View SMM spot aluminum quotes, data, and market analysis

Order and view SMM historical metal spot price trends

SMM April 17th News:

Spring recovery! Despite the poor performance of aluminum billet processing fees in the month following the Chinese New Year holiday, influenced by high in-plant inventory, weak downstream demand, and aluminum prices fluctuating at highs, some aluminum billet enterprises in provinces like Guangxi signaled small-scale production cuts or impending reductions. However, with the deepening of the traditional peak season of "Golden March and Silver April," the destocking of aluminum billet in-plant and social inventories accelerated, coupled with the upward trend of aluminum billet processing fees after the pullback in aluminum prices, the small-scale production cuts in the domestic aluminum billet supply side were curbed. The willingness to operate among aluminum billet enterprises in most regions was significantly boosted. The primary aluminum billet industry as a whole ushered in a seasonal recovery.The daily average production of domestic primary aluminum billets increased by 3,000 mt MoM to around 48,000 mt/day in March.

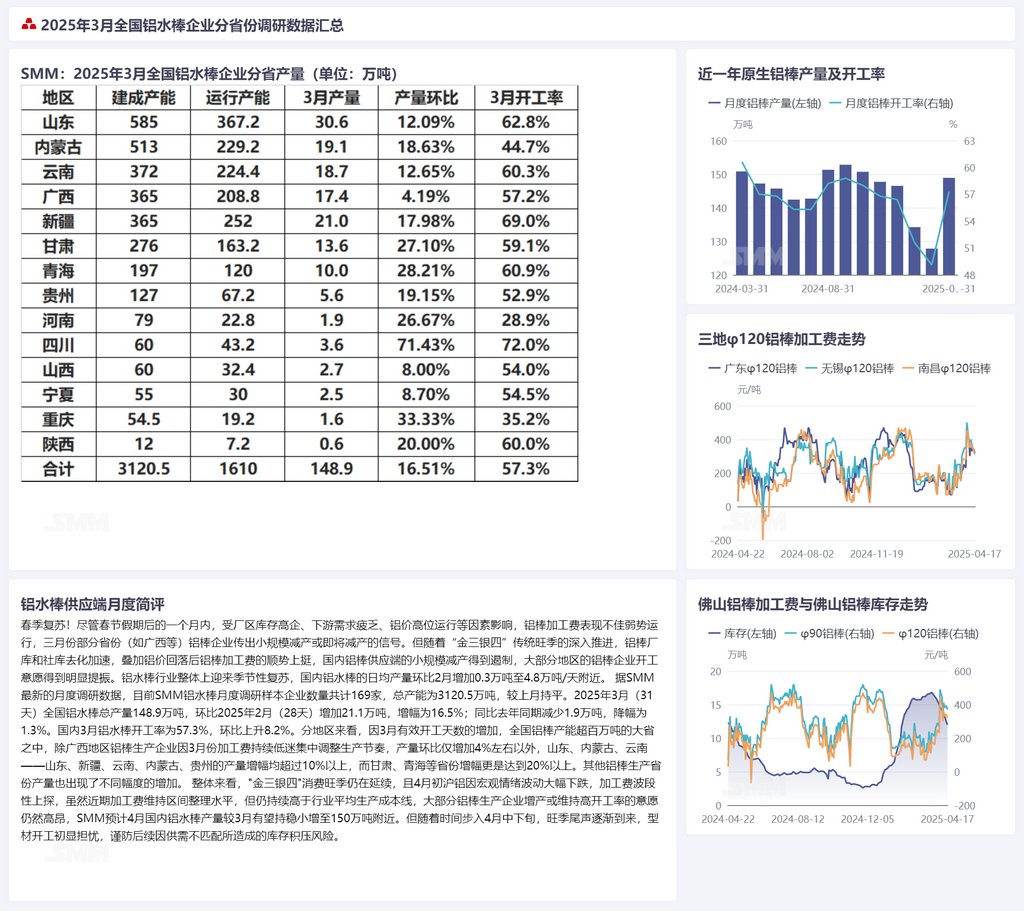

According to the latest monthly survey data from SMM, the number of enterprises in the SMM primary aluminum billet monthly survey sample totaled 169, with a total capacity of 31.205 million mt, flat MoM.In March 2025 (31 days), the total production of primary aluminum billets nationwide was 1.489 million mt, an increase of 211,000 mt MoM from February 2025 (28 days), up 16.5%; a decrease of 19,000 mt YoY, down 1.3%. The operating rate of domestic primary aluminum billets in March was 57.3%, up 8.2% MoM.By region, due to the increase in effective working days in March, among the provinces with aluminum billet capacity exceeding 1 million mt, except for Guangxi, where aluminum billet producers adjusted their production pace due to persistently low processing fees in March, resulting in only a 4% MoM increase in production, the production increases in Shandong, Inner Mongolia, Yunnan, Xinjiang, Guizhou, and other provinces exceeded 10%, with Gansu and Qinghai seeing increases of over 20%. Other aluminum billet-producing provinces also experienced varying degrees of production increases.

Overall, the "Golden March and Silver April" consumption peak season continues, and with SHFE aluminum prices experiencing a significant drop due to macro sentiment fluctuations in early April, processing fees have periodically risen. Although recent processing fees have maintained a range-bound consolidation level, they remain consistently above the industry's average production cost line. Most aluminum billet producers still have a strong willingness to increase production or maintain high operating rates.SMM expects domestic primary aluminum billet production in April to remain stable with a slight increase to around 1.5 million mt compared to March.However, as time progresses into mid-to-late April, the end of the peak season gradually approaches, and concerns about extrusion operating rates begin to emerge, cautioning against the risk of inventory accumulation due to supply-demand mismatches.

Data source: SMM Click on the SMM industry database for more information