries in Guangxi Province in May: According to SMM, the procurement price of caustic soda for major alumina refineries in Guangxi Province in May remained unchanged from April, with a delivery-to-factory price of approximately 3,600 yuan/mt (converted to 100% concentration) for 50% ionic membrane liquid caustic soda, with slight price variations in some regions due to different transportation distances.

Basis Report: According to SMM data, on May 6, the SMM Alumina Index had a premium of 204 yuan/mt against the latest transaction price of the most-traded contract at 11:30.

Warrant Report: On May 6, the total registered volume of alumina warrants decreased by 11,419 mt from the previous trading day to 260,000 mt. The total registered volume of alumina warrants in the Shandong region remained unchanged from the previous trading day at 601 mt. The total registered volume of alumina warrants in the Henan region decreased by 300 mt from the previous trading day to 4,201 mt. The total registered volume of alumina warrants in the Guangxi region decreased by 6,004 mt from the previous trading day to 30,600 mt. The total registered volume of alumina warrants in the Gansu region remained unchanged from the previous trading day at 18,000 mt. The total registered volume of alumina warrants in the Xinjiang region decreased by 5,115 mt from the previous trading day to 206,600 mt.

Overseas Market: As of May 6, 2025, the FOB Western Australia alumina price was $348/mt, with an ocean freight rate of $20.50/mt. The USD/CNY exchange rate selling price was around 7.23. This price translates to an external selling price of approximately 3,091 yuan/mt at major domestic ports, which is 195 yuan/mt higher than the domestic alumina price. The alumina import window remained closed.

Summary: With the commissioning of new capacity and the resumption of production from maintenance-related production cuts, the operating capacity of alumina has rebounded significantly. In the final week before the holiday, the weekly operating capacity increased by 3.48 million mt/year on a WoW basis. In the short term, some alumina refineries have plans for maintenance-related production cuts, but at the same time, new alumina capacity will further ramp up production, and the operating capacity of alumina may exhibit minor fluctuations. On the cost side, caustic soda prices have remained largely stable overall, while bauxite prices have decreased somewhat, leading to a pullback in alumina costs and alleviating the loss pressure on alumina refineries. In the futures market, with the downward shift in the cost line and a slight recovery in supply, the futures market has been in the doldrums recently, with some transactions occurring for warrant cargoes. The total registered volume of warrants decreased by 11,500 mt in a single day. Overall, the tightening of spot alumina supply caused by the concentration of maintenance-related production cuts in the earlier period is expected to ease, and short-term prices are expected to fluctuate.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make cautious decisions and should not rely on this as a substitute for independent judgment. Any decisions made by clients are unrelated to SMM.]

![2026 Arrangements for Secondary Aluminum Alloy Enterprises During Chinese New Year Break [SMM Analysis]](https://imgqn.smm.cn/production/admin/votes/imageskkgTu20240508153005.png)

![Costs Drag Down Supply-Demand Pressure, Aluminum Auxiliary Material Prices Under Pressure and Weaken [SMM Analysis]](https://imgqn.smm.cn/usercenter/NQyKF20251217171655.jpg)