Philippine Nickel Ore Prices Hold Steady, with Diverging Trends in Domestic and Indonesian Markets

This week, the FOB prices of Philippine nickel ore fell. The mainstream CIF transaction prices for NI1.3% nickel ore from the Philippines to China were in the range of $44-45/wmt, while those for NI1.5% nickel ore were in the range of $60-61/wmt. From the perspective of supply and demand, the rainy season in the main mining areas of the Philippines has ended, leading to a significant increase in shipments in April. The total number of vessels dispatched from the Philippines in April exceeded 110, indicating market expectations of an increase. On the demand side, the recent continuous decline in domestic NPI prices has resulted in poor acceptance of high-priced nickel ore by domestic smelters. From the inventory perspective, the raw material inventory of domestic NPI smelters remains low, and there is still a need for just-in-time restocking. In terms of ocean freight rates, they remained stable overall during the week, with rates from the Surigao region to Lianyungang, China, being approximately $10.5-11/wmt. Regarding the Philippines-Indonesia route, exports from the Philippines to Indonesia continue to increase. Indonesian nickel ore prices have generally held steady and strengthened during the month, providing some support to Philippine nickel ore prices. Therefore, it may be difficult for Philippine nickel ore FOB prices to experience a significant decline. Overall, SMM expects that Philippine nickel ore prices may temporarily hold steady in the near future, with the market awaiting further transaction developments.

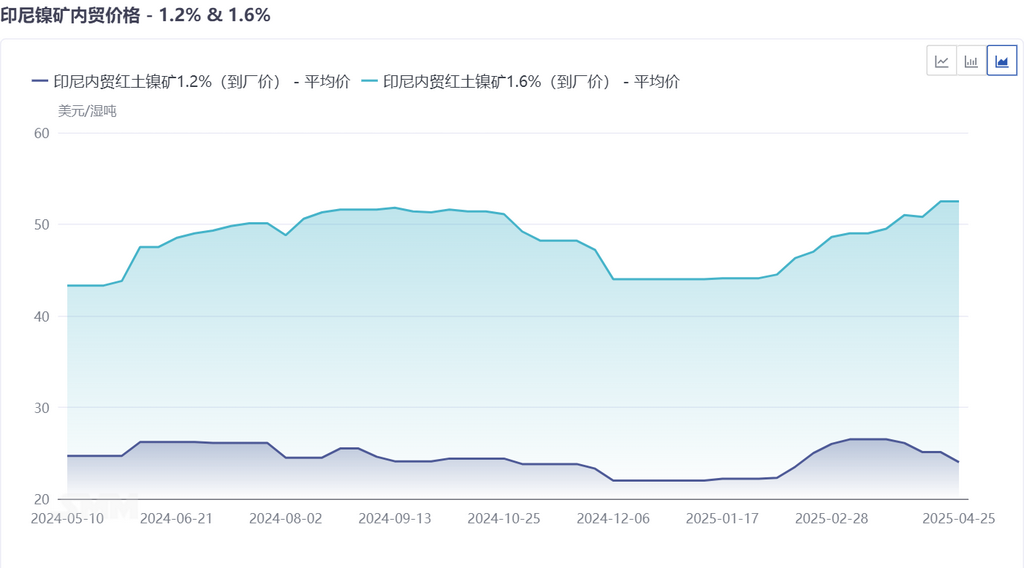

Indonesian Ore Pyrometallurgy Prices Rise Again, Leaving Downstream Enterprises in a Dilemma

Indonesian ore prices increased slightly this week. For pyrometallurgy ore, the mainstream premium for Indonesia's local ore in May fell within the range of $26-28/wmt. The delivery-to-factory price for SMM's 1.6% Indonesia's local ore was in the range of $52.6-54.6/wmt, representing a $1.1/wmt increase or a 2% rise compared to last week. For ore used for hydrometallurgy, there was a slight easing in market prices, with the delivery-to-factory price for SMM's 1.2% Indonesia's local ore being $23.5-24.5/wmt.

Pyrometallurgy ore: The nickel royalty under the PNBP policy has been increased and officially implemented since April 26, leading to a certain increase in the sales cost of nickel ore and a strong sentiment among mines to stand firm on quotes. From the supply and demand perspective, on the supply side, precipitation remained frequent on the Indonesian island of Sulawesi during the week, and the island of Halmahera will also enter the rainy season in May, with rainfall continuing to affect the supply of nickel ore. On the demand side, downstream NPI enterprises still have a need for just-in-time procurement. Additionally, the restocking of raw materials by smelters in Q1 was not smooth, and the tight supply situation of nickel ore continues. Under these circumstances, influenced by the decline in LME prices in April, the HPM price for 1.6% Indonesia's local ore in the first half of May decreased by $0.87/wmt compared to the second half of April, deviating from market prices. Therefore, the nickel ore premium was increased again. Overall, pyrometallurgy ore prices rose slightly again during the week, leaving downstream NPI enterprises in a dilemma.

Ore used for hydrometallurgy: On the supply side, the tight supply situation of ore used for hydrometallurgy was not evident during the week. On the demand side, the accident at the HPAL project in the Sulawesi (Sulawesi) industrial park affected the demand for ore used for hydrometallurgy by Indonesian HPAL smelters in April. Overall, ore used for hydrometallurgy prices are expected to be in the doldrums in the near future and may experience a slight decline.