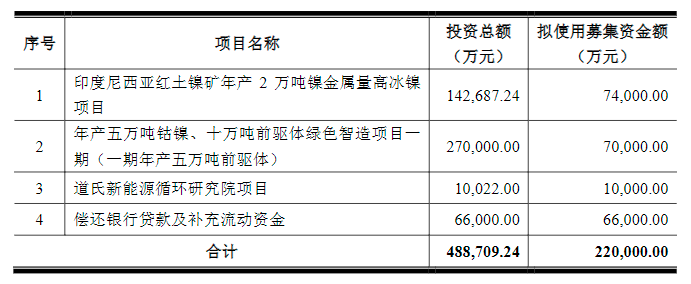

On April 15, Guangdong Dow Technology Co., Ltd. issued a feasibility analysis report on the use of raising funds by issuing convertible corporate bonds to unspecified objects. the total amount of funds raised in this issue does not exceed 2.2 billion yuan (including capital). After deducting the issuance expenses, the net funds raised are intended to be invested in the following projects:

Implementation background and necessity

At present, the new energy vehicle industry is in a stage of rapid growth, ternary power battery is the mainstream power of new energy vehicles, the technical route of high-nickel technology of ternary materials is gradually clear, high-performance ternary precursors and nickel resources have a broad market space. With the development of the market, the market concentration of ternary precursors has gradually increased, and the scale of production capacity has become one of the important competitiveness.

Through the collectivization and integration of lithium materials business in 2021, the company has gradually established and formed a complete cobalt product industry chain, including raw material procurement, wet smelting, production and sales of cobalt salts and ternary precursors, and has achieved a stable supply of overseas copper, cobalt ores and other raw materials through the controlling subsidiary of DRC (DRC).

At present, there is still a certain gap between the production capacity of ternary precursors and the supply of nickel resources between the company and the leading enterprises in the same industry, so the company plans to further increase the production capacity of high-performance ternary precursors through this fund-raising investment project. practice the "going out" strategy, distribute nickel resources in Indonesia with high resource endowment to further improve and consolidate the company's industrial chain layout, and effectively improve the company's competitiveness and competitive position.

(1) the technical route of high nickelization of ternary materials is gradually clear, and the market space of high performance ternary precursors is broad.

The cathode materials of ternary battery mainly include metal elements such as nickel, cobalt and manganese, in which the increase of nickel content has a significant positive effect on battery capacity. At the same time, because the content of cobalt in ternary battery is relatively high and the price of cobalt fluctuates obviously, it has a significant effect on the cost of ternary battery. Therefore, increasing the content of nickel and reducing the content of cobalt in ternary materials has become the main way for ternary battery enterprises to reduce battery cost and increase energy density.

(2) the rapid development of high-nickel batteries leads to the growth of the demand for nickel resources, and China's nickel resources are poor, and the company implements the "going out" strategy. The distribution of nickel resources in Indonesia with high resource endowment can further improve and consolidate the layout of the company's industrial chain and effectively improve the competitiveness of the company's products.

At present, the new energy vehicle industry is in the stage of rapid growth, ternary power battery is the mainstream power of new energy vehicle, while high nickel ternary material has significant advantages in terms of mileage, energy density and material cost. High nickel has become the future development trend of ternary power batteries. In the future, the demand for nickel resources in the field of lithium electricity will show explosive growth. According to Cinda Securities, in the field of new energy batteries, the global demand for nickel metal will reach 890000 tons in 2025.

(3) to further improve the company's supply capacity of high-performance ternary precursors

The competition in the new energy industry shows the characteristics of locking customers and obvious concentration in the new energy industry. the main reason is the high concentration of new energy vehicle industry. the high concentration of customers promotes the rapid improvement of the industry concentration of lithium batteries, cathode materials and precursors. From the perspective of industry concentration, the market concentration of ternary precursors has gradually increased, and in 2020, the top five market concentration is about 70%.

(4) the construction of the New Energy Recycling Research Institute project is in line with the company's strategic planning and promotes the integrated development of the industrial chain.

With the goal of becoming the world's leading new energy material manufacturing operator, the company continues to promote the progress of its R & D strength, and actively layout the lithium battery recycling business on the basis of the original business. The company's harmless high-value recycling mode of new energy power battery was rated as the typical recycling mode of power battery of new energy vehicles in Guangdong Province, and successfully passed the "whitelist" of battery recycling enterprises of the National Development and Reform Commission. The purpose of this project is to accelerate the green, circular, collaborative, high-value, professional and cluster development of the renewable resources industry on the basis of the company's original business, in order to adapt to the development model of the renewable resources industry in China, give full play to the advantages of the company's industry and manufacturing platform, and realize the integrated green circular manufacturing of the new energy battery industry chain.

(5) the "double carbon" policy has accelerated the landing, and the new energy vehicle industry chain has ushered in a historical opportunity for development.

With the increasing depletion of global petrochemical energy, especially the increasingly serious problem of environmental pollution caused by petrochemical energy, decarbonization and electrification of new energy vehicles have become a comprehensive consensus. New energy electric vehicles to replace traditional vehicles has become an inevitable trend of historical development.

(6) the permeability of new energy vehicles is increasing, and the shipments of power batteries continue to rise.

The production and sales of new energy vehicles in China have maintained rapid growth compared with the same period last year. According to the China Association of Automobile Manufacturers, total car sales in China in 2021 were 26.275 million, an increase of 3.8% over the same period last year, while sales of new energy vehicles were 3.521 million, a year-on-year increase of 1.59%. From January to December of 2021, the cumulative permeability of domestic new energy vehicles reached 13.4%, of which the permeability reached 18.6% in December, a significant increase compared with 5.4% in 2020. Benefiting from the national policy support and active promotion, new energy vehicles will continue to develop rapidly in the future.

Recommended reading:

"five trading days up 9% supply tight VS demand weak nickel price up and down dilemma? [SMM analysis]

"the fluidity of pure nickel has not been improved. The shortage of downstream raw materials affects supply [minutes of SMM Morning meeting].

"Marriage has taken a big step! Taigang stainless Steel Holdings Shandong Xinhai Industrial Co., Ltd.

"the investment is nearly 4 billion US dollars! Another Chinese Enterprise layout of Indonesian Nickel Industry

Golden Wheel shares: opening stainless Steel Business Space