SMM, December 20, 2024:

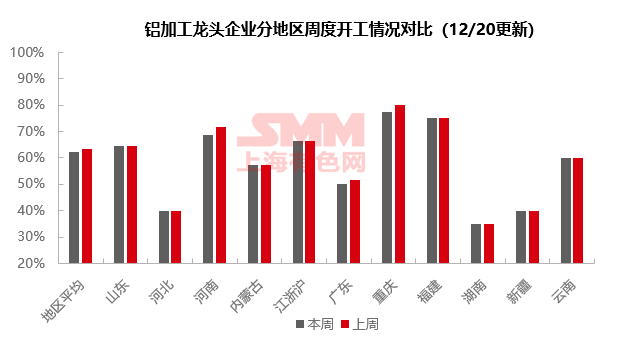

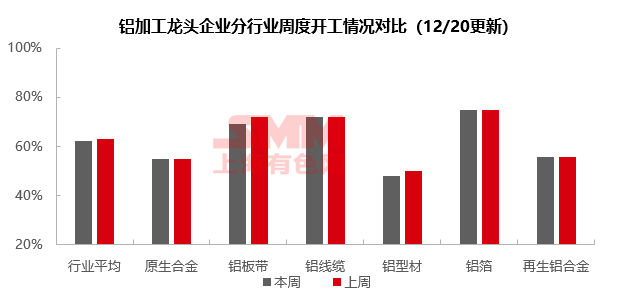

This week, the operating rate of leading downstream aluminum processing enterprises in China saw an expanded decline, down 0.8 percentage points WoW to 62.4%. By segment, operating rates for aluminum plate/sheet and strip, aluminum foil, and aluminum extrusion all showed a downward trend this week. Among them, aluminum plate/sheet and strip enterprises experienced a significant decline, mainly due to continued weakening demand, coupled with the resumption of environmental protection inspections in Henan, a key production area, prompting multiple enterprises to lower their operating rates and focus on equipment maintenance. The off-season and sharp aluminum price drops also dampened downstream customers' purchasing enthusiasm for aluminum foil products, leading to a decline in operating rates for some leading enterprises. The aluminum extrusion segment was primarily affected by the off-season and earlier export rush orders that had overdrawn some demand, resulting in a decrease in orders on hand for enterprises. Operating rates in other segments remained mostly stable, except for the primary alloy segment, which maintained moderate stability supported by liquid aluminum alloying tasks. However, operating rates for aluminum wire and cable and secondary alloy segments may fluctuate downward in the future. Overall, with December halfway through, the off-season effect has become more pronounced. At the same time, the sharp drop in aluminum prices has suppressed the enthusiasm of some downstream enterprises to pick up goods, coupled with environmental protection-related controls in certain regions. This week, the decline in operating rates for downstream aluminum expanded, and the overall operating rate for downstream aluminum is expected to continue its downward trend in the short term.

Primary Aluminum Alloy: This week, the operating rate of the primary aluminum alloy industry remained at 55%. The primary aluminum alloy market continued to operate steadily, with leading enterprises maintaining stable production to fulfill liquid aluminum alloying tasks. During the week, aluminum prices fell continuously, and bearish sentiment prevailed in the market. Some enterprises reported that downstream customers were not very active in picking up goods, but this did not disrupt production for alloy enterprises. Unless there are production cuts in supporting aluminum operations, the operating rate of the primary aluminum alloy industry is expected to remain stable.

Aluminum Plate/Sheet and Strip: This week, the operating rate of leading aluminum plate/sheet and strip enterprises fell by 3.0 percentage points to 69%. Demand continued to weaken this week, coupled with the resumption of environmental protection inspections in Henan, a key production area, prompting multiple enterprises to lower their operating rates and focus on equipment maintenance. Once this round of environmental inspections concludes, the operating rates of some sample enterprises are expected to rebound. However, given the overall weak demand environment, the operating rate of the aluminum plate/sheet and strip industry is expected to continue its downward trend.

Aluminum Wire and Cable: This week, the operating rate of leading domestic aluminum wire enterprises recorded 71.8%, unchanged WoW. There was an increasing trend in winning bid orders this week, with the official announcement of winning bid results for power transmission and transformation projects, as well as the release of distribution network agreement bid lists in Liaoning and Hubei. These aluminum wire and cable orders will provide sustained momentum for enterprise production next year. Operating performance remained stable this week, with no significant weakening in the overall operating rate. Although the aluminum wire and cable industry currently has numerous orders, the delivery of State Grid and provincial grid orders for this year is gradually coming to an end, and new energy grid connection projects have also temporarily concluded. The overall demand in the aluminum wire and cable industry may show signs of pullback, and SMM expects the operating rate of leading aluminum wire and cable enterprises to gradually weaken.

Aluminum Extrusion: This week, the weekly operating rate of the domestic aluminum processing industry fell by 1.80 percentage points WoW to 48%, mainly due to the domestic off-season and earlier export rush orders that had overdrawn some demand, leading to a decrease in orders on hand for enterprises. By segment, regional differences in construction extrusion remain, with some enterprises in south China steadily producing rush orders, while some enterprises in east China have proactively reduced output due to year-end payment considerations. In industrial extrusion, new orders for PV extrusion were insufficient, mainly due to a noticeable weakening in short-term production schedules at module factories. Automotive extrusion remained stable, with some enterprises reporting that automakers have year-end promotional plans, providing support for extrusion orders. Overall, the domestic off-season atmosphere remains strong, and the operating rate of aluminum extrusion is expected to continue fluctuating downward.

Aluminum Foil: This week, the operating rate of leading aluminum foil enterprises fell by 0.3 percentage points to 74.7%. Demand continued to weaken during the week, coupled with an overall decline in aluminum prices, which suppressed downstream customers' enthusiasm for picking up goods. The aluminum foil market overall remained sluggish, with operating rates at some leading enterprises beginning to decline. In the short term, as it is the off-season, demand is unlikely to improve, and operating rates are expected to continue to weaken gradually.

Secondary Aluminum Alloy: This week, the operating rate of leading secondary aluminum enterprises remained stable WoW at 55.6%. Supported by year-end pushes from automakers and other end-users, demand for large secondary aluminum enterprises remained relatively stable, with even some incremental orders. However, due to insufficient raw materials, manufacturers were cautious in taking orders, and operating rates remained mostly stable. Downstream maintained just-in-time procurement, with little restocking activity. Additionally, environmental protection-related controls emerged in regions such as Henan during the week, causing some secondary aluminum enterprises to halt production for the entire week, with no confirmed resumption time. In the short term, the operating rate of leading secondary aluminum enterprises is expected to remain stable with slight declines.

》Click to View the SMM Aluminum Industry Chain Database

(SMM Aluminum Team)