SMM February 10 News:

The shift in supply-demand dynamics caused by tight supply at the mining end led to a generally strong performance in rare earth raw material prices in January. Among them, Pr-Nd oxide, dysprosium oxide, and terbium oxide rose by 4.27%, 3.42%, and 6.07%, respectively, in January, while their production volumes all declined MoM. Entering February, the tight supply situation at the mining end has not eased, and some market participants hold strong expectations for growth in rare earth end-use demand, resulting in a significant post-holiday price increase for rare earths.

Pr-Nd Oxide Rose 4.27% in January, with MoM Decline in Production

》Click to View SMM Rare Earth Spot Prices

》Subscribe to View Historical Trends of SMM Metal Spot Prices

Light Rare Earths: Taking the price trend of Pr-Nd oxide as an example, according to SMM quotations: the average price of Pr-Nd oxide was 415,000 yuan/mt on January 27, compared to 398,000 yuan/mt on December 31, 2024, with an increase of 17,000 yuan/mt in January, representing a monthly increase of 4.27%. Entering February, rare earth prices continued to rise, with the average price of Pr-Nd oxide reaching 438,500 yuan/mt on February 10.

Pr-Nd Oxide Production: In January 2025, domestic Pr-Nd oxide production further declined MoM. The main reductions were concentrated in Jiangsu, Sichuan, and Shandong provinces. According to the SMM survey, after entering January, some raw ore separation enterprises in certain regions experienced significant MoM declines in monthly production due to raw material shortages or year-end shutdowns for maintenance. Enterprises that reduced or halted production due to the holiday are expected to gradually resume normal operations after the Chinese New Year holiday in February.

Dysprosium Oxide Rose 3.42% in January, Terbium Oxide Rose 6.07%, with a Slight MoM Decline in Medium-Heavy Rare Earth Oxide Production

Medium-Heavy Rare Earth Prices: Taking the price trend of dysprosium oxide as an example, according to SMM quotations: the average price of dysprosium oxide was 1,665 yuan/kg on January 27, compared to 1,610 yuan/kg on December 31, 2024, with an increase of 55 yuan/kg in January, representing a monthly increase of 3.42%. Entering February, dysprosium oxide prices mostly rose, with the average price reaching 1,735 yuan/kg on February 10.

Taking the price trend of terbium oxide as an example, according to SMM quotations: the average price of terbium oxide was 5,940 yuan/kg on January 27, compared to 5,600 yuan/kg on December 31, 2024, with an increase of 340 yuan/kg in January, representing a monthly increase of 6.07%. Entering February, terbium oxide prices continued to rise, with the average price reaching 6,120 yuan/kg as of February 10.

》Click to View SMM Metal Industry Chain Database

Medium-Heavy Rare Earth Production: In January 2025, the production of medium-heavy rare earth oxides from raw ore separation plants saw a slight MoM decline, while production from scrap recycling enterprises increased to some extent. Overall, total production showed little change compared to December 2024. According to the SMM survey, the continued lack of recovery in Myanmar ore imports has led to a significant tightening of domestic ion-adsorption ore supply. After entering January, some raw ore separation enterprises even reduced or halted production due to the inability to procure ion-adsorption ore.

Outlook: Focus on the Growth in End-Use Demand for Consumer Electronics and Energy-Saving Home Appliances Driven by the Expansion of the "Program of Large-Scale Equipment Upgrades and Consumer Goods Trade-Ins" Policy

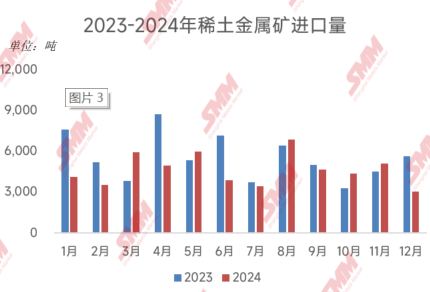

From import data, rare earth imports declined in 2024. According to customs data, China's rare earth metal ore import volume in December 2024 was 3,022.5 mt, down 46% YoY and 41% MoM. The total import volume for 2024 was 66,416 mt, down 16% YoY. It is understood that although border crossings in Myanmar resumed normal operations in December, the local requirement to impose an additional 20% resource tax significantly increased costs for miners, which they found unacceptable. As a result, Myanmar ore imports did not recover as expected by the end of December, leading to a decline in rare earth import data.

According to SMM, the supply situation of Myanmar ore has yet to stabilize, and the tight supply situation at the mining end has not eased. Coupled with strong market expectations for end-use demand growth driven by policy measures, rare earth prices have seen consecutive increases after the holiday. However, as Pr-Nd oxide approaches 440,000 yuan/mt, downstream "price resistance" sentiment has become apparent, with limited acceptance of high-priced materials. Caution is advised as some rare earth suppliers may sell products at lower prices to mitigate risks, potentially suppressing rare earth prices in the short term. Nevertheless, considering the ongoing tight supply of rare earth raw materials and optimistic market expectations for demand growth, the downside for rare earth prices may be limited. Future attention should focus on the implementation of rare earth quotas, rare earth imports from Laos and other countries, and the growth in end-use demand for consumer electronics and energy-saving home appliances driven by the expansion of the "Program of Large-Scale Equipment Upgrades and Consumer Goods Trade-Ins" policy.

For more information on rare earth fundamentals, policies, technologies, and end-use applications, please join the 2025 SMM (2nd) Rare Earth Industry Forum .