Since the beginning of this week, the prices of many products in the rare earth market have increased, and although there are few transactions, the attitude of the holder is more optimistic, the willingness to ship is not strong, the spot is easy to rise and difficult to fall, and the price remains high.

As of today, the transaction price of praseodymium-neodymium oxide has risen to 605000 yuan / ton, the spot price below 605000 yuan / ton is hard to find, and the high price is 608000 yuan / ton; the trading price of praseodymium-neodymium metal is also up, with a small amount of transactions in the account period of 755000 yuan / ton. cash transaction price is 748000 yuan / ton, there are magnetic materials enterprises are ready to raise product prices; the prices of other light rare earth products are relatively stable.

In terms of medium and heavy rare earths, the prices of many products have risen. As of today, the mainstream turnover of terbium oxide is 8.95 million yuan / ton, dysprosium oxide is 272 yuan / ton, dysprosium oxide is 272 yuan / ton, and metal terbium and iron oxide are also slightly upward. individual large factories metal terbium reported 1150-11.6 million yuan / ton, iron iron 274-2.75 million yuan / ton, the overall metal turnover is relatively small.

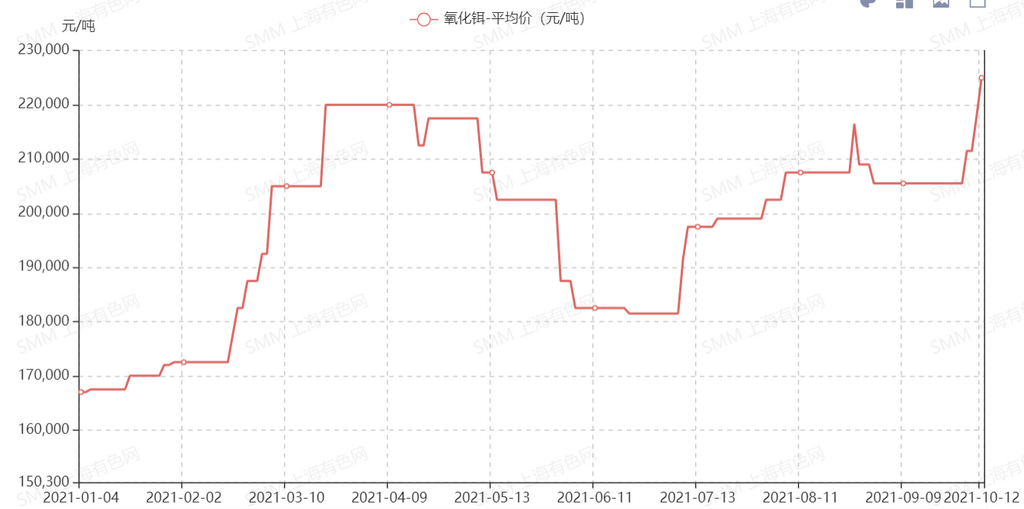

Other medium and heavy rare earths, prices rose significantly this week, gadolinium, erbium, yttrium, holmium and so on. Among them, the price of erbium oxide reached 230000 yuan / ton yesterday, setting a new high this year, and there are few manufacturers who take the initiative to quote outsides. it is rumored that some magnetic materials enterprises use erbium iron instead of ferrous iron to produce magnetic materials.

For more information about the price of rare earth products, please pay attention to the spot quotation of SMM rare earth area!

According to SMM research, the production of praseodymium-neodymium oxide and praseodymium-neodymium metal

Praseodymium neodymium

In September 2021, China's production of praseodymium and neodymium oxide was 5814 tons, a slight increase of 1.6% over the previous month, mainly in Sichuan, while production in other areas was more flat than in August.

In September, the output of praseodymium and neodymium in rare earth separation plants based on light rare earth ores in northern China was relatively stable. Even if affected by power cuts, most enterprises will maintain praseodymium and neodymium production at the expense of relatively cheap lanthanum and cerium products. Myanmar mine imports are blocked, superimposed power cuts, the output of rare earth separation plants based on medium and heavy rare earth ores in the south is relatively difficult to maintain, and the output of praseodymium and neodymium oxide in individual enterprises is reduced by about one-third. The output of praseodymium and neodymium in rare earth separation enterprises with waste as the main raw material remains stable, and individual enterprises in Jiangsu have a greater impact on electricity limitation, coupled with high costs, the output of praseodymium and neodymium oxide in individual separation plants has been reduced by nearly 90%. There are also small waste enterprises in Jiangxi that reduce the production of praseodymium

With the end of environmental protection inspectors, separation plants in Sichuan and Guangdong have resumed production one after another, and the output of praseodymium and neodymium oxide in China is expected to continue to increase month-on-month in October, reaching 6000 tons.

Pr-ND metal

In September 2021, China produced 5614 tons of praseodymium and neodymium metal, a slight increase of 2.6% over the previous month, mainly due to the expansion of production by individual enterprises in September to catch up with orders.

Most metal factories mainly deliver long orders, and at the same time, they also sign long orders with upstream suppliers, so the overall output of praseodymium and neodymium metal is relatively stable; there is also a decline in production, mainly because prices are difficult to transmit downstream, metal factories in order to reduce risk, take the initiative to reduce the purchase of high-priced raw materials.

Due to the limited influence of electricity, the rise in the price of rare earth accessories has led to a rise in production costs. Some small and medium-sized magnetic enterprises are worried about the difficulty of follow-up procurement, and the demand for ordering metals has increased slightly recently, but the energy consumption of metal factories is generally higher. In the context of power and production restrictions, China's praseodymium-neodymium metal production is expected to increase slightly in October compared with September