With downstream expansion plans hitting the brakes and the industry chain entering a deep adjustment cycle, orders for lithium battery equipment have also pulled back. Moreover, the overcapacity concerns arising from earlier large-scale expansions by battery companies have become evident. The low utilization rate of newly installed equipment and idle capacity have led to capital stagnation, interrupting the revenue growth curve of lithium battery equipment companies.

In previous years, during the global energy transition wave, the lithium battery industry surged like a tidal wave, becoming a favorite of capital and policy support. In 2022, annual investment in the battery and new energy industry chain for capacity expansion exceeded 2 trillion yuan, with nearly 80 projects valued at over 10 billion yuan each...

As the "shovel sellers" of the battery and new energy industry, the lithium battery equipment sector also flourished, with orders pouring in, production lines running at full capacity, and a booming market. The market capitalization of companies in the sector soared accordingly.

However, following the development trajectory of the battery and new energy industry, lithium battery equipment is now entering the deep waters of a cyclical adjustment.

The Glorious Afterglow and Struggles of Transformation

Looking back, NEV production and sales doubled year after year, the ESS industry developed rapidly, and battery demand skyrocketed. Battery producers frequently announced aggressive expansion plans. At that time, from upstream lithium mine extraction equipment to midstream battery cell manufacturing equipment like coating and winding machines, and downstream battery pack assembly detection devices, lithium battery equipment was not only in high demand but also highly sought after. Advanced equipment often required months of pre-ordering, and corporate profits soared.

"In the equipment business, it will be hard to see a year like 2023 again, where we did three years' worth of work in one," said an industry insider.

In mid-2023, research institutions EVTank and the China Battery Industry Research Institute jointly released the "White Paper on the Development of China's Lithium-Ion Battery Equipment Industry (2024)." The report analyzed that the rapid expansion of China's lithium-ion battery capacity in recent years created a massive market for lithium-ion battery equipment. The market size of China's lithium-ion battery equipment grew from 63.43 billion yuan to 137.05 billion yuan in just two years, with numerous equipment manufacturers sharing the industry's growth dividends.

However, looking ahead, as China's lithium-ion battery capacity gradually reaches saturation, the entire lithium-ion battery industry is showing signs of structural surplus. Many projects under planning or construction have stalled or been delayed, bringing significant uncertainty to the lithium-ion battery equipment market.

With downstream expansion plans hitting the brakes and the industry chain entering a deep adjustment cycle, orders for lithium battery equipment have also pulled back. Moreover, the overcapacity concerns arising from earlier large-scale expansions by battery companies have become evident. The low utilization rate of newly installed equipment and idle capacity have led to capital stagnation, interrupting the revenue growth curve of lithium battery equipment companies.

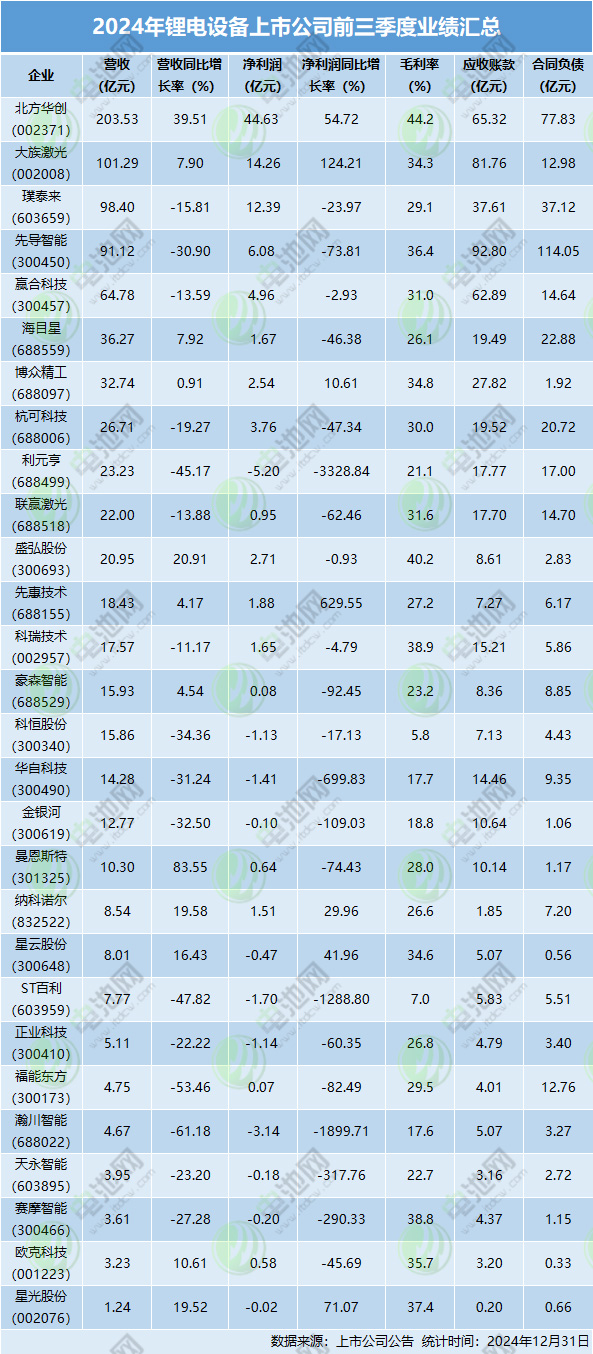

According to incomplete statistics from Battery Network, in the first three quarters of 2024, 28 lithium battery equipment companies in China achieved a total revenue of 87.704 billion yuan and a net profit of 8.566 billion yuan. Among these 28 companies, 21 experienced a YoY decline in net profit, with the largest drop reaching 3,328.84%. Eleven companies were in a loss-making state during the first three quarters.

Regarding the reasons for performance changes, many publicly listed firms revealed during their performance briefings that the industry's downward cycle slowed business growth. Downstream customers extended project delivery and acceptance cycles, reducing the number of accepted projects. Some companies admitted that extended project cycles, high interest expenses due to significant bank loans, and substantial asset and credit impairment losses during project execution further impacted their performance.

From the perspective of accounts receivable in the first three quarters, the total accounts receivable of the 28 equipment companies reached 56.205 billion yuan, with contract liabilities at 41.12 billion yuan. Among them, Lead Intelligent had the highest figures for both, with accounts receivable at 9.28 billion yuan and contract liabilities at 13.308 billion yuan.

The surge in receivables and liabilities has become a "tightening curse," putting pressure on performance and significantly shrinking the market capitalization of publicly listed firms. For instance, Lead Intelligent's market value plummeted from over 100 billion yuan to just over 30 billion yuan. Furthermore, on November 28, CATL reduced its stake in Lead Intelligent by selling 33.5488 million shares. After this equity change, CATL's shareholding in Lead Intelligent dropped below 5%, to 4.99999%.

Meanwhile, Lead Intelligent recently faced a layoff controversy. Numerous individuals claiming to be current or former employees of the company publicly accused it on online platforms of implementing forced layoffs with insufficient or even no compensation. This controversy mainly affected Lead Intelligent's lithium battery division, which reported H1 revenue of 3.904 billion yuan, down 27.10% YoY.

Under immense financial pressure, these phenomena are merely a microcosm of the cut-throat competition within the lithium battery equipment sector.

Industry insiders pointed out that in recent years, the lithium battery equipment sector has seen frequent anomalies, with "price wars" becoming rampant. To compete for market share, some companies engaged in bottomless price-cutting, compromising on raw materials and production processes to reduce costs. Some even blindly bundled entire production lines and sold below cost, leading to declining product quality. This not only failed to meet customer needs but also posed safety risks, harming the production interests of related companies and triggering numerous social disputes and lawsuits.

Overall, the fierce battle in the lithium battery equipment industry is, in the short term, marked by chaotic price and service competition. In the long term, however, it serves as a mechanism for natural selection. Disorderly and malicious competition is unsustainable. Only through innovation, improving product quality, and enhancing service levels can companies gain market recognition.

Going Global and Unlocking Domestic Potential

EVTank predicts that China's lithium-ion battery equipment market size will decline over the next three years, with a turnaround expected in 2027.

Compared to the domestic market's sluggishness, EVTank stated that the growth of the global lithium battery equipment market in the coming years will rely more on overseas markets. Overseas lithium battery projects, particularly in Europe, the US, and Southeast Asia, are expected to experience a construction boom, driving rapid growth in the overseas lithium battery equipment market. The market size is projected to reach 126.65 billion yuan by 2030.

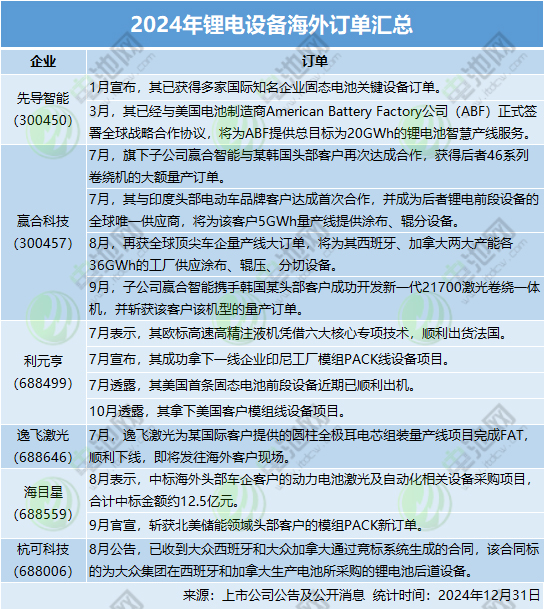

Amid the rise of overseas new energy markets and the incomplete local lithium battery equipment supply chain, Chinese lithium battery equipment companies are opening new windows for going global. Currently, some Chinese equipment companies have already established overseas projects and secured new orders.

Recent reports indicate that Yan Lei, Chairman of Hangke Technology, revealed that the company currently operates two overseas factories in South Korea and Japan and plans to build a large manufacturing plant in Malaysia to meet future overseas demand and adapt to market policy changes. Previously, Lead Intelligent, Li Yuanheng, and Zhongding Integration under Noli Stock also established overseas projects.

In addition to building factories abroad, Battery Network's incomplete statistics show that in 2024, six Chinese lithium battery equipment companies announced 14 overseas order updates. Companies such as Lead Intelligent, Yinghe Technology, Li Yuanheng, E-Fly Laser, Hymson, and Hangke Technology were among them.

While seeking new growth points in overseas markets, deeply tapping into domestic demand has also become a crucial direction for lithium battery equipment companies to break through and transform. For example, in the ESS sector, which is transitioning from pilot projects to large-scale commercial applications, lithium battery equipment companies have adjusted their product structures to gradually achieve business transformation.

Additionally, the rapid development of next-generation battery technologies centered on solid-state batteries has provided more opportunities for lithium battery equipment companies. According to the "Research Report on the Current Status and Trends of Solid-State Battery Technology and Industrialisation (2025)" jointly released by EVTank and the China Battery Industry Research Institute, China's half-solid state battery shipments exceeded 3GWh in 2024, while full solid-state batteries are in the sample and pilot stages. EVTank stated that solid-state batteries are rising irresistibly, becoming a new battleground in the new energy sector.

Of course, the effectiveness of these efforts depends on the capabilities of the "shovel sellers." Multiple industry research reports indicate that leading lithium battery equipment companies are already involved in solid-state battery equipment.

Conclusion:

From a historical perspective, the current cyclical adjustment in lithium battery equipment is an inevitable growing pain for the industry. It is both a reckoning for past blind expansions and a dormant period for honing core competitiveness for the future.

Fortunately, amid the intensifying competition for market share and increasing uncertainty in future profitability, lithium battery equipment companies are gradually realizing and acting on the fact that only by focusing on technological innovation, exploring new markets, and aligning with genuine market demands can they recalibrate their course during this adjustment phase and sail toward new growth horizons.