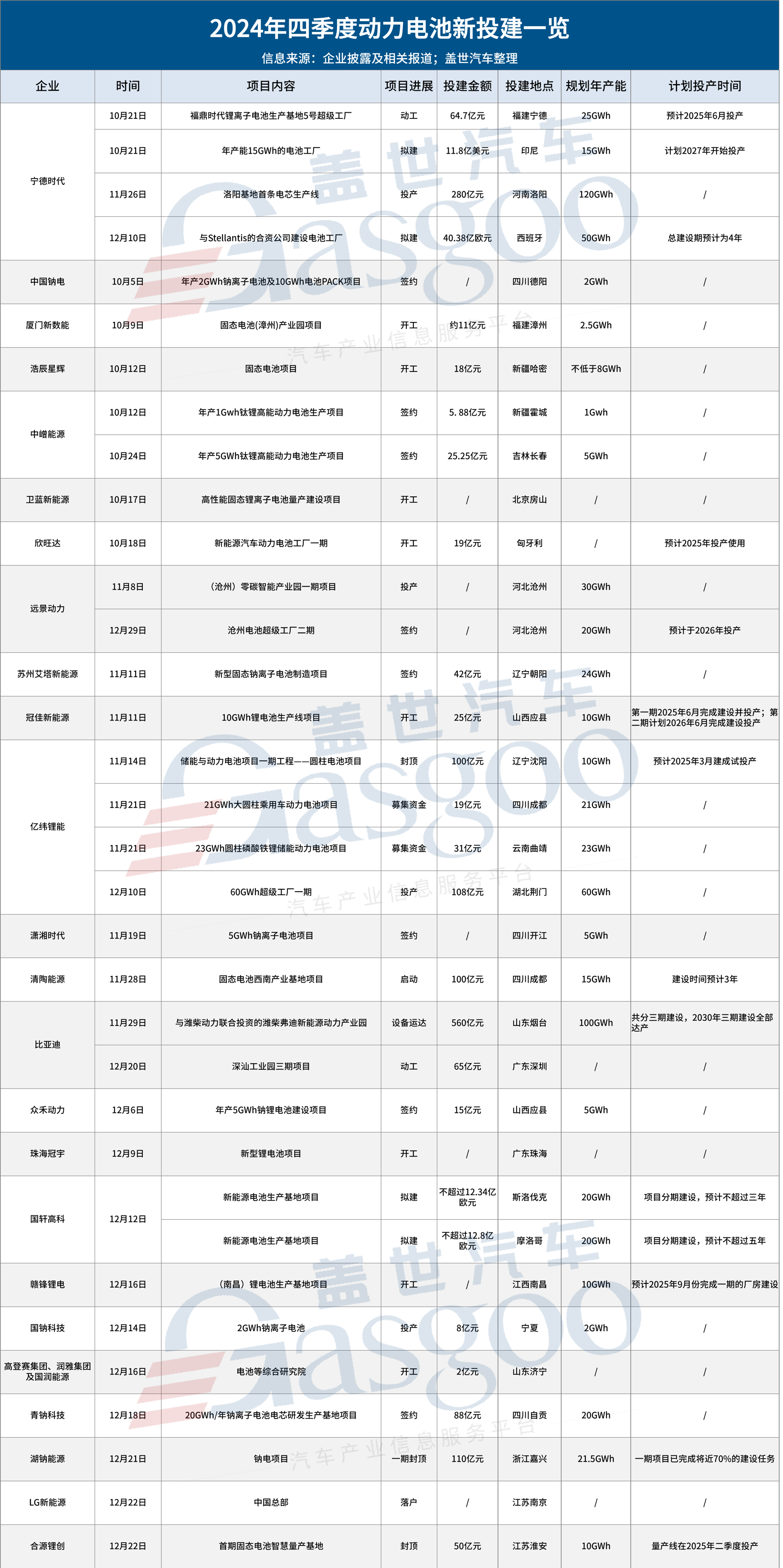

In the last three months of 2024, domestic power battery enterprises continued to demonstrate a strong trend of capacity expansion. According to incomplete statistics from Gasgoo Auto, in Q4 2024, power battery enterprises launched a total of 33 new projects domestically and internationally, with a total investment exceeding 180 billion yuan and planned power battery capacity exceeding 655 GWh.

Simultaneous Domestic and Overseas Expansion, Frequent Large-Scale Investments

Looking at Q4 2024, there were 10 power battery projects signed domestically, with a total planned capacity exceeding 126 GWh. Among them, the planned annual capacities of projects by CATL, EVE, and AESC were particularly notable.

On October 21, CATL commenced construction of its Fuding Times No. 5 Super Factory project. This project involves an investment of 6.47 billion yuan to establish four internationally leading new energy battery super production lines and intelligent manufacturing equipment, with an annual production capacity of 25 GWh of new energy power batteries. The project is expected to be commissioned in June 2025.

On November 8, EVE announced that its issuance of convertible corporate bonds to unspecified investors had been approved by the Shenzhen Stock Exchange.

According to the disclosed prospectus, EVE plans to raise no more than 5 billion yuan through the issuance of convertible bonds, which will be allocated to a 23 GWh cylindrical LFP ESS power battery project and a 21 GWh large cylindrical passenger vehicle power battery project, with investment amounts of 3.1 billion yuan and 1.9 billion yuan, respectively. The two projects have a combined planned annual capacity of 44 GWh. With this latest announcement, the 5 billion yuan refinancing plan has been confirmed.

On December 29, AESC and the Cangzhou Municipal Government held a signing ceremony for the second phase of the Cangzhou Battery Super Factory. The second phase of the AESC Cangzhou Battery Super Factory is planned to have a capacity of 20 GWh, producing high-grade power and ESS battery products, and is expected to be commissioned in 2026.

Additionally, 10 projects commenced construction this quarter, including BYD's Shenzhen-Shan Industrial Park Phase III project and Ganfeng Lithium's (Nanchang) lithium battery production site project.

Judging from the construction timelines of the projects that commenced in Q4, most are expected to be commissioned within 2025, with the latest completion by 2026. This means that by the end of 2026, these projects will bring over 60 GWh of new capacity to the power battery market.

While expanding domestically, the overseas market was also a key focus for power battery enterprises' capacity expansion this quarter.

According to incomplete statistics from Gasgoo Auto, in Q4 2024, four power battery projects were launched overseas, with each investment amounting to nearly 10 billion yuan. These projects were signed by CATL and Gotion High-tech.

Specifically, CATL launched two new projects in Q4, located in Indonesia and Spain.

On October 22, CATL partnered with Indonesia to establish a joint venture for battery cell manufacturing. Both parties committed to investing $1.18 billion to build a battery cell factory in the Karawang region of West Java, Indonesia, with an annual capacity of 15 GWh. The factory is expected to commence commercial operations in 2027.

In December, CATL signed a joint venture agreement with Stellantis Group to establish a joint venture in Spain, with each party holding a 50% stake. The joint venture will build a large LFP battery factory in Zaragoza, Aragon, Spain.

The total investment for this battery factory is expected to be 4.038 billion euros (approximately 30.9 billion yuan), making it CATL's first joint venture factory in Europe. The joint venture's total construction period is expected to be four years, with production planned to begin by the end of 2026, achieving an annual capacity of 50 GWh.

As for Gotion High-tech, the company announced on December 12 two new projects in Slovakia and Morocco to build new energy battery bases.

In Slovakia, Gotion High-tech plans to invest in Surany to build a high-performance lithium battery and supporting project with an annual capacity of 20 GWh, with an investment not exceeding 1.234 billion euros (approximately 9.3 billion yuan) and a construction period of three years.

This project will focus on battery manufacturing to achieve local independent supply of power batteries. The project company, GIB EnergyX Slovakia s.r.o., is jointly established by Gotion High-tech and InoBat, with Gotion High-tech holding an 80% stake.

In Morocco, Gotion High-tech plans to invest in a high-performance lithium battery and supporting project with an annual capacity of 20 GWh, with an investment not exceeding 1.28 billion euros (approximately 9.7 billion yuan) and a construction period of five years. This project will also focus on battery manufacturing while collaborating with regional raw material suppliers to achieve local independent supply of power batteries.

The total investment for these two projects is approximately 19 billion yuan, with a combined planned capacity of 40 GWh. Gotion High-tech stated that these investments aim to further deepen the company's global strategic layout, promote overseas business development, and meet overseas market demand, focusing on battery manufacturing to achieve local independent supply of power batteries.

Additionally, in October, Sunwoda's production site in Nyíregyháza, Hungary, entered the construction phase, with commissioning expected in H2 2026. The site involves an investment of approximately 1.9 billion yuan to build Phase I of an NEV power battery factory, primarily engaged in the manufacturing and sales of lithium-ion batteries and power battery systems.

These significant investments highlight the determination of domestic power battery enterprises to go global. However, the journey overseas is not without challenges. For instance, policy changes such as the EU's "New Battery Regulation" will pose challenges to Chinese battery enterprises' exports. Addressing these issues has become a critical task for domestic battery enterprises in their overseas expansion.

Accelerated Deployment of New-Type Batteries

Entering 2024, new-type battery technologies such as (half-)solid-state batteries, sodium-ion batteries, and cylindrical batteries have been key areas of capacity expansion for power battery enterprises, and this trend continued in Q4 2024.

From the Q4 power battery expansion list, 14 out of 32 new projects were in the new-type battery sector.

Among these, the expansion in the sodium-ion battery sector was particularly notable, with six signed or commenced projects in Q4, involving a total investment exceeding 14.7 billion yuan and a planned total capacity of over 54 GWh.

The entities involved in this sector include China Sodium Battery, Suzhou Aita New Energy, Xiaoxiang Times, Zhonghe Power, Golden Sai Energy, and Qingna Technology, among others. Among these, Qingna Technology's 20 GWh annual capacity project stood out.

On December 18, Sichuan Zigong High-tech Zone signed an investment cooperation agreement with Guangde Qingna Technology Co., Ltd. (Qingna Technology) for a 20 GWh/year sodium-ion battery cell R&D and production site project.

The project covers approximately 500 mu, with plans to build a 20 GWh/year sodium-ion battery cell production line and a 10 GWh/year Pack production line. The project will be implemented in phases, with Phase I covering approximately 280 mu to build a 10 GWh/year sodium-ion battery cell production line and a 5 GWh/year Pack production line. Once completed and fully operational, the project is expected to achieve annual sales revenue of 3 billion yuan and annual tax revenue of 90 million yuan, effectively driving the aggregation of upstream and downstream enterprises in the sodium-ion battery industry chain.

It is worth noting that the Battery Comprehensive Research Institute, jointly invested by Golden Sai Group, Runya Group, and Guorun Energy, involves a total investment of 200 million yuan and includes five core R&D divisions, covering solid-state battery R&D, sodium-ion battery R&D, perovskite battery R&D, power battery system R&D, and ESS R&D.

In the (half-)solid-state battery sector, there were four expansion projects, including one with an investment exceeding 10 billion yuan.

On November 28, the Qingtao Solid-State Battery Southwest Industrial Base project, with a total investment of 10 billion yuan, officially commenced. It will establish Chengdu's first half-solid-state battery production line.

Meanwhile, the intensifying cut-throat competition in the power battery industry has accelerated the commissioning of new-type battery projects.

In Q4 2024, four new-type battery projects entered the commissioning phase, including two sodium-ion battery projects.

On December 14, Guona Technology announced the official commissioning of its 2 GWh sodium-ion battery project. Public information indicates that this project may be the sodium-ion battery industrialisation project signed in August 2022 in Xiji Prefecture. The initial phase involved leasing 32,000 m², with an investment of 800 million yuan, and plans to purchase approximately 150 mu of land to build a 10 billion yuan sodium-ion battery industrial park project.

Additionally, on December 20, Huna Energy's sodium-ion battery project Phase I was fully topped out, completing several key construction tasks.

Reportedly, the Huna Energy project broke ground in early 2024. As of now, Phase I's packaging workshop roof skylights have been installed, the battery cell workshop, divided into five zones, is nearing completion, and supporting facilities such as office buildings and dormitories are being finalized. According to the project manager, Phase I has completed nearly 70% of its construction tasks and is expected to be commissioned soon.

Beyond sodium-ion battery projects, (half-)solid-state battery and cylindrical battery projects are also progressing steadily.

On November 14, EVE's ESS and power battery project Phase I—cylindrical battery factory—was successfully topped out. The ESS and power battery project, which began construction in March 2023, involves an investment of 10 billion yuan and a planned total capacity of 40 GWh.

The topped-out Phase I cylindrical battery project focuses on producing 46-series large cylindrical batteries, with an annual capacity of 10 GWh, and is expected to be completed and trial-produced by March 2025.

On December 22, the first phase of the solid-state battery intelligent mass production site of Heyuan Lithium (Huaian) New Energy Technology Co., Ltd. was topped out in Huaian District, Jiangsu Province. Chairman Min Liu stated that the mass production line is expected to be commissioned in Q2 2025.