The European People’s Party (EPP), the largest political group in the European Parliament, is spearheading efforts to dilute the EU’s key policies aimed at reducing CO2 emissions from cars, according to a draft position paper reviewed and reported by Reuters. This push by the centre-right party aligns with growing calls from automakers and national governments for immediate support to address the challenges facing Europe’s struggling car manufacturing industry.

The EPP document proposed reversing the European Union's 2035 ban on sales of new CO2-emitting cars, advocating for the continued sale of combustion engine vehicles powered by biofuels and alternative fuels beyond the set deadline.

Additionally, the draft recommended revising the law to provide support for plug-in hybrid cars, which combine an electric battery with a combustion engine. It urged Brussels to conduct an early review of the 2035 policy next year to incorporate these suggested changes.

Europe's automotive (car) sector is facing a crisis, with thousands of jobs at risk due to sluggish demand, intensifying competition from Chinese manufacturers, and underwhelming electric vehicle sales.

The European People's Party (EPP) wields considerable political influence, with a majority of the 27 European Commission members, including President Ursula von der Leyen, belonging to its ranks.

Appeal for postponement of stricter 2025 CO2 regulations

The draft EPP document also proposed measures to shield automakers from the effects of stricter car CO2 limits set to take effect next year.

The 2025 limit could result in fines amounting to 15 billion euros ($15.8 billion) for the industry, potentially redirecting funds away from essential investments, warned Renault CEO Luca de Meo, who also serves as the head of the ACEA automakers' lobby group, on December 10, 2024.

Luca de Meo said, "Those that have set the rules have not provided the necessary market conditions, charging infrastructure, stable incentive schemes, pricing of energy, etc."

Renault's CEO emphasised the urgency of addressing the 2025 CO2 emission limits while noting that the 2035 combustion engine ban still allows a decade to explore solutions.

The 2025 targets mandate a 15 per cent reduction from 2021 levels, requiring automakers to achieve at least 20 per cent electric vehicle (EV) sales. This comes at a challenging time, as the EV market in Europe has plateaued at around 14 per cent.

In response, the European People's Party (EPP) has proposed either postponing the 2025 limits to 2027 or revising the compliance metrics for automakers.

Brussels has thus far resisted these appeals. In September, EU climate chief Wopke Hoekstra emphasised that the climate regulations offer a stable and predictable environment for investment. He also noted that numerous companies have assured the EU of their progress toward meeting the established targets.

Trends in electric cars – IEA

Electric car sales approached 14 million globally in 2023, with 95 per cent of these purchases concentrated in China, Europe, and the United States.

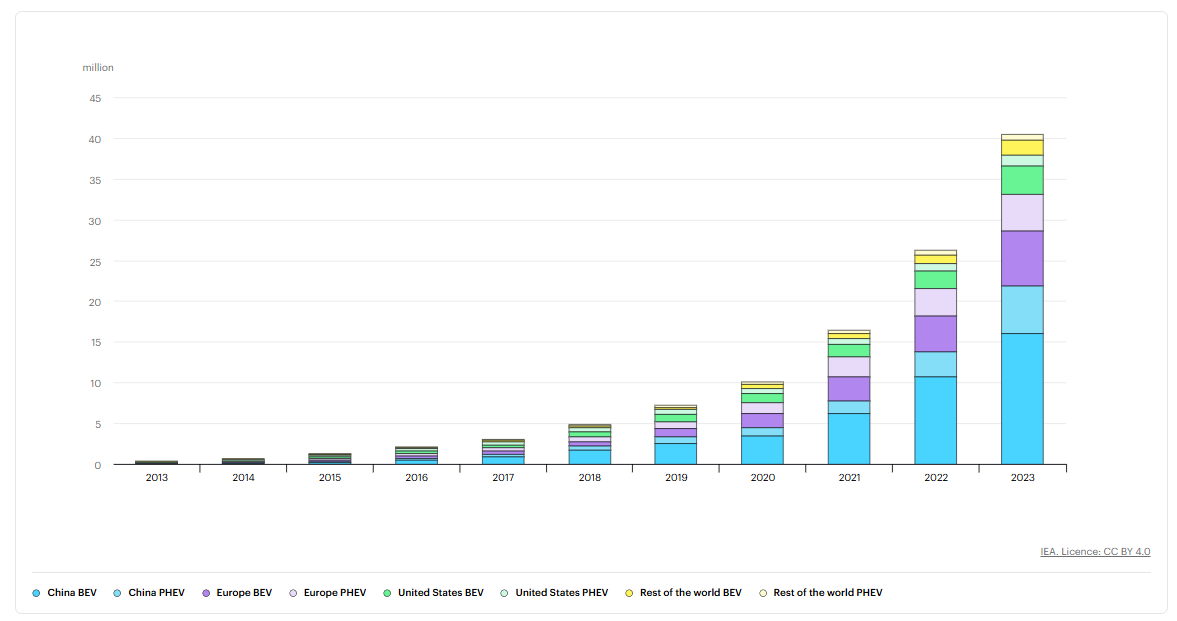

Global electric vehicle (EV) adoption reached new heights in 2023, with nearly 14 million electric cars registered worldwide. This brought the total number of EVs on the road to 40 million, aligning closely with the projections from the 2023 edition of the Global EV Outlook (GEVO-2023).

Global electric car stock, 2013-2023

Electric car sales in 2023 surged by 35 per cent compared to 2022, representing an increase of 3.5 million vehicles year-on-year. Remarkably, sales in 2023 were over six times higher than in 2018, showcasing a rapid acceleration in the market. On average, over 250,000 new EVs were registered each week in 2023—an amount that exceeded the entire annual total from just a decade earlier, in 2013.

EVs accounted for 18 per cent of all cars sold in 2023, a significant rise from 14 per cent in 2022 and a dramatic leap from just 2 per cent in 2018. This robust growth highlights the ongoing maturity and expansion of the electric car market. Notably, battery electric vehicles (BEVs) made up 70 per cent of the global EV stock in 2023, reflecting their dominance within the sector.

Image credit: https://www.nationalcollisionrepairer.com.au/

Bar graph credit: IEA

Information credit: Reuters