SMM, January 20:

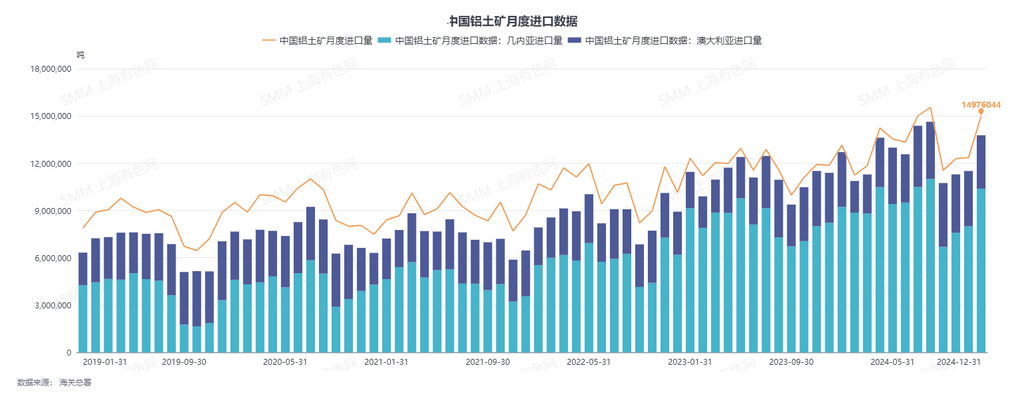

According to the General Administration of Customs of China, China imported 14.976 million mt of bauxite in December 2024, up 21.9% MoM and up 26.2% YoY. From January to December 2024, China’s cumulative bauxite imports reached 158.767 million mt, up 12.3% YoY.

(HS code: 26060000)

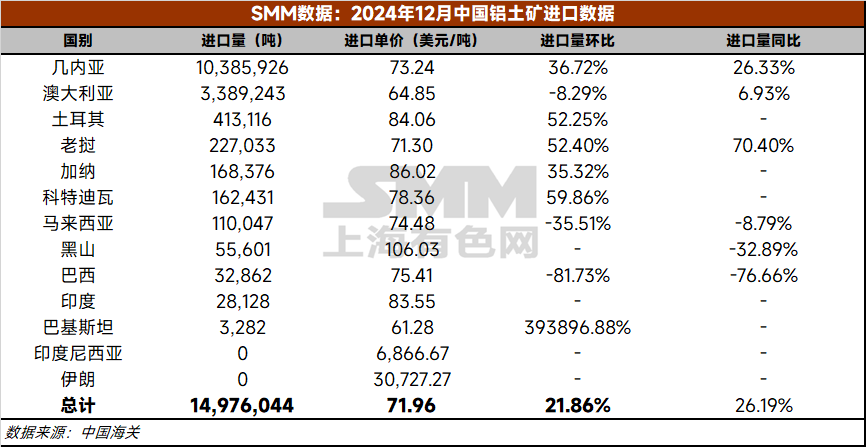

By country:

In December, China imported 10.386 million mt from Guinea (up 36.7% MoM, up 26.3% YoY), 3.389 million mt from Australia (down 8.29% MoM, up 6.93% YoY), 413,000 mt from Turkey, 227,000 mt from Laos, 168,000 mt from Ghana, 162,000 mt from the Republic of Côte d'Ivoire, 110,000 mt from Malaysia, 56,000 mt from Montenegro, 33,000 mt from Brazil, and 28,000 mt from India.

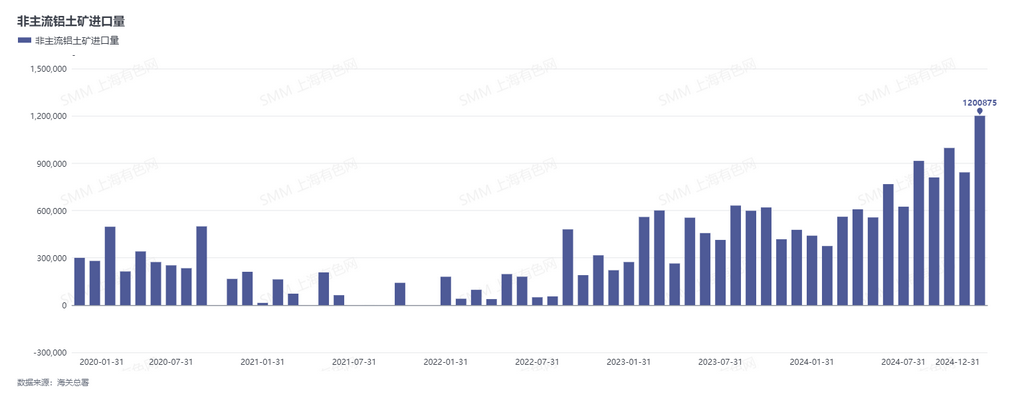

From January to December, China’s cumulative bauxite imports from Guinea totaled 110.207 million mt, accounting for 69.41% of total imports, up 11.2% YoY; imports from Australia totaled 39.884 million mt, accounting for 25.12% of total imports, up 15.4% YoY. Non-mainstream bauxite imports totaled 8.676 million mt, accounting for 5.46% of total imports, an increase of 47.9% compared to 2023 non-mainstream bauxite imports (excluding Indonesian imports).

Regarding mainstream bauxite import sources:

In December, the impact of Guinea’s rainy season on China’s bauxite imports was lifted, and import volumes rebounded significantly, with both YoY and MoM growth rates exceeding 20%. In November-December 2024, Guinea’s weekly average bauxite shipment volumes reached 3.1 million mt/week and 3.25 million mt/week, respectively, further increasing from the weekly average shipment volume of 2.91 million mt/week in October. It is expected that China’s total bauxite imports from Guinea will increase again in January 2025.

In December, China’s total bauxite imports from Australia decreased, mainly due to the gradual arrival of Australia’s rainy season, with its impact gradually becoming evident. In January 2025, Australian bauxite supply is expected to decline further, but the overall reduction will be relatively limited.

Overall, bauxite imports in January 2025 may see a slight increase. According to weekly bauxite port arrival data, the weekly average port arrivals of bauxite at Chinese ports in the first three weeks of January 2025 were 3.76 million mt/week, an increase of 330,000 mt/week compared to the weekly average of 3.43 million mt/week in December.

Regarding non-mainstream bauxite import sources:

In December 2024, China imported bauxite from countries such as Turkey, Laos, Ghana, the Republic of Côte d'Ivoire, Malaysia, Montenegro, Brazil, India, and Pakistan, with a total import volume of 1.201 million mt, accounting for 8.0% of December’s total imports, setting a new five-year high for non-mainstream bauxite import volumes.

SMM Comments: As of January 20, domestic alumina operating capacity remained fluctuating at highs. Coupled with the raw material stockpiling demand for newly commissioned alumina capacity, bauxite demand remained robust. Although bauxite import supply in January is expected to increase to some extent, the bauxite spot market may not experience a significant surplus due to strong demand. However, the accelerated decline in spot alumina prices continues to exert some pressure on bauxite prices, making it difficult for imported bauxite to reach previous peak transaction prices in the short term.

(The above information is based on market collection and comprehensive evaluation by the SMM research team. The information provided in this article is for reference only and does not constitute direct investment research advice. Clients should make prudent decisions and not replace independent judgment with this information. Any decisions made by clients are unrelated to SMM.)

Data source: SMM Click SMM Industry Database for more information

(Mingxin Guo, 021-51595800)