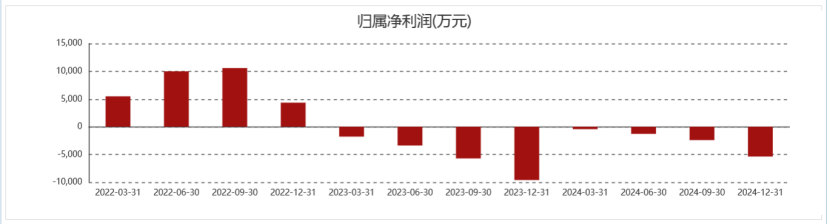

Jiuri New Materials narrowed its losses.

On the evening of April 18, Jiuri New Materials released its 2024 performance report, showing that the company achieved revenue of 1.488 billion yuan during the reporting period, up 20.52% YoY, and a net loss of 53.7608 million yuan, narrowing the loss by 44.08% YoY.

Regarding the narrowing of the net loss, Jiuri New Materials attributed it to two reasons: first, the sales of photoinitiators reached a record high of 23,100 mt, up 20.21% YoY, but due to the low unit price of photoinitiators and significant investment in the semiconductor industry, the net profit remained in the red, although the loss amount decreased significantly compared to the same period last year; second, the company adopted diversified marketing strategies to stabilize its existing market share and attract potential customers, thereby enhancing its overall competitiveness.

In April this year, the US imposed additional tariffs on China. As the global production of photoinitiators is concentrated in China, and several varieties are only produced in China, the US market remains somewhat dependent on Chinese photoinitiators in the short term.

Regarding the impact of US tariffs, Jiuri New Materials stated in its financial report that during the reporting period, the company's export value to the US accounted for about 8% of its total revenue, and most of its products were not subject to the US tariff hike, so the new US tariff policy would not have a significant impact on the company's business.

"In recent years, the international situation has become increasingly complex and volatile, and the uncertainty of trade policies has gradually increased. If there are significant adverse changes in the international economic and trade environment, it may bring some pressure to the company's product exports," Jiuri New Materials further stated.

Jiuri New Materials is mainly engaged in the R&D, production, and sales of photoinitiators, monomers, and other photocurable materials, as well as photoresists, photosensitizers, and other semiconductor chemical materials. Its products are applied in industries such as electrical/electronic coating, printed circuit board manufacturing, 3D printing, and semiconductors.

Jiuri New Materials' layout in the semiconductor photoresist field has become a focus of market attention.

On November 19 last year, Jiuri New Materials announced that the "Dajing New Materials Technology Group Co., Ltd. (hereinafter referred to as 'Dajing New Materials') annual production of 4,500 mt photoresist project," invested and constructed by its controlled subsidiary, has been completed, and the trial production plan has been approved by an expert panel, officially entering the trial production stage on November 19.

Jiuri New Materials stated that the project includes an annual production of 4,000 mt of panel photoresist and 500 mt of semiconductor photoresist, which will promote the industrialisation of its photoresist products and achieve large-scale production.

The Science and Technology Innovation Board Daily reporter noted that in 2024, in addition to the record-high sales of photoinitiators, the company's photoresist-specific photosensitizers and photoresists have achieved batch supply and generated revenue.

The company stated that it has successfully developed more than 30 photoresist formula products. During the reporting period, the company's photoresist revenue was 1.3424 million yuan, accounting for 0.09% of total revenue.

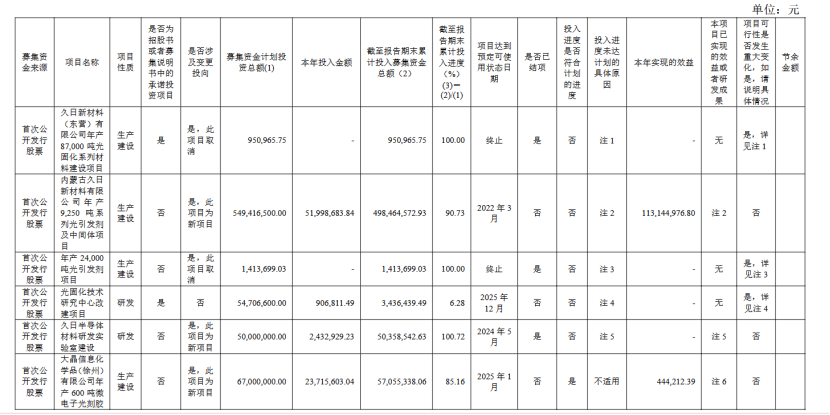

In terms of the progress of fundraising projects, Jiuri New Materials has experienced delays in the investment progress of several initial fundraising projects and changes in the direction of fundraising projects.

Among them, regarding the reasons for the delayed investment progress of the annual production of 4,500 mt photoresist project by its subsidiary Dajing New Materials, Jiuri New Materials stated that to meet the domestic market demand for photoresist products and ensure product quality, the company re-evaluated the project design and adjusted some construction contents, resulting in delayed delivery.