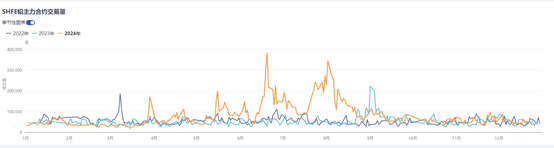

As the year-end approaches, both supply and demand in the lead market have declined. Although refined lead supply is tight in some regions, spot prices have reported a high premium of 200-300 yuan/mt. However, downstream sectors are also experiencing year-end production cuts and reduced just-in-time procurement. This Friday, the most-traded SHFE lead contract plunged over 3%, hitting a new low in more than a month. Temporary disruptions from year-end fund recovery demands led to a decline in the SHFE lead 2502 contract with increased open interest. Among the top 20 positions in the long and short rankings, both sides showed signs of exiting, with bulls retreating less aggressively than bears. Intraday capital outflows amounted to 9 million yuan.

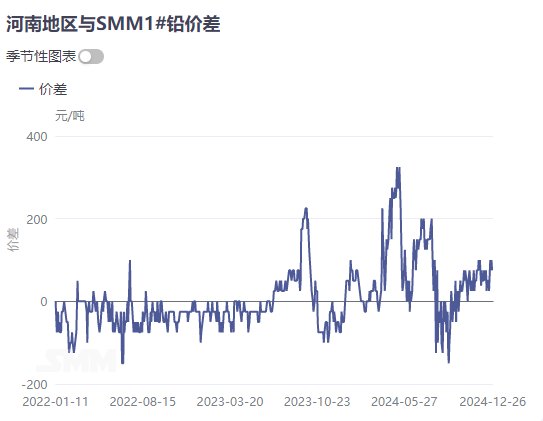

In the refined lead spot market, before the most-traded SHFE lead 2502 contract fell below the 17,000 yuan/mt threshold, suppliers were moderately following market trends, quoting a premium of 50 yuan/mt against the SHFE lead 2502 contract or a slight premium against SMM #1 lead for just-in-time transactions. However, as the SHFE lead weakened during the second trading session, coupled with factors such as declining December production and depleted inventories in regions like Hunan, Yunnan, and Guangdong, spot market supply tightened locally, and spot order quotations decreased. Additionally, during the year-end period, medium and large enterprises closed accounts and conducted inventory checks, while downstream enterprises reduced procurement activities, with some even taking holidays. The market exhibited a balanced supply and demand scenario. In the secondary refined lead sector, smog continued to impact production and transportation in certain regions, delaying smelters' production recovery. As lead prices weakened, the discount for secondary refined lead narrowed to parity against SMM #1 lead, with some suppliers holding back sales at a premium.

Next week, air pollution in regions such as Hebei, Henan, and Shandong is expected to gradually ease, with Shandong already issuing a notice lifting smog restrictions and Henan following suit. The supply reduction of secondary refined lead caused by environmental protection factors will no longer be the primary imbalance in trading. Additionally, some crude lead production in Hunan is expected to resume gradually after meeting rectification standards post-New Year’s Day. However, the recovery of primary lead production may be delayed due to insufficient raw material stocking. After the holiday, attention should remain on the actual resumption of lead smelting enterprises across regions, as well as the recovery of downstream enterprises' regular operations and pre-holiday stocking by dealers after year-end account closures and inventory checks are resolved. The lead market's supply and demand imbalance may ease.