》View SMM Cobalt and Lithium Product Prices, Data, and Market Analysis

》Subscribe to View Historical Price Trends of SMM Cobalt and Lithium Spot Products

SMM January 27 News:

In 2024, diaphragm companies face significant challenges under the dual pressure of price wars and downstream customers driving down prices.

Price side, diaphragm material prices in 2024 continued to decline to a relatively low range. Against the backdrop of rapid development in the new energy industry, diaphragm companies in 2024 focused on launching new production lines and capacity ramp-up, achieving substantial capacity expansion. However, market demand growth failed to keep pace with capacity expansion, leading to a pronounced surplus issue. In this context, some companies proactively initiated price wars to compete for market orders, intensifying market competition and causing a sharp decline in diaphragm product prices, significantly reducing the profit margins of diaphragm companies. Particularly for dry-process diaphragms, the challenges in 2024 were especially severe. The 280Ah battery cell in the ESS sector was gradually replaced by the new-type 314Ah battery cell, and wet-process diaphragms were more suitable for the new-type cells. This further eroded the market share of dry-process diaphragms by wet-process diaphragms, driving product prices to historical lows.

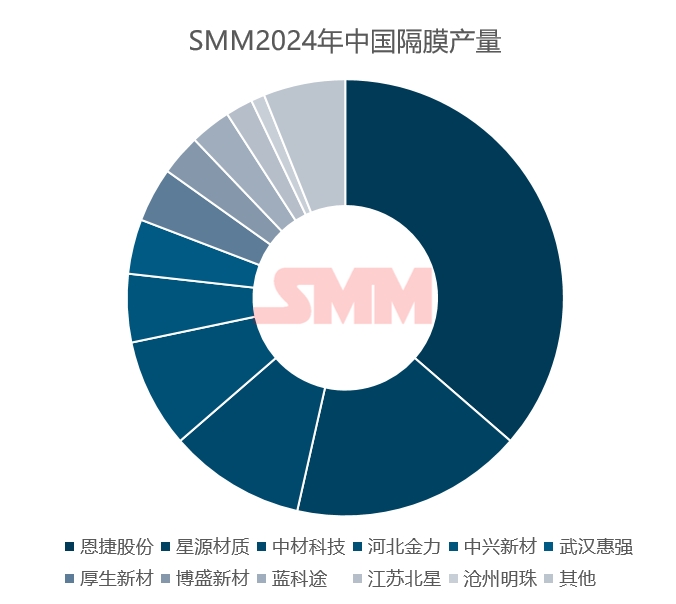

Production side, diaphragm production in 2024 significantly exceeded that of 2023. Among them, Enjie Co., Ltd. remained firmly in the leading position in the diaphragm material industry, with a market share of approximately 36%. Meanwhile, Shenzhen Senior Technology Material, Zhongcai Technology, Hebei Jinli, and Zhongxing New Material also ranked among the top five in the industry amid fierce market competition.

Looking ahead, production side, new capacity releases by 2025 are expected to help companies compete more actively for market share, driving further production growth. Price side, current dry-process diaphragm prices are at a relatively low range, close to the cost line, making further price reductions difficult. Dry-process diaphragm companies exhibit a strong sentiment to stand firm on quotes. For wet-process diaphragms, with the gradual release of new capacity in the future, the wet-process diaphragm market may still face an oversupply situation. Under such circumstances, wet-process diaphragm companies may initiate a new round of price wars to compete for market share, potentially leading to further declines in wet-process diaphragm material prices.

SMM New Energy Research Team

Cong Wang 021-51666838

Xiaodan Yu 021-20707870

Rui Ma 021-51595780

Ying Xu 021-51666707

Disheng Feng 021-51666714

Yujun Liu 021-20707895

Yanlin Lü 021-20707875

Ye Yuan 021-51595792

Chensi Lin 021-51666836

Zhicheng Zhou 021-51666711

Haohan Zhang 021-51666752

Zihan Wang 021-51666914

Xiaoxuan Ren 021-20707866

Yushuo Liang 021-20707892

Jie Wang 021-51595902

Yang Xu 021-51666760

Mengqi Xu 021-20707868