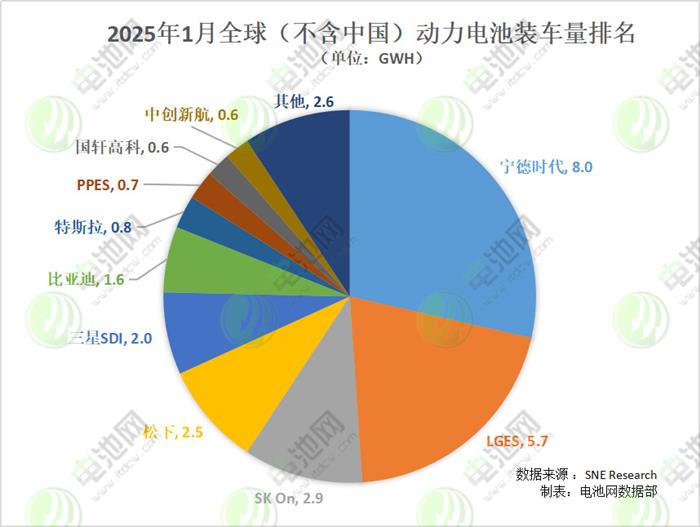

South Korean research institute SNE Research released data on global (excluding China) power battery installations for January 2025, reaching 28GWh, up 26.5% YoY. Among the TOP10 companies in January 2025, LGES, Panasonic , and Samsung SDI all experienced a YoY decline in market share.

Recently, South Korean research institute SNE Research released data on global (excluding China) power battery installations for January 2025, reaching 28GWh, up 26.5% YoY.

In terms of market share, among the TOP10 companies in January 2025, LGES, Panasonic, and Samsung SDI all experienced a YoY decline.

Regarding ranking changes, in January 2025, among the TOP10 companies, the top 7 positions and the 10th position remained consistent with 2024 rankings. PPES saw fluctuations in its ranking, settling at 8th place this month, while the 9th position was claimed by Chinese company Gotion High-tech. Notably, this marks the first time Gotion High-tech entered the TOP10 for overseas power battery installations.

In terms of YoY changes in installations, in January 2025, among the TOP10 companies, Panasonic ended a year-long YoY decline with a slight increase of 0.3%. In contrast, Samsung SDI saw a significant YoY drop in overseas power battery installations.

Apart from the YoY changes of Panasonic and Samsung SDI, Tesla, after entering the TOP10 for overseas power battery installations from January to August 2024, continued its rapid growth. Following a YoY increase of 7,900% in 2024, its YoY growth in January remained strong at 918.4%. Additionally, CALB achieved a doubling of installations in January.

For Chinese companies, CATL, BYD, Gotion High-tech, and CALB collectively recorded 10.8GWh in overseas power battery installations, with their market share rising to 38.6%, surpassing the three major South Korean companies for the first time.

Specifically, in 2024, CATL surpassed LGES for the first time to become the global (excluding China) leader in market share for power batteries. In January 2025, it maintained its top position with a market share of 28.5%, recording installations of 8GWh, up 40.4% YoY.

BYD recorded installations of 1.6GWh, up 28.9% YoY, with a market share of 5.8%, maintaining its 6th position.

Gotion High-tech achieved installations of 0.6GWh, with a market share of 2.2%, up 66.5% YoY, making a strong debut in the TOP10 for overseas power battery installations, ranking 9th.

CALB recorded overseas installations of 0.6GWh in January, up 105.4% YoY, with a market share of 2.1%, ranking 10th.

For South Korean companies, in January 2025, the three major South Korean battery companies held a market share of 37.9%, down 5.6% compared to the full-year 2024 figure of 43.5%, with total installations of 10.6GWh.

In January, LGES, SK On, and Samsung SDI ranked second, third, and fifth, respectively, in terms of installations.

Specifically, LGES recorded installations of 5.7GWh, up 14.8% YoY, with its market share dropping to 20.5%.

SK On recorded installations of 2.9GWh, up 35.1% YoY, achieving the highest growth rate among South Korean battery companies, with a market share of 10.4%.

Samsung SDI recorded installations of 2GWh, down 23.5% YoY, with its market share also dropping to 7%. SNE stated that the decline in Samsung SDI's installations was mainly due to reduced battery demand from automakers in the European and North American markets. However, on March 14, South Korean battery manufacturer Samsung SDI announced plans to raise 2 trillion won (approximately 9.96 billion yuan) through a new share issuance to invest in factories in the US and Europe as well as new technologies.

For Japanese companies, after being pushed out of the global third position by SK On in 2024, Panasonic, despite achieving positive YoY growth in January 2025, remained in fourth place with installations of 2.5GWh and a market share of 8.8%.

The Toyota-Panasonic joint venture battery company PPES saw its ranking rise again in January 2025, moving up to 8th place with installations of 0.7GWh, no YoY change, and a market share of 2.4%.

For US companies, Tesla, after entering the rankings in 2024, continued to climb, ranking 7th in January 2025 with installations of 0.8GWh. Its market share rose from 2.2% in 2024 to 3%.

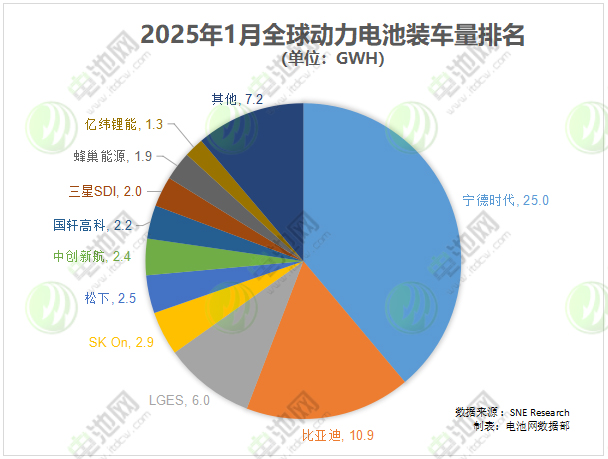

Additionally, SNE Research recently released data on global power battery installations for January 2025, including the Chinese market. The data showed that in January, global power battery installations reached 64.3GWh, up 25.7% YoY.

In terms of market share, among the TOP10 companies for global power battery installations in January 2025, Gotion High-tech, SVOLT Energy Technology, BYD, and SK On achieved YoY growth, while CALB, CATL, Samsung SDI, LGES, and Panasonic experienced YoY declines, and EVE remained unchanged.

Regarding ranking changes, compared to January 2024, in January 2025, the competitive landscape among the TOP3 companies remained relatively stable, with CATL, BYD, and LGES maintaining their rankings. The second and third tiers saw significant changes, with SK On rising from 6th to 4th place; Panasonic dropping from 4th to 5th; CALB climbing from 7th to 6th; Gotion High-tech moving up from 8th to 7th; Samsung SDI falling from 5th to 8th; and SVOLT Energy Technology and EVE maintaining their positions at 9th and 10th, respectively.