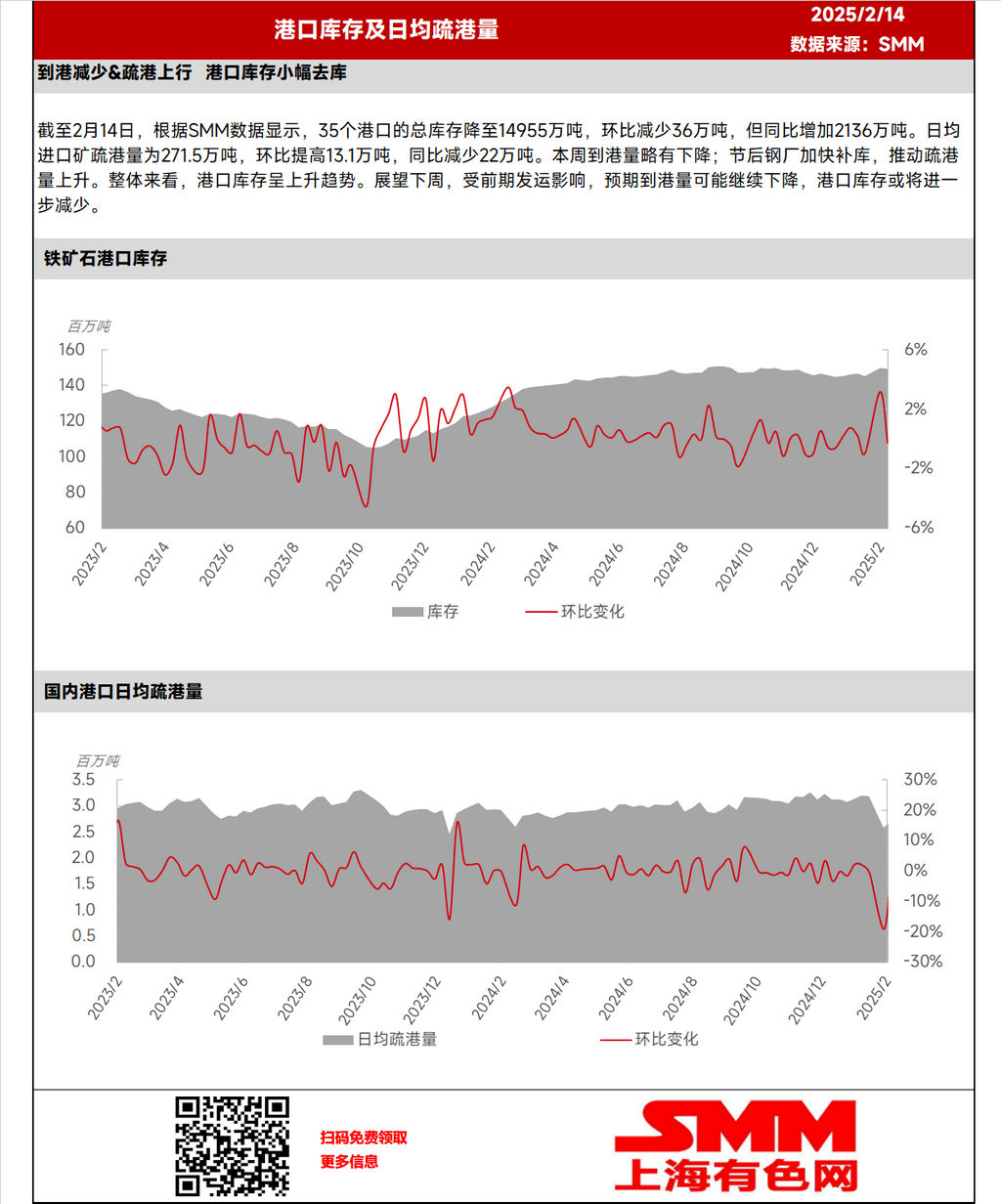

As of February 14, according to SMM data, total inventory at 35 ports fell to 149.55 million mt, down 360,000 mt WoW but up 21.36 million mt YoY. The daily port pick-up volume of imported ore averaged 2.715 million mt, up 131,000 mt WoW but down 220,000 mt YoY. Port arrivals slightly declined this week; post-holiday restocking by steel mills drove an increase in port pick-up volume. Overall, port inventory showed an upward trend. Looking ahead to next week, due to the impact of previous shipments, port arrivals are expected to decline further, and port inventory may decrease further.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)