Brokers and exchanges have asked large commodity trading companies to add hundreds of millions of dollars to cope with the risk of soaring natural gas prices, according to several people familiar with the matter.

Commodity traders such as Glencore, Gunvor, Trafigura and Victor all face the need to make margin calls on their European and US gas positions, according to sources.

Margin calls will force traders to prepare more money. As a result, smaller companies will have to borrow more to maintain the floor of the guarantee ratio, which will lead to less cash available for transactions and could hurt their profits.

The sources, including executives, brokers and bankers, declined to be named because of the sensitive information involved.

Fluidity extrusion

To hedge the gap between spot and futures prices of natural gas in the US and elsewhere, traders need to sell short positions in natural gas futures markets in Europe and Asia. Traders will build short positions when they want to be able to buy back at a lower price in the future.

This strategy triggered a liquidity crunch last month due to falling inventories, increased demand for natural gas in Asia and lower supplies of natural gas from Russia and liquefied natural gas to Europe.

In Europe, the main platform for establishing short positions in natural gas futures is the TTF natural gas market center in the Netherlands. Trading companies and other participants have accumulated short positions worth 30 billion on the TTF platform, while the European division holds equal long positions, according to two sources.

Traders usually make loans to establish short positions, of which 85% to 90% of the money comes from banks, while the remaining 10% to 15% of the short positions, known as minimum margin, are paid for by the dealer's own funds and deposited in the broker's account. In this case, a minimum margin call warning will be triggered when the account funds are less than 10% to 15%.

With the European standard of natural gas prices-TTF natural gas contracts in recent months have risen by 385%, 10% and 15% since January, margin coverage is only 3% to 5%, triggering a margin call. Traders will be forced to provide additional funds from their own reserves or bank credit lines.

Sources said that the current margin call is unprecedented, which puts great pressure on small and medium-sized traders, while larger companies have deeper financial strength to cope with the current situation. Small and medium-sized traders such as Swiss Kolmar Group said they were adding high trading margin, but the position was still fully covered and would not pose a threat to the main business, and the company did not provide further details. BB Energy, a Lebanese company, said it had not received a margin call.

Trafigura's semi-annual report released in June showed that the company still had $6.8 billion in cash and equivalents. A bond prospectus released this week by Gunvor rarely shows the size of the company's hedging business, most of which is related to natural gas and liquefied natural gas. The company's pre-sale or hedging inventory totaled $5.3 billion in June, compared with $2.8 billion for all of 2018, according to the brochure. Natural gas and liquefied natural gas transactions accounted for nearly half of all transactions in the same period, or about 45%. The prospectus also shows that of its total credit line of 18 billion, at least $2.5 billion is used for margin calls.

LNG sellers also require traders to provide additional requirements and credit certificates to ensure that they can pay on time, according to industry insiders.

The transaction is more difficult.

According to the report, traders seem to have been hit hard by spreads (or arbitrage) trading errors this year. For many years, natural gas prices in Europe (red line) and the United States (green line) have been operating within a relatively clear range. The strategy of buying one and selling the other works as the price difference between the two changes.

However, as shown in the chart above, the market so far this year has not only invalidated the trading strategy, but also led to the collapse of several Sigma in the low-risk, slow-return market of the past 12 years (that is, a black swan event with a very low probability).

A spokesman for Gunvor said:

"although the surge in European natural gas prices has led to the need for margin calls, Gunvor still maintains a healthy liquidity position and corresponding tools to cope with further price fluctuations."

Glencore, which focuses on the mining industry, declined to comment, while gas traders Trafigura and Victor declined to comment.

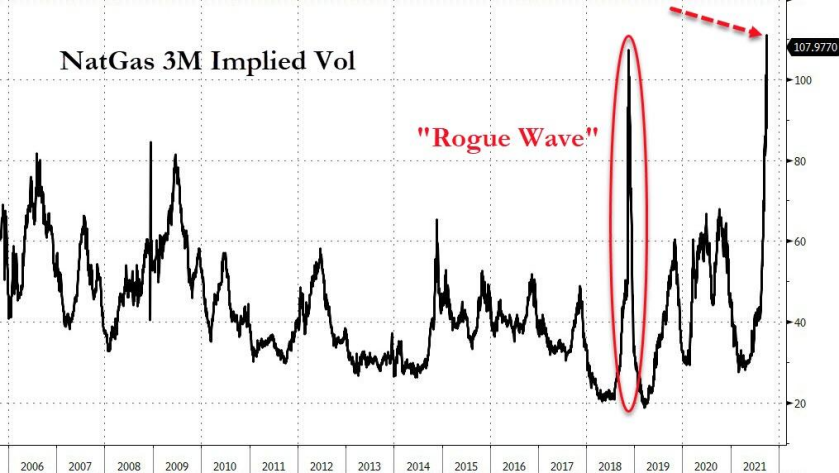

Given the current record-breaking implied volatility of natural gas, some traders may have been buying protective options to protect their positions in the wrong direction.

In recent years, trading companies have made large bets on natural gas produced and exported from the United States, assuming that long-term natural gas prices will remain low and opting for long-term contracts to buy liquefied natural gas commodities rather than short-term contracts. Some of these contracts will last until 2041, mainly for natural gas exports to Europe and Asia.

Trading companies are also seeking to adjust their books to reduce their exposure, the source said.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)