SMM, January 3: The 2024 rare earth mining quotas are divided into two batches, with a total volume reaching 270,000 mt, an increase of approximately 6% compared to last year. Among them, the mining volume of rock-type rare earths is 251,000 mt, with a growth rate of about 6%, while ion-adsorption type rare earths remain at 19,000 mt, unchanged from last year. When the second batch of quotas was released, it was emphasized that groups must strictly adhere to the "Rare Earth Management Regulations," promptly report the implementation of quotas, and provide updates on the production status of smelting and separation using imported ores, such as monazite, as raw materials. By the 10th of each month, production data and traceability reports on rare earth data must be submitted to the Ministry of Industry and Information Technology (MIIT).

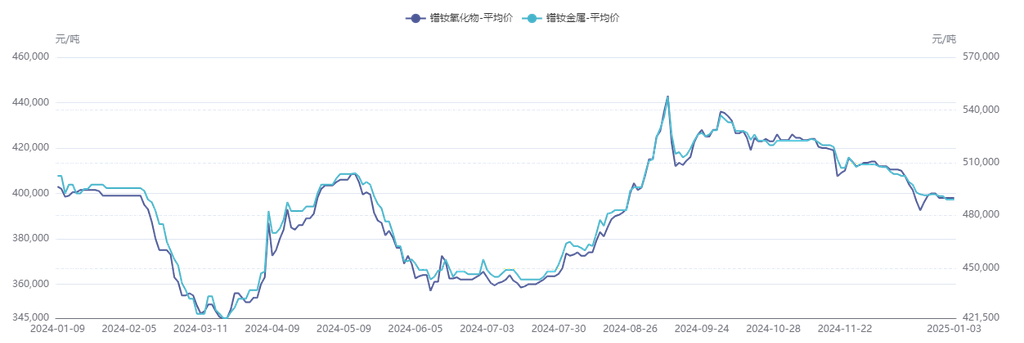

Looking back at 2024, domestic NdFeB blank production reached 280,000 mt, corresponding to a Pr-Nd oxide demand of approximately 90,000 mt, which was roughly balanced with the Pr-Nd oxide production in 2024. After experiencing fluctuations, Pr-Nd oxide prices eventually entered a rangebound trend in Q4.

In Q1, the price of Pr-Nd alloy underwent a continuous decline due to the dual impact of overall market pessimism and a lack of end-user orders. This downward trend not only destabilized the market but also caused deep concern among many related enterprises and investors. Over time, the situation did not improve but instead worsened. By the end of March, a severe inversion occurred between the raw material costs and the actual selling prices of Pr-Nd alloy, indicating that metal plants faced significant economic pressure during production.

Under such circumstances, metal plants could no longer bear the losses caused by price reductions and decided to stop lowering product quotations in an attempt to stabilize the market and alleviate economic pressure. At this critical moment, positive news emerged from the mining sector, bringing new hope to the market like a breath of spring air. Influenced by this optimistic signal, the price of Pr-Nd alloy finally bottomed out, injecting a much-needed boost into the struggling market. As prices rebounded, market confidence gradually recovered, and the attitudes of investors and enterprises turned more optimistic.

Since June, as downstream demand entered the traditional off-season, the market initially expected significant fluctuations in Pr-Nd alloy prices. However, the stable listing prices of China Northern Rare Earth provided a stabilizing force for the market. This strategy offered solid support for Pr-Nd alloy prices, preventing a sharp decline. Consequently, in stark contrast to the significant pullback in Q1, Pr-Nd alloy prices fluctuated rangebound during June-July, with neither significant increases nor sharp decreases.

As time progressed into August, the "September-October peak season" was approaching, and market demand for Pr-Nd alloy began to recover gradually. Driven by this seasonal positive factor, the price trend of Pr-Nd alloy once again showed signs of improvement, entering a warming phase.

In Q4, downstream market demand fell short of expectations, with orders mainly concentrated among large magnetic material enterprises, while small and medium-sized factories struggled to take orders. Some magnetic material enterprises indicated that they would begin holiday shutdowns at the start of this month, with production expected to resume on the eighth day of the Lunar New Year, resulting in a one-month shutdown period. The order prices for magnetic material enterprises in the market were generally low, making it difficult for metal products to achieve high selling prices. Against the backdrop of some raw ore separation enterprises planning to suspend production for maintenance in January, the market supply of oxides became tight, leading suppliers to maintain firm quotations for raw materials, further exacerbating the price inversion of metal products.

Under the current market conditions, SMM expects that oxide supply may remain tight after the Lunar New Year. Entering February, oxide prices may continue the slight upward trend seen before the holiday during the early part of the month. However, as the operating rates of separation plants gradually recover, rare earth prices are expected to stabilize.

》Apply for a Free Trial of the SMM Metal Industry Chain Database