1. According to the SMM survey, coke profit per mt was 41.4 yuan/mt this week, with coke producers' profits shrinking.

From a pricing perspective, coke prices underwent the eighth round of price cuts this week, with a reduction of 50-55 yuan/mt, negatively impacting coke producers' profit per mt. From a cost perspective, after the Chinese New Year, coal mines resumed production, gradually restoring coking coal supply. Coking coal prices declined, reducing coking costs and improving coke producers' profitability.

Next week, coke prices are expected to see a ninth round of price cuts, but coking coal prices are also under pressure. Prices and costs may decline simultaneously, with coke producers' profit per mt fluctuating rangebound.

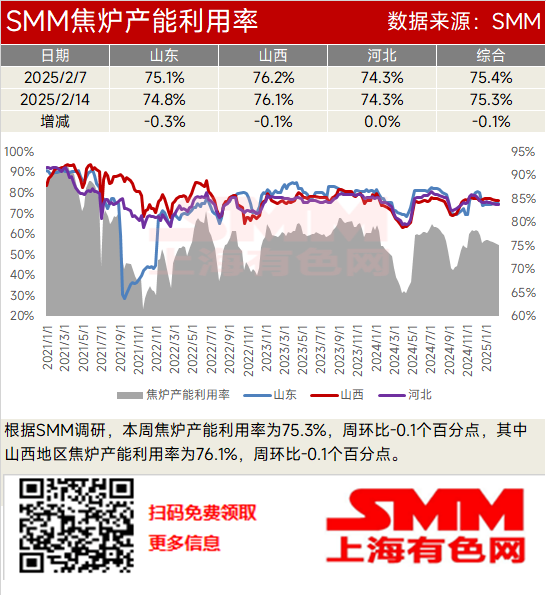

2. According to the SMM survey, the coke oven capacity utilization rate was 75.3% this week, down 0.1 percentage points WoW. In Shanxi, the coke oven capacity utilization rate was 76.1%, also down 0.1 percentage points WoW.

From a profitability perspective, most coke producers' profits remained at the break-even level, with minimal impact on production. From an inventory perspective, after the Chinese New Year, coke producers faced sluggish shipments. Coupled with maintaining normal production, coke producers continued to accumulate inventory on top of already high levels, dampening production enthusiasm. From an environmental protection perspective, environmental protection policies in Shanxi, Hebei, and Shandong did not tighten, with no significant impact on coke production.

Subsequently, most coke producers face relatively low risks of losses, and even if losses occur, they remain within tolerable limits for most producers. A small number of coke producers may reduce production, keeping coke supply loose. However, steel mills hold a pessimistic market outlook and maintain coke inventory at safe levels, continuing to purchase as needed. In summary, the coke oven capacity utilization rate of coke producers is expected to decline slightly next week.

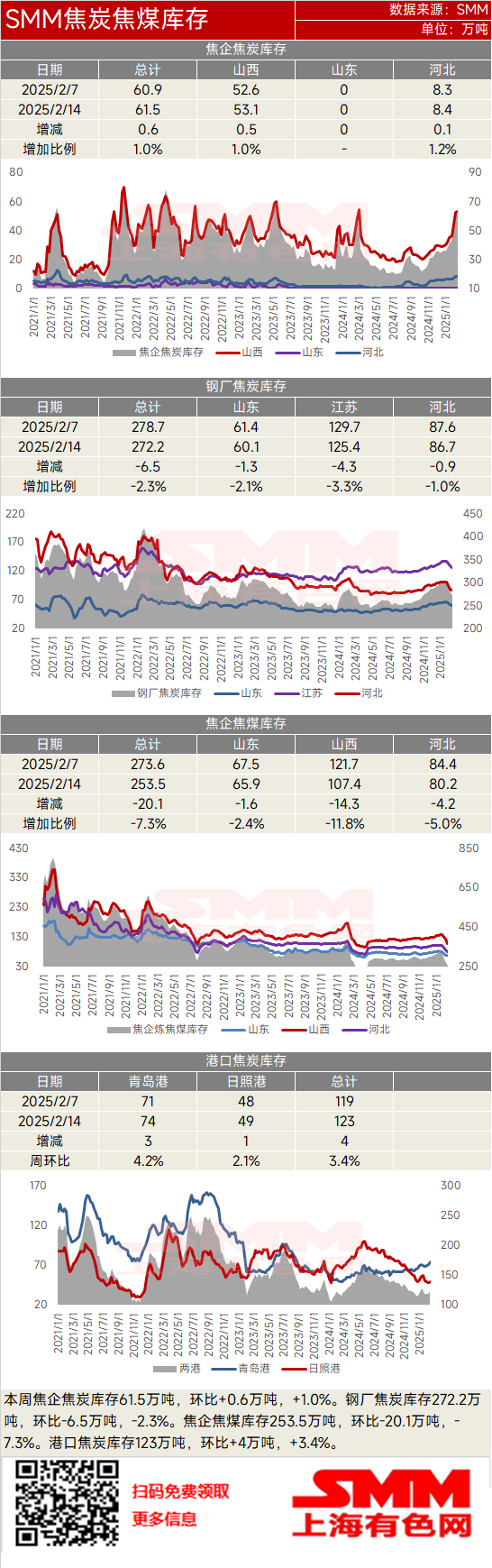

3. This week, coke producers' coke inventory stood at 615,000 mt, up 6,000 mt (+1.0%) WoW. Steel mills' coke inventory was 2.722 million mt, down 65,000 mt (-2.3%) WoW. Coke producers' coking coal inventory was 2.535 million mt, down 201,000 mt (-7.3%) WoW. Port coke inventory was 1.23 million mt, up 40,000 mt (+3.4%) WoW.

This week, coke producers' coke inventory remained at high levels, while steel mills' coke inventory saw a slight decline. Most coke producers' profits stayed at the break-even level, with production conditions barely stable. However, downstream end-users showed moderate purchasing enthusiasm, keeping coke producers' coke inventory fluctuating at high levels. Steel mills continued to consume their own inventory this week, and with steel prices declining, they maintained a willingness to push for price cuts, suppressing restocking demand and slightly reducing coke inventory.

Subsequently, most coke producers are expected to maintain profitability, and even if losses occur, they remain within tolerable limits. Overall production conditions are stable, but due to high inventory levels and sluggish shipments, some coke producers may slightly reduce production. However, steel mills hold a pessimistic outlook for the end-use market and maintain coke inventory at safe levels. Restocking demand next week is expected to remain moderate, with purchasing as needed. Therefore, coke producers are expected to shift to inventory reduction next week, while steel mills' coke inventory may fluctuate rangebound.

This week, coke producers' coking coal inventory continued to decline, mainly due to the gradual resumption of coal mine production, easing coking coal supply, and the slow decline in coking coal prices. Additionally, downstream coke producers and steel mills maintained coking coal inventory at reasonable levels, with moderate restocking demand. As coal mines further resume production and market logistics normalize, coupled with some coke producers holding relatively low coking coal inventory and having restocking needs, coke producers' coking coal inventory is expected to stop declining and fluctuate rangebound next week.

This week, coke supply remained loose, and the market anticipates a ninth round of price cuts for coke. However, some traders hold expectations for policies from the Two Sessions and slightly restocked inventory. Port coke inventory is expected to increase slightly next week.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)